Detroit Free Press from Detroit, Michigan • Page 42

- Publication:

- Detroit Free Pressi

- Location:

- Detroit, Michigan

- Issue Date:

- Page:

- 42

Extracted Article Text (OCR)

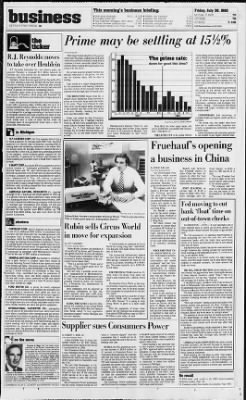

ifl if fmiiiiing This morning's business briefing: Friday, July 30, 1982 MUTUAL FUNDS 7D OPTIONS 7D STOCKS 7-10D Call Business News at 222-5392 Dow-Jones Industrials 812.21, 0.38 Prevailing prime rate 16 New fixed-rate mortgages (20 down) 17 Highest 26-week certificate rate 12.19 Donoghue's Money Fund7-Day Average 13 Inflation rate (national) Inflation rate (Detroit) Michigan unemployment rate National unemployment rate All-savers certificates 3.1 14.4 9.5 9.99 DETROIT FREE PRESS 6D Prime may be settling at 15V2 FTNb ticEiesr A ii I 2o The prime rate: down for good this time? 19- 18- y- 17- 1e.y.tr i. i.OiLilJLLiJilS IJH JULY SEPT I OCT. I NOV. DEC. FEB.

MAR. JULY 1981 1982 -r R.J. Reynolds moves to take over Heublein R.J. Reynolds Industries the tobacco giant, announced Thursday a proposed $1.3 billion takeover of Heublein best known for its Smirnoff liquors and Kentucky Fried Chicken restaurants. Heublein, whose directors approved the Reynolds offer, has been resisting a takeover attempt for the past several months by General Cinema which has been actively buying chunks of Heublein stock and recently had control of about 18 percent of Heublein's outstanding shares.

Reynolds, under terms of its merger offer, will acquire 100 percent of Heublein, which along with Reynolds' Del Monte will form a new foods and beverages group for Reynolds. Under the agreement, Reynolds said it first would make a tender offer, beginning today, of $63 a share for up to 11.4 million'Heublein common shares, or 52 percent of the 21.7 million outstanding. Each remaining Heublein share would be exchanged for a package containing a fraction of a share of Reynolds common stock and a fraction of a share of new Reynolds preferred stock. The fractional share of common stock would have a value of about $31.83, while the fractional share of new preferred would have a value of about $25, Reynolds said. From AP and UPI Most major banks adopted a 1 5 percent prime rate Thursday, making the half-point reduction an effective industry-wide level in response to lower costs and a falloff in loan demand.

Many leading Michigan banks went along with the move. But private analysts predict further significant reductions in the prime, the base rate for business loans, will be slow in coming. That would be a major disappointment for the automotive and housing industries and other sectors of the economy that have suffered from the high rates of recent years. THE REDUCTIONS began when No. 3-ranked Chase Manhattan Bank lowered its prime, as three other large banks had earlier in the week.

Chase was followed by eight other of the top 20 largest banks, bringing to 14 the number that had sliced their prime rates since Monday, reaching the lowest level since November 1980. Chase was joined by San Francisco's Bank of America, No. Morgan Guaranty Trust of New York, ranked fifth; Continental Illinois National Bank Trust Chicago, No. First National Bank of Chicago, No. Crocker National Bank, San Francisco, No.

12; and many smaller banks as well. the declining cost of funds in money markets and a falloff in loan demand at banks. Both factors, under most circumstances, would call for a much lower prime rate than the current 15 percent. But bankers have been reluctant to quickly pass along lower costs to corporate borrowers. David M.

Jones, economist at Aubrey G. Lanston said "there definitely has been some stabilization in Federal Reserve policy and there's at least a chance for one more notch downward in the prime to 15 percent." Jones said the $100 billion in government borrowing in the second half that was confirmed Wednesday also will underpin rates. "The Federal government will be crowding all other borrowers, large and small, businesses, consumers and mortgage borrowers," he said. "Unfortunately that means a deeper and longer recession and higher unemployment." CONSIDERABLE Fed borrowing of available funds can tighten credit and drive up rates. The prime rate, the banks' short-term base rate to credit-worthy corporate borrowers, is considered a bellwether of other interest rates.

Small businesses and consumers generally can expect to pay higher interest rates. Free Press chart by MOSES HARRIS Most likely the other major banks will join in, Ted Gibson, economist with Crocker, said. "They have to." THE LATEST CUT in the prime reflects Manufacturers Hanover Trust Co. and Chemical Bank, both in New York, started the move to 15.5 percent on Monday. They were joined Wednesday by New York's Citibank.

in Michigan R.P. SCHERER the Troy company that is trying to block a takeover by Chicago-based FMC has filed papers in U.S. District Court in Delaware, accusing FMC of making false and misleading statements in its tender offer for Scherer stock. On Tuesday, Scherer's board of directors rejected FMC's offer of $22 a share for a controlling interest in the company, which produces gelatin capsules for the Fruehauf 's opening a business in China drug industry. A spokesman for Scherer said Thursday the board is asking the Delaware court to block FMC takeover attempt.

MART CORP. has closed 305 of its automotive service It" vr x.ttzi centers because of "inadequate profitability," chairman Bernard Fauber said. The only Detroit-area service center affected was attached to the mart store in Glenwood Plaza in Pontiac. Company spokesperson Susan McKelvey said mart, headquartered in Troy, will continue to operate Km. Bianchi said, however, that Fruehauf expects to make China the base for exports to other Far East nations.

The manufacture of trailer products is to start in September in Guangzhou. SINCE REACHING an all-time high of $7.28 a share in fiscal 1979, Fruehauf's earnings have de clined sharply, to $2.63 a share in 1980 and $1.74 in 1981. This year, Fruehauf lost 87 cents a share in the first quarter and 59 cents a share in the second quarter. The company said that much of its second quarter loss was the result of the devaluation of the Mexican peso. automotive centers at more than 1,400 stores.

The 305 closed centers failed to make enough money for differing reasons, McKelvey said, including competition from nearby service stations or other mart stores. AMERICAN NATURAL RESOURCES Co. reported earnings of $15.7 million in the second quarter of 1982, up 11.6 percent from $14 million reported in same period last you w-'--. year. Earnings per share were 66 cents versus 60 cents.

ANR is a Detroit-based diversified energy company with interests in interstate gas transmission and storage, oil and gas exploration, coal, synthetic fuels and interstate trucking. Revenues for the quarter were $683.4 million, up 15.8 percent from $590 million. Gas sales were down for the quarter 4.3 percent. etcetera Free Press photo by RICHARD LEE Sidney Rubin, founder and president of Circus World: "This is a success story. This is finally good news for metropolitan Detroit." Rubin sells Circus World in move for expansion CHRYSLER CORP.

said its financial arm has arranged the sale of an additional $200 million in installment loan contracts. Chrysler Financial Corp. reached agreement with Associates Corp. of North America, also known as The Associates, which has its headquarters in Dallas. The firm will beein purchasing the receivables in Serjtemher.

Chrvs- By BERNIE SHELLUM Free Press Business Writer The Detroit-based Fruehauf which started losing money this year for the first time in 23 years, announced Thursday it is going into business in China. The company said it has signed a five-year renewable licensing agreement that gives China Fruehauf Ltd. the right to manufacture and sell Fruehauf truck-trailers and chassis in the People's Republic of China and Hong Kong. Jim Bianchi, a spokesman for the parent company, said China Fruehauf is owned by financial interests in Hong Kong. The China venture was announced by Joseph Mack II, president of Fruehauf International which already manufactures and sells products in 18 foreign countries and operates sales, service and rental facilities in 44 countries, including Japan.

MACK SAID THAT China's planned highway system "will expand considera-bly the need for truck-trailers and related equipment" and that Fruehauf, the world's leading manufacturer of trailers, will be "the first to establish a manufacturing relationship with the People's Republic of China." By itself, however, the Chinese market is expected to do little for Fruehauf's balance sheet, at least in the next few years. China is just starting to build a national highway system that is scheduled to link Guangzhou, formerly known as Canton, with the ports of Macao and Hong Kong in 1984, the company said, and the Chinese market is expected to take only a thousand or so trucks a year for the next five years. ler said the money will allow dealers to make loans for up to ou.uuu uirysier cars ana trucks, he agreement is Chrysler Financial's second sale of receivables in a week. On Julv 21. it announced an agreement with Manufacturers Hanover Trust for the sale of $500 million in receivables.

GENERAL MOTORS CORP. has decided to withdraw from a joint venture to produce heavy-duty trucks in Taiwan, following Taiwan's failure to ban imports of trucks from Europe and Japan, Taiwanese economic officials said. Officials said GM sent a cable Wednesday to the government saying it would withdraw its investment in Hua Tung Automotic established last year for production of By KITTY McKINSEY Free Press Business Writer Sidney Rubin, founder and president of Circus World Toy Stores, said Thursday he has agreed to sell his 18-year-old company to a Pennsylvania corporation which has promised to finance expansion of the successful Taylor-based chain. "This is a success story," Rubin said of the sale. "This is finally good news for metropolitan Detroit." Rite Aid a publicly owned company headquartered in Shiremanstown, will pay an undisclosed amount of cash by Sept.

1 for Circus World and another company owned by Rubin, Toy Animals a Savannah, manufacturer of stuffed animals. Both companies will be operated as autonomous subsidiaries of Rite Aid, which operates more than 1,000 drug heavy-duty trucks, buses and diesel engines. Economic officials said trucks jointly produced by GM sold poorly "I will be totally in command at Circus World for a long, long time," said Rubin. The deal also will make him a vice-president of Rite Aid. The 44-year-old entrepreneur opened his first Circus World store in Warren in 1964 and has expanded the chain to 135 stores in 22 states, including 18 in Michigan.

The stores typically carry 6,000 different items. FOR THE FISCAL YEAR ended Jan. 30, 1982, when 116 stores were open, the chain's sales totalled $51.1 million, Rubin said. He describes Circus World as the largest privately owned toy-specialty chain in the country and "one of the most sought-after companies for acquisition for the past few years." After turning down a number of other proposals, Rubin said he accepted Rite Aid's offer because "it is going to help Circus World to grow at a more rapid pace." With the popularity of home video games, the toy business has mushroomed from sales of $300 million a year in 1981 to $6 billion a year today, he said. Because tney were were priced at least 50 percent higher Fed moving to cut bank 'float time on out-of-town checks WASHINGTON (UPI) If your bank takes six to eight business days to credit out-of-town checks, the Federal Reserve Board advised Thursday to "get another bank." The Fed announced it is planning improvements in check processing for later this year that will credit commercial banks with the funds from out-of-town checks in 24 hours and pointed out that it now should take only 48 hours.

Asked about many banks that advise customers of six-to-eight business day waiting periods for out-of-town check clearing, a Fed spokesman replied, "I would advise you to get another bank." The question is no trivial matter for bank balance sheets, since the longer money can be held before being credited to customer accounts, the more interest the banks can keep. THE FED, WHICH PROVIDES check-clearing services to banks, has aggressively been trimming the amount of these delayed transfers, called "float," that it is responsible for. Yet the total "floating" at any one time still averages $1.8 billion, the Fed says. E. Gerald Corrigan, president of the Federal Reserve Bank of Minneapolis who announced the changes, said the additional total held by commercial banks beyond the 48 hours it takes the Fed to deliver is probably far larger.

The faster delivery of out-of-town balances will trim as much as 1 million a day in transfer costs, extra money someone is keeping because of the kinks in the supply pipeline. "There are winners" among commercial banks in the present system that generates the float, Corrigan acknowledged, "some by accident of location, some by clever design, some by the sheer weight of their relative economic power and even some by outright abuse." The speedup in check clearing, of course, can also be to the disadvantage of check writers who count on a delay in bank transfers and may not have money in their accounts to cover checks until several days after they write them. As part of the speedup, checks deposited in New York drawn on a Chicago bank will be able to arrive at the New York Federal Reserve Bank as late as 3 a.m. to be credited that same day, Corrigan said, instead of the present 12:30 a.m. deadline.

CORRIGAN ALSO ANNOUNCED that, after a month of public comment, the Fed will increase its charges to commercial banks for processing checks and returning them, a service in which it competes with several private check clearing businesses. While denying the Fed plans to offer "loss leader" services in strong competition with the private businesses, Corrigan said the pricing schedule is designed to cause "all market participants the Fed included to sharpen their pencils in search of lower costs and better services." tnan those ottered by Japan. FORD MOTOR CO. is giving its hourly employes discounts on car purchases that normally are available only to the company's executives. Ford called the move an indication of the firm's appreciation of the worker's approval of contract concessions.

Ford's hourly workers, who ordinarily received a much smaller discount in the past when they bought new cars, now will pay only dealer cost for Ford stores in 18 states and sells wholesale food and medical services. RUBIN, WHO LIVES in Beverly Hills, said he will continue to run Circus World and Toy Animals while Rite Aid finances what Rubin called "a very aggressive expansion program" within Michigan and into new markets. autos, trucks, tractors and lawn and garden equipment. INTERNATIONAL HARVESTER anticipating losses of close to $1 billion this fiscal year, said it must close more plants, consolidate other operations and get greater concessions from lenders in paying off its $4.2 billion debt. The giant manufacturer of farm implements, heavy equipment and trucks will propose a new restructuring plan in a closed meeting with its 200 lenders today and expects negotiations on changes to begin early next month, a spokesman said.

The proposal includes an effort to get the lenders to eliminate $300 million to $400 million of its debt in exchange for stock. Supplier sues Consumers Power on the move Eug.n. U. Bego, left, has been named president of the Power Transmission Division of Ex-Cell-0 Corp. in Troy.

He will be responsible for the Cone Drive Operations In Traverse City, the Accurate Bushing Co. in Garwood, N.J., and the Chicago Gear Manufacturing Co. In Chicago. Bego joined Ex-Cell-0 in 1966 as systems manager. His Immediate past job was as president of the 'ST i a standard escape clause in its contract with Union Carbide letting it nullify the agreement when a state regulatory agency intervenes.

Union Carbide's suit contends that no law requires Consumers Power to get PSC's approval before meeting its obligation to take delivery of the oil. The contract with the Jackson-based utility ends in 1987. Consumers Power provides gas and or electricity to about two million customers in Michigan. In another action, Union Carbide is challenging in Ingham County Circuit Court a portion of the PSC's order which prohibits Consumers Power from burning the oil. On June 10, the Lansing court stayed the challenged portions of the order until Union Carbide's case could be heard.

when it "received signals" from the commission that it would not be allowed to include the cost of the oil in a pending rate case. IN MAY, the PSC granted an interim rate increase of $120.5 million, or 8.3 percent, to Consumers Power. As Consumers had expected, the commission said the utility could not include the cost of the oil in its rate base. The PSC said Consumers Power could have generated the power less expensively at another facility, or bought it more cheaply from another utility. PSC Chairman Eric Schneidewind said at the time the commission's decision would save the utility's customers $87.5 million.

The Consumers Power spokesman said this forced the company to invoke By ROBERT H. BORK JR. Free Press Business Writer Union Carbide Corp. is suing Consumers Power Co. for $160 million, claiming the utility failed to buy fuel oil it contracted for in 1980.

But Consumers Power officials say it was a Michigan Public Service Commission action that forced them to refuse the oil, which was meant for the utility's generators in Essexville, near Bay City. The suit, filed Wednesday in U.S. District Court in Detroit, claims that since January, Consumers Power has refused to buy any of the minimum 10,000 barrels of oil a day, or 3.65 million barrels a year, the contract specifies. But a Consumers Power spokesman said the utility stopped buying the oil I Tool Abrasive Products Division. A grad- uate of General Motors Institute, he earned 'fw a master's degree In management at Meruit i gan State University.

He and his wife live in Ln sJ ii i Bloomfield Hills and have five children. David A. Brockwsy to vice-president and general manager of the industrial truck division at Clark Equipment Co. in Buchanan At Comerica Inc. in Detroit.

Gregory E. Hooks to vice-president of the Kentwood Bank, and Mlch.4 E. Gar.y and Hsrv.y R. Hohsuw to assistant vice-presidents at Detroit Bank Trust Flo recall EPA won't seek recall to fix GM's below-standard emissions systems. Page lA.

Commerce chief has doubts on economy. Page 10D. Compiled by ALAN S. LENHOFF and BARBARA WOOLF 1.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Detroit Free Press

- Archives through last month

- Continually updated

About Detroit Free Press Archive

- Pages Available:

- 3,662,451

- Years Available:

- 1837-2024