The Wall Street Journal from New York, New York • Page 11

- Publication:

- The Wall Street Journali

- Location:

- New York, New York

- Issue Date:

- Page:

- 11

Extracted Article Text (OCR)

STOCK OF RAW COPPER IN REFINERS HANDS SMALL UNCERTAINTY OVER PRODUCTION REDUCED IN SECOND QUARTER URGENT DEMAND SENDS PRICES UP Boston Charles Hayden, long Identified with the porphyry coppers, says to the Boston News Bureau: "In estimating the so-called surplus stock of copper, it has been customary for the press to take as a basis of figuring this surplus the monthly statistics of mine production. "There Is an interval of three to four months between tho time that the copper is mined and is ready for market, namely, the period in concentrating, smelting and re-fning the same. This copper thus tied up is called the permanent 'stock in trade. What may be called the actual surplus of copper is only the marketable shapes over and above the usual carry of the refineries in the ordinary conduct of their business. "All of the marketable copper produced down to the middle of December last was sold and delivered before the end of the year except a special stock that was sold in this country for the account of soxc of our allies.

"The unsold stock of copper on hand on Jan. 1, 1919, consisted of: 1. Copper belonging to the allies. 2. Copper that was refined during the second half of December.

3. Copper carried over for the account of consumers. 4. The usual stock in transit arid in process. "It should be recalled that the mine production at the solicitation of the United States Government was continued at full scale to the end of the year It was not until late in February that the refinery production began to show a substantial decrease, but has continued that decrease ever since then until it has reached a parity with the present c0 mine output.

"In the meantime the accumulated stock of raw material at the refineries has been cleaned up. "In the first quarter of the year production considerably exceeded deliveries because of practically no demand and with this there was a consequent depression in the price. This condition, however, wa3 completely reversed In the second quarter because of reduced production. Unexpectedly a large and urgent demand came in which caused a natural advance in the price. The sales for the months of May, June and July were 637,000,000 pounds.

Frequently an erroneous impression of "1110 picture grows due to confusion of the terms 'sales' and 'delivery'. While the sales for the last few months have substantially exceeded the production, that is not necessarily the case with deliveries, so that a stock of copper on hand might, isn the relative importaace of the same, ba very different as to whether it was a stock of copper on hand not sold or a stock of copper on hand sold but undelivered. "Present domestic consumption is about 25 in excess of pre-war times, with the mills booked ahead in certain of their lines to their capaoityy for the next three or four months. Some of these mills are already calling for immediate shipment of copper although it was originally bought for delivery in September. "The eastern mills have an ample supply of labor and working conditions have been satisfactorily adjusted, indicating full capacity output.

This is in striking contrast with the continuous scarcity of labor at the western smelters with their 50 output. "The mills are booking largely for export as well as home trade. The reduced value of sterling and francs has naturally advanced the export price in parity of currency price in this country and much beyond the pricc3 current in England and France. The buyers there are drawing on government stocks, which it is well known an steadily going down. "The total stock in transit, in process and in marketable shape is not available but is probably larger as of July 1 than as of Jan.

1. If so, it is a fortunate situation for the industry as a whole in that Jan. 1 there was a total absence of business and for almost three months thereafter, whereas July 1 the largest baying movement in the history if the industry was in full swing, with a record tonnage i for peace times sold for delivery spread over the third quarter. Whilst the stock of July 1 in this country may be and probably is larger than Jan. 1, there i3 no doubt the stock of the world is much les, with a greatly reduced production here and as well in Australia, Japan, South America and wherever copper has been produced, c'ue to the same underlying conditions everywhere, the withdrawal of pressure for war supply; the reduced price and the labor shortage.

The world is depending on this country for 80 or more of its copper requirements, and a continuance of demand of th past three months will rapidly deplete the present surplus stock concentrated in this country, with little prospects of increase in production, now 50 to 60 of last year. "Most of tho copper bought in the last three months was to supply the home demand, as the consumers in England, France and Italy have, drawn against government-owned stocks in those countries. "Looking forward, there seems to be more occasion for concern as to prospective supply to meet the world's need than as to the present stock. "During this current calendar year the stock of copper held in this country for the Allies and belonging to them has been Teduced by shipments abroad from approximately 90,000,000 pounds January 1 to 30,000,000 pounds August 1. "While due to the causes above mentioned the stock of copper on hand has increased substantially from, what it was the first of January, because of the large refinery output the first of the year, and a lack of sales and consequent deliveries during the early months of the year, the basic fact -which accounts for the strength of the copper metal market at the present time over and above what it was at the beginning of the year is due to the fact that with no increase in mine output there has been an enormous increase in sales both here and abroad, although (he deliveries for such sales have not appeared in any of the statistics given for either the first six months or the second quarter of 1919." Jewell of Shopmcu Sees Hines Washington President Jewell of the shop mens organization is in conference with Director-General Hines.

Mr. Jewell has declared the shopmens' strike over and it is probable that discussion of the wage problems will be resumed THE WALL STREET JOURNAL, TUESDAY AUGUST 39, 1919 COFFfcE MARKET When the official weather report was received from Brazil on Monday morning, showing front In several'dis-tricts where buds are appearing, coupled with an advance of 1750 to 1773 reis in Santos term market, produced unusual excitement and opened market on the call with an advance of 70 to 107 points. The short interest in tha market were frantic in their efforts to cover on this news, which easily put prices at higher levels. Other traders took on contracts on the belief that a damaging frost now, with a world shortago of coffee prevalent, would causa serious consequences. Toward midday, however, a easie.

tendency was displayed, due to cables from Brazil showing a lower Santos market. The last cable received showed a decline of 9G0 to 1023 reis from Saturday's Seling pressure- from local importer and profit taking caused an easier tone in the afternoon, which continued clear through to the final Market closed strong with an advance of 54 to 65 points. Short selling is said to have helped the decline. In the cost and freight market, Santos offerings were withdrawn, and conditions there. show an unsettled market.

While the extent of the frost damage is unknown, it ii said by influential interests that the flowering had not begun but the buds have started and frost may have destroyed or retarded the flowering. From the temperature reported it is unlikely that plantations on high ground were affected, and at this early stage of the crop a frost need not spell ruin as there is ample time for good flowering between now and the middle of October. Local spot market quiet and firm, quoting Santos from 29 to 30c; Rio 7s 22Vi to 22V4c. Closing Months: Open High Low Last Un Off BidA'ket Aug 21.15 21.23 Sept 22.00 22.00 20.90 20.90 47 20.99 21.05 Oct 20.83 20.85 Nov 20.66 20.68 Dec 21.00 21.00 20.40 20.50 Jan Feb March 21.00 21.00 20.40 20.40 April May 20.55 20.70 20.33 20.40 June July 20.40 20.40 20.40 20.40 BRAZILIAN COFFEE CABLES The principal items in the day's Brazilian cables, with comparisons, follow: Receipts: Aug. IS Aug, 15 Rio 8,000 Santos 23,000 Sao Paulo 124,000 Jundiahy, flS.OOO Stocks: Rio 524,000 Santos .1,828.000 Prices: Rio 7s 16330 Santos 4s Rio exchange ..14 Two days.

NTot quoted, 9,000 Mar. 124 July 121 Jan. 129 Sep. Dec. 121 June 1521 Feb.

120 Mar. Mar. Mar. Mar. Aug.

Mar. 122 Jan. Jan. Jan. Jan.

Jan. Jan. Jan. Jan. 57 97 96 99 101 99 97 96 120 100 l.l 101 122 102 123 122 Dec.

15, '23 55 65 7o 1027 99 99 97 121 100 1, '22 100 123 98 1,25 126 127 128 Aug. 15, 21 Dec. Apr. Feb. Dec.

98 98 98 98 98 99 l.TO 103 120 99 120 100 1,28 97 Aug. 14 6,000 18,000 22,000 14.C0O 507,000 1,842,000 1.250 20000 14', id. Unofficial. 20.49 20.50 20.46 20.48 20.43 20.43 20.40 20.42 20.38 20.40 20.36 C0.39 20.33 20.35 20.30 20.32 Aske.1 iom 99 103 99 10O 100 100 100 100 102 102 100 9 Us 98 94 101 99 99 101 100 100 99 97 98 99 102 100 97 97 101 102 102 103 100 99 98 100 101 100 100 100 100 100 100 100 104 100 100 98 coffee 1918 e.ooo 23,000 30.0CO 666,000 2,931,000 12 l-16d. Santos futures 17S0 to 1776 higher from close (Aug.

14). Clearances Santos, Aug. 16, S.S. Santu Alicia (San Francisco) 40,000 bags. COFFEE CLEARANCES Rio Clearances to United States during week ended Aug.

16 totaled 28,000 bags; elsewhere 9.C00 bags. Rio freight rate per steamer to United States $1.30 plus hrc primage. Steamers loading at Rio for United none; for Europe, 2. Santos clearances to United States last week were 71,000 bags; elsewhere 70.C00 bags. Santos shipments to United States last week were 124,000 bags; Europe 14,000 bags.

Santos freight rate per steamer to Havre quoted 210 francs, plus 10 primage. Steamers loading at Santos for United States, for Europe, none. Victoria clearances to United States totaled 19,000 bags; Europe, nil. Bahia weekly receipts were C.200 bag: stock, clearances United States, nil; Europe, SCO bags; elsewhere, 300 bag3. SHORT TERM SECURITIES (Furnished by Curtis Sanger) Security: Rate American 673 Am.

6 American Tobacco. 7 Anaconda Copper. .6 Armour Co 6r "Armour ...6 Armour ..6 Armour i 6 Armour Co 6 Bethlehem 7 Bethlehem 7 Canadian Pacific. ..6 Cen. Argentine Ry.6 Rock Isl.

6 B. Q. 4 Cudahy 7 Del. 5 Domin. of Canada.

5 Duquesne Light. 6 General Electric, 6 General 6 Great Northern ...5 Hocking 6 Kansas City Term. Vh Laclede Gas Light. 7 Lehigh Valley ....6 Liggett 6 Pennsylvania Philadelphia 6 Procter Gamble. 7 Procter Gamble.

Procter Gamble. 1 Procter Gamble. 7 R. J. 6 'fit.

Paul Union De.5'i Southern Railway. 6 iStudebaker 7 Studebaker 7 tStudebaker 7 Studebaker 7 Studcbaker 7 Studebaker 7 Studebaker 7 Studebaker Corp. ..7 Swift Rubber 7 War Finance Westinghouse 6 Wilson Due Bid Dec. 100 Feb. 99 Nov.

103 Jan. 129 98 Si June 15, '20 99 June 15, '21 99 June 15, '22 99 June 15, '23 99 June 15, '24 99 July 15, -22 101 July 15, '23. 101 Mar. 224 99 Feb. 1, 27 89 Feb.

1,22 98 July 121 94V4 July 1523 101 Aug. l.O 99' Aug. 121 99 July 1,21 100 July 119 100 July 120 100 Sep. 120 98 5.80 6.15 5.95 6.15 5.55 5.80 5.85 5.90 5.90 6.15 6.35 5.95 7.50 6.70 7.00'3 6.55 5.35 6.65 6.45C: 4.65 5.30 6.00 6.607o 5.60 7.00 6.70 5.90 5.80 7.35 5.90 5.95 I 6.00 5.55 6.65 i 6.30 7.00 7.00 7.00 7.00 7.0C7t 7.00'.. 6.00 6.80 E.00 6.40 6.25?i OIL SECURITIES REFLECT SOUNDNESS OF INDUSTRY PRICES CONTINUE FIRM IN FACE OF WEAKNESS OF GENERAL MARKET LISTED OILS SHOW MODERATE ADVANCES Trices of oil stocks continued firm during the week in line with the underlying strength of the Industry, Demand for oil products continues active, notably for gasoline and lubricating oil.

Developments pending in the fuel oil trade presage a remarkable expansion of this business in connection with marine transportation and the use of oil in industrial plants. The oil stocks on the New York Stock Exchange generally showed advances, with Pan-American Petroleum Transport the outstanding feature. Following table shows the range of the leading Standard Oil, listed and miscellaneous oil securities last week, giving last bid prices for Standard Oils, and closing price fof listed and miscellaneous; STANDARD Oil, STOCKS. Aug. 15 Aug.

8 Wk's Changes Anglo-American 21 20 1 Atlantic Refining 1,370 1.S30 20 Continental Oil 650 675 25 Penn-Mex. Fuel 72 65 7 Prairie Oil Gas 685 .690 5 Prairie Pipe Line 280 283 5 South Pcnn Oil 315 305 10 S. O. of California 292 297 5 S. O.

of Indiana 730 735 5 S. 0. of Kansas 570 670 S. O. of Nebraska 525 640 15 S.

O. of New York 390 390 S. 0. New Jersey 688 700 S. O.

of Ohio 515 515 Union Tank Car 125 125 Vacuum Oil 423 430 6 Ex-rights. LISTI'II OIL STOCKS. California 41H iV.i -f. 3tt Calif. Petroleum pfd R3M- 80 -f 3V4 Col.

Gas r.9 57 '4 ltt Ohio Cities Gas 51 51 Oklahoma Prod. Rfg. 10 10 Pan American Petroleum. 101 104. '4- 4 Pierce Oil 2Ui 20 4- Mexican 174 175 1 Royal Dutch, N.

89 86 -f 5 Transcontinental 454 44 Vi 4- Sinclair Oil fif. 524 2V4 Texas Co 230 232 2 STOCKS. Cosdcn Co 10 9Ti -f Midwest Refining 167 159 8 General Asphalt 75 76 1 Sinclair SP.Vi 61 Si -f 14 Houston Oil 110 110 Shell T. 68 Ti 68 4- Penn-Mex Fuel and South Penn were the strongest of the Standard Oil issues. The Jast named company owns the- Penn-Mex Fuel which lias developed a big reduction in Mexico which it can market COTTON MARKET Cotton market yesterday reflected tho weakness of the Stock Exchange futures selling off 40 to 63 points from the close of Saturday.

The immediate news from the belt was favorable but Liverpool's response was weak. This fact coupled with the declining tendency of the exchanges and the export situation cooled any bullish sentiment. Local speculative groups and Liverpool were persistent sellers throughout the session. When U. S.

Steel broke through par on the Stock Exchange futures reacted sharply to almost $3 under the price on Saturday. After the decline prices rallied feebly on short covering by the more timid bears. Closing Month: Open Hitrh Low La. Up Off TVil A Aug 29.60 20.60 29.60 29.60 40 29.60 29.75 Sep 29.84 29.84 29.70 29.70 65 29.75 Oct. 30.25 30.30 29.75 30.08 57 30.05 30.08 Nov 30.12 Dec 30.40 S0.43 29.89 30.18 62 30.18 30.23 Jan 30.15 ::0.30 29.86 30.14 56 30.14 30.18 Feb 30.1C Mar 30.10 30.32 29.96 30.18 58 30.18 30.22 Apr.

30.18 May 30.25 30.30 29.90 30.20 61 30.19 30.32 dune 30.10 July 30.03 30.10 New York spot cotton market quiet at 60 points decline; middling uplands 30.55. NEW ORLEANS COTTON MARKET Closing BiA High Low Bid Ask-1 August 29.50 29.60 October 30.20 29.60 29.74 29.80 December 30.02 29.41 29.62 29.63 January ....29.91 29.45 29.60 29.61 March 30.00 29.45 29.60 May 29.8.) 29.50 29.53 29.58 LIVERPOOL COTTON Liverpool Spots opened with fair demand, prices easier. Sales 4000 bal.es; receipts 37,000 bales, including- 16,800 American; good middlings 19.39d.; middlings 18.29d. Futures opened quiet. Open High Low 12:30 August 18.50 18.53 l.w7 18:50 September 18.68 18.76 18.63 18.71 October 18.81 18.92 18.81 18.83 December 18.93 12:43 p.

m. American middlings fair, 20.82d.; good middlings 19.39d., fully middlings 18.S9d., middlings 18.29, low middlings 16.54d., good ojdinary 14.83d., ordinary 14.36d. Liverpool, 2 P. M. Market quiet.

Sales, 4,000 bales, including 3,800 American. September, 18.73; October, 18.85; January, 18.97; February, 18.94; March, 18.92; May, 18.91. Liverpool Market closed easy. August 18.23; September 18.40; October 18.56; November 18.61; December 18.64; January 18.70; February 18.68; March 18.67; April 1866; May 18.65; June 18.64; July 18.63. N'EW ORLEANS CROP MOVEMENT New Orleans Cotton crop movement brought into-wght'for the week ended Friday totaled 88,349 bales against 8272 bales last year 61,193 in 1917 and 87,448 bales in 1916.

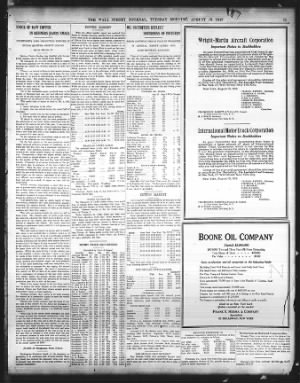

Wright-Martin Aircraft Corporation Important Notice to Stockholders As your Committee has ascertained that there Is apparently a very large amount of common stock of Wright-Martin Aircralt Corporation which is not owned by the persons in whose names the stock is registered, and as it is of the greatest importance to the shareholders that they should have an opportunity to deposit their stock underthe Plan and Agreement of July 11th, 1919, the Committee has extended the time for deposits until and including September 1st, 1919, so that the Plan and Agreement may be broughs to the attention of owners of stock who are not registered on the books. of the plan and agreement should be obtained at once from the Depositary, The Equitable Trust Company of New York, 37 Wall Street, New York City. New York, August 15, 1919. CHARLES HAYDEN, Chairma. FREDERICK B.

ADAMS, A. J. BROSSEAU. JAMES B. CLEWS, GEORGE H.

HOUSTON, AMBROSE MONELL, HENRY K. POMROY, ANDREW V. STOUT, Committee. CnADBOURNE, BABBITT WALLACE, Counsel, 14 Wall Street, New York, X. Y.

II. J. WOLFF. Secretary, 14 Wall Street, New York, X. Y.

International Motortruck Corporation Important Notice to Stockholders As your Committee has ascertained that there is apparently a large amount of stock of International Motor Truck Corporation which is not owned by the persons in whose names the stock is registered, and as ft is of the greatest importance to the shareholders that they should have an opportunity to deposit their stock under the Plan and Agreement of July 11th, 1919, the Committee has extended the time for deposits until and including September 1st, 1919, so that the Plan and Agreement may be brought to the attention of owners of stock who are not registered on the books. Copies of the p'an and agreement should be obtained at once from the Depositary, The Equitable Trust Company of New York, 37 Wall Street, New York City. New York, August 15, 1919. CHARLES HAYDEN. FREDERICK B.

ADAMS, A. J. BROSSEAU, JAMES B. CLEWS. GEORGE H.

HOUSTON, AMBROSE MONELL, HENRY K. POMROY, ANDREW V. STOUT. Committee. CHADROURNE, BABBITT WALLACE, Counsel, 14 Wall Street, New York, N.

Y. II. J. WOLFF, Secretary, 14 Wall Street, New York, X. Y.

Boone Oil Company Capital, $2,000,000 $835,000 Two and Three Year 6 Notes Outstanding Total Shares of Stock 400,000 Par Value $5.00 Owns production and oil properties in the following fields: Big Sinking Creek Field, Kentucky and Goose Geek Fields, South Texas. Pine Island, Homer and Bull Bayou Fields, Louisiana. Palo Pinto, Young and Stephens Counties, Texas. Owns in fee 37,000 acres in Missouri. Owns approximately 70,000 aqcs of leases in the Republic of Colombia, South America.

Total acreage owned approximately 1 1 6,000 acres. Present earnings now running at the rate of $600,000 per year. Company has recently sold 500 acres of its holdings in the Pine Island Field of Louisiana for a consideration of $1,250,000. The Company is undertaking to develop its vast holdings as rapidly as possible. Dealt in on NeCU York Curb Orders executed at the market Frank E.

Herma Company Specialists 52 BROADWAY, NEW YORK KEYSTONE TELEPHONE CO. Combined comparative statement of earnings of Key- Net after taxes Surn after charges 7 months' gross Net after taxes Surp after charges 1919 1918 Changes $133,471 1129,652 Inc. 3,819 37,701 47,448 Dec. 9,747 7,922 18,271 Dec. 10,349 921,391 936,961 Dec.

15,570 295.290 391,194 Dec. 95,904 90,567 190,450 Dec. 99,883 Pittsburch. Pa. South West Pcnn Pipe Lines declared regular quarterly dividend of 3, payable October 1, to stock of record September 15.

11 No Decision on llailroud Compensation Chicago There is no decision yet in the claim of tha Chicago Western Indiana, Eastern Illinois, Monon, Rock Island, Alton or Pullman for increased compensation from the Government. Atorncys for most of thee companies1 are in Washington. The Pullman, Monon and Western Indiana cases may be settled as the differences are not vide, but for Eastern Illinois, Rock Island and Alton are material end court contests may result Montreal New York exchange J10.6250 premium, off $1.23. I.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About The Wall Street Journal Archive

- Pages Available:

- 77,728

- Years Available:

- 1889-1923