New-York Tribune from New York, New York • 30

- Publication:

- New-York Tribunei

- Location:

- New York, New York

- Issue Date:

- Page:

- 30

Extracted Article Text (OCR)

FOREIGN GOVERNMENT BONDS Preflt 1.0% to Through our direct connec? in Europe, we can offer all issues ot Foreign Gov? ernment bonds at low prices. Full description and prices on all issues. ScnJ for Circular T.R.-S00 Farson.Son&Co. M.mb.rs York Stock Kxchanje 115 Broadway, New York Foreign Currency We are prepared to quote firm markets in German Marks Russian Rubles Roumanian Lei French Francs Italian Lire mjNHAMfcjo Spccialiils 43 Exchange Place, New York Telephone 8300-16 Hanover The Coppers We have prepared a comparative chart of the more impor? tant copper securi? ties together with an analygis of the copper situation. Copy upon request Miller, 60.

MemLerra NooJY.rk Siock Exebande 120 BROADWAY Branch Offices 211 Ftftfa Areone 1475 NEW YORK NBW ISSUE BR00KS STEAMSHIP CORPORATION STOCK Circular on request R.GMegargel&Co. 27 St N. T. Tel. Fimutcial Saw.

UV.Wagner&C*. r. IM. 33 York Singer Building to Use Oil Instead of Coal Fuel American Shipping Also Fast Turning to New Type of Burners, Review Shows The Singer Building will probably be the first big oMice building in the city to turn to oil for etearn. Two of the live bollers in the steam plant have already been converted and the other three will be changed next week, it is understood.

It is planned to start operations with the use of oil Monday. About 100 barrels of oil will be needed daily for the building, it is be? lieved, and a contract has been let for the first three years. Because of the greater advantages "tlered by oil as a fuel, a majority of the better ships now under construc? tion in American yards are oil burners according to a studv of the shjpping Mtuat'on by the Bankers Trust Com? pany made ptiblic yesterdav. More than three-fonrths of the steel uot of 11,547,386 deadweight the Shipping Board's construction program were planned as oil burners. The advantages offered are curtail? ment of crew, saving in fuel consump? tion, greater speed and increased cargo The reduced costs give an Im? proved competitivo ability with na? tions having lower wage standards.

he percentages of saving vary ac? cording: to the type of ship. Other advantages obtained by the use of oil are the better control of steam ing, because fires can be started and stopped instantly, steam raised quickly and time in port saved through the ease of taking on oil as con. trasted with coal. It is also said that does not deteriorate, that it climi nat.s the danger of fire from spon taneous combustion and is not sub? ject to the danger of shifting in a rough sea. It is calculated that beginning with 60,000,000 barrels of oil a year will be needed for ships now operated by the Univd States Shipping Board, exclusive of any private construction don.

after August 1. Virtually all of the. ships under private construction are designec! as oil burners. Stocks Display Firm Tone in a Quiet Session Mexican Oils Harden On the News of Carranza's Death; Low-Priced Oils Bank Statements Off; Stocks continued to display a better tone yesterday in a quiet session in which professional tradcrs were the dominating element. With the Street in a more hopeful frame of mind as a result of the prospects of relief from the transportation blocade tnd a feeling that, in the long run the process of defiation will prove bene flcial in that it will get industry and commerce back upon a more atable basis, the short interest ahowed signs of increasing nervousness.

Most of the buying that came into the market was for the account of the profession? al bears did not care to run the risk of having to face a better market at the beginning of next week should favorable newa develop over Sunday. The movement of the oil shares waa about the most interesting feature of the session at the exchange. The Mex? ican oils displayed a strong tone fol? lowing receipt of news of the death of Carranza, fugitive President of the Mexican Republic. On the other hand, the lower priced oil shares continued under pressure, notably Sinclair and Middle States, which were weak on Friday. The offerings of Sinclair Oil Were especially heavy, breaking the price below 30 for the first time.

In the railroad group, Missouri, Kansas Texas and Texas Pacific were strong spots. Steel common moved within a comparatively narrow range. Advices from Tokio, to the effect that, despite the finaneial and economic upheaval, there withdrawal of gold from rhe United States is not likely at this tinve, helped in creating a bet? ter feeling in finaneial circles. Predie tions that large shipments of gold from London to New York are to be made, have not yet come true, al? though it is insisted, in certain finan? eial quarters, that a consignment of the metal is already on its way here. The weekly statement of the Fed? eral Reserve Bank of New York showed substantial improvement, The bank gained heavily in gold through the settlement.

fund, indicating a large flow to this center from interior points. The local institution again last week discounted the paper of other reserve banks on an active scale. At the end of the week the ratio of reserves to deposit and not liabilities stood at 42.3 per cent against 40.3 the week before. The New York Clearing House banki reported a sharp decrease in surplus reserves although there was also a substantial reduction in loans and dis counts. The Dollar in Foreign Exchange The problemj of the American dollar over tne currencies of Great Britain, France, Belgium, Italy and Germany was substanially reduced during the last week.

Focusing of attention on the matter of making the collection or reparation payments a practical thing sentimentally the exchange value of the countries which would most benefi, and this, coupled wth short covering, was largely reponsible for the movement. France, according to reports, many Frenchmen were technically short of francs, and the abrupt change in the market caused not a little excitement. The rise in marks was perhaps the most striking development. Germany too would be helped by removing the vagueness that surrounds the indem? nity problem. and would be benefitted by leading precisely what it wil have to pay.

Bankers returning from Ger? many report an apparent desire of the Germans to get back to work, and this has helped the mark, which has gained strengh also by covering operations by dealers in this country who have been selling German securities in the United States. Despite the rse of the European finaneial questions, and are dininclined to overemphasize the significance of the week's movement. lf yon calculate the cost of the dol? lar in erms of foreign money at cur? rent exchange is, if you were buying a dollar with pounds, marks or value at the close of last week, as compared with a year ago, follows: --Cost one Yesterday.Year ago. In English $1.24 $1.05 In French money. 2.41 1.25 In Dutch money.

1.07 1.01 In Swss money. 1.16 1.01 In Italian 4.40 1.50 In Swedish 1.24 .96 In Spanish 1.00 .07 (Quoted dollars to the pound.) Yester- Week 0 day. ago. Sterling, $3.8650 $3.8175 Sterling, cables. 3.8725 3.8250 Sterling, sixty 3.81225 8.77625 Sterling, ninety dayB 8.80 3.7550 (Quoted units to the dollar.) Francks, checks.

13.52 15.52 Francs, cables. 13.50 15.20 Belgium, rancB, chks. 13,17 14.37 Belgium, francs, cbls. 13.16 14.35 Lire, checks 18.64 20.45 Lire, cables 18.60 20.40 Swiss francs, 6.66 6.60 Swiss, francs, 5.64 5.69 (Quoted cents to the unit.) Guilders, 86.375 Guilders, cables 36.45 I Austrian crowns, cks. .50 .47 Austrian crowns, cbs.

.41 .48 Sweden, checks.20.90 20.95 Sweden, cables. 21.00 21.05 Denmark, checks 16.30 16.65 Denmark, cables 16.40 16.75 Norway, checks.18.00 18.46 Norway, cables.18.10 18.55 Pesetas, checks 16.70 16.80 Pesetas, cables 16.76 16.85 Rubles, checks Rubles, cables. Greece, checks 11.40 11.30 Greece, cables 11.45 11.35 Manila, checks 49.75 49.75 Manila, cables 60.00 57.00 India, rupees, 40.75 40.75 India, rupes, 41.00 41.00 Japan, yen, 60.25 60.00 Japan, yen, 50.50 51.00 Argentina, checks. ..104.20 103.90 Argentina. cables ...103.70 103.40 Brazil, Rio, 26.375 26.25 Brazil, Rio, 26.50 26.20 Marks, checks 2.41 2.04 Marks, cables 2.42 Czecho-Slovakia, cks 2.88 1.75 Nickel Co.

Earnings Drop InterriationaTs Balance Shows Decline of About 50 P. C. i A shahrp decline in earnings wus Bhown by the annual report of the In ternationad Nickel Company issued yes? terday. The balance after charge and tke year ended March 31 was I equivalent, after preferred t0 $1'32 a 8hare $41, 834,600 outstanding common stock, as I compared with $5,922,629, or $3.22 a share in the previous year. Total earnings were $6,064,762, a de ine of $5,121,642.

The gross income showed a drop of Atlantlc Fruit Co. Profits Net profits of the Atlantic Fruit Com pany, after deducting charges and Fed i eral taxes, were $1,807,070, equivalent to $4.57 a share on the 895,000 shares of capitl atock of no par value. The I port shows total revenue of $8,191,680. Summar) of Stock Exchange Dealings (Copyrlght, 1020, Nuvr York Trtbune Inc.) Day Y.nr January 1 date. Yeat.rda.

bafore. aro. 1920. 1919. 1918.

Railroad 46,100 106,700 99,800 17,491,800 18,112,200 12,801.100 Oth.r stocks 287,800 684,100 678,100 96,9.4,100 79.B41.200 44,164,100 Al! 333,900 689,600 777,900 113,456,900 97,753,400 56,966,200 Ysstsrday. before. Year aro. 1920. 1919.

U. 8. terernment bonds. $7481,000 $,283,984,000 $1,018,978,000 Railroad bonds 1,101,000 1,164.000 8,950,000 141,991,000 140,969,000 Othar bond. 2,047,000 1,477,000 1,047,000 160,228,000 158,229,000 All bonds 10,529,000 24,569,000 5,906,000 1,587,203,000 1.318,196,000 Record of Stock and Bond Averages (Copyrlght, 1930, Ne York Trlbuno, Ino.) Stocks Rangethai Bang.

Day Year far 1920. year Yoatarday. bafore. age. Tllgh.

Low. High. Low. 20 Railroad stoclw 61.20 61.20 77.44 48.70 68.60 78.80 63.36 30 Industrial atoeks 88.80 88.73 103.03 110.30 87.93 119.33 79.20 50 Stock. 77.78 77.76 92,80 92.06 76.96 M.64 Bonds 10 Railroad bonds 66.83 66.73 80.87 76.28 64.73 82.80 72.83 10 Industrial bonds 84.36 .3.81 96.26 91.46 83.81 96.70 90.66 6 Utlllty bonds 68.34 68.62 85.22 74.53 68.34 87.75 71.80 25 74.14 73.94 87.49 $1.71 73.94 87.91 80.21 1920.

1920. Rato. Sales. Advance 1000 72 61 6 Advnnce Kumcly pf. 200 6 300 Alaska Gold 200 3 Alaska Juneau 200 83.1 31 AllU-Chalmers.

300 95 76 8 Amer Agr 100 8 Amer Beet 2800 101 10 Amer Bosch 200 37 Amer Can 200 124''8 12 Amer fcar 300 4 Amer Cotton 011... 400 .80 Amer Drug 200 175 95 6 Amer Express. 100 Amer Hlde Leath. 700 122 87 7 Amer 300 38 4 Amer Ice 200 81 Vi 6 Amer Int'l Corp. 700 95 74 3 American Linseed 200 82 6 Am Locomotive 1800 Am Safety 1600 Am Ship 1400 72 56 4 American Smelt 300 83 6 Am Smelt pf A.

200 86 8 American Snuff 200 50 35 3 Amer Steel Fdy. 1400 7 Amer Sugar 800 77 10 Amer Sumatra 200 8 Amer Tel 2400 6 Amer Tob pf 100 5 Amer Tob 800 7 Amer Woolen 13100 96.2 7 Amer Woolen 200 54 4 Anaconda 1000 30 4 Assoc Dry 300 76 6 At, Top San Fe. 400 Baldwin Loco Co. 9600 3874 Balti Ohio. 600 41 4.

Balti Ohio pf. 600 Beth Motors 1400 5 Beth Steel Class B. 4100 17 Bklyn Rap Tron. 400 15 Booth Fishorles 1100 Brunswick. 200 Butte Cop 200 29.4 20 Butte Super 700 11 Bmterick Co 300 6 Calif Packing 200 46 26 CalU Petrol 100 65 7 Calif Petrol pf.

100 134 110 10 Canada Pacific 300 6 Central Leather 2100 4 Cerro De Pasco. 700 117 10 Chandler 5100 47 4 Ches Ohio. 100 2 Chi Gt Western 100 Chi, Mil St Paul. 800 Chi, Mil St pf. 100 41,8 Chi, Rock Isl Pac.

15800 66 64 6 Chi, I pf. 200 "1 90 7 Chi, St pf. 200 55 42 St Louis. 15 68 59.8 5 St pf. 15 Chile Copp.r 400 Chino Consol 800 1 Coca Cola 100 28 3 Col Fuel 700 27 20 Col Southern.

400 1 Columbia Graph 2900 67 50 5 Col Gas Elec. 1600 75 6 Consol Cigars 100 75 7 Consol Gas 800 32 Cosden Co. 700 13 2 Con Int C-llohan M. 300 1 Continental Candy 200 4 Corn Products 400 3 Con Textile 1600 121 12 Crucible Steel 3200 62 7 Cuba-Amer Sugar 3100 Cuba Cane 5100 7 Cuba Cane Sugar pf. 200 9 Denver Rio 100 9 Denv Rio Gr pf.

100 Erie 700 Erie 1st pf. 100 63 Fairbanks 200 95 8 Famous Players 800 7 Fed Min Smelt. pf. 400 48 3 FUk Rubber 1000 20 Freeport Texas 600 11 Gaston, Wms Wig. 800 100 90 6 Gen Chem Co 100 6 General Cigar 1600 172 134 8 General Elec 100 42 1 General Motors.

14100 6 Gen Motors deb. 200 6 Goodrich, F. 400 7 Gt Northern pf. 400 33 4 Gt Northern Ore snbs 400 Green Can 100 34 28 Gulf Mobile North pf 100 30 Hendee 800 58 4 Haskell Bar 1900 71 61 6 Homestake 100 13 1 Hnpp Motor. 400 50 6 Inspiratlon Cop.

500 Inter Corp 600 Inter Mer 600 6 Inter Mer Marine pf 200 170 50 Inter Motor 200 Inter Mor Truck rts. 200 71 60 Int Mot Trnck 2d pf 100 Inter Paper 1100 Inter Nickel 2800 9H .40 Indiahoma 600 51 Vz Iron Products 200 30 2 Jones Tea. Kansas Clty Southern 200 4 Kelly SprlngBeld 300 95 Kelsey Wheel 200 2 Kennecott Copper 1400 Tire. 200 62 6 Lackawanna Steel 100 43 37 Laclede Gas 100 2 Lee Rubber 100 N. Y.

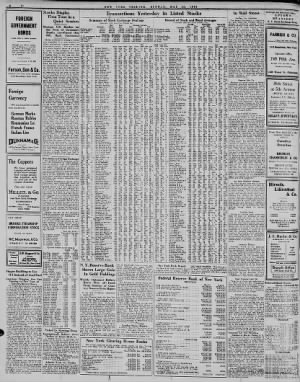

Reserve Bank Shows Large Gain In Gold Holdings Weekly Statement Reflects Heavy Flow of? Funds From Interior of Coun? try; Reserve Ratio Higher In the face of heavier rediscounts for other Reserve banks the New York Federal Reserve Bank was able to re? port for last week a decrease of $44, 625,588 in its total loans. At the aame time there was an increase of $33,322, 679 in the gold settlement fund, which increase would have been considerably greater had it not been for the heavier discounts for oher reserve banks. The improvement in the gold posi? tion and the declne in bill holdings resulted in an increase to 42.3 per cent in the bank's ratio of total reserves to deposit and Federal Reserve note liabillties from 40.3 per cent fo rthe week ended May 14. The ratio of re? serves to net deposts at'er deducting 40 per cent gold reserves against Fed? eral Reserve notea in circulation was 44.9 per cent against 40.6 per cent the week before. Discount operations with member banks of this district showed a falling off of $76,171,485 from a week ago.

while discount for other reserve banks increased $31,645,896. The oper aions with member banks showed a drop of $73,011,430 in loans secured by government war obligations; a de? crease of $4,590,373 in loans on com paper, and an increase of $1 429,318 in holdings of bankers accept? ances. Tha decrease in membr banks bor row.ngs is attributed in some degree to the wave of price cutting that is now takmg pace but it is believed that this development has not yet advanced sufficiently to be an important factor in the money market. It is evident however, that merchants and dealers in commodities are seeing the neces sity of reducing their bank borrowinga hrough the sale of inventories at marked down prices. of th-e New Joik Clearing House banks showed a decrease of $21,061,980 in the excess that item dow" to J7.690.3o0.

Ths drop, however, was! 0fFSet by a decrease of $294,6,000 in loans making a total at the close of the week of $5,127,139,000. demand deposits declined $26,249 i 000 $4,184929,000 while government' noonCrea8ed to from a week ago. London Monev Market LONDON, May silver, per ounce. Bar gold, 108s 2d. Money, per cent.

Discount rates: Short and three months bills, 6 13-16fa per oent. Gold premiums at Lisbon; 140. New York Clearing House Banks sr -SaSKSa companies ftnn Reserve in depositories 9 nnn Circulation 4,184,929 999 Dec. Excess 34.907,000 Dec. Aggregate re.eWV..V.V.V.V.V;;.V.V..-.'.' seiSKJoo Dec! States deposits deducted, $56,249,000.

i High. Low. 1920. 1920. Rate.

Open. High. Low. Cloie. ehgo.

Bid. Ask. Lehigh Valley 200 41 18 13 Llggett Myers rts. 1000 14 14 36 2 Loews, Inc 200 28 70 44 I.oose Wilrn Bi.Mcuit. 200 45 46 50 12 Lorlllard, 100 133 133 133 133 98 7 Louiaville Nashrllla 100 98 98 98 98 98 100 60 4 Mackay Cos pf.

100 60 41 3934 7 Manhattan Ele. 200 45 45 43 43 42 44 45 31 Malllnson 143 31 31 31 29 31 222 161 10 Mexican Petrol 4800 172 172 170 171 26 2 Miami Consol 800 20 20 1.60 Middle States 7800 28 29 4 Midvale Steel 700 41 41 11 Mo, Kan Texas- 7100 5 18 9 Mo, Kon Texas pf. 1200 10 10 9 9 10 21 Missouri Pacific 2000 24 40 Mont Ward 200 31 61 33 4 Mullins Body 300 33 33 37 44 National Aniline 400 67 66 66 66 83 7 National Aniline 300 84 84 84 84 83 86 13 8 Nat Con 200 6 National L.ad 300 76 76 76 76 76 78 Nat Mex 2d pf 100 5 1 Nevada Con 700 1134 403 New Orl Tex Mex 100 36 36 36 32 36 117 92 10 Alr Brake. 100. Va 95 96 6 Central.

800 68 67 67 233,4 Chi 8t Louis 100 25 25 25 25 27 48.2 30 Dock. 200 33 33 33 35 2400 16. 1 Ontario Wast 100 16 Nunnally 300 17 17 88 7 Norfolk 600 89 89 89 89 72 64 4 Norfolk 500 64 64 64 64 83 65 68 48 5 North 100 49 49 49 49-4-1 47 49 7 Northern Pacific- 400 72 31 4 Ohio Gas 600 39 Vz Vk Oklahoma Prod Ref 1500 4 4 4 Otis Steel 100 5 Pacific Gas Elec. 100 6 Pan-Amer Petrol 13900 97 11134 7 Pan-Amer Petrol ,600 92 92 03 30 4 ParUh 100 31 31 31 33 3 Pennsylvania 5600 39 42 30 People's Gas Coka 1400 32 32 32 Pere Marquette 1300 24 24 3 Phila Co. 300 68 57 Phillips Jones 100 67 67 57 57 57 60 Pierce Arrow 3900 48 48 Vz 48 15 Pierce Oil 400 14 16 16 16 88 81 8 Pierce Oil pf.

100 82 82 82 83 66 5 Pittsburgh Coal. 100 56 58 86 6 Pittsburgh Coal pf. 100 21 Pitts West 400 28 28 Vz 84 8 Vressed Steel Car- 200 2 94 96 7 Pressed Steel Car pf 100 96 96 96 95 100 124 109 8 Pullraan Co 200 110 120 74 5 Punta Alegre Sugar. 12100 103 103 8 Railway Steel 700 90 90 90 90 91 2234 1 Ray Cons Copper- 800 17 17 17 17 17 6434 4 Reading 3400 8134 82 94 Remington Typowr. 200 7 Rem'ton Type 2d pf 50 8834 883.4 12434 6 Republic Iron Steel 3800 88 95 7 Repub Iron Steel pf 300 steel 800 85 83 85 5.50Royal Dut shs.

6600 115 115 116 2 116 .1 6 Arms 100 Va 49 300 1034 1034 1034 1 Joseph Lead. 200 16 St Louis San Fran 400 23 23 22V, 23 18 11 St Louis S'western 500 11 11 11 11 12 Seaboard Air Line. 200 7 7 7 7y 1234 Seaboard Air Line pf 100 13 13 13 13 243 205 8 Sears Roebuck. 300 206 2C6 206 210 Shell Trans 600 75 75 0il 31900 29H 61 6 Sloss Sheff Steel Ir 200 63 63 63 63 63 64 6 Southern Pacific 2800 92 92 92 ll Southern R. 300 22 22 2114 50 5 Southern 200 55 56 7 Standard Oil pf.

1600 102 102 10134? Standard Oil rts 2000 118- 4 50 4 Stromberg Carb 300 61 61 61 61 62 7 Studebaker. 14100 6 3teeI 30? 47 47 47 Tenn Cop 2100 10 8 10 Texas Co 3100 46 46 47 25 Texas Pacific. 9800 40 40 40 6 Tobacco ProducU 700 4f4 Oil 800 .28 8 Union Bag P.per. 300 74 75 75 1 38 Union Oil 1000 ll 110 10 Union Pacific 1800 1.3%__T% 1.1/ 62 4 Union Pacific 200 .3 148 124 8 United Dmg 300 126 126 124 JZ 53 United Drug 1st 100 49 49 49 49 49 53 4 United Alloy 400 41 41 -Jr tl 224 176 12 United Fruit 300 196 196 196 19. Tl 197 United Ry 200 17 United Ry Invest pf.

100 18 18 18 6 US Food 300 69 59 ai. 8 S.In'AlchoI.... 2900 gg 64 3 Unit.d Retail Storos 4600 fou 89 8 Rubber. 4800 IL 109 S9VS 5 Steel. 21900 8034 65 6 Utah Copper 300 68 68 67.44- 97 42 6 Vanadium Stoel 1400 rn 4 Va-Car Chemical 600 JVA 104 8 Va-Car 100 105 9 113 76 6 Va Ir, Coal Coke.

200 98 98 SS .1 6 Va Ir' Coke. 200 98 98 98 98 7 20 17 2 Vivaudou 700 II 7 W.bash 300 31 pf A. 800 2vXZZ Western 100 9 gfeZTu Western 300 31 Wabash pf A. 800 Western 100 9 gfeZTu Western 300 26 82 7 Western Union 200 82 119 7 West'hotue Alr Brake 100 105 106 105 Westinghouse 300 46 46 White Motors 800 49 Willys Overland 5600 18 17 Willys pf. 600 ll Worth Pump 700 61S Kg J.gJ Western Pacific 300 82 7 Western Union 200 19 105 7 Atr Brako 100 105 106 105 4 Westinghouse 300 46 46 47 4 White Motor.

800 fr 32 1 Willys Overland 5600 18 17 93 7 Willys pf. 600 "K4 60 New York Dock Report The New York Dock Company earned a surplus after all charges of $921, 944 in 1919, according to the annual re lw This was equiv stock dividends Shar9 0n thft com? mon atock, compared with $8.36 a share earned in 1918. anare Federal Reserve Bank of New York RESOURCES Gold coin and certificates. Gold settlement R. Board.

Gold with foreign agenciea. Total gold held by Gold with F. R. agent. Gold redemption Total gold reserve.

Legal tender notes, silver, etc. I Total reserves. Bills discounted Secured by government war obligati All others. May 21 $81,488,001 118,277,679 41,390,300 $241,166,981 294,186,868 26,993,900 $662,285,750 106,446,613 Mayl4 $83,860,702 84,954,965 41,390,300 $210,206,968 306,072,468 27,000,000 $542,278,436 106,888,700 Bills bought in open Total bills on hand. U.

S. government bonds U. S. Victory notes. U.S.

certificates of indebtedneaa! Total earning assets. Bank Uncollected items and other dedu't tions from gross deposits redemption fund against F. R. Bank notes. All other $668,732,262 618,167,137 672,569,070 618,196,705 216,667,2024 216,868,985 171,629,318 $960,656412 91,005,180,847 1,466,900 1,456,900 60.000 50,000 75,352,875 78,299,117 $1,037,515,188 3,284,921 3,284,300 160,346,392 Total rosources 3,108,840 978,267 3,139,830 1,089,686 LIABILITIES Capital paid in.

Surpius Government Due to Deferred liability items. All other $1,868,163,917 $1,902,012,812 Total gross deposits. F. R. notea in actual circulation.

F. R. Bank notes in All other $24,621,200 46,081,932 5,396,374 725,214,293 113,449,807 42,967,448 $887,017,923 849,245,965 38,269,800 23,927,096 Total liabilitiea Ratio of total reserves to depoaitaand note liabilities combined. Ratio of reaervea to net deposits after de ducting gold on F. R.

notea in circulation $24,558,900 45,081,932 10,634,117 754,427,532 122,959,548 40,000,000 $928,092,142 843,927,195 37,666,600 22,686,042 $1,868,163,917 $1,902,012,812 42.3% 40.3% Contingent liability on bills purchased for, foreign correspondents. 44.9% 40.6% $16,181,776 $16,187,837 In Wall Street Kei-'onK for OptimiHm The drastic lirjuidation of securities the past week has brought about a change in sentiment among several Stock Exchange firms which have been bearish on the stock market outlook for several months. Among this number are Goodbody who say that "if we were to hazard a predic tion it would be that prices of most stocks, except, perhaps the luxury stocks, are now near bottom and that they will sell materially higher in the next months. We are moderately optimistic in spite of the poor out? look for this year's crops." The firm gives as reasons for its optimistic at titude toward security values the fol? lowing: Commercial interests have heeded the warnings of the Federal Reserve Board, the efficiency of labor will be greatly Increased owing to the slowing up of business, the throwing on the market of goods on which the banks will no longer make loans will lower money rates, lower money rates will mean higher prices for good bonds and preferred and common stocks, the proposal to increase railroad rates to make the carriers self-supporting and independent, reduced prices of com modities and increased efficiency will reduce the cost of operating railroads, street railways and other public utility corporations. Mexican Oils Up Mexican oil issued moved up sharply yesterday following publication of the report of President Carranza's death.

The Pan-American Petroleum in which pool operations also were a fac tor, after opening points higher, at advanced further to and finally closed at The stock was less active, but nevertheless gained a full point in the two-hour trading ses? sion. The advance in Mexican Petro? leum was only fractional. The state? ment of General Obregon to The Trib? une that he favored establishing an era of friendship with the people of the United States was regarded as a favor? able stock market factor. The Problem of Prices One of the greatest needs of Ameri? can citizens to-day, in the cpinidn of Howard S. Mott, vice-president of the frving National Bank, is a competent understanding of the problem of prices.

"Diagnosis leads us, inevitably, to the conclusion," says Mr. Mott, "that pres? ent high prices and their concommit ants of shattered standards, uneasy politics and social unrest, have been provoked by stationary or declining production of staples and the substitu tion of dollars for wealth. With such a diagnosis the remedies should be simple if we are. courageous enough to take them. The first one, naturally, could be to produce more staples.

The second, to stop buying things we do not really need or can get along with? out. The third, namely, to create wealth instead of dollars, would fol? low partly automatically from the ap? plication of the first two, but would be tremendously accelerated were we to admonish our legislatures and our political administration to follow our example." Mr. Mott believes that the peak of prices has been reached, at least for the time being, and adds: "Should the signs and portents of the last few days prove to be the forerunners of a period of defiation? long or outlook should be regarded not as a cause for discourage ment but merely as an opportunity again to exercise the virtues of pru dence and good judgment." An Ohio Banker's Opinion An Ohio banker, who was a visitor in the finaneial district yesterday. de? clared that in his opinion too much attention was being paid to the reports of price cutting. "Out in Ohio, where I live," said, "we do not believe that prices are coming down right away, because the farmers are barren of supplies and are buyers rather than seliers.

The law of supply and demand will continue to assert itself, and. be lieving that the demand for goods is stil greater than the supply, the banks with which I am connected are still lending money based on current prices." Crucible Steel Selling of Crucible Steel, which has been so much in evidence te past week, carried the price of tat stock down yesterday to 121, a new low since the 50 per cent. stock dividend came off. Fear that Congress may pass the soldier bonus bill carrying a retro active tax of 10 per cent on stock dividends is believed to be behind the weakness in Crucible. Early in the year the company authorized an in? crease in its common stock capitaliza tion from $25,000,000 to $75,000,000, the intimation being made that the in? crease would ultimately be given to shareholders in the form of stock divi? dends.

American Woolen President Wood of the American Woolen Company denied reports that the management intended to put into effect a curtailment of production. He said that while the company has been inconvenienced by the. present rail? road freight tie-up, it is "certainly doing its best and will continue to do its best to keep running under the present very trying circumstances. No official representative of the American Woolen Company, so far as I can as certain, has made any such statement as appeared in Friday morning's pa? pers with reference to curtailment of production by the American Woolen Company. If any person made such a statement it was witout authority." Steel Workers Laid Off Plans for a 20 per cent reduction in the office force of the Youngatown Sheet Tube were announced yester? day by President J.

A. Campbell. The did not warrant it, and our heavy) over carrying our full force when conditions will not. permit it any longer. British Ssecurities Down The London stock market has been undergoing a period of drastic liquida tion which apparentiy compares in vol? ume with the heavy selling that has taken place on the New York Stock Exchange since February.

"It is a long time since our valuation of Stock I Exchange securities showed such a wholesale decline aa that which has taken place during the last month," aaya "The Banker's Magazine" of Lon-! don. "In fact, the occasion is in the sense that not only is the ag gregate depreciation heavy, but there is not a single department showing an improvement for the month." Accord- ing to the magazine's compilation the total depreciation in 387 representative British stocks during the period from March 18 to April 20 was Contract Let for Wireless Station at Rocky Point, L. I. The contract for the construction of the r.ew vireless station to be built by the Radio Corporaion at Rocky L. has been awarded to the J.

White Engineering Corporation, 43 Ex change Place, it was announced yester- i day. Work will be begun immediatelv. I The station, when completed, will have a diameter of more than three miles with twelve sets of antanny, strung to seventy-two-foot self-support- ing steel towers 400 feet high, set up a mile and a half away from the central power house, and will probably cost about $10,000,000. It will be divided into five units for communication with Argnentina, France, Scandinavia, Ger? many and one with Italy and Poland. The annual raeetlnr of the oan OU Company will held ln Londvn June 23.

reslftlna; In America are entiUoii to atisnd in. person. lf their share warrants are. deposited with the Guaranty Trust Company fourteen days be- I fore the date. of fSrokrraffe and InveitmerU UP'TOWN BRANCHES N.

y. Stock Exchange Virmt PARRISH CO. Uenrter, 115 Broadway, Kew York Up-town Office 749 Fifth Ave. 67th and Mth Streeu. Telephone Plaia 1500 Wabut 59th Street at 5th Avenue (HOTEL SAVOY) Entrance 5 E.

58th St. Accounts carried on a con? servative margin or orders execut'ed for cash. We offer all the facilities of our main office. TELEPHONE 379? KELLEY, Members New York Bfvck Exchmgt 35 Wall St. Tel.

Hanover 4163 Private Wires Enslle Us to exceptional facilities for trading in Canadian Securities BRUMLEY, CHAMBERLIN CO. Members Nen York Stock Exchangi BRANCH OFFICE 503 Fifth Ave. (Cor- 42d St.) 15 Broad Street, New York Telephone Hanover 72S5 Hirscht Lilienthal Co. Members Nent York Slock Exchange New Yorl( Cotion Exchange N. Y.

Coffee Sugar Exchange Chicago Board of Trade STOCKS I50.VDS COTTON GRAIN Hotel Belleclaire, B'wuy 77th St Hotel Breslin, B'way 29tk St 3 East 44tb St. 165 Broadway J. S. Bache Co. 43 BROADWAY.

NEW .883 BONDS STOCKS COTTON GRAIN PROVISIONS FOREIGN EXCHANGE MamiMir. Yorls Bought and Sold os Commiuhn Branch Office 106 Eaat 14th St. I Branches and Correspondenta throughout the United Stataa Inbersoll-Rand Report Shows Substanial Gain Net surplus of the i Company for 1919 tial increase, accordir.g to ths snnu statement issued yesu-n after charges and Federal taxes $5,016,907, equivalent after dividends to $44.63 a share on the 900,035 common stock, against 172, or $30.69 a share in the preeedirj year. Net earnings showed a decline 1919 of $2,684,212, being placed st V-' 116,552, but Federal taxes wert siderahly lower, and the net balaiK showed an increase of 1,350,735, rtttr. ing a total of whien counted for the gain in tht smoar available for dividends.

Dividends Stoek Rate and period payable. oirt. Cheesebor Co.3"-% 30 Int Agrr fSilt do pf JordWl Motor 01 Jun- do pf JuneSO of Cobalt, I.td July Tranult no July Sprlny Brew Co, May Ex-Dividends May Brpi May 29-Am Tel. Pittsburfti Hy May Kodak Co. May Corp IV May 31? do pf May May Mfg.

Hnelt Co. Pf- JJ Co. 2d pf. May 24? Oeneral cigar Ce. pf.J? May Wmu? Rf juay ot! May Co lt pf Majr Cigar Storea Co of Am.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About New-York Tribune Archive

- Pages Available:

- 367,604

- Years Available:

- 1841-1922