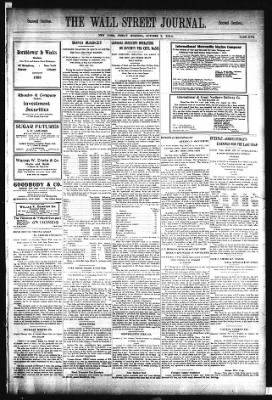

The Wall Street Journal from New York, New York • Page 5

- Publication:

- The Wall Street Journali

- Location:

- New York, New York

- Issue Date:

- Page:

- 5

Extracted Article Text (OCR)

it TIE wAL ft JOUMAL Second Section. Second SectionS- -n i 1U1IM: XEW YORK, FRIDAY MORNING, OCTOBER 3, 1914. PAGE FIVE, Hornblower Weeks Htmtam JTew Fori and Boston Steel Exchanges 42 Broadway, New York Boston Chicago Established 1888 Rhoades Company Bankers Investment Securities Member! Mew York Stock Exchange. 37 Wall Street, New York SUGAR FUTURES A. H.

LAMBORN 98 WALL STRfcET, NbW YORK INTERSTATE BANK HI.IK1., NKW ORLEANS, LA. OLD STOCK KXCHANUK, PHTI.ADELPKXA, PA. OKIHPO (ALTOB) HAVANA, CI'HA Mentors London Produce Clearing House, N. Y. Coffee Exchange rarrrspoadenta LONDON, HAMIH'KH, PAKI8, AMSTERDAM, ROTTKKlAM.

ANTWERP. Warren W. Erwin Co. Stocks and Bonds 26 Beaver New York Our fortnightly review of Conditions has been remarkably accurate since 1907. Sent tree on request GOODBODY CO.

MEMBERS KEW YORK STOCK EXCHANGE. Securities Bought and Sold on Commission. Coupons Cashed nd Dividends Collected. Orders Executed on th LONDON AND DUBLIN STOCK EXCHANGES. BROADWAY, NEW YORK Tel.

1225-6 Rector HstaMUawd 180. WILLIAM R. COMPTON Cft Municipal Bonds Lis lare dlTcnlBeil. yfeldlsK 414 to VHf, Pine Street, eor. William St, Chicago rw York St.

1-ooL The Tillotson Wolcott Company MUNICIPAL txtt-x steamship 6 BONDS 14 Wall Street New York BOND MOUSES TRYING AGAIN TO AROUSE INTEREST limited Number of Securities Offered With Some In quirySuccess of New York Loan Encouraging Signs of an Improvement in Prices The bond houses are beginning again to send out circulars in an attempt to rekindle interest in the bond market. One such issued by N. W. Halsey ft Co. contains a summary of the investment situation, from which we quote as follows: "Until very recently there has been practically nothing the investor could do but await developments.

Now, liowever, a limited list of securities is being offered by many dealers, and any one who has funds may put them to work by buying interest-bearing bonds if he desires. The extraordinary large subscription to the New York city short-time securities indicates that a very large number of investors has reached the decision that there no muo. 4n vf 41ia An-nntfiinfr nnliv On Vin contrary, such investors believe this fa the time to purchase tound securities if offered on an attractive basis. ''Many phases of the existing point to the conclusion that the present period of low prices for high-grade bonds will not be of long duration. In the first place, we have experienced a tremendous dislocation of the credit machinery of the United States.

Payment of existing loans has not to any appreciable extent been insisted upon by the banks, but new borrowing, except in cases of absolute necessity, has to the furthest possible degree been dis-eouraffed. The inevitable result of the irreat shuck which has affected the credit structure will be a material contraction in commercial and industrial activity. Business will go slow until it catches its breath. This will result in a great diminution -of demand for credit Some bankers incline to the view hat within a few months we shall see just the reverse of the present situation, i. a plethora of loanable funds in all financial markets, on account of the limited ftamanl tHnnall miim aAmiM6ritlal mfA tnln4tij 1 lam WVIllBtaJlA AVI UWUCJ ilVlU VVIIllll v.a HUU HIWO 3e STEWART MINING CO.

Control Through Sale of 550,000 Shares Cost the Buyers About (825,000 "'v Control of the Stewart Mining through the sale of 650,000 shares of stock, cost the purchasers who are said to represent F. Augustus Heinze, about $825,000. The price was divided, $1.25 per share for the securities, two dividends of 10 cents per share and about five cents a share for legal expenses of the owners. The 850,000 shares were held as part collateral for a loan of whioh was made to th. United Copper iCo.

by a Philadelphia syndicate a few years back and in which syndicate the Assets Realisation Co. was a big factor. wc The loan matured on February 7, 1912, with privilege of being renewed for six months. The United Copper Co iwas unable to meet the at final maturity but before the collateral could be realised receivers were appointed ior the copper company and the matter has Just been BOND MARKET CORPORATE FINANCING IN MONTH OF SEPTEM- BEE WAS LESS THAN 115,000,000 AU But $1 00,000 of This Wat for Refunding Is Behind Financing in September, 1911 Nine Months of Thit Year Below Last Year During the month of September less than 116,000,000 corporate financing was actually consummated by United States corporations, and all but $1,500,000 of this was necessary to meet maturing securities. Two-thirds of this financing was simply an extension of maturing issues, the return being made so high on the new securities offered that holders of the old gladly excepted them in exchange.

In this way the tying up of banking capital in the underwriting of the new issues was obviated. For that reason corporate financing during the past month, in the usually accepted meaning of the term, was practically at a standstill. In August, when' a total of only $12,000,000 financing was reported, there was, how' ever, more new capital raised. Only about half of that month's total went for refunding. In the past month, however, over $50,000,000 of investment capital was drawn out by the New York city note Bale, and the existence of approximately $150,000,000 ready investment capital was disclosed by the total applications for those notes.

Since the war started there has come to light approximately $10,000,000 of financing that took place prior to July 31. This is made up of approximately $6,000,000 Piedmont ft Northern Railway 6 noteB, which were taken privately from the $8,500,000 authorized issue; $2,000,000 Union Traction Co. of Philadelphia bonds; $1,000,000 Great Lakes Dredge ft Dock Co. stock, and $800,000 equipment notes of the St. LouiB, Brownsville ft Mexico.

In order to correct the total, these-. are now inserted in the July figure. Corporate financing of $14,500,000 in the past month compares with $187,000,000 in September, 1913, a falling off of $172,60000. For the nine months of the year now completed corporate financing has been $1,119,500,000. This is $353,500,000 below the same period of 1918, and $447,500,000 less than in 1912.

Financing so far this year compares by months with the past two years as follows: 1914 1913 1912 January $103,000,000 $355,500,000 $217,500,000 February 168,000,000 196,000,000 17600,000 March 160,000,000 150,000,000 193,000,000 April 254,000,000 118,500,000 Muy 178,500,000 157,500,000 327,500.000 June 126,500,000 144,000,000 211,000,000 July 103,000,000 124,500,000 58,500.000 August 12,000,000 40,000,000 78,030,000 September 14,500,000 187,000,000 85,000,000 Total 1,119,500,000 1,473,000,000 1,567,000,000 One effect of this reduction in the amount of financing will be favorable to the general financial situation. The fact that new issues are not being brought out leaves more investment capital to compete in the purchase of present outstanding issues. This will have the tendency to advance or hold up these issues in price. The following table shows the amount of capita' that has been raised during each of the past rlne months for new work and for refunding: New Capital January February 148,000,000 March 120,000,000 April 130,000,000 May 113,500,000 June 76,500,000 July 58,000,000 August 6,000,000 September 1,500,080 Nine months 706,500,000 Refunding $50,000,000 20,000,000 40,000,000 124,000,000 65,000,000 50,000,000 1 45,000,000 6,000,000 13,000,000 413.000,000 Division of the financing for the past two months and for the first nine months of the year as to form of se curity used was as follows: September Bonds $1,000,000 Notes 11,500,000 Stock 2,000,000 August Nine Mos. $8,500,000 $571,500,000 2,500,000 423,000,000 1,000,000 125,000,000 All this note financing of September was done on a fV, to a 7r basis.

Below is given the details of tho past month's financing: Company: Security N. Y. Central Notes Erie Notes Lake Shore ft Mich. South Notes-Newark Bloomfield R. Stock Huntington Land ft Imp Bonds Elmira Water Lt.

ft R. Stock Elmira Water Lt. ft R. Rate 7 '1 6H f. 7 6 Amount $5,000,000 4,550,000 2,000,000 1,4964 50 939,000 425,000 284,000 'Basis on which they were offered in exchange to old noteholders.

CITY BOND SALES AFFECTED Sue hxues Since the War Began, tHJOO.OOO, Compared With in Corresponding Month 191.1 Effect of the European war on our market for investment securities is strikingly illustrated by the decrease in the sale of bonds by states and cities in the United States since August first N'ctf issues of such bonds floated during the two mouths following the declaration of war amount to only $14,300,000, according to The Daily Bond Buyer. This figure compares with $46,000,000 of bonds sold in the corresponding months of 1913, and $32,000,000 in 1912. The two months just prior' to the commencement of the war brought out a total of $72,000,000 municipal bonds. That cities and towns have had to resort to the sale short term notes, is evidenced from the fact that in August and September $120,000,000 was raised in this way, as against only $39,000,000 in the same months of 1913, $10,500,000 in 1912, and $13,700,000 in June and July of this year. New York city's sale of $100,000,000 ne, two, and three.

year securities made up the larger part of the past two months' total. BOND NOTES Committee headed by Waldo Newcomer, representing the first mortgage 6 bonds of the Mount Vernon-Wood bury Cotton Duck announce that it has adopted a plan for the exchange of the bonds in the reorganization of the company, copies of which can be obtained from the Safe Deposit ft Trust Baltimore. Further deposit of the bonds with the trust company is limited to November 1. Dayton The city commissioners have sanctioned the plan to issue bonds in the sum of $1,850,000, to be voted on at the November election. The improvements include the elevation of the railway, also $250,000 for park and play grounds, $100,000 for water works extensions, and for other municipal improvements.

Chicago Herman Gifford, western manager of WIL liam Salomon ft who has returned from the East, says the investment situation is much improved. Other bond dealers are of the opinion that the banks of Chicago will encourage freer trading in investments soon. Stock Transfer Tax Receipt A.banyJhe September stock transfer tax amounted wnnst 249,853 for GENERAL INDUSTRY OPERATING ON SEVENTY PER CENT. BASIS SOME COMPANIES OPERATING TAR ABOVE PERCENT. AND OTHERS BELOW 1 THAT FIGURE 70 Production of Steel and Iron Bos Been Drifting Down-ward Equipmen Companies Running From SO to Per Cent.

Petroleum Has Recovered a Great Deal of its Lost Copper is Still in the Dumps It is estimated that taken as a whole the manufacturing business of the country is on about a 70 operating basis. Some branches are operating far below .10 and others considerably above that figure. The steel and equipment companies seem to be about the hardest hit of all lines. This is due as much to the inability of railroads to increase their revenue as it is to the European war. The' eastern railroads claim the small increase in freight rates granted by the Interstate Commerce Commission was not sufficient to allow for exten sive improvements and new construction.

Even on peace basis, the steel companies would not expect abnormal demand on the part of the railroads. The war has simply aggravated a erious situation so far as ap plied to the railroads of the country. Rail, car and loco motive buying is smaller today than it has been in years, and the steel companies say they expect to see nothing encouraging until the greatest steel consumers in the world, the railroads, are granted a reasonable increase rates. One steel manufacturer holds that a favorable recon slderation of the freight rate case by the Interstate Com merce Commission, would result in good railroad buying, even under present war conditions. He points out that unless the railroads get some relief there will be great deterioration of railroad property, and that with new con struction work suspended the railroads will experience great difficulty in handling the country's freight wher normal conditions again prevail.

The railroads," he added, "are going backwards. A forward movement is absolutely necessary to facilitate the growth of this country's commerce and industry which is bound to occur in due time. We cannot encourage or handle a big increase in export business without the hek of the railroads. But they must first get help from thi Interstate Commerce Commission in order to help general business." The extent to which the equipment companies ars suffering as a result of suspended railroad buying is evi dent from the fact that the car manufacturing companies are operating about 409S- of capacity. The locomotivj companies are even in a worse position, as they are turn ir.g out scarcely 30rc of their normal product The steel companies, which depend largely upon the railroads to take their heavier classes of steel such a rails and structural material, and the car and locomotiv? companies for plates, have felt this lack of buying power on the part of railroads for two years or more past It is estimated that the steel companies ar operating leas than 50 of their capacity, and the belief is general that 40 operations will prevail within the next few weeks.

One western steel man says his plant is runnini; en a 50 basis at present and that before the winter ii over operations will reach 86. He bases this prediction cn the small amount of business now in sight The following table showing the percentage of certain industries, gives one an idea of the present stat of business throughout the country: 7c Oper. to Industry capacity Car manufacturing 40 Locomotive works 30 Copper mining industry 50 Steel industry 50 Electrical industry 70 Can mnnufacturinir industry 75 Sugar rcferics 100 Corn products 85 Air Brake companies 65 Tobacco manufacturing tlOO Ertimated. Cic.c to of normul on domestic business, Irt there is little if Miy foreign business. While the copper producers cluim to be operating their mines on a basis of 50 of normal, consumers uf copper are running their plants considerably above that figure.

One manufacturer figures that including brass, electric, and other consumers, operations are between 65 and 70 of normal. As this country's exports of copper since war was declared have averaged about 60 of nor mal, it would seem that copper consumption is running in excess of the 60 production of the mines. However, copper refinery output must be somewhat in excess of mins production, as copper produced before the curtailment policy was inaugurated iB still being shipped to the re fineries. There has been practically a cessation of shipbuilding all over the world, due to the war. In the war sone ship building is being confined to completing warships and other sea craft to be used against the enemy.

According to representatives of the trade itself, th? automobile industry, except in isolated catses, has not bec-i hit hard by the war. Muny manufacturers of popular ca-s say they are selling more automobiles than a year ago. With exports of raw sugar from Germany suspended. the present activity of the sugar refining companies of this country is not surprising. With exports from Germany cut off, the ability of the refineries to operate full for any great length of time is questioned.

Tobacco manufacturing is an industry which in the past has suffered little in periods of depression. At the beginning of the European war the petroleum industry suffered severely, due to the falling off in exports, This came on top of a several months period of declining prices. But within the last few weeks there has been an improvement in exports and gains have been made ii the production of petroleum and byproducts thereof. The fact that gasoline is being sold in New Jersey at 10 cenU a gallon, gives one a good idea of the slump in the petrol- eum industry over the last few months. The benefit of this reduction has gone to the consumer, particularly to owners of automobiles.

Manufacturers who have adopted automobile tracks as means of transportation, regard this as one ray of sunshine in a gray sky. COOPERATIVE TIRE CO. President of. New Orleans Concern Proposes to Establish a Faetorn in Canton Canton, O. Leolie Dunn, president of the York Co operative Tire ft Rubber of New Orleans, wants to establish a factory here capable of turning out 2,000 fin ished tires a day.

He wants to bring his shops as well as a cotton factory, where tire fabric can be made He asks the Chamber o5 Commerce to give him ten acres of land, on which to erect the buildings. He also wants aid in disposing of remaining stock In the firm. His plan is unique. He would have the company include automobile owners only, each stockholder to be limited according the number of tires be consumes. Zinc Market DuU Spelter practically dead with some -offerings a.t 496 cent This compares with, recent hitch of 6 JK otnti.

International Mercantile Marine Company To the Holders of Four and Onchalf Per Cent Mortgage and Collateral Trust Gold Bonds, Dated October 1, 1902: rine i JEw. 521 to represent and protect wftrs Mss: now eoant ot New York, October 114. OTTO T. BAKNAHD, ChalrsM. AJTDRBW J.

M1LI EH, FWKORRIfK H. SH1PMAIT. 1 SIDNEY F. TT1.KR, ALBKRT H. WIttttllf, THE NEW YORK TRUST COMPANY, Depositary Ommltte.

28 Broad Street. Now York. CO- Amsterdam. Holland, OL.TN, MTlfLS, CURRIH OtJ, 67 Lombard UU. TSndon, LAND TRUST Philadelphia, Pal.

"maon' Agents for Depositary. HOROTTvOWraR MTLLBm, POTTER A EARLE, Counsel. C. E. HAYDOCK, gecretary.

2 Broad Street. Kew York. International Great Northern Railway Co. TO THE HOLDERS OF Three-Year Five Per Cent GoU Notes, due August 1st, 1914: This Committee refers to its previous notice, and new announces that a large majority it the above-named Notes have been deposited with the GUARANTY TRUST COMPANY OF NEW YORK, as Depositary under the Noteholders Agreement of August II, 1914, and that farther deposits will be accepted antil October 22d, 1914. The Commit, tee Is acting solely in the interest of the holders of deposited Notes, and is ander nb commitment towards the holders ot aadepoaited Notes to continue to receive their Notes after October 22d.

1914. MfflfflR WIMARn V. KIHO, W. KRKTH. WM.

C. COX, Secretary. 140 CRAVATH A 140 Broadway. N. T.

HENDERSON. Counsel. September 22d. 1014. EUROPEAN HOLDINGS OF AMERICAN SECURITIES Sew Haven Reports Only $651,700 of Its $157J17J00 Stock Held Abroad Miami Copper Foreign Holdings iSJt75 Shares Detroit VniUd The Wall Street Journal is making inquiries of the larger corporations of the United States as to the amount of their capital stock held in Europe.

This information i published from time to time as received. The following companies have just reported: YKW HAVEN Of a toUl of 26,386 stockholders registered on the, books of the New York, New Haven ft Hartford Railroad Co. as of June 30, 1914, 77 were European, holdings amounting to $652,700 of a total outstanding stock of 117,900. Number of women stocUioiaers January 1, totaled 11,0114 as compared with 10,102 on January 1, 1913., Total number of stockholders June 80, 1913, was June 30, 1912, June 30, 1011, 18,652. In 1906 there were 12,627 stockholders and in 1901, 9,667.

Mim corPRR Of a total of 1,565 stockholders registered on the books of the Miami Copper Co. as of May 15, 1914, 41 were European, holdings touting 49,275 shares (par $5) of total outstanding of 746,895 shares. On May 15. 191S, there were 1,195 stockholders, of which 44 were European hold ings totaling 60,283 shares. Number of women stockholders May 15, 1914, totaled 885 as against the year be fore.

In 1911 there were 950 stockholders. DETROIT KITED Of a total of 2,045 stockholders registered on the books TTi-A4 sao TnnS 1 1 01 i CO watra European, holdings amounting to $497,700 of a total out- kw standing stock of $12,500,000 Number of women Mock-I holder. June 1, 1914. totaled 709 a. against 578 June 1.

ij FjlrTc lTT 1913. Total number of stockholder. June 1. 1913, AfS ST ,1 i in 1906 thre were 1,321 and in 1901 only 474. iS6 WKsnsGHorsrc Exnrnur a maki p-acti bjg a large percentage of its business consists in the ex-Of a total of 8,480 stockholders registered on the books nortation of phosphate rock and it remains to be seen of the Westinghouse Electric ft Manufacturing Co.

as ofiwhat tonnage Europe will continue to' take. If pyrites May 23, 1914, 29 were European, holdings amounting tojghipments from Spain are cut off or curtailed, there $258,800 of a total outstanding stock of $39,993,537. Num--jM)uid be an abnormal demand for sulphuric acid in this ber of women stockholders May 23, 1914, totaled 2,146. Total number of stockholders in May, 1913, was in 1912, 8,793, in 1911, in 1906, in 1901, 2,000. J.

P. MORGAN CO. TO OCCUPY NEW HOME FIRST WEEK IN NOVEMBER Firm Will Move to White Marble Palace on Site of Former Drezel Structure Cost Estimated at $5,000,000 J. P. Morgan ft Co.

will take possession of their new banking home the first week in November. This means the continuance of the historic house of Morgan on the corner so long associated with it name,) and the resumption of its business at the very heart of I American finance. The corner of Wall and Broad streets tin. int.Mut ii 4Via nn n-Vi lAv p. ov ander Hamilton, the father of the financial system of the nation.

It faces the United States Sub-Treasury and the Assay Office, and has commanding position at the in tersection of the main arteries of the financial district In a permanent and peculiarly close manner, the new building represents the personal equation of the late J. P. Morgan, who gave to its a great amount of time and interest It is imposing, massive, and unique, and Instinctively suggests a- private, as distinct from a commercial atspe-'t, and a guidance of individual taste and purpose. Exterior design and multiplicity of interior details were the fruit of Mr. Morgan's of 4he experience that he had gained in the embodiment of plans put into practical operation in the building of the fine structures of the Bankers Trust Co.

and the Guaranty trust Co. The building is a remarkable combination of Greek architectural effect and of Italian suggestion. It gives the impression of extraordinary strength, in perfect proportions, and it has been constructed to make possible a superimposing of many stories, if such should be deemed desirable in future. To a much higher building, the massive-nsas of tht present completed building would form a foundation admirable in it. possibilities of utilization for further development This is one of the extraordinary architectural qualities of the new building.

There are three basements, and four floors. The Wall street frontage is 132 feet, that of Broad street 90 feet, and the height is R5 feet. An entrance 84 feet wide perpetuates the door of the older building, by facing the angle of the two streets. Enormous blocks of Tennessee marble constitute tb and the sides of the building. Domestic and imported marbles of great beauty and' of various colors form the interior finish.

Decorations are of the highest order, of simple, chaste, and rich type. The new structure, of which Trowbridge ft Livingston are the architects, W. E. S. Strong is the consulting engineer and representative of J.

P. Morgan A and M. Eidlitz ft Co. are the builders, stands upon a plot valued at $4400,000, and represents a cost whose estimates rise to $5,000,000. Foreign Copper Statiuticn London September statistics of copper show stocks decreased 912 tons, and visible supply decreased 212 ton.

1 Compear iavlnar defanlted In tn. Mortsrsw an3 Collateral Trust payment ot Gold Bonds) ERR 1 1,1. KRKOKRIOK STRAUS. BEWJAMIX STRONG, JR H. YOORHKRa, R.

l.AKCASTKR WIUJAM. CeMmlttr. INTERNAL AGRICULTURAL EARNINGS FOR THE LAST YEAR REPORT WILL SHOW NET OF APPROXIMATELY $1,000,000 BEFORE BOND INTEREST CHARGES Surplus of a Compared With Deficit of for the Year Previous Outlook for Current Year Filled With Problems and Uncertainties Because of War International- Agricultural Corporation's report for the year ended June 30 last will be issued shortly. It will WI" show net earnings of approximately $1,000,000, as com pared with $664,391 for the preceding year. Earnings will then compare with earnings for the previous three years approximately as follows: Year Ended June 30 1914 Net $1,000,000 Interest 650,000 Balance 350,000 Prefd divs Surplus S50.000 Estimated.

Deficit 1913 $664,391 650,000 14,891 457,303 442,912 1912 $2,031,209 565,696 1,465,513 914,505 651,008 1911 1,42044 835,527 684,819 The foregoing shows an encouraging gain over the very unsatisfactory year 1912-13, but of course does not take in any part of the present war period. Officials of the country which would be of advantage to the International Corporation. The question of potash supplies also enters into the situation as with the other chemical fertilizer companies, so that it may be said that the future seems to be more bestrewn with problems and uncertainties now, than at any time in the company's brief history. SOUTH AMERICAN TRADE WILL NEED CULTIVATION American Goods Seeded, But United States Manufacturers Must Work If They Expect to Get Bumens Chanre for Automobile Makers South American countries, due to the war, are need ing American made goods says P. L.

Jewett, manager of jjotor Car "but no manufacturer should expect big results overnight. Automobile makers can expect to gain a strong foothold on the southern continent only by steady and persistent work. Much ingenuity and a. great deal of merchandising ability will be required. "Since the wir began and European trade has been -temporarily suspended a great deal has been printed about America's opportunities in the southern republics, and, apparently, from much that one reads, all that is necessary is to ship a i' to mobiles down there and they will sell themselves.

Optimism is a good thing, but it is well to face the facts, and in this case it is absolutely necessary, as they are inescapable. "The Paige and some others I know of, can feel optimistic and more than satisfied with present conditions because thc-y went after the business some time ago. Our South American trade, which is not falling off, but on the contrary more than holding its own, is the result of two years' work." CANADA CEMENT CO. Dominion Concerns Not in a Position to Compete for Business in South America Montreal An official of the Cunadu Cement Co. state) that the Canadian cement compunies are not iu a position to compete for business in South America and other world markets.

Germany and Belgium have been the principal European exporters of cement, and England has also been an exporter. A splendid opportunity is offered American manufacturers, but an export business is not possible for Canada; first by reason of the distance, and second by reason of the fact that navigation is only open for six months of the year, and for the remaining six months it would be impossible to vhip cement out of the country on a competitive basis. Japan Rice Crop. Chicago-Tokio cable to Dally News reports bumper rice crop of 275,000,000 to 300,000,000 bushels, and prices decliniagb.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About The Wall Street Journal Archive

- Pages Available:

- 77,728

- Years Available:

- 1889-1923