Santa Cruz Sentinel from Santa Cruz, California • Page 72

- Publication:

- Santa Cruz Sentineli

- Location:

- Santa Cruz, California

- Issue Date:

- Page:

- 72

Extracted Article Text (OCR)

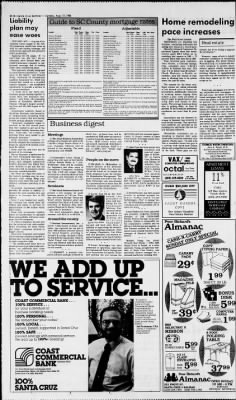

D-10-Santa Cruz Sentinel Sunday, Aug. 17, 1986 Guide to SC County mortgage rates Home remodeling pace increases Liability plan may ease woes Fixed Adjustable Lender Rite Down Mix. Mu. PU. Fees Amt Rite Down () Pmt Real estate 8250 8200 8250 8250 8250 8250 8200 8300 8250 8250 8250 8300 8200 8300 8250 8300 8200 8285 8133.250 2.0 8133.250 2 0 8133.250 2.0 8133.250 2.0 8133.250 2.0 8133.250 1.5 8133.250 2.0 8133.250 2.5 8133.250 2.0 8133.250 2.0 8133.250 2.0 8133.250 2.0 8133,250 2.0 8130.000 2.0 8133.250 2.0 6133.250 2.0 8133.250 2.0 8133.250 2.0 Alliance Mortgage 10.37 10 Bank of America 10.25 10 Baysldf Mortgage 10.18 10 Capltola Countryside Fin 10.00 10 Central Pacific Mtg.

of SV 10.37 10 Commerlcal Pacific 10.50 10 Monterey-Coast Savings 10.57 20 County Bank 10.25 20 Eureka Federal Savings 10.37 10 CSM 10.25 10 New Equities 10.37 20 Pac. Contlnenllal Financial 9.87 10 San Francisco Federal 10.50 5 Santa Cruz Mortgages 10.37 10 Security Trust Mortgage 10.18 10 Home Loan 10.00 20 Wells Fargo 10.25 5 World Savings 10.62 30 Life. PU. Fee Cp 13.50 1.5 6250 13.25 2.0 8200 12.78 2.0 8250 12.75 2.5 8250 13.87 2.0 8250 13.50 1.7 8250 13.25 1.2 8250 14.25 1.5 8200 12.75 1.5 8250 13.25 1.5 8200 13.78 2.5 8250 13.50 1.5 8200 13.87 2.0 8250 13.75 1.5 8200 13.00' 2.0 8300 14.00 2.0 8250 13.87 2.0 8250 13.18 2.0 8250 14.00 2.0 8200 13.50 1.5 8285 () Pint. Amt Alliance Mortgage 8.50 10 8250.000 Bank of America 8.25 20 8500.000 Bayslde Mortgage 7.78 10 8133.250 Capltola Countryside Fin 'JS 10 8350.000 Cen.

Pacific Mtg. of SV 7.87 10 8133.250 Citicorp Savings 8.50 10 8250.000 Commerlcal Pacific 8.25 10 8133.250 Monterey-Coast Savings 8.50 10 8500.000 Eureka Federal Savings 8.75 10 8300.000 Great Western 8.50 20 8300.000 GSM 8.78 10 8300.000 Home Savings 8.50 10 8300.000 New Equities 7.87 10 8133.250 Pac. Continental Financial 8.75 10 Santa Cruz Mortgages 800 10 8133.250 San Francisco Federal 9.00 10 8200.000 SecurityTrust 7.87 10 8133.250 Home Loan 8.18 10 8200.000 Wells Fargo 9.00 20 8400.000 World Savings 8.50 20 8250.000 around, but we're trying to upgrade the profession." However, some efforts to bolster consumer confidence in remodeling are struggling. The Home Owners Warranty 3 1-2-year-old warranty program to protect homeowners against shoddy remodeling work has barely gotten out of the starting blocks. A spokeswoman says that only 250 remodelers in six cities have signed up for the coverage so far.

The Wall Street Journal Homeowners are installing new kitchens, renovating bathrooms and adding new rooms at a record pace. Recently released Commerce Department figures show that homeowners spent $80.3 billion on remodeling and repairs In 1985 78 percent more than they did in 1982. That feverish pace continues. Vem Pitcher, a Colorado Springs, remodeler, says, "I did $1.2 million in business last year. This year I'll do better than 2 million." Chuck Moriarty, a Seattle re-modeler, says the volume of business is allowing him to be pickier about the jobs he takes.

The reasons for the boom vary. Many owners are taking advantage of low interest rates to finance improvements. Additionally, with sales of existing homes topping three million a year, there are plenty of buyers eager to spend money on tailoring their new homes to their tastes. The average American home also is getting older. At least 30 percent of the 92 million permanent residences are more than 45 years old.

Kemodelers say the sharpest increase in business has occurred in multifamily housing. They speculate that landlords are sprucing up the buildings for sale before the new tax law becomes effective. Meanwhile, remodelers are attempting to improve their sometimes poor record on consumer complaints. Pitcher says: "It used to be that a remodeler meant two guys in a pick-up with out-of-state license plates and a wheelbarrow and ladder in the back. Those guys are still Rates quoted are for single family, owner-occupied homes with loan amount of 8133.250.

RATE Rates are for standard 30-year, fixed-rate mortgage. MAXIMUM LOAN AMOUNT: The most that can be advanced to a borrower under a specific loan program. MAXIMUM RATE The highest Interest rate that can be charged during the life of the loan. DOWN PAYMENT: Down payment percentage Is for loan amount noted. A greater down payment percentage may be required for a larger loan.

POINTS: Loan origination fee charged by the lender at closing expressed as a percentage of the loan amount. FEES: The fee lenders charge to process your loan application. Appraisal, document preparation, credit report, and other fees may also be assessed when a loan closes. This chart Is only a sampling of fixed mortgage loan rates at area financial Institutions. Kales are subject to change dally.

Founders Title Company contributes to this report Rates quoted are for single family, owner-occupied homes with loan amount of 8133.250 or above. DOWN PAYMENT: Down payment percentage is for loan amount noted A greater down payment percentage may be required for a larger loan. RATE Rales quoted are introductory rates and will usually increase to a fully Indexed rate after an Initial period. MAXIMUM LOAN AMOUNT: The most that can be advanced to a borrower under a specific loan program. MAXIMUM KATE: The highest Interest rale that can be charged during the life of the loan.

POINTS: Loan origination fee charged by the lender at closings, expressed as a percentage of the loan amount. FEES: The fee lenders charge to process your loan application. Appraisal, document preparation, credit report, and other fees may also be assessed when a loan closes. This chart Is only a sampling of adjustable mortgage loan rates at area financial institutions. Rales are subject to change dally.

Founders Title Company contributes to this report Fixed-rate mortgages are swamping adjustable-rate mortgages. In the last year, the share of conventional mortgages that carried fixed-rates has grown to 69 percent from 44 percent. That's alarming many savings and loan associations. ARMs were supposed to solve the thrift industry's dangerous mismatch between the long-term rates it earns on mortgages and the more volatile short-term rates it pays depositors. But savings and loan associations are seeing the ARMs they made two and three years ago being refinanced at today's lower rates with fixed-rate mortgages.

To add insult to injury, the ARMs often are being refinanced with money supplied by the government-backed players in the secondary mortgage market. Business digest Meetings operations and new accounts departments. A 15-year resident of Santa Cruz County, Sciarappa joined Com-. mercial Pacific in 1985. John Vera has been named vice ASAP, of Santa Cruz, will be marketed by IBM under the terms of a contract recently signed by the two firms.

IBM direct sales and authorized industrial distributors will offer the package. ASAP is a part of IBM's new "Vendor Logo Software" sales program. The Small Business Consortium of Santa Cruz County will meet at the Cabrillo College Sesnon House at 4 p.m. Tuesday. Officers will be elected at the meeting.

For more information call 479-6229. CHICAGO (AP) A group of accounting firms caught in the liability-insurance crunch has come up with its own backup coverage, and predicts the approach will spread to other professions. Applying the old adage, "If can't beat 'em, join 'em," the accountants have formed their own liability-insurance company to supplement coverage that is eroding under their commercial plans. This approach, already being used by some lawyers and doctors, "is the wave of the future," said Howard Stone, chairman of Accountants Liability Assurance which was formed last month as a so-called captive company one established specifically to provide a service to its owners-members. "I think we'll see more professional groups banding together to create their own insurance companies," said Stone, also managing partner of Altschuler, Melvoin Glasser, Chicago's largest accounting firm and the 18th largest in the nation.

Accountants Liability, based in Hamilton, Bermuda, was formed by 27 medium-sized accounting firms across the country that were having trouble getting adequate coverage. I "Insurance companies began to ponclude in the last several years that they wanted to get out of the professional liability insurance business," Stone said. "As a result, accounting firms were unable to get adequate insurance." Some insurance companies reportedly chopped the maximum coverage for claims to $1 million a year from $5 million. Stone said his own firm lost 60 percent of its coverage. Harvey Seymour, a spokesman for the New York-based Insurance Information Institute, an industry group, said adequate commercial liability insurance has indeed been tnore difficult to get and that the reduction cited in maximum claims coverage sounded plausible.

But there are signs the worst of the liability problem may be over, Seymour said, adding things may friiprove even more this year if the industry continues operating in the black. At present, Accountants Liability provides $5 million in liability insurance for each member firm and Cxpects to increase this to $10 million. Since it was founded last month, the company has raised about $12 million and hopes to increase its Capitalization to $40 million within three years. Stone said Accountants Liability Emits its membership to mid-sized firms and probably will never cover jriore than 50 companies. It's these companies, he said, that are the preferred risk, with smaller firms accounting for more claims and larger companies involved in bigger awards.

Insurance companies had lumped all accounting companies together in Setting rates, he said, without regard their respective risks. "The middle-sized firms have as clients primarily privately held companies, not publically held, Stone said, "and the more significant risk Comes from the public." TECHNICAL WRITING CONSULTANT: Ann A. Wood, M.A. Business Academic Computing, Educational Materials, Promotional Press Releases (415)726-5412 R.R.I, Box 112D Half Moon Boy CA 94019 president and general manager of KCBA-TV in Santa Cruz, Monterey and Salinas by Ackerley Communications. Prior to joining KCBA, Vera VAXr COMPUTER.TIMtSJHARING octal Low Rates Local Access People on the move Marybeth G.

Richardson, executive director of the Downtown Association of Santa Cruz, has completed the fourth of six annual one-week programs from the Institute for Organization Management. This year's session was held at San Jose State University, and was.attended by representatives of more than 300 voluntary organization executives from around the United States. was genera) sales manager John Vera INCORPORATED (408) 429-8080 11 OVER $50,000 OFF 30 year fixed CALL Jeff Bays Gabrio Valerie Reile (408) 425-7880 David Van Etten has been Commodore Users Group of Santa Cruz will meet at the Cabrillo College Sesnon House at 7 p.m. Wednesday. Help will be available for beginners and other users of Commodore Computers including the C-64, C-128 and Amiga.

There will also be a demonstration of word processing and discussion of printers. For more information call 688-2843. Seminars The Small Business Council will present a free seminar for small business owners at 7:30 a.m. Tuesday, at Citicorp Savings, Ocean and Water streets. Business owner and consultant Pam Myatt will offer "An Overview of Business Plan Information Required by Banks, Venture Capitalists or Investors." For more information about the seminar, call 423-1111 or 429-5710.

Around the county Borland International, a Scotts Valley-based software publisher, has captured the top slot in June 1986 business software sales in the United Kingdom, according to Softsel UK ratings. Borland's Turbo Prolog held the top position, while its Turbo Pascal was listed in third place and Sidekick held fifth among the top 10 business software products for the month. IBARSOFT, a personal computer software package produced by MViSiV' I YACHT HARBOR COVE See todays Classified Real Estate Section named vice president of sales and marketing for the Chaminade Whitney Conference Center. He will be responsible for training and directing Chaminade's sales force, in filfe a5 it- of KMST-TV in Monterey. He has held other upper management positions at KTXL, KXTV and KCRA of Sacramento, and at KNTV in San Jose.

David Navarro has been named director of national accounts for Scotts Valley-based Victor Technologies. Prior to joining Victor, the Philadelphia resident was a consultant and vice president of U.S. sales for Atari. Larry Dodson has been appointed vice president corporate facilities manager of San Carlos-based Eureka Federal Savings. In his new position, Dodson is responsible for the corporation's archives and its delivery distribution and supplies.

A Ben Lomond resident for the past Severn years, Dodson was previously manager of Eureka's Santa Cruz branch. Michael Young has joined Network Real Estate ERA, 4630 Soquel Drive in Soquel, as a sales associate. Young, an eight-year resident of Santa Cruz County, was previously district manager for a national health food retailing firm. Poor Richard's David Van Etten national and local Almanac addition to supervising the advertising and marketing programs. Prior to joining Chaminade, Van Etten was vice president and western regional manager in the San Francisco offices of Boston-based Forum Corp.

Carol Sciarappa has been promoted to operations supervisor for Commercial Pacific Savings and Loan Association in Capitola. In her new position she will oversee the CW COPY iTYPING PAPER j- CANARY rTL MAGAZINE 1 JL 'f i -JFTLE 500 CT. 20 LB. tA I BONUS fc.V DISK wfefestf 1IBM CQQ VirT'J l'i FORMAT 2U yl Ljss ov D.S.D.D. mm y5 1 98 LIST 39 COMPUTER PAPER "It's easy to understand why I bank at Coast Commercial Bank; they're friendly, cooperative, and responsive.

Coast Commercial always comes through when I recommend them to one of my clients." Jeff Fioshman, CPA. Jeffrey S. Froshman Accountancy Corporation 15 LB. "I 99 250 CT. JL COAST COMMERCIAL BANK 100 SERVICE for your individual or business banking needs 100 We remember your name! 100 LOCAL owned, based, supported in Santa Cruz 100 insured savings with personal service.

We add up to 100 Banking! IBM SELECTRICJJ RIBBON 6 FOOT FOLDING TABLE TABLE KitB' BY-86" 99 Pt CORRECTABLE COAST COMMERCIAL ENVELOPES Vj fL QQ WALNUT' 1 Membor FDIC BANK qua r-m -M 5UU MtW 37" 701 Front Street and 1664 Soquel Drive Administrative Office: 104 Walnut Ave, Suite 201 Santa Cruz, CA (408) 458-4500 Poor Richard's Almanac 100 SANTA CRUZ OPEN SUNDAY 521 FRONT ST. SANTA CRUZ SALINAS (4081 425-1 99 1 (409) 758-2 1 88 10 AM 4 PM MONDAY SATURDAY.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About Santa Cruz Sentinel Archive

- Pages Available:

- 909,325

- Years Available:

- 1884-2005