New-York Tribune from New York, New York • Page 12

- Publication:

- New-York Tribunei

- Location:

- New York, New York

- Issue Date:

- Page:

- 12

Extracted Article Text (OCR)

FINANCIAL BUREAU. Tribune Building 154 Nassau Street Beekman 3000 Beekman 8243 PERSONAL INVESTMEiNT SERVICE Offered te our clients, enabling them to command expitl advice. Sptcial lists pre? pared on request fcjj our Service De? partment. Merrill, Lynch Co. 120 Broadway, New York Chicago Detroit Members Koto York Stock A Year's Oil Output The marketed output of the oil wells of the United States in 1918 is estimated at 345, 500,000 barrels with a value many millions greater than in 1917.

In addition to this vast amount of oil from the wells must be counted the 27,000,000 barrels taken from the storage tanks of pro? ducers and pipe line com? panies and about 36,500,000 barrels brought in from Mex? ico. Some 5,500,000 bar? rels of crude were exported. Therefore, the gigantic total of 397,000,000 barrels was required to meet domestic needs in 1918. J. R.

Co. Ill Broadway New York THE MARINE TRUST COMPANY BUFEAIO.KY. SIXTY-NINTH YEAR OF SERVICE SEVENTEEN. MJLLION DOLLARS, RESOURCES $100,000,000 J.K. Rice, Jr.

Co.Buy Sell Am. Hawaiian S. S. American Vanadium Childs Co. Com.

Pfd. Eastman Kodak Franklin Ins. Penn. Coal Coke Victor Talking Mach. J.K.Mce,Jr.&Co.

400? to 4010 John. 36 Wall N. T. Swift Co. Rights Shippee Rawson Member? New York Stock 111 Broadway New York Telephone 5740 Rector Allied Packers Inc.

Circular on CAMERON BLAIKIE 44 Broad New York Tel. Brood Liberty bonds All AonrmnMin bought cash on the closing wo Ut-disf tit.fA> tor Bond, tiff --upon? tor Bond, I I tilt I tor lUmii. 4 for a VtttQty I-oau PURDT toL fete BU, W. Breadth of the Market Activity in stocks expanded to close to 1,900,000 shares, but the trading list was somewhat narrower. In all 304 different stocks were traded in, six? teen less than on Monday.

A Runaway Market for a Time There were times when the market became a runaway affair. Violent bid? ding for the industrials caused further sensational advances. Crucible Steel common continued its wild gyrations, soaring in the early afternoon to 149, I which really was 160M-, for the stock sold ex the quarterly dividend of per cent. Then there was Bethlehem Steel which sprang into promi I nence with a spectacular spurt to United States Steel common opened at its high for the day and sold off later to close at Baldwin Loco? motive common was for a time pushed forward by vigorous and aggressive i buying, getting up to 124M, but at the I close of 120 it showed a net loss of 3 i points. The general markest, closed ir regular.

Money Again The market hesitated for a while after the opening because of fears of an other money squeeze. The rate on all in i dustrial call loans shot up to 12 per cent at close Monday and this led tho Street to look for a high opening i rate. Therefore there was much sur i prise when opening and renewal rates of 6 and 7 per cent were announced shortly before midday. With a fair supply of funds available at these flg ures the stock market immediately took on fresh strength and developed into a wild affair. This was around 12:15, when Crucible Steel had its most sensational move of the day.

Crucible was selling aroi nd 139 at the time. The next sale was 142Va, then came another transaction at 143 the next at 145, and then another at 146. There? after Crucible eas-ed came back strong an hour and a half later, this time going to 149. Crucible closed at up .6 points. Dear Time Money It was reported around the Street that some brokers were paying as high as 7 per cent for time money, secured 'by Stock Exchange collateral.

Such a rate would be 1 per rent above the legal rate, but the banks that made the loans, it was asserted, got around the iaw by making the interest rate only 6 per cent, but adding a "service charge" of 1 per cent. Although the fact could not be confirmed, it was stated that $1, 000,000 had been loaned on this basis for a six months' period. Industrial Alcohol United States Industrial Alcohol was in better form. That issued shewed strength for the first time since it I was rumored that the company would I do some new financing. It went from to 150V? and closed 6 points up I at 149.

In connection with the re- covery in the stock it was reported that one of the financing plans under nsideratioh by the board of direc? tors would involve the is-sue of new stock to be offered to the stockholders at par, thus giving them valuable subscription rights. When it first be? came known that the company needed new working capital it was stated that; a note issue was contemplated. It Is understood there is considerable dif? ference of opinion among the direc? tors as to just what should be done, some members of the board favoring a new stock issue and others favoring notes. The Street heard among other things during the day that the 16 per cent dividend rate on Industrial might not be cut after all. Cuba Cane Report To-day The Cuba Cane sugar directors meet to-day after the close of the market.

At that time the report of General Goethals, has been making an in? vestigation of the financial condition of the company for the stockholders, will be read. The report, which is said to be exhaustive, covering 125 pages, will be adverse, the Street heard. Re? ports that the plan for financing the company's need with a $25,000,000 bond issue would be announced to-day was denied by bankers who have been identified with the property. They said the financing was not Cuba Cane common lost the pre? ferred recovered 2 points of the 6 lost on Monday. Commonwealth-Union Oil Deal The Commonwealth Petroleum Com? pany, recently oiganized by a strong banking group, has obtained options on more than $20,000,000 of the capital stock of the Union Oil Company of California.

It was reported about a week ago that the deal was under negotiation, but the president of the Commonwealth issued a vigorous denial. Hide and Leather The American Hide and Leather Com? pany's report for che quarter ended June 30, to be issued shortly, will show a surplus available for dividends on the preferred of approximately $800,000, it was stated yesterday. That would be equivalent to $0.20 a share on the 916,000,000 preferred for the three months compared with $4.73 in the preceding quarter. The June quar? ter of 1918 showed a surplus of $830,000. Utilities Improving Dealers in public utility securities report substantial improvement in that market.

Thin has been reflected in tho stock market, where public utility is? sues have been gradually working One of these has been Con? solidated Gas, which touched yesterday, a new high for the year. The stock sold as low as 87 Vs this year. The attitude toward public utility cor? porations has undprgoaie quite a change in recent months, and public service commissions generally are more dis? posed to allow these companies to charge rate? for their service that will enable them to operate on a profitable Market Opinion The Market a Sale I believe the market is Robert S. Winsom. Caution Against Overtrading We would purchase the weak-credit rails and on reactions the standard Partie ilarly we would caution against overtrading.

Halle Stieglitz. Short Account Reduced The general characteristics of the market show no groat change, though the ranks of those who conser? vatism for time are being swelled, Th? violent up-bidding of specialties does not please the more sober bunking people? The short account has been much reduced, thus depriving the mar? ket of one clement of support. It is now believed that the United States, Steel quarterly report will be a little better than many have expected; this is based upon a current cash position considerably ahead of Clark, Co. Would Take Profits Any sign of the public buying power flagging will be taken advantage of by professionals to sell the market and it may run into a big volume of stop orders. It would seem good judgment to take profits on any swell with the view in mind to replacing lines oij natural W.

Wagner Co. Call money opened at 6 and 7 per cent. It held there until afternoon, when rates moved up to 12 per cent for all industrial loans. That was the closing rate. The ruling rates for money yester? day, compared with a year ago, were as follows: Call money: Yesterday.

Year ago. Percent. Percent. On mixed collateral. 6 6 On indus, Time money (mixed collateral): Sixty days 6 Ninety days 6 Four months 6 Five to six 6 Bank were un? changed yesterday as follows: Thirty Sixty Ninety Spot de- days.

days. days. livery: Per cent. Per cent. Per cunt.

Eligible member banks Eligible non-mtm ber banks.4A@4 Ineligible bank bills.5!4@4!/2 Fov delivery withic thirty days: Percent Eligible member banks.4A Eligible non-member banks. Ineligible bank bills. 6 Discount followinf table gives the current rates of the twelve Federal Reserve banks on commercial paper for all periods up to ninety days: 2 -E a. Boston 434 4H New York. 4 434 Philadelphia 4 Cleveland 4l-4 Richmond 5 5 Atlanta 4 43a Chicago 4 434 4H St.

Louis .4 Minneapolis 4 5 Kansas Dallas 4 5 The Federal Reserve Bank of New York has put in force the following schedule of rediscount rates, which apply to bunkers' acceptances: Maturi? ties up to 15 days, 4 per cent; 16 to 60 days, inclusive, per cent; 61 to 90 1 days, inclusive, 4V? per cent. Bank clearings yes- terday were Exchanges. Balances. Now $964,290,928 Baltimore 18,514,176 7,262,279 Boston 83,128,834 24,685,834 i Chicago 110,598,742 8,272,850 Philadelphia 71,755,382 13,668,155 Sub-Treasury. The Sub-Treasury gained $932,000 from the banks on Monday.

New York, Mexican dollars, London Money Market LONDON, July money, per cent. Discount rates, short bills, 3V4 per cent; three months bills, per cent. Gold premiums at Lisbon, 110.00. The Dollar in Foreign Exchange The principal developments in the' local foreign exchange market yester? day were: Exchange on London and Paris fell to new low record levels. Dealings were resumed in exchange on Berlin.

Demancf sterling declined to making the discount on the pound, as quoted in American currency, about 9 per cent. French exchange wont to 7.03 francs to the dollar for checks, a discount of about 35 per cent. The first dealings in German marks were made on a basis of cents for check marks and cents for cables. (Quoted dollars to the pound.) Week Yesterday, ago. Sterling, demand Sterling, cables 4.39 4.48% Sterling, sixty 4.35l/8 4.44% Sterling, ninety days.

4.34 4.43J4 (Quoted unitB to the dollar.) Francs, checks 7.03 6.89 Francs, cables 7.01 6.87 Belgium, checks. 7.27 7.12 Belgium, 7.25 7.10 Lire, checks 8.42 8.37 Lire, cables. 8.40 8.35 Swiss, 4.65 5.55 Swiss, cables. 5.63 5.53 (Quoted cents to the unit.) Guilders, checks' 38H Guilders, cables German marks, chks. 8JA German marks, cables 8-4 Sweden, checks .24.55 25.00 Sweden, cablea .24.75 25.20 Denmark, checks 22.85 Denmark, cables .22.65 23.05 Norway, checks .23.90 2425 Norway, cables .24.10 24.45 Pesetas, checks 19.17 19.45 Pesetas, cables 19.25 19.52 Japan, yen, 51'4 5114 Japan, yen, Argentina, checks ...103 103 Argentina, cables Brazil, Rio, Brazil, Rio, Pierce Oil Financing The Pierce Oil Corporation yester? day announced a plan giving holders of Its ten-year 5 per cent debentures of 1924 tho privilege of converting each $100 bond into one share of pre? ferred stock, whose par value is $100.

Provision has been made for the re? demption on January 1, 1920, of nil debcnturoB which are not bo ex? changed. Those who desire to make the conversion must deposit their de? benture? with the Guaranty Trust Company by August IB next. The pre? ferred stock is to be part of a total authorized issue of which bears dividends at tho rate of 8 per cent a year. The issue Is to he con? vertible at any time on or before Jan? uary 1, 1923, into an equal par amount of Class common stock. Tho en? tire issue has been sold to Lehman Brother? and Goldman, Sachs Co.

Dealings in German Mark Resumed Here Six Times Normal Volume Handled ou First Day of Trading Since the United States Entered the War Range From 8c to 8'Mc Importers Buy Exchange Against Prospective Pur? chases of Teuton Goods Unrestricted trading in German marks took place yesterday in the New York foreign exchange market for the first time since the United States en? tered the European war. Tho formal announcement by the War Trade Board of the State Department that trading with Germany would henceforth permitted removed tho legal barriers to dealing in Teuton exchange. The mark in terms of American money was ten cents less yesterday than when the United States a state of war existed. In a broad market, in which nearly six times tho volume of business that was done on a normal ante-bellum day was trans? acted, the mark closed.at 8V2 and yesterday, compared with the quota? tion of 18V. cents two years and four months ago.

Orders for marks, dealers in ex? change declared, came largely from im? porting houses in this country, who anticipate buying merchandise in Ger? many. It was explained that the marks purchased were not for im? mediate use, but were secured by mer chants who expect to need them in the next year or two and desire to profit from the present tinprecedentedly low quotation. A fairly large inquiry for marks also originated among individuals here, I who wanted immediately to transmit funds to relatives in Germany. The market in German exchange was ir i regular and quotations varied what in different banking institutions. I The range for the day, however, wh3 approximately from 8 to cents.

Some dealers quoted the identical rate for Berlin marks and for those des? tined to go to occupied parts of Ger many. Trading in marks to occupied parts began a week ago, when took over the function temporarily performed by the American relief ad? ministration. The normal value of the mark is 23.83 cents. Sterling and French exchange, which have been fast declining in this mar? ket, reached new low levels for all time yesterday. Lack of desire on the part of American interests at this time to create additional balances abroad is making the supply of sterling bills run far ahead of the demand.

In terms of commerce, the exchange sit? uation, bankers say, is 'caused by the fact that Great Britain and the pean nations are making large pur? chases here, whereas? the United States is buying virtually nothing from Europe. Moreover, the dominant posi? tion of this country in the gold market makes the dollar sell at. a premium Sterling is at a discount of about 0 per cent in this market, and francs at a discount of nearly 35 per cent. De? mand sterling was quoted yesterday at $4,388, and 7.03 francs were needed (.0 buy a dollar, compared with a parity of 5.185. Exporters look upon the depreciation of foreign currency as a bar to trade, because the premium of tho dollar adds to the cost to the foreigner of American merchandise.

Get Options on Stock Of Union Oil Company LOS ANGELES, July Options on more than $20,000,000 of the capital stock of the Union Oil Com? pany of California have been secured for the Commonwealth Fetroleum Com? pany, a New York syndicate, it was an? nounced to-day. The syndicate was said to include Henry Lockhart, New York banker and oil man; Charles S. Sabln, president, of the Guaranty Trust. Company of New York, and Percy Rockefeller. The company has $43, 000,000 stock outstanding.

The arrangement was devised, Mr. Lockhart said, to provide the Union Oil Company with financial backing needed to extend its business to Europe, South America and the Orient. -m-, Chile Copper Reports Deficit For First Quarter of 1919 As a result of operations for tho quarter ended March 31, 1919, the Chile Copper Company returned a de? ficit after charges of $660,769, com with a surplus of $300,936, or 8 cents a share, par value $25, earned on the $95,000,000 capital stock in the preceding quarter. During the quarter 3,977,849 pounds were sold and delivered out of a pro? duction of 15,508.924 pounds. The av? erage price realized for tho copper was 18.724 cents a pound, compared with 25.66 cents a pound in the pre? ceding quarter.

The cost of produc? ing this copper, including deprecia? tion and all general expense, was 1T3.25 cents a pound. Significant Relation Money and Prices: Stock of money gold in the Bills discounted and bought by Fed- eral Reserve 348 000 Federal Reserve notes in circulation $1.378,346,000 Total gold reserve. 824 MO 1.813,425,000 1.960,052,000 March? Nearost period Loans on all national $9.691,187,000 Their Hurplus 76 981 COO 75,920,000 Average price of fifty stocks. Ayearairo Average price of twenty-five 86 37 77-46 Food cost of living (Annalist SOBJkSi- General commodity price level (Dun's 282.168 index number). 233:707 227 97-i AZS" Production: ,973 232-575 Unfilled U.

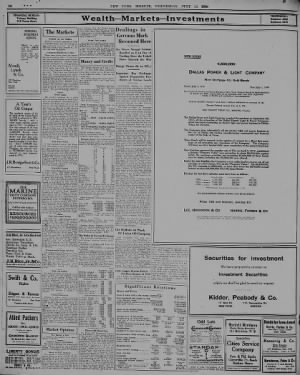

S. steel orders, tons. (Rtffo Pig Iron output (daily average), May Wheat crop, buBhels. yield, estimated Th Corn, bushelB 1,161,000,000 91710OOOOP' Cotton, 500-lb. 2,815,000,000 10,986,000 Distributions year before-, Gross railroad earnings Bank clearings Active cotton spindles.33,943?405 33,556,011 33 Commercial failures (Dun's): Number A Liabilities 485 531 804 Building permits' $11'956'651 $10.606,741 $37:092,701 NEW ISSUE 4,500,000 Dallas Power Light Company First Mortgage Gold Bonds Dated July 1, 1919 Due July 1, 1949 Principal and interest payable in Boston or New York.

Coupon Bonds in denominations of $1,000 and $500, registerable as to principal only, and fully registered bonds of $1,000 and multiplies; interchangeable. Interest payable January 1 and July 1 without deduction on account of the Normal Federal Income Tax up to OLD COLONY TRUST BOSTON, Trustee. The Dallas Power and Light Company'acquired by purchase on September 29, 1917, all the properties of the Dallas Electric Light Power Company, which had been conducting an electric light and power business in Dallas, Texas, for 16 years. The Company does substantially all the electric light and power business in the city of Dallas, the leading manufacturing, commercial and financial center of the State of Texas. These Bonds will be secured, in the opinion of counsel, by a direct first mort? gage on all properties and franchises of the Company.

The Company will have no other funded debt, upon completion of the present financing. New franchise approved by popular vote of City on April 3, 1917, established a definite "Property Value" now amounting to about $6,200,000, against which, the mortgage provides, not exceeding $5,000,000 of these bonds may be issued, including the $4,500,000 now offered. Under the new franchise the Company is now authorized to reserve out of net earnings, as a first charge, on the "Property Value." On $6,200,000, this amounts to $558,000, or more than twice the $270,000 annual interest on these $4,500,000 First Mortgage Bonds. Earnings for last three calendar years have been as follows: Gross Earnings Operating Expenses Net 1916..., 1,143,065 533,360 609,705 589,214 678,708 1,434,367 737,998 696,369 franchise became operative October 1, 1917. WE RECOMMEND THESE BONDS FOR INVESTMENT Price 100 and interest, yielding LEE, HIGGINSON CO HARRIS, FORBES CO The statements contained herein, while not guaranteed, are based upon Information and advice which we believe to be accurate and reliable.

for investment We have prepared a circular on Investment Securities which we shall be glad to send on request Kidder, Peabody Co. 17 Wall St. 115 Devonshire St. NEW YORK BOSTON Odd Lots Write Dept. 10.

New York Stock Hxchana? 71 Broadway New York City fptown Office.3D E. 42nd St. Harlem 290 Lenox cor. 126th St. Bronx Office.391 E.

149th St. Brooklyn Office. 32 Court St. i Yonkora Office.12 N. Broadway Newark Ottlco.777 Broud St.

STANDARD WEEKLY WXl nK 6L MM All- yf MAILED ON TO STANDARD OIL INVESTOR? ISSUES ON RKQUE91 ft WH. I'Uone 4800-1-3-8-4 Broad. 2S Broad Lyrnan N. Hlne, vice-president of the American Cotton Oil Company, has been a director of the Liberty Securities Corporation. 1er Srntberf? Ul N.

$. Specialists Cities Service Company I Com. Pfd. Stocks Convertible Bonds Bankers Shares PrlvEtt Phon? to Pnllsdslpnla Bonds for Investment Harris. Forbes Co.

Pina Street, Corner Will-Ms NEW YORK Hannevig Co? Marine Fi-anci-f Marine Securibci 139 Broadway, New York Foreign Exchange Letters of Credit Hartshorne, Fales Co. Members N. Y. Stock Exchange 71 Broadway New Yerk Telephone 7610 Bo-Wtag Green.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About New-York Tribune Archive

- Pages Available:

- 367,604

- Years Available:

- 1841-1922