The Los Angeles Times from Los Angeles, California • 35

- Publication:

- The Los Angeles Timesi

- Location:

- Los Angeles, California

- Issue Date:

- Page:

- 35

Extracted Article Text (OCR)

Tuesday, February 5, 1985Part IV 3 PEOPLE DOLLARS AND NONSENSE TIMES BOARD OF ECONOMISTS Arthur B. Laffer CosAnfldee Slimes Tax Plan Needs a Minor Tuneup Hoglund Will Run GM's New Saturn Unit OUMLOP AND DISINVESTMENT COUNSELORS Not so long ago, the high point of a drive from Los Angeles to Palm Springs was- the glorious visual sensation of the pristine desert vista. Unfortunately, however, the transitory packs of legislators skulking the corridors of Washington and Sacramento have succeeded in violating even this pleasures A once beautiful panorama is now littered with a myriad of windmills. These windmills are not the quaint variety similar to those found in Holland. These "energy efficient" windmills look as if they were made from rejected coat Arthur Laffer is an economic adviser to the Reagan Administration and a professor at Pepperdine University in Malibu.

General Motors Corp. on Monday named William E. Hoglund, 50, president of its new Saturn Corp. subsidiary. Hoglund will take over Saturn in the wake of the death of 54 -year -old Joseph J.

Sanchez, who died Jan. 26, only two weeks after he was named president of the new company. On Jan. 8, GM announced the formation of Saturn, a $5-billion company that will be charged with the development and production of a new line of small cars that will be cost-competitive with Japanese imports, GM hopes that Saturn will develop a fresh approach to the car-building process that can then be used throughout the rest of GM's manufacturing operations. Hoglund, GM's group executive in charge of its corporate operating staffs, is best known in Detroit for running GM's Pontiac division.

He was general manager of Pontiac from 1980 until last summer, when he was named to his current post. Still, most of his career at GM has been spent in finance. Before taking over at Pontiac, Hoglund was GM's comptroller and had also ordinary income. Such is not the case. "Capital gains" is the appreciation of an asset that results from an increase in that asset's capacity to earn after-tax income.

(For example, when a small-business owner successfully brings a new product to market, the value of the company rises.) As long as that company's income is to be taxed, any additional tax on increases in the value of that company is double taxation and wrong. Besides, it's unnecessary. Abandonment of all taxes on capital gains would have virtually no net revenue impact. The Treasury proposal also increases the lives of plant and equipment purchases for tax write-off purposes. The bottom-line impact of such a change would be to slow growth and yet not raise much money.

Modest changes in the Treasury proposal could easily allow continued use of current depreciation schedules. The third drawback is the Treasury's proposed increase in personal exemptions. Such a change will not have its desired effect of helping people with low incomes, but it would reduce federal tax revenue inordinately. Personal exemptions provide very little redistributive justice and yet they cause enormous dead-weight revenue losses. Those with no income clearly receive no help from exemptions, while those including the very affluent with incomes above the exempted amount get the full benefits of the exemptions.

Reductions in exemptions, on the other hand, would broaden the tax base by allowing significantly lower tax rates while providing sufficient additional revenues to provide assistance to those with low incomes. Certainly there are other problems with the Treasury proposal. But even with all of its shortcomings, the Treasury proposal would greatly improve the tax codes of America. The best must never be allowed to become the enemy of the good. Tax reform, Treasury style, is good.

Tax simplification was long ago recognized as being as important as deficit reduction. As the classical California economist Henry George wrote in "Progress and Poverty" more than a century ago: "The mode of taxation is, in fact, quite as important as the amount. As a small burden badly placed may distress a horse that could carry with ease a much larger one properly adjusted, so a people may be impoverished and their power of producing wealth destroyed by taxation, which, if levied in another way, could be borne with ease." will retire April 18 with the close of Itel's annual shareholders' meeting, according to a company announcement. William P. Twomey, who became president and chief executive on Sept.

19, 1983 the day Itel, then a computer-leasing firm, emerged from Chapter 11 will remain in those positions, Swearin-gen said. -VICTORIA McCARGAR LOS ANGELES COUNTY Bob McCurry has been named senior vice president of Toyota Motor Sales U.S.A. Torrance. He will be succeeded as group vice president-sales, marketing and distribution by Jim Perkins. ing firm's common stock and common stock warrants.

Zell, 42, received a seat on Itel's board of directors last November after Equity Financial Management of which Zell is chairman and general partner, disclosed that it had accumulated a 10.8 stake in Itel. In December, Zell purchased additional stock and warrants from Smith -Vasiliou Management a New York investment group, said Itel spokesman David P. Swearin-gen. Smith -Vasiliou had earlier disclosed the purchase of an 8.8 share of Itel and said at the time that it was considering a takeover. Kunzel, who untangled the massive bankruptcy of Westgate California Corp.

before taking on Itel, ON-TV: SelecTV Buys Unit hangers. And, due to the nature of the wind currents, they are crowded along the mountain ridges and clustered on the floor of the canyon pass. The deception used by lawmakers to push through "windmill" legislation was the existence of an energy crisis for which the lawmakers themselves must bear responsibility. True as it is that windmills do provide energy, they are an uneconomical, inefficient, costly source of electricity. The sole reason these eyesores exist is the special-interest legislation now embodied in state and federal tax codes.

This misuse of the federal tax law is but one glaring reason why tax reform is so urgently needed. In fact, a recent Times poll showed that two out of every three taxpayers polled feel that the top legislative priority should be tax reform rather than deficit trimming. The taxpayers' preference in no way diminishes our need to get the budget under control. What taxpayers are demanding, however, is immediate action on what could well be viewed as one of the most serious scandals in our nation's history our federal and state tax laws. Political maneuvers such as pork barreling, loopholes and tax shelters necessitate unconscionably high tax rates on wage earners merely to collect the requisite revenue to fund our government.

Would Reduce Deficit Tax reform as proposed by the Treasury would rid our tax code of some of its most blatant loopholes. In exchange, tax reform would provide reductions in tax rates. Consequently, the most obvious result of that reform would be a substantial increase in both the economy's quality meaning no more loss-leading investments in windmills and quantity meaning more production would be aimed at serving the needs and desires of consumers. These alone would be reasons enough to support a flatter tax bill. Such a bill also would make headway in reducing the federal deficit and in increasing state and local budget surpluses: Higher incomes simultaneously raise tax revenue and lower welfare spending because people move off the welfare rolls and back onto the tax rolls.

For these reasons, tax reform is indeed the first priority of our fiscal agenda. However, the Treasury proposal does have at least three major drawbacks, each of which could easily be corrected in Congress. The proposal incorrectly treats capital gains as spent time on GM's financial staff in New York. One of 1-u first tasks will be to decide where to build Saturn's assembly and complex. GM says it wants to choose a site for Saturn 'A Hoglund said, comes from combining accounting and subscriber services on one computer system.

As part of the deal, SelecTV will retain 178 ON-TV employees, or most of the existing staff of 187. The remainder have already resigned, LeVitus said. "Everybody is up," he said. Despite the dwindling subscribers for subscription television in general, its days are not numbered, he added, "Or why would we buy ON? I'm not sure about growth, but some of the plans we have for the future indicate there's plenty of room for us to grow in this market." With a combined subscriber list of 215,000, the deal makes SelecTV "by far" the largest subscription-television service in the country, LeVitus said. Continued from Page 1 predicted that the two services will be forced to consolidate eventually in order to survive, SelecTV President and Chairman Jim LeVitus said: "I have no intention of changing (ON-TV's service).

I haven't had a chance to sit down with Jerry Buss (owner of the Kings and Lakers, with whom ON-TV has a contract to broadcast games through the current season), but I'm going to." Not included in the deal is KBSC-Channel 52, the Oak-owned TV station in Corona from which ON-TV is aired. The station is for sale, but LeVitus said that, when it is sold, "we have a right to talk to the new owners and discuss buying time from them." The big savings from the consolidation of ON-TV and SelecTV, he Nigeria Leader Says Nation to Match Britain's Oil Prices within about 90 days, and virtually every major industrial state in the country is now trying to woo GM. -JAMES RISEN CALIFORNIA Herbert Kunzel, the 76-year-old bankruptcy specialist who led Itel Corp. through its Chapter 11 reorganization, will retire as chairman in April, the company said. His successor is Samuel Zell, a Chicago financier who recently purchased about 22 of the equipment-leas- LONDON (A1) Nigeria's military leader was quoted Monday in the Financial Times as saying his country will match Britain's oil prices, even if it means breaking ranks with OPEC.

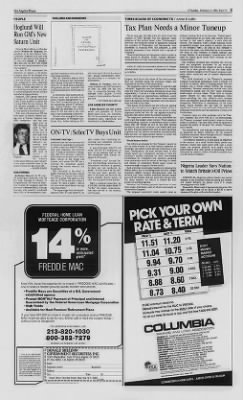

Meanwhile, Mexico said it has lowered the price of its light Isthmus crude oil by $1.25 to $27.75 a barrel because of the glut on the world oil market. I I I I fir Now YOU have the opportunity to invest in FREDDIE MAC certificates-one of today's fastest growing capital market instruments. Freddie Macs are Securities of a U.S. Government established agency Prompt MONTHLY Payment of Principal and Interest Guaranteed by the Federal Home Loan Mortgage Corporation High Yields Available for Most Pension Retirement Plans If you have $20,000 or more to invest, let us explain what a FREDDIE MAC might be able to do for you. Either call or mail the coupon today without cost or obligation.

For additional information, call 000 minimum balance for all our rates 24 nou ouyifVjS TkiNGS AND LOA u7Wi776-7W 213-820-1030 800-352-7279 Outside Los Angeles, call collect DONALD SHELDON GOVERNMENT SECURITIES, INC. 12301 Wilshire Suite 101, Los Angeles, CA 90025 PO. Box 49053, Los Angeles, CA 90049 Name "This is our estimated anticipated yield which is formulated based on our analysis of this particular group past performance and which, in our opinion, while not guaranteed, offers such attractive potential. The yield, based on a 12 year average life using FREDDIE MAC standard bond yield tables is 10.30. fill (business) Telephone (home) Address City State Zip.

Home Office: One Wall Street, New York, N.Y 10005LAT2.S t984 Donald Sheldon Government Securities. Inc.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the The Los Angeles Times

- Archives through last month

- Continually updated

About The Los Angeles Times Archive

- Pages Available:

- 7,612,445

- Years Available:

- 1881-2024