The Wall Street Journal from New York, New York • Page 8

- Publication:

- The Wall Street Journali

- Location:

- New York, New York

- Issue Date:

- Page:

- 8

Extracted Article Text (OCR)

3 Boston St 11 0 II Y. KECOTT GOLD EXPORTS TO BE KEGAHEID THE SIIirMENT OF SO MUCH MEKCIIAN DISE, GIVING CREDIT "BALANCE. Pupostfion (o Take an Entirely Wrong View of Rcktnl ilovement-Our Inability to Chotk tXt Movement A'ot Question in Thit Catt Arbitrary Kej- ulation of Exchange! or Money. Rati 'no Good Unless Currency it Elastic Exchange. Dot 1 A'ot Denote Advene Balance l.

While -w bemoan th fact that Europ a drawing on our gold supply, and that ar apparently -unabl to check the outflow, there is a-ditpo-ition to take an entirety wrong view of the present situation. We may aay that we have no means at oar disposal, as it the case with the central bank of Europe, to control the change by raising or lowering the rate of money. This ia to certain extent true. But how would that have availed In the present ease? Would we have been able to prevent the Bank of France taking 135,000,000 by any- enforced regulation of the money rate or the exchange niarketT Apparently not, because it would seem that she has carried on the operation entirely oblMout to these For the most part It might be said that the recent gold exports have been made with exchange far below the gold shipping point In fact, a good part-of the gold engagement for Paris lately have been made with the market 'considerably below the par of exchange, As money rates It can only be said that eU money has been cheap. The rate for long term loans and for discount have been quite as high, If not higher, than they were ia Europe.

Call money will naturally rule cheap when It is lying Idle and In abundance, The only, mesne of arriving at a. proper regulation of money market is to provide am automatic Sxpan- alon and contraction of the supply of currency, This must eomo first in any remodeling of our banking eys- tem. Unless we have this meana perfected any arbitrary forcing of the exchange or the money rats will have the same result a wav Just It will faQ to accompiiah what it does In Europe, Under the dream stances" it is a fallacy to regard the -recent exports to Paris wholly in the light of settling an adverse balance against this country. There could not nave been much of an adverse balance against the eoun- try 'with the exchange market following the trend It has for the past several months. Certainly, our visible trade oil nee, with Its record excess export of $562,000,000 for the ten months, doe not show it.

The final and net suit of our visible and invisible trade balance ia always reflected in the position of exchange. The way to look at the recent gold export to Paris and much of what has been-shipped, to other countries. including South America, is In the light of so much mer ebandise for which we have a 'over In Europe. The Bank of France's gold purchaaea here of Jate can certainly not be looked at in any other light Therefore, far from being an adverse incident it should be regarded as a favorable factor. This, gold movement has given us.

balances to our credit in Europe which can jb drawn upon when the occasion arise. 1 CALL AND TIME MONEY. Call money opened .24, high 2, low 1H re newals 2V: closed 2i ruling rata 2H. An extremely limited volume of business is trans- acted in the market 'for time The sp- proach of the holrday at the end of the current week is, of course, not calculated to give it a fillip. Rates, however, are steady in tone.

The supply 'of loanable fundi is not over-abundsnt. and were the stock market to nlanifest greater activity, quotations for money wonld unquestionably rule on considerably blgheT levels, Rates are unchanged as follows:" SKsJ4 for sixty and ninety days, 44K for four months, 44i for five months, 4H49i for and CVi 8K fr over the year. Commercial Taper; Market. Commercial paper is In very stagnant condition. Th.is characterisation applies both to the city and the country market.

Even where institutions have available supplies of capital their attitude of doubt and hesitancy prevents them 'from investing it in paper. Bate are 6tt for srime names, with some offerings above that figure. Other paper, where negotiated at is moving on a 6 basis. Boflton Jtank Statement. Boston On call, money is still 8g3H.

Quickest borrowers are satisfying their demands at 8. tSome of the larger banks do not wish to make a 8 loan becaiue it would force them to mark down a large part of their -outstanding call Joins to that figure. Some of them get. around it by making a very short time loan at S. Time money rules at 4tt5 for short dates, 65H for six months, and.

84 sharp for year. Commercial paper is duU, six months 6gStt, mostly KJStt. aJSMaBeaaBataeiMaiamiv Money In Chicago. 1 Chicago Jsme B. Forgan says: "When rates are normal country banks 'rend Us their unemployed cash, for which we pay them 2 and put It out at aay 4.

'But at such times as the present and -in the recent past the out town banker buys commercial paper, a proceeding that lightens our bank depoeits, but at -the same time relieves us of Just so much responsibility. When the crop moving weeks shall approach the interior tanker must to a certain extent finance himself instead of relying upon us to finance him." Outside Bank Statement. The combined reports of state banks and trust com. panics outside of Greater Now York for the week end ing May 24, 1913, as compiled by the State Banking De partment, follow: State banks: -V Leans and $116494,100 Dec. $788,400 Total deposits 122,408,400 Dec.

93400 Total reserve 22414,700 Inc. 438,000 Average reserve, reserve required, 15. Trust companies: Loans Total deposits 183,764,900 Dec. 666,800 Total reserve 22419400 Dec 168,700 Average reserve, 13.1 reserve required, 10J4. Bank 1913 1912 Chsncres New 31 7,636492 $301436,788.

Inc. $16,737404 Chicago 851,729,671 $47,475,190 Inc. $4454.481 $24,742,176 $23408.133 $11,648,143 $6,787,073 Dec $2347,064 $13,276,289 Dec. $5401,440 Dec, $2,043440 $61460 $1,733,146 $10447 Zimmermann ft Forshsy quote SiIve 60; "Mexican dollars 47. 'i 1 London-UBsr sUver 27.11-16d., off Guaranty Trust Company of New York -ISO Hew Terk.

Sarpta CLASSIFIED roslTIOMS VyUITKI-OSALf3. OKNTLtlMAN dirs to bwm aiBoclKtn) with etb-. llnhed lnil ou or Iruit fmnjjMy i naiar of Horn) J.prtmnt In Kr York Cliy 01 London. Ha clientele and ba ovr ten yr' Fxiirrlrnra in offlo mnnns-mnt, burin. tra1lnu and dlatrihutin.

tSMnrr 7 two. or eonslder Interest ajrranaement. Kxcallerft rererencea. "Bonds." Bo 12 K. Tlia VII htreet Journal.

WANTFH Pntlm a Aedltor. Treasurer Corpora. tloO. by ynanit man, 20. C.P.A.

(T. 7 years' Public Ao-: I'lantlng expt-rlenre: at present aenlor wltti wl icnoarn C.P.A. a. Addreu Ht K. Tka Wall rUreet Joun.

I COWSfBtA Student deelra poilllon w( -r-at or hanklas firm. Wall educated and ambhl. Addareaa Boa X. Tha Wall Btraet Junr Fisfol Years Ending December 81: Gross receipts Manufacturing and 'Operating expenses Balance. Intereet charges, subsidiary companies Total dividends OUK LOXDOX CAULES.

i a Sarplas after dividends. Previous surplus excl Intcr-comp, profit In Tots) surplus Disposition of 8nrplns Settlement commitmenta sub. adjustments, Appropriations for construction, otc Appropriations for plants and properties at Appropriations for mining royalti Total appropriations, adjustments, etc Call Money Demand at to Stock Markit lna- tivs and Hcafc Preparation for Settlement, London Call which was in demand, close at 3r to $54. i were Arm at 3, at which rate business was done. The Joint stock banks are expected to sk 4 to 4Vi from stock exchange houses for the carry-over at the settlement tomorrow.

The stock market was inactive, suid closed without showing any recovery. Home rail declined to of a point American stocks on ths curb were weak, especially Canadian Pacifir and thrHarriman The 6 two-year notes of the Mexican National Railway were readily taken at. 97. lONDOft COLD MOVEMENTS. London The Bank of England, bought 41102400 in gold over ths counter.

FORBION D1SOOVNT RATBSV London London discount up 1-16. -j Psris discount! 8li, unchsnged. Berlin discounts 6M, unchanged'. FOREIGN. EXCUAXGE MARKET.

The foreign exchange market opened steady, with demand sterling at 4.86304.6633, unchanged from Monday's close. Transactions. throughout the day. were devoid of any feature of Interest, extreme dullness prevailing. The fact that no steamer i leaving for Europe on Wednesday, a rare occurrence, induced traders to defer their business.

Ths. London Stock Exchange settlement, now in progress, had no perceptible effect on quotations. Demsnd sterling ruled steady at 46304463i. The. other exchanges manifested a similar tone.

The market closed with demsnd sterling unchsnged from the opening quotation. CaWea Bterllngeablen4 8660a4 8663 do closed ...4 $66ua4 8663 Francs open. ..5 18' 4-1 83 1HJ Marks 93J 133 J-' Ouldersopon do i Demand 4 8630a4 603A 4 8toa4 eaxs 1-83 6 05 8-16-1-64 93 816 1 16. 40 l-3 40 1 16 1 S3 United Stat Treasury. AO-Days 4 8175ft 4 8170a B83t4' 6 38, 1-83 98 13-16 9813-16 Paris exchange on London, 25fr.

21 He; up Berlin exchange on London 20m. off pf. Domestic Eschance. Chicago New York exchange 86 cent premium; advance 6 cent. 'v Montreal New York exchange par; St Paul New York exchange 65 cents premium; advance 16 cents.

-V. tribal vearlB12-13: Mav 26 7 Thl month FCsr1 var against the "snthracite trust" by' the Department of Justice in the near future, sccording to a statement made Atlorney-Gcneril McBeynolds yesterday, 8.001.78T 1142,431,617 1,542,237 OF LOVED 1912 rf fir 09,420,250 Tialance Per cent manufacturing costs to i Manufacturing gains or adjustments, 8,344,505 Total net manufacturing and producing income. Other tneoaie Total Income jfi i 3alane $101,137,651 Less profit. subsidiary companies-Is $7,037,021 Total net earnings before 1108474,678 Per cent total net earnings to gross. Deductions from Total Met Earnlnst 1 Depreciation and replacement funds 82,734,806 Various accounts chsrged off 17,698 Binklng funds bonds of subsidiary companies.

Sinking fundsbonds of Etsel Corporation Interest en bond In einking funds r. i i 1 tnvezm oa uoiiea otaiee bmi uonui, 'Total ded actions before dividends. Burpla for i Per cent balance surplus en preferred per cent balance surplus availabW for common. i DrrUsndas i. Preferred stock Common stock 4,060,000 880,879 2217,470 i $53,084,628 $2819,677 25,415,125 1911 433,134,474 1127,014,363 96730 8127,972,018 2,804,938 29,564,634 8,037,695 198,184,825 JU.120,839 $10405,464 1U $18,229,060 1,610,038 4,060,000 21090,927 23,106,928 $19,005,168 $55,300,296 $21519,677 25,415.125 $3,805447 $4,665,494 130,438,719 $185,104418 $580,197, $1,418418 $580,197 Final surplus, excL inter-eomp.

profits in Inventories. $138,716445 Intetrcomp, profit in inventories, not Included 15446478 $1,413,018 $133,691495 22483,600 1910 $703,061,424 629,215,790 $174,745,634 TO 2,728,818 $177,473,982 $180,598,602 $150,735,747 7,263,458 $143,472,294 2,41740 $141,054,754 $22,140,555 83,122 2,176,041 4,050,000 1,831,089 83,866,760 $53,64767 $8707,187 S-LS 7 i $25,219,677 $36,772485 120,401496 Surplus on old basis, I. incl Intsr-comp. $152462,823 $156474,795 Total net earnings first Total net earnings second Total net earnings third Total net earnings fourth quarter. Totals 'Credit Increase.

4 isEstimated. 6 Includes ordinary repairs, but not provisional charges for depreciation. -e Income from properties owned, but not in eluded in general statement, amounting to $451401 In 1912, end In $17426,973 25402468. 80,063,512 35,181422 $28,519402 28,108420 29,522,725 23456,017 $37,616478 40,170,960 87465,187 25,901,730 1909 483,417,843 $162,964,408 $166,319,790 8,132,617 "$169,782,407 27,786,420 $134,108308 8,617,895 $131,49118 $21,994,054 648,445 1,724,260 4,050,000 1380J558 23,61798 $52,417,718 $79,078,696 ICS) $25,519,677 2032,100 $33521418 105,079,477 $26,735,060 $18400,000 $130,438,720 33,704439 $120,401408 80453,132 come from sundry investments and on deposits, amounting to $2449,986 in 1912. a Include administrative and wiling expenses, employes' compensation and pension payments, taxes, commercial discounts and interest Based noon present amount of preferred stock.

ST. LOUIS SAN FRANCISCO APPLICATION FOR RECEIVERSHIP. (Continued from Tint Pag.) It lound that renewal of the note would be an act of altruism. Despite strenuous efforts in New York snd St Louis, bankers realising that receivership of the road would be at best only postponed refused the money, hence 'Frisco's default on the $2450,000 note. St Louis VSan Francisco Railroad Co.

was organ ised under Missouri laws in 1896 as a reorganisation of an old company started in 1876. In 1903 B. F. Yoakum, who has always been more or less closely associated with 'Frisco, permitted 'Frisco to come under the control of Rock Island. These roads were managed together for six years, with Mr.

Yoskum paying particular to 'Frisco. In December, 1909, certain interests, including Mr. Yoskum and fit. Louis snd other southwestern men, purchased control of 'Frisco from the Bock Island, and it has been operated separately ever since. 'Frisco proper with 5450 miles of line operating from St Louis into the Southwest touching Memphis, Birmingham, Kansas City.

Fort Worth, Dallas, and Oklahoma City end serving eleven si tee, with principal mileage in Mis souri and Oklahoma, by itself Is a fin piece of property earning substantial net after charges, taxes, expenses, etc. This year 'Frisco proper would have had a balance for dividends of $2,300,000. Unfortunately it wss loaded with two burdens apart from the clumsiness and exhaustion of its own financial structure; these were 'Chicago Eastern Illinois and New Orleans, Texas Mexico Division. Chicago Eastern Illinois control was acquired in 1902. 'Frisco gave stock trust certificate for C.

4t E. 1. common at par and promised to retire these at 250 for the common and 150 for the preferred. The amount received in dividend each year from the ownership of C. A E.

I. stock has fallen behind 4he amount of interest paid out by Triico on the certificates, the usual loss run ning about $250,000. This year, however, floods dam aged the Chicago Eastern Illinois much more severely thsn was reported, and risco stood to lose about $1,000.. 000 on the investment Negotiations were msde with the St Paul to escape from the ugly situation, but no deal was negotiated. While owned by risco, C.

ft E. 1 merged Evsnsvllle ft Terre Haute, but expected economies therefrom failed to materialise. The New Orleans, Texas ft Mexico Division, a consolidation of ths lines running from New Orlesns to Brownsville along the Gulf coast of Texas, was acquired by 'Frisco shortly after the divorce of that road from the Rock Island. 'Frisco paid somewhat more than for the St Louis, Brownsville ft Mexico portion of this Whether 'Frisco paid too much for the tine or not the N. O.

T. ft M. hss been a heavy burden. Its cost has averaged $1,000,000 a year for three years. Last year it cost $937,000, over $1,000,000 In 1911, and somewhere around $750,000 the current fiscal year, St Loai ft San Francisco stock hss been e-raduallv approaching a receivership basis for some time.

Its highest for the current calender year was in January and Feb ruary, irst preferred, which sold at 69 in February. 11.12S 632 ii.7H2 aaa tmfiJMS ns with a range of 6854 to 69 in 1912, the same in 1911. 68 Expenditures 1,704,204 60.235.6o5 621470,921 1' w.ith.tM) thieved In 1902, Deficit 678472 5,453 422 3424.161 iciurreu, wmcn oiu i Surplus. i In January with a range of 2654 to 48 in 1912, 87 to Corresponding period 1911-12: Receipts. Expenditures Surplus Deficit v.

Working balance Bal. in banks, etc $3.456478 $49,601,499 $597,614,705 1,984418 47,422409 608,016,050 1,471,761 2,179,090 10,401,315 -474O0493 In Treasury 25,496,033 Total balance ...181,150,012 Apr. 26, '13 $73,156,816 41,894,822 25,471,011 140,522,649 May 27, '12 $58,768,697 34,190,443 30,475,426 123,434,469 National bank notes received for current redemption This day, this month, fiscal year, wStilts. Washington A -number of salts, will bo filod 49 in 1911, .37 lo 40 In 1910 with 80S in 1902. its highest mark, sold at yesterday.

The common stock, which sold at 19 in January, had a. range of 17 to 29 In 1012 and 25 to 27 in 1911, sold at 6 "Frisco's general lien bonds sold yesterday at 69. The highest of ths current calendar year was 82 V. Since the beginning of the year the decline has been steady and 65 was reached last week. The refunding 4s sold yesterday, at 65, compared with a low last week of 66 and a high for the year, of 76.

May Since Friday. 724? New York Sub-Treasury. Paid to Banks $2,120,000 Received From Bank Banks $3,274,000 Lost Lost Sub-Treasury debtor at the New York Clearing Ilout Jir.2,807,810 867,735403 $2519,677 10,168,050 $10442,986 94,736,491 $105 079,477 28435,788 $151451427 $133,415414 KABUmiOS WUAKTBSU.Y. $22421468 $18429,005 29,810491 88446,907 40,982,746 20465,756 27406,275 26446,675 i A i 1907 $757,014,767 CG446.777 $19247,990 ,1,48805 86810 $116,061,512 4,208,080. $120,359,622 21,001,037 $99,85885 .7,40105 10970 $9147,710 $18,877,111 94,084 188,078 4,050,000 18508 2362,647 $18,118,997 $48,728,713 $196,114,200 6,482,740 2595,879 $170,709,366 9,744,698 $160,964,678 SI 681,515 1.977,761 4,060,000 1,087,497 22,860,853 $56,899,109 $104,566,664 $25419,877 10466,059 $69,179,837 79456,654 a 'w $35400,000 18,600,00,0 $39,122,492 45403,706 43404,285 82,534,191 I i TAI.LS I.

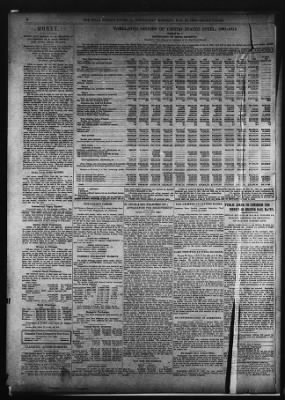

T)isro3iTiox ci' cnoss RECEirTS. fComplled by Dow, Jones Co, Publishers of The Wall Street Journal STG2L, The following table shows how the gross income of the United' Elates Steel Corporation has been disposed of from time of organisation to Dee. 81, In It will be found the Interest ana sink! payments, arprc; for new construction, urplu avaCabio for dividends, and other detailed Information of valno to It should be noted that tl.e item of "gross receipts" cot represent merely the tnoney received by the Stool Corporation for ateel sold, but represents the agyreRaU gross value of the commercial the subsidiary corrnatiies. and Includes ssles made between the mtiKiiliarv enmnanira nnd ihm r-m -inf. nr n.n-4 yni i.Kii;m i 4k.

1906 $696,756,926 $179,872,971 3,700,920 $183,463,891 8,868,948 $188,882,834 22,907,679 $1770161 $165,925,155 8,492,195 861,4 $159,863,676 8,739,408 $156,624,278 as $28,758,270 90401 1,904,068 4,050,000 868,000 22439,850 $58,495,684 $98,128489 ST "$25,119,677 10,166,050 $62,742482 69,811,794 $28400400 21400,000 2400,000 $36,684 4 90 40,125,032 88,114,624 41,730,126 1905 $585,831,788 440,013,433 $145,818,308 ru 2,758,634 $148,076,937 8,208,508 $151,875,437 1870,374 $132,805,063 6,710418 $126,004,849 6407490 $119,787,658 se.4 $21,665,062 99,254 1,689,999 4,050,000 23,056,437 $51402,188 $63485,403 is $43,865,816 62447,979 $16400,000 10400,000 $23,025495 80405,116 81410,588 85416,068 After all preferred dividend deductions. Preferred dividends were larger ia 1901, 1902 and 1908, due to the fact that $510481,000 of that issue were outstanding. 0 Provided at time of organisation, Includes $6400,000 expense of conversion of preferred tock into bonds end sals of 10-60 year bonds and TAX TECllTEX OX SAYINGS' BANKS. Depositor Have Steadily Increased Indicating Thrift Among the People. Chicago -Vice-President Van Vechten of the Continental ft Commercial National Bank, asys: "It is true there is a great deal of extravagance and waste in the United States, but it is equslly trpe that thia extravagance has not extended to average savings bank Savings bank deposits have steadily increased year in and year out They are higher now than at any time.

There has been no extravagance among this overwhelming majority of thrifty people who make up the army of saving bank depositors; it hss been elsewhere. "Most of the extravagance has been smong the -cor 1904 858,627415 $90,778,115 .796,838 $91,57458 2,960,111 $536,672,871 409468,691 $127401, TJS 1,720,03 $94,535,064 $132,572 14,785498. $79,749,668 ,8.578,146 $78,176,522 $73,176,522 $109471.2 ia $12,574,211 1,188472 1,688,117 4,030,000 $5,047,852 65,721,879 $129,024, 6 3448,1 0 $53, $53, $25419,877 $25419477 $39,. 16,8471 j2' 6453ji 1 6.pl37 23418493 19) $42,908,999 $30467429 1 4 2,798 4,498 :6,654 la-S fl.178 12,707,162 $30,834408 $50,634402 $50,634,802 $45451,777 $36488,727 $38485,727 $35485,727 $26410,677 $25419,677 35 7747l7 $157478,780 $188,601495 $105,079477 $148,736,491 $132,066,656 $95,613,795 $60,772,781 $735,060 15400400 10,000,000 1400400 $10,000,000 8,000,000 8400,000 $3424,751 $54,000,000 $52400,000 $26400,000 $8424,751 $24,0130 $94,736,191 27408,752 $79456,654 18464,060 $69413,794 15,424,658 $52447479 9,117,466 $18,445,232 19,490,725 18,778,982 1,466,632 15,037181 fund eTiares, -hsactiona rnuauu Of the toUl re-'P i In 1912, for example, the gross sales by manufacturing, iron ore, cosl and coke companies amounted to of which 1494,837,808 were sales to customers outside of.U. fi.

fiteeL tad 189,237,318 sales betwea 7 1 ea JjUUJu elUU IIU SCVUHneOUB CUHlJJel nicl UlUViHJ Will Ac-tv iUfUVvfUitf i-. 1902 1901 $560,610,179 a $100,000,000 411,408418 3,128470 $152430,631 6,426,452 $157,657,083 .17,601,892:. $140,155,191 $446,427 $183,808,764 $133408,764 $84,737491 SS.T $24,150,825 $9,695,701 828,494 824,064 824,064 8,040,000 I43942S 15487459 $43,002,239 $24,187481 $90406425 $60,600,108 as 1 as MX $86,720,177 $28,762494 20432,690 15426474 $56,052,857 $41479,168 $34453,658 $18,620410 43420440 25,000,000 $77474498 $43,620440 $77474497 $43420449 $122,645443 $97,720,714 $84,738,450 $77474497 $13,620440 $26,715,457 87,662,058 36,945,489 31,985,759 $26463411 29,769,911 $108474,678 $104405,464 $14454,753 $131491412 $91447,711 $160,964,673 $156,624472 $119,787457 $78,176421 $109,171461 $133,808,763 $84,787495 $17434428 charged, off Dec 81, 1903, for expenditure made for construction, payment of capital obligations, ste. i In carrying t.k surplus forward the Inter-company profit of $1047isri has been deducted for purposes of comparison. Jnfs Upw cases adjustments ia the last dollar figure have ervmsds to cheek.

PUBLIC ASKED TO CONSIDER THE MERITS OE HIGHER RAIL RATES. SPECIAL BULLETIN OF iHAILWAY BUSINESS AS- SOCIATION DISCUSSES THE PROPOSED 6 ADVANCE FOR EASTERN LINES. Special bulletin Issued by the Railway Business As sociation discusses the proposed advance in freight rates on the eastern railroads. George A. Post; president of the association, says: "The railroad proportion of total issues in 1912 was tbo 'l A JJ I iL noration.

Bis eorvorations in recent Tears flndinr ther row oe.aae, wane oiner corporauone issues weir could borrow readily have made extensive use of their highest; and the railroads in 1912 issued more notes, credit for axteniion that otherwise would not have been which bear higher Interest rates, than they issued stock sttsmntod. Now thst banka are scrutinising loans very closely and holding borrower in check, the result ha been beneficial both to the money market and corporations themselves," GARY TESTIFIES AT STEEL HEARING. and bonds combined. There is something the matter with railroad credit" The bulletin hows that from 1909 to 1912 the rati-load share of all dropped from 62.4 to 19. In 1909 the railway securities issued were $601435,043 more thsn the not; railroad, and in 1912 the non-railroad isecuritles wese re thsn four times the Tsilrosd secur- Thomas W.

Joyce, a clerk in the office 0f J. P. Mor-ilti p.ilrnL ni bearinir various his rutes of ia. gn, was called at the afternoon session of the S. nM fron, $187400,000 in 1908, to hearing.

Ho testified that on Sunday morning, innn in 1flll to 1368.000.000 in 1912. Such railroad Nov. 3, 1907, he examined tha books of Moore ft Schley rot, a temp is rv expedient, exceeded, in 1912, the out. at the request of his firm and found -that it had about put of railroa-i f.i'eks snd bonds combined, by $22413,000. :S7.700 shares of the Tennessee Coil, Iron ft R.

R. Co. on -Xhe Railway Buainess Association," the bulleUn eon-its books. not Phrtv to the rate cases and will not dis. The witness said he had reported to the late J.

P. tw. involved in the advanced rata nroceed- Morgan and afterward to Mr. Schley of Moore ft Schley 1 jnt now before the Interstate Commerce Cora- nd that latter told the witness his figures and those of nation, fjf rg. however, deeply inteiested in th wel-the witne correaonded.

Mr. Joyce said that of the far th which are the customers of our mem- total amount 01 sxoca noons 01 we nrm r.e louna mnA hj.inK gMrai grounds as business men snd oo.uuv snares were -iree aio.n. Icititens an I The Government has contended that Moore ft Schley I Ji JtSJ m. UI UIU pVNVBI W1I.IVI VI I.IV V. ft.

ft t-t'ft WllVIVfia the figures of Mr. Joyce showed it did as th firm held 157,700 out of total of 298,000, oesire 10 promote enugnionea metnoas ay questions, we regard it as our function to encourage tic Juiiest ascertainment or the pertinent facts. A A aitlSo-atVS kaaas mtrAxA RsamilsaHAffl The witness snid he showed Mr. Morgan that if th t. rA i v.

Steel Corporation cxcbanged Sl bond, at 84 for th. oZZZx Ita Tpu bUc tii S2L -y br. of tl fSi 80o7nUL Jl'if it This 1. progress. It is v.stly ihmm uii that railwav nueationa shall be settled in disposed of the bonds at the market good temper thun that any particular rate case shall bo Judge uary waa nexx cauea ano asseo 10 tell howi 1.

k. vj he became connected with fhe StM Corporation. He dead'd 'nl pi fL? that durinr his life be has been associate with OY" Consolidated Steel ft Wire the American Steel ft Wire Co. of Illinois, th Illinois Steel the Federal Steel Co. and is now chairman of the board of directors, chairman of the finance committee and chief executive of the U.

S. Steel Corporation. NO INVESTIGATION OF LOBBYISTS. Washington 'Under objection of Senator Owen, ths Senate refused immediate consideration of a resolution offered by Senator Cummins proposing ths appointment of a committee of nve senators to inquire into th presence of lobbyists in Washington, and whether they are using proper or Improper on legislation, particularly the tariff bill; and calling upon the President for the names of the alleged lobbyist bad in mind when mak ing his statement. The resolution went over, Cummins saying that the Senate had been placed in an unenviable position by the President's statement and that the people had a right to know the legislation being enacted was not being dictated by the "interests." He announced that ha would talk on the subject Ister.

To Inquire Jnto Armor Mate. WashingtonThe Senate adapted, a resolution Intro duced by Senator Tillman, calling upon the Secretary of ths Navy -for information as to the -cost of armor plate, how much it would cost the Government to erect a plant of its own for the manufacture of armor plate; whether there i any patent involved, and, if so, who owns the patenif. Phililnlnhia V.AvmrA V. Park lis. Ivun WIm1 a 1 1 1 prefrl an Mack era llUt.

Com dent thr president 01 in naxernoan oc rcuerica naiiroou, uc-i iUI. cocding Emery L. CoblenU resignea will offer tion and views much mo opera tin by waf Federal vividly roads ij heart 0 diffusion lie will the me I Senate mittee I I at- ike it tor granted that the railway managers ipaiiy mi. hipittrfs the frankest explanation 01 the situa- snf Ipportunities for the fullest axchsng of are thorol arbttr; uioenc uiai uie puuuc now than three' years ago tha Increased ica. has been imposed upon th roads ion and by outlays compelled under.

I statutes, and appreciates much mors siv undertakings which confront the tit rilargemeut of terminals, mostly in ths large ties wnere lana cost is eigne sr. This knowledge gives reason to hop that th pub sider fie new application for rata advances on an! without prejudice." 'jrlpluftr-Penosylvanla Utilities Bill passed ths reading, and waa recommitted to com. PVIOEXDS iXD INTEREST. IH MACK A (WMPASIM I'rtbM N. SN ItMUMI SS f.ili tu.rtsrly dlvtdrnd of on.

par cent oa t) rntr-f Sind th reaular guarl.rly dividend of on uuri" lr rpni on in common anaraa ia ma I nrnparf win pain Jul? lKt, iBl.l. lu anaranQui- curd a(itar in nos 01 Dii.in.aa uua rt kii iiiKiipivr Dirnni win nob I), KDWARD PIATT, Xreasurw. 1,1 lv KV.U ossotiuiTcu (vrrK (oartxr, Nw York. Majr 27, 181S. of the Board o( Director of lha Nevada' i-iSpar Company hfl today, a quarterly dlvl-.

rr waa darlard. payable Jar ener record June jkij. rne annum ti tr.n.Or of afw-k will ba olu4 8 F. M. rtopened to A.

M. June U. ISIS. V. iitN'MjTI.

gecratary..

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About The Wall Street Journal Archive

- Pages Available:

- 77,728

- Years Available:

- 1889-1923