Pittsburgh Post-Gazette from Pittsburgh, Pennsylvania • Page 13

- Publication:

- Pittsburgh Post-Gazettei

- Location:

- Pittsburgh, Pennsylvania

- Issue Date:

- Page:

- 13

Extracted Article Text (OCR)

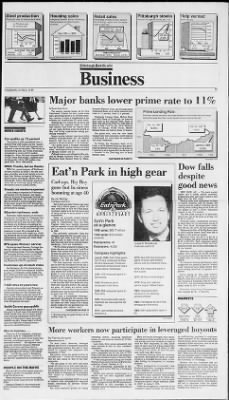

Steel production Pittsburgh area (in thdusands of tons) Pittsburgh stocks Index of 41 regional stocks as of 63 Help wanted Local job ads Housing sales Allegheny, Beaver, Butler, Armstrong, Westmoreland and Washington Retail sales Percentage change of retail sales In the Pittsburgh region from the same week a year ago Previous year Current year 230i 1 210 170 -r I i i i counties Source: West Penn Multi-list May 1989 2000 "I 1500. prij 1000- 500" LJ LjJLJ Feb Mar 1,655 1 pi i i L-3 1 Apr May Downtown Week ending 527 Downtown Region 0.3 Source: Mnllon Bank Chamhnr of Commerce 22 29 6 13 20 27 I Apr May 'jV zz- 257.28245 1.06 I 240 235 6 13 20 27 3 May Jun Source- Leon Mason Master) Pittsburgh banks lower prime rate to 1 1 Prime Lending Rate Each bank sets Its own prime rate; major banks tend to set similar rates and change them at the same time. Dates are for general industry move to new rate. I Feb. 24., 989 LLhv-, PXJ 4 11.0 immmmmmmmmmmmmmmm "Current Previous e.ooo r4.ooo i- 2,000 30 7 14 20 27 3 Apr May Jun Source: Pittsburnh Press 13 1987 1988 1989 Associated Press low falls despite good news NEW YORK (AP) The stock market lapsed into a steady decline yesterday, pulling back after last week's climb to new highs since the 1987 crash.

Several stocks with investments in China or nearby countries sold off sharply. But analysts said the conflict in Beijing, and the ensuing break in Hong Kong stock prices, did not appear to have a severe widespread impact on the U.S. market. The Dow Jones average of 30 industrials, which had risen 27.20 points on Friday, fell 37.13 to 2,480.70. Declining issues outnumbered advances by more than 3 to 2 in nationwide trading of New York Stock Exchange-listed stocks, with 609 up, 941 down and 450 unchanged.

Volume on the floor of the Big Board came to 163.42 million shares, down from 229.14 million in the previous session. Windmere Corp. fell $3.75 to $15.25 in active trading and Lewis Galoob Toys lost $1.50 to $10.12. Both companies, which have production facilities in China, said their operations there had not been affected so far by the turmoil. Otherwise, analysts said, it appeared that traders were cashing in on the market's recent gains, believing it was due for at least a pause after its strong advance in recent months.

The domestic business and financial news background was generally positive, brokers noted. Numerous large banks lowered their prime lending rates from 11.5 percent to 11 percent. Losers among the blue chips included Boeing, down at General Electric, down 62 cents at $55.12 American Telephone Telegraph, down 87 cents at $35.37, and International Business Machines, down $1.12 at $109. Elsewhere, Hong Kong Telecommunications dropped $2.12 to $16.87. Dow Jones Closed at 2,480.70 Gold Closed at $364.80 Dollar Fed index 102.48 as profit-sharing payments to employees.

Three members of the Independent Steel-workers Union, which represents most of the company's 8,000 employees, also sit on the company's 13-member board. But experts say there is no evidence that employee ownership always benefits companies, "there are a lot of success stories, there are also examples where it hasn't worked," said Jan Svejnar, professor of economics at the University of Pittsburgh. Workers who buy companies that are failing for solid economic reasons can end up losing their savings as well as their jobs. And ESOP-owned companies must also make sure they have the finances to buy back the shares of employees who leave. Workers can use ESOPs as a tool to buy their companies in competition with the most aggressive corporate raiders.

"Shareholders will sell to whomever offers the highest price," said Jeff Gates, counsel to merchant banking firm Kelso Co. UP yv 63 Year ago I By Reuters News Service The nation's leading banks, led by New York-based Citibank, cut their prime rates half a percentage point to 11 percent yesterday, reacting to signs of sluggishness in the economy and expectations for easier credit. Citibank gave no reason for its move, but economists had expected banks to lower their interest rates after two reports came out last week showing weak job growth in May and falling expectations among purchasing managers. Money market interest rates have fallen recently on expectations that the Federal Reserve will ease its grip on credit to prevent a serious downturn in the economy. "It's pretty much a foregone conclusion that the Fed will validate the move to lower rates," said Stephen Roach, senior economist at Morgan Stanley and Co.

Citibank's move was followed within minutes by Morgan Guaranty Trust Chase Manhattan Bank, Bankers Trust Manu iOCUEL JUL ii Carhops, Big Boy gone but business booming at age 40 By Jim McKay Post-Gazette Staff Writer Eat'n Park was born 40 years ago today when Larry Hatch opened a yellow 13-seat restaurant on Saw Mill Run Boulevard that cashed in on the then-novel idea of using carhops to serve people in their automobiles. Today the privately owned business employs about 4,000 people at 49 restaurants in Pennsylvania, Ohio and West Virginia. Sales have steadily increased and are expected to reach (75 million this year, up from an estimated $66.7 million in 1988. The profitable restaurant chain has changed along with the teen-agers who in the 1950s and 1960s made Eat'n Park a popular spot to meet friends, show off their cars and chow down a double-decker hamburger, fries and milkshakes. "We're always prepared to adjust to the times, the area, our customers," said Paul Baker, who started with Eat'n Park as a 19-year-old grill boy in 1949 and now is director of property development.

"In this business, you have to be prepared to change, or it's 'see you The first restaurant caused a traffic jam on Saw Mill Run Boulevard the day it opened, forcing management to close six hours later to regroup. The second restaurant opened four months later in Avalon. Within 11 years, there were 27 locations. Business was so hot that policemen were hired to direct traffic on Saturday nights. Eat'n Park now bears no resemblance to the tiny Saw Mill Run Boulevard shop where the chain first started.

The carhops are gone. All meals are served inside restaurants, some of them large enough to hold 200 seats, and the menu has expanded to more than 100 items. "We have a tremendous following," said James Broadhurst, the current chief executive. "We had the teen-agers back in the 1950s and 1960s. Today a lot of those people are parents and grandparents who are bringing their children back." CONTINUED ON PAGE 15 Remembering the good old days of the carhop, Page 21.

6 13 20 27 3 May Jun Last week Year ago Pittsburgh 178 204 Nationally 1,920 1,976 Source: American Iron and Steel Institute TUESDAY, JUNE 6, 1989 NEWS BRIEFS Car quality up 12 percent The quality of 1989 automobiles rose 12 percent from 1988 models, but the "quality gap" between U.S.-built and Japanese cars widened, a new survey shows. The survey by the marketing firm J.D. Power, found that complaints by owners of U.S. models dropped to 163 per 100 cars, compared with 177 per 100 on 1988 models. Japanese models dropped to 119 for 1989 models, compared with 144 for 1988 models.

NWA: Thanks, but no thanks NWA parent company of Northwest Airlines, rejected all offers to buy the company yesterday and invited suitors to revise their bids. Bidders included oil billionaire Marvin Davis, offering $2.7 billion, Pan Am, offering $3.3 billion; Northwest's machinists' union; and an investment group led by former hotel executive Alfred Checchi. Steady job market expected Little change is expected in Pittsburgh's job market over the summer, say respondents in the latest Employment Outlook Survey from Manpower, Inc. The survey found that 31 percent of employers polled expect to hire more people from July through September; 13 percent expect to cut jobs and 56 percent see no changes. Bilzerian testimony ends Testimony ended yesterday in the securities fraud trial of Singer Co.

Chairman Paul A. Bilzerian, paving the way for closing arguments to the jury later this week. Bilzerian denied any deliberate wrongdoing but conceded that he had given misleading information to the Securities and Exchange Commission in the past. He is charged in an 11-count indictment with conspiracy, violating securities and tax laws and making false statements in connection with three failed takeover attempts. RPS opens Western service Pittsburgh-based Roadway Package System Inc.

opened 15 terminals in the West and Florida last month. The move expands RPS package delivery service to the West Coast. RPS, which competes with United Parcel Service, now has 145 terminals serving 73 percent of the U.S. population. Huntsman ups Aristech stake Jon Huntsman, the Utah chemical magnate, bought 25,000 more shares of Aristech on June 1, according to an SEC filing.

The $2.7 million purchase raises his share in the Pittsburgh chemical company to 7.25 percent T-bill rates at year's low Interest rates on short-term Treasury securities fell in yesterday's auction to the lowest level this year. The Treasury sold three-month bills at a discount rate of 8.17 percent, down from 8.50 percent last week. Six-month bills sold at 7.99 percent, down from 8.36 percent last week. Smith Corona goes public British conglomerate Hanson Pic yesterday said it will sell most of the stock of its Smith Corona Corp. unit in a major public stock offering, marking the return of the leading U.S.

typewriter maker as an independent company. Hanson said it will sell just over 50 percent of Smith Corona's shares for about $333 million. Also in business Three out of five newspaper employees rate their paper as "adequate but not outstanding" and even most of their bosses feel that way, according to a survey of 1,200 newsroom workers The Supreme Court yesterday rejected a request by Michael Milken, the former junk bond chief at Drexel Burnham Lambert, to disqualify the judge presiding over the SEC's suit against him Paul M. Zito, owner of Bacharach has bought GMD Systems, a maker of gas detection equipment for the chemical industry PEOPLE di THE MOVE Marvin L. Fry has been named controller and Bird T.

Lewis vice president of Pitts-burgh-Des Moines Inc. Wendy DeGeorge was named managing attorney at Hyatt Legal Services' Downtown office. Thomas Gillespie Jr. was named president of Lockhart Iron Steel of McKees Rocks. ST facturers Hanover Corp.

and Chicago-based Continental Bank, all of which lowered their rates to 11 percent, from 11.5 percent. Pittsburgh National Bank, Mellon Bank and Dollar Bank of Pittsburgh also lowered their rates as did Chemical Bank, Bank of New York and Irving Trust both units of Bank of New York Co. First National Bank of Chicago, NCNB Texas, Marine Midland Bank and Seafirst Bank of Seattle. The prime rate, once the rate banks charged their best customers, is now used as a benchmark for many loans to consumers and small businesses. On Friday, the Southwest Bank of St.

Louis, a small Midwest bank that has previously set interest-rate trends, cut its prime to 1 1 percent in what appeared to be the start of a reversal in the year-long rise in bank interest rates. CONTINUED ON PAGE 15 JL11 IJiJL ANNIVERSARY Eat'n Park at-a-glance 1988 sales: $66.7 million 1989 sales: $75 million (projected) Restaurants: 49 Employees: 4,000 Company highlights June 6, 1949: Eat'n Park opens first 13-seat restaurant on Saw Mill Run Boulevard. It features uniformed carhop service and a double-decker hamburger. 1956: 10th restaurant opens in Monroeville. 1958: Strawberry pie is introduced to the menu.

1965: 30th restaurant opens in Penn Hills. 1967: Automated order-taking machines are now used for car service. 1971: Last carhop service is phased out. ownership further, acquiring significant stakes, or even majority ownership, of their companies. Last week, three unions announced they were involved in bids for their members' employers: The United Steelworkers said it negotiated a successful bid for the sale of LTV LTV steel bar division to an employee group that includes workers in Beaver Falls.

The Amalgamated Clothing and Textile Workers Union said it will bid for Farley Inc. subsidiary Cluett, Peabody Co. The International Association of Machinists said it bid for NWA Northwest Airlines. ESOPs have already mushroomed in a decade that has seen organized labor's strength wane. There are 10 million employees in 10,000 ESOPs, compared with 248,000 employees in 1,601 ESOPs in 1975, according to the National Center for Employee Ownership in Oakland.

Calif. 15 103 5 1985 1986 ear James S. Broadhurst Chairman and CEO 1972: New 200-seat restaurant opens in Butler with hostess service and first children's menu. 1973: 40th restaurant opens in New Castle. 1977: 24-hour service begins.

1978: Soup and salad bar service begins in New Castle. 1983: Breakfast buffets introduced; non-smoking sections offered. 1985: First bakery at Eat'n Park introduced in Sewickley. 1989: 50th restaurant to open in fall. Post-Gazette Many are heavily leveraged, with companies taking out loans secured by their assets and placing equivalent amounts of stock in trust for their employees.

In 1988, ESOP loans of more than $10 million totaled $6.5 billion, compared with $1.2 billion in 1986, according to the center. To date this year, such loans total $8.2 billion. Investment banking firms are encouraging unions, whose pension funds are major investors in leveraged buyout pools, to consider bidding for companies, or company divisions. "We're working on it very actively," said Frederick McCarthy, managing director at Drexel Burnham Lambert Inc. Employee-owned companies have proved successful in many instances.

Weirton Steel with annual sales of $1 billion, has performed consistently better than its major competitors since it began operation under an ESOP in January 1984. Under the arrangement, 50 percent of the company's annual earnings are distributed I Dec. 20, 1984 ,0.75 1 i vjXX'lyXXvlvlviv li 6J9 I 7.5 I eh JJ" fry i 53 ill More workers now participate in leveraged buyouts By Patricia Zengerle Reuters News Service To most casual observers, leveraged buyouts are the tool of corporate executives and investment bankers who add to their wealth by crippling their companies with mountains of debt. But another group has gotten involved in the LBO arena unions and worker groups who are also taking on debt to buy their companies. "We are going to see more and more groups of employees in both union and nonunion companies hiring investment bankers and making bids for their companies," said Joseph Blasi, an Employee Stock Ownership Plan expert at California Polytechnic University.

Companies are initiating ESOPs to ward off takeover bids, compensate for wage and benefit concessions or increase worker involvement. But many employee groups are taking.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Pittsburgh Post-Gazette

- Archives through last month

- Continually updated

About Pittsburgh Post-Gazette Archive

- Pages Available:

- 2,103,942

- Years Available:

- 1834-2024