Quad-City Times from Davenport, Iowa • 18

- Publication:

- Quad-City Timesi

- Location:

- Davenport, Iowa

- Issue Date:

- Page:

- 18

Extracted Article Text (OCR)

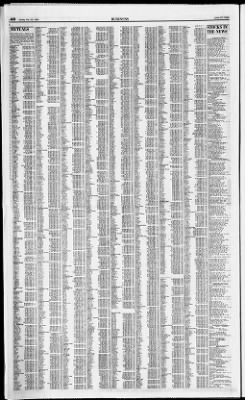

QUAD-CITY TIMES 4B MuBdr STOCKS li Dlverintl 11. 0811.0211.05. 05 10. 8410. 7410.84 .13 10.

2410. 2110. 22. 03 0.779.399.77 .06 Citibank IRA-CIT: Baton nt Equity nf Income nt IV1UIUALS Peine Webber: AitlA ATLA BlueA ColTOP COITAP IntBd STIF Value Rainoown ReaGra Regis Fund: Cifc Bal CS.B Ea DSl Ov HE NEWS MUHVf MuLtdt MuALt MuAR MuCAt MuFLt MuGAt MuMDt MuMAt 13 4913.51IJ 4915 25.0224. 8424.92 .08 17.6017.6017.60 25.0324.6325.

03 .52 5. 565.425. 56 07 11.50 13.37 13.50 .10 13.4112. 1412.41 .11 13.71 12.4712.71 .25 11. 5911.4311.

59 17 10.20 10. 1710. 19.04 10.5010. 3510.50. 11 16.57 16.2714.57 .24 10.019.9410.01 .04 15.6315.09 15.63 .20 11 AAIO out OA.

11 IntBd NY Mun ST Bdn SmCoEqo Gen Elec Iftv: EltDiva EltGIn Elfunlnc ft ElfunTrn ElfunTxE SS-Sn GnSec 13 20 13. 1 113. 20 .04 I1.9511.8811.90 .04 33. 7033.0233. 70 .59 12.2712.

1212.27 .19 12.1412.0912.11 .01 37.6036.9537.60 .44 ll.Slll.3411.il .197 9. 439. 369.43 .09 7.697.657. 69. 06 10.7010.60 10.70.

13 10. 1910.1010.19. 11 5 885.H5.S8 .09 10.3910. 23 10. 39.

19 10.9610.86 10.96. 14 11. 7311.6511.73. 11 11.7411. 6611.74.

11 9.699. 609.69. 11 11.1011.0711.20 .15 12.1312.0512. 13. 12 12.4112.3012.41.

14 10.6710.57 10.67. 12 12.0711.9612.07. 15 11.8511.7511.85 14 14.54 14.2014.54. 14 14 A013.7714.09. 13 DvGrA EurGrAp GlEnAt GllnA GIGIA GrthA HilnAp American Bonkers ins.

17 fro. 15 DSI LM MA Spec ft ICMSC SAM I Pfdn Sir SpEqn SterBI RehTano hub yiMu last NAV tor the week with tht net changefrom the previous week's ftlast NAV.AII quotations, supplied by the NatlonolAssoclotlon of Securl-wtles Dealers, reflect net asset values, at which securities could hove been sold. High Lsw-leit-ChB AAL Mutual: 8.791.771.71 7.497.497.49 11.4711. 2911.47 14 12.5912.5012.57 .11 I3.9213.51I3.92 .12 12.2212.1812 22. 10 12.4512.2412.45.

25 12.0211. 8812.01. 14 9.939.669.92. 08 9. 729.669.72.

07 11.96ll.80ll.90.O4 17. 2917.0917.29. 15 12.7312.7012.7! .02 7. 497.347. 49 .09 7 .117.

727.81. 12 8.178.138.17 .01 7.527.417.4506 XS.3I8.2S8.25 02 9.288.959.28 13 1.648.558. 64 .13 x8.238.228.22-.04 8.678.588.67 11 9.218.749.21 .10 019 R14 112.5312.4212.43 USGvt tne Funds: AdiUS Bolan Bdlncpp CopGr GlobGvp GrOpp GvSc Gwthp Hi Inc IntEqp MOST Prlncp RetEqp TxExp TRAK Fundi InlrFxn IntlEq IntlFxn LgGrw LgVgln MtgBkdn Muni SmGrwn Smval TtlRtnn MuMSr MuNYt MuNCt MuSCt MunTEt MuVAt MuWVt MF1 Lifetime: BOUSCn Lgniu.w'ium Circle Financial .10 from .065 Detroit Edison .515 from .495 Duracell intl.lBtrom .08 Goldman Sachs: 17i01 16.5317.01 .41 ShtTr nt Clipper Colonial Fundi: InlEat USIdxp ColTE A ConTE A edSec FundAp GwthA HIYIdAp IncomeA MATxA Ml TE A MNTE A NatResA NY TE A OhTE A SmStk ie ttemaranai runas: incA InvGAp MHInA NTaxAp NYTxA miro svgs ba ij iruni iv 6ond CopGt st Noll BncpGA .1725 from .17 16.6116. 5716. 59 14.7514.3714.

75. 43 14.4014.0214.40 17 X14.67K.60I4.6O .03 10.06 10.0510.06 .01 14.67 14.51 14.67 .08 1S.5515.2415.55 .34 10.23 10. 1710. 23 07 3.223.15J.2Z.0J 2.402.582.59. 01 1.921.921.92 52.6751.27 52.67.

79 11.17 14.951i.M.M 21.6421.2421.64.43 7.557.497.55 .08 7.667.587 .66. 10 11, 2611. 1811. 21 .07 23. 6023.34 23.60 .35 14.3914.1214.37 16 6.576.556.57 .03 6.666.626.66 .05 7.937.857.93 .10 7.177.117.17 7.327.177.32.

06 9.929.849.84. 03 7.317.257.31. 08 7.477.427.47 .07 15.4615.21 15.46 .05 7.157.137.15 .02 13.9413.8413.94 13 438.358.43 10 11. 0510. BUI.

05 16 6.906.896.90 14. 06U. 0414, 05. 25 7. 557.497.55 .08 7.667.587.66 10 11.1611.

1111.21 .07 X1.6O23.3423.60 .35 Regt-AP 11.07 10.9811.07 10 744 175 71 .06 St Ntl Bk Ml lorlda Pub Utll .28 from .17 i uip BalTr K18.I4H.09H.11 GwthTr HO. 1610. 0110 13 10 IntlEq 10.159.9910.0S 08 SIGvflTR Xl0.21l0.17ip.17--. SmCop X9.789.699.78-. II Tax ITR Xl0.3610.30 10.30 .01 Value xlO.23IO.1510.23t.

13 Righlime Group: BlueChp 11.1930.4931.29 .44 A0IGV CapGr Glome GovAg IntlEq SelEq ShrtTF SmaCop ST Gov Govett Funds: GIGvin IntEmgMkts imcaoA 7.097.067. 08. 02 10.2210-1610. 18. 04 16.

68 16. 2416. 68 .15 Un.rinu.ionu Gollogher.Arthur .16 USGvA AsstB J1.1J1.31.1 .11 16. 1316. 11 It 13 .01 -elco LP .1 from 13 ATLBt 29.9929.7129.97 .25 10.2610.24 10.24-.OI 9.939.849.84 01 aver 1 ibiu 9.159.049 .07 -02 16.9316.3016.93t .26 30.5930.

1530. 59 1. 52 17.21l7.0217.21t.22 16.7316.41 16.73 .35 15.3515.0415.11 16 98.4596.0798.45 2.19 19. 5419. 1419.

54 .33 1.2011.1811.2041 ll.45U.42H.44t.04 10.5110.44 10. 4S .00 17.4826.6327.48 .37 20. 4920. 1920. 49 .30 13.

0913.0013. 08 10 12.2912.1712.25 12 10.7610.7010.73 .06 10.0610.0410.05. 13.7413. 5313.5705 7.587.537.56 .06 9.969.889.94 .09 16.2316.0916.23 .08 12.2212.1312.21 .11 11.2411. 1811.23 .08 46.0265.0466.02 .79 33.

1832.5433. 18 .70 12.O9.12.02I2.O8 10.8310 8010.81 8. 838. 768 .82. 08 13.

0913.0013.07 10 12.2512. 1711.14 4.ll 10.3410.0810.34. 14 24. 8124. 2324.

81. 04 12.0011.9211.99. 10 21.0520.6620.9008 12. 5612. 5012.

55 09 lS.4715.3tT3.47. 15 13. 5413. 3213.54 20 14.3215.9214.32.05 10.0210.0110.02 9.539.519.52 .01 9. 799.

779.79 .01 20.06 19.8920.06 .33 18 .0617.77 18.06 .24 55.0453.2055.04 1.35 ll.09U.04U.07t .05 14. 6814. 6514. 68 .26 36.5136.0736.51 .49 10.29 10.22 10.29 10 liueBT StrtlncA 6-16. 1J6.

1 -U3 9.028.988. 99. 03 9.028. 929.02. 13 14.3213.67 14.32.

34 11.0210.9111. 02. 13 11.4213.21 13.42. 04 11 5411 1211.54. 21 12.7511.6012.75.05 15.

5615.0315.56 .30 11.7911.6011.79 .21 11. 8011.6111. 80 .11 10.159.7710. 15 .09 21.2320.5621.23 .57 7.687.537.68 .07 12.4312.3212.32 .08 10.8210.77 10. B2 9.149.049.

144.05 18 2217. 6418. 22t. 24 8. 188.

148. IS .05 10. 1910. 1310. 18 .06 10.

9010.8310. 89 .07 10.9610. 8510.96 .13 12.0911.97I2.09 .15 10.9910.8910.99 .11 18.5418. 1918. 54 .36 9.809.

789. 80 .02 10. 04 10. 00 10. 04 .03 10.

2010.1710. 17 .01 11.5611.3511.56 .21 12.6212.4812.62 .04 15.3414.8215. 34 .29 11 8111.6111 B1 .22 10.5610. 1710. 56.

10 21. 1620.4921. 16 .57 7.617.467.61 .07 17.9817.41 17.98 .23 12.4412.3312.33 .08 10.8010.7510.80 .05 9. 109.009. 10 .05 B.178.13S.17 .05 10.

1910.1210. 17 .06 10. 8910.8310.88 .07 10. 96 10.8410.96 .14 12.0811.9712.08 .14 10. 9810.8910.

98 12 18.44 18. 1018.44 .35 9.779.769.77 .01 10.049.99 10.04 .04 10.2110.1710.17 21.2120.5521.21 .56 10.8210.7610.82. 06 8.198.158 19. 05 12.0911.9712.09 15 9.789.769.78 .02 10.049.9910.04 .04 10.2010.1710. 17 .01 14.7214.35 14.72 .30 1M216.4914.57 4..

10 18.52 18.32 18.52 .2 11. 3211. 2811. 28 .05 ExmtAP .03 Home Fedl Svgs Bk IN .075 IronV .05 bmgGT Goldt GvPIt GvSct Hllnct Intmdt MuBdt Sectt TotRtt WldE Mackeniie Grp: AdjGv AmerFdp CA Munp Canada Flxlncp Global 10.089.989.99 insA inrieq ntp GovSec Growth MldCapp SocAw JJ.BUJJ.U43J.OV 14.0613 8713.95 .18 24.5026.0526.5O .29 2B.4027.7028.40 .47 29.2728.6529.27 4.63 EmgGror Equtlnc EQIIn Equtlndx Europe ExchFdn FideiFdn GNM GloBd GvtSec GroCo Grolnc HighYieldn InsMun IntBd InterGvt IntlGrl InvGB ltdMun LowPrr Ml TF MN TF Magellan Mkflndnr MA TF MtgeSec Muncpt NY HY NYlnsn NewMIII OTC Oh TF Ovrseo PocBas Puritan ReolEstn RetGr SlntGvt ShtTBdn STWIdn Sped Sit StkSic Trend USBI utliincn Value wrldwde Fidelity Selects: SelAirr SelAGIdr SelAutor SelBlor TempletoB Group: CalTBt CapABt DvGrB EuGrBt GrthBt GlEnBt Gradtton McDonald: Ipaleo Enterprise from .49 USGrA USGvAp UtllAO Estvaipn x2i.Bj2e.rizi.Bu.j4 6 969.949.96 .02 Laclede bas .01 Trom MNT Ltd from Si Govlnc 10 3X10 7310 38 TE 12.2312. 1112.23 10.5810.

4810 58. 13 067.B28.06 .24 Mga Muni rn 11 iwi jiui Hints HGIBt 10.8610.7010.86. 20 TE CT1 XIJ.3VIJ.34IJ.34 X13. 2413.1113.24 15 17. 4517.3117.45 11 10.4610.3910.46 .08 14.

5314. 3U4. 53. 22 14.5114.3214.49 16 unu-p Oppval pn GHNotTE Greensorna Kimco a Rlmco Stk RiverlnE RiverftGVI RivCapEq RIvCopFI RobSEGnp HilnBt edScB undB Maritime Electric .24 from .23 Mov Dept Strs .46 from .415 Miners Notl .30 from .28 1 77 frnm 74 IncB InvGB 12.2411.0912. 22 11.5111.4411.4704 10.

129.97 10.11 19 22. 3222.0422. 17-. 08 11.3111.2411.3107 14.8914.8014.89. 06 9.779.709.76 .09 I1.6111.47U.62 .17 11.3211.2111.32 11 6.536.476.53 .06 8.788.718.78.04 13.

5313. 4413. 53. 05 16.0215.6516.02 .28 10.029.989.9V 11.5311.3811.S3 10 5110. 4710.

50. 05 15. 0014. 7215. 00-.

30 11.651I.5211.65 .13 GwthWash EaB Amerrrr CapAcc PevMktp Forgnp GlobOp Growth Incom InsTF RIEstp SmalCOP Value World ThlrdAve Thomson Group Grlncp LtdMup MHInBt GwthB Guardian Funds: Bondn 11.1011.7111.74 K003V1 NBSCCp.l3trotn.ll NTqxB MYTxBt YMuB YSec RuihmoreOrewp: AmGasa 11.7311.4511.71 .30 KlO.49 10.3810. 39. 02 10.1710.0510. 17 .02 9.639.439.43 12 Xl0.6010.55 10.55 X10. 2010.1210.

20 10 X10.2910.2110.27 .10 6.786.696.78 .09 14. 8814. 51 14, 88 .26 9.158.959.15 .14 19.7819.4819.59-.05 12. 6412. 4612.

64 ,22 18.4817.82 18.48 .38 9.829.789.82 .03 14. 3514.0914. 33 16 10.2910.2310.29 .07 6.576.556.57 .03 9.919.839.83 .03 7.157.137.15 .02 13. 9413.8413.94. 13 11.00 10.7611.

00 16 Z6.6076.1B7a.6U .44 24.9324.5024.93 .39 12.0911.8412.09 25 Pennsylvania ri iw nv 40 .4 in ta nf.M 7A4S Nova NotResB StrtlnB ParkAv Stock HTInsEq HTMgFI HonlfnColo nt mun NatMu Amer IvyGr IvvGrl Ivy Intl MalnStCA RegFBt ST GIB SmCaoB USGvBt 10.4410.5710. 60 .06 reiroi negi Piedmont BkGrp .18 from .15 ExB 9.099.099.09 Pleamonr Naiurai vjus mn EqlnA 6.906.896.90 1U.4UIU. IJIV.4Vt.4V I7.44I7.1617.44 .32 15.1414.68I5.13 .14 10.7610.6210.71 .14 9.909.779.82 .08 11.0710.9611.07 14 11. 2711. 1611.

27 13 9.959.949.94 01 11. 4211.3511.42. 07 15.33 15.1115.33 12 inln Cnlrlt n75from .05 Marshal Funas: USGrB USGvB UtIIB Conn Mutual: Govt Grwth 14.06 14.0414.05. 25 II1.4411.44H.44 .61 14. 7914.5814.79 .12 Gvtlnc 110.1516.

1514.28 .01 Harbor Funds: Bond CooAoo IntBd San Diego GOSJ.EI .37 from .36 Security FedSvgs MT .11 trom-105 -Shoreline Inonclal .21 trom .20 A 11.5911.5111.54 07 15. 2714. 7915. 24 18 11. 2610.

8311. 26 23 17.6317.3917.49 .10 stock SMP Idx OTC Idxn GovLT US Int MD TF VA TF SBC Wldln SBSF Cvn SBSF Grn SEI Funds: Bond np Bdlndxp CopGr GNMA LtdVBdnp ShtGv np GlInD HllncD NTxDp STGIDp SmCopD USGD Papp LRStk ParkstonB Fds Balan Bond Growth ncome Mathers TotRet 10.039.8110.03 18 14.9314.7214.72-. 18 12.9412.7512.94 18 XU.3611.3011.32 .01 12.6012.2512.60. 09 MaxusEqfpn intl ShtOurn GwthA IncoA IntIA OporA PrcMtA ShIGvA TorgetA TE xA i USGvA EqlnB GrwthBt IncomeBt IntlBt 11.6011.9611.40 xlO.0310.0010.03 Copley Maxusi rpn. 14.6314.1514.15-.0S IB 4916.

44 10.69. 14 I4.U31J.414.U3 .40 value X9.969.949.94-.02 14.3514.24 14.35 16 20.8620.7520.86 .43 M.75M.3428.75 .47 9.899.629.89 .14 10.1610. 1410. 15 02 UilminiM Fll' nftenroxn Meridian 20. 6920.

3520.69 .27 coreFunos Eqldx 22.52I.V624.3 11.1311.(011.13. 12 U.4111.28I1.41 .17 10.9510.70 10.05. 15 13.7713.7213.74 .23 12.4112.1112. 41 .22 10.67 10.40 10.43 .04 10.5110.49 10.504-.01 t.899.889.l9 Jll 8.498.508.69 .15 14.4213.8914.42. 15 14.2013.7314.20 .12 5.735.715.73 .03 9.199.119.18 .02 10.2310.2210.23.

01 9.549.299.54. 20 10. 88 10. 8 110. 88 .09 16.50 15.97 14.50.

15 1I.2I17.S11I.11 .23 10.3710.34 10.34. 04 11.6311.2311.63 .26 9.459.599.65 .04 1.378.3 18.37 .09 8.578.498.57 10 11.0410.9811.04t.il 14.0313.9814.03 .24 18.40 17.9718.40 .17 9.999.999.99 81 10.009.999.99 .01 10.98 10.9510.94. 01 ll.40U.3811.40t.02 9.329. 199.32 .14 11.4411.3511.44 .14 11.2611.2011.24. 07 13.5413.3413.56 .24 10.77 10.7510.77 .04 11.

4411. 3411. 46 17 57.5355.5557.53 .97 22.1621.8222.10 1. JO 10.2(10.21111.24 .04 Xl0.3210.2510.25-.02 10.5610. 3710.56 16 9.139.039.04-.03 4.874.664.87 15 22.7421.5822.60 85 lUCnbQ XIJ.4BI2.rviJ.4Bt.4i Eaulfv 1I.4111.4611.S1 .14 10.

4610.4110.44. 05 12.4412. 1012.44 12 10.2710.2510.2502 10.7010.6610.68 .05 10. 1810. 1710.

18 .02 10.7510.7010.75. 07 10.3510.3210.33 .02 Merrill Lvncti: stage it Apparei -uj 11 win Suffolk Bncp.l7from. 16 Textron Inc .31 from .28 UnltedBkshrsWV.23from.22 1. Utd llluminotlng .665 from .64 Unlvest Corp .28 from .25 Washington I st .22 from .21 Extra Dividends 1 Capitol Tronsomerica .125 ban ii.ooio.aoii.oe.i4 21.7921.0721.75. 28 8.758.708.73 .05 9.949.809.83-.07 24.1723.0724.17 .40 7.547.317.3108 9.899.889.89.

10.189.8410.18 17 12.3412. 2212.34 14 9.619.589.58 .01 10.9910.7610.99. 17 21.5920.8821.55. 27 8.726 676. 70 .05 9.809.659.67-.07 23.8022.7123.

80 .40 7.417.197.1908 9.909.899.89. 12. 3412.2212. 34. 14 10.

149.8210.16. 16 9.589.559.56. 01 10.06 10.0510.0S-.01 10.8410. 7310.84. 13 scEq 16.2617.9818.26 .34 Govtlnc SelBrdr AO KA X11.7611.56U.76 .22 IntBdn IntlGr Se 10 3A 10.

2310. 28 Ul max ArmFldn Brkr Chr DUIM BasVIA HYlbq IntGvt IntlDls X10.0410.0210.U2 1A 171 01A 19 .77 10.4410.3910.41 1. 05 14.3713.7314.37 .30 10.0810.0510. 08 .04 14.01 13.7414.01 .15 10.5510.51 10.52 .04 10.2410.1110. 1 1 I0.2010.1710.19.03 10.

9910.9110.99 11 10.9610. 8810.95 10 IB OA1A.9418.0A 13 rthEa OporB CalMnA inTMn IntGvt np Intlp Eqlnc np X13.0512.8713.03 .12 Ltd Mat precMetB CowenlGrp CowenOp CrabHusnp Crest Funds Inc: CaoFdA ncEq ncome SelCom SelConsH SIConP SelDetr IGvB 12.8412.7612.84 .20 13.2212.9313.22 10 12. 2812. 1512.28 16 18.1716.1118. 1J .04 10.1510.

1010. 12 .03 X10.4510.3810.JB vlO.9010.B510.B5-.01 4.PHIA Ml Mun MunBd 14.2213.9014. 22 .35 28.7128.5828.61 20. 2619.8520. 16 .05 15.7415.5715.74 19 12.9712.5112.97 14 15.0BI4.5415.08t.

62 16. 4416. 0316. 44 41 15.8415. 7515.84 1.

26 14.3814. 1514.28 05 13.7113.46 13.71 27 LtVol Invest CO Amer tj 1 Declared Slock Dividends. Hawkins Chem 5pc -1 Intl Molding 5pc X11.091I.0111.07 .09 LPHUA ColTA Bond SmCapIt Mun uanEq Dvcr X1I.JU.4BII.J PA Mun no Bdn pnrnnssus DevCap xii. iyn. 1211.

io.u 30.9630.6830.96. 16 21.6 111.0111.41 Pasadena Group: ToxExBt TargetB USGovB Transamerlca: AdjGvA CATFAP CapAp rug mil spc -114 eoubllcSec Find lOpc Uaritnn Flinric' lEgvr lEIecr lEUtlr DragA FnrnA 11.5511.29U.55 X10. 8710. 7210. 86 17 10.0110.0110.01 10.06 10.0410.05 .02 SpEqn Value CuFdAdln CuFdSTn SmCop pn Value np CapA np SIFE Trust Sofeco Funds: CopAppp 13.8313.5511.

B3 .72 Dlvlncp 10.7510.72I0.75 .04 FedSecAp 11.0U0.9111.01 .31 13.V613.4UI3.VO 16.6616.0916.66. 46 14. 2914. 0214. 29 .34 11.2410.

7811. 24. 12 ncur ii.ii.ii.wt.ii ivt A FdFTA 2Z.3521. 5722.35.! San Miguel 20pc Shoreline Financial Spc Resumed Ladd Furniture .03 Reduced Dividends Bowoter Inc .30 SelEnSvr SetEnvr SelFlnSr SelFoodr SelHIthr calTFr moA vlncp 11.311. 17I1.3 7.177.017.1701 (jov V.OV.03.W IjghMark Funds: ill.B61B.9910.99.

GIAIA GIBdA MvCopGrop MMunBd Invst: CopGr "GlnieM "Grwlnc HQ Bd aTxFBdn mABT Funds: nE merg Tr TF aha Funds: 4alaBM nFutl wLIm aim Funds: AdiGVP "thortp "omtlp ConvYd HIYIdp n-iotlE LlmMtTrp Summit TF Int WetngEqp -AIM Funis ApesvC GoS.cC GrthCp HYIdCp incoCp MuBCP TeCtCp UtIIC Value amf Funds: AdiMtg IntMtgn IntlLlqn MtgSec ASM Fdn ASO Funds: Bolanca Bond Equity LtdMort Acornln AcrnFd AddisnCa Aetna Funds: Aetna Bond Grwlncmn IntlGrn Alliance Cop: Aliancep Baton BondA Canada Countpt GlbSmAp GovtA GovtB Grolncp InsCalTxAp InsMunlAp IntlAp MrtgAp MrtgB MrtgTrB MtgTrAp MltlG Mltlnt WlAASAp MMSBt MunlCAAp Be MunlNYAP NtlMunlAp NEurAp NAGvA NAGvBp PrGrthBp QuasarA ST Mia STMIbt Tech Wldlncp Amer Capital: CmstA CorpBdp EmGrop EmGrBp EntAp EntBp Eqtytnc GrlnA 8.588.538.54. 03 11.4311.2711.43. 22 8.478.438.44. 02 9.309.269.27 .03 GICV, ncoEO XI. 8411.7111.81.

15 ndi sviec nvQual 11.3611. 1611.36 12 53.2951.5453.191.78 30 6630.0430.B6t.76 52.6149.4952.57 1.30 17.5017.3417.44 12 21.58 20.8321.58 .39 35.7734.9035.77 .64 14.4813.6314.46 10.109.869.86-. 17 16.2216.0816.08 .08 OUItv Ull 131 iu GIUtA Dean Witter: Amvalt CalTxFrt CopGrot Convtt Growth Incom Munlc NW USGov Hawthorn flncl .25 GrIRA Sellnsurr SelLesrr 10.98 10.86 10.98. 15 ti-boa SpGrEqn 11.8511.5211.85 .08 HllllariGr 15.1014.7715.10 .30 HomstdValn 13.2013.0213.19 .14 HorocMnn 20.5620.3120.52 .34 omittea uiviaenas 1 HeolthA 16.1916.1716.28 .13 17. 8217.4517.82.

29 18.3518.2518.35 .08 20.9620.6820. 96 .31 10. 1010. 0510. 05.

02 vR MR 508.50 .01 TrnsqmerlcaSpcl: imd 9.769.759.76-.0I 12.3712.2612.34 .10 21. 8121. 4421.81 .32 12.1812.0112.18 .20 27 .0726.8527.06 .24 7.997.957.99 .04 12. 3712. 2712.

34. 09 12.0911.9912.05 .08 10.9710.9010.90. 03 10.9610.87 10.87 .04 11.3611.2311.33 OS 10. 019.989.99 .02 10. 8510.7210.

85 .16 16.0115.6216.01 .31 12.0011. 9512.00 .07 10.009.969.97 .02 10.0510.0210.05 08 12.2212.1412.22 .21 15.9315.4915.81. 16 3.513.363.5101 10.30 10.2610.27 .02 11.2811. 1211.28 .07 9.979.859.95-.01 10.9910.8910.99. 13 8.648.

528.64 13 10. 0510. 0210. 05 .03 10.2810.2010.28 .11 13.5613.4613. 56 17 11.

1711.0911. 17 12 12.2112. 1012.21 14 16. 1316. 0116.07 08 11.3911.2611.39 15 12.6112.3612.61 .21 14.7614.4214.76 1.

17 13.2113.1213.21 .13 8.728.708. 72. 02 5.004.964.99 .01 1I.0U0.8811.01 .15 9.039.009.02 .02 9.779.759.7601 10.99 10.8310.99 16 17 4412.3312.42 10 IChipl instinp IntHdA Angeles Mtg Inv Graham Corp 5 Metlr 11.6411.1111.44. 19 10 8410. 7310.

84 .13 SagomrGr Salomon Bros: CATFB Huasonuap 14. nn.ajix.itt.i Hummer 21.6621.2521.66 .39 DvGtnr DIvGtht Dlvlnt LtnAmAr BaiKin Growth Nifty 50 PaxWorld Pelican PenCap A Phoenix SeriBs: BalanFd CapApp CvFdSer Growth HIQuol HIYIeld Intl StockFd TE Bd TotRet USGvB Pilgrim Grp: ARS III AUSI-A ARS I ARS l-A ARS II AdlUS Adiusil mGB urco companies Chapter 11. 7ft 8870.4120. 88 .61 cap IPaprr iRear iRtir MnHYA 21.9921.2321.99. 15 10.029.979.97 .03 11.4511.3011.45 .22 nves Muiuai t-unas: rgeCon 14.3614 0814.36 .30 qtinct Mn nsA vlnct nr.Bt 9.129.049.08-.02 13.37 13.

16 13.37 4- .19 11. 5311.3611.53 19 15.0514.8715.05. 16 23.8623.4323.86-.06 22.1821.6022. 18 .70 malICo MnLtdA uro i Ibl 9.809.739.80 YTF 13.8313.6013.83 .19 27.6126.4327.61 IS Treas SelSL SelSoft SetTech Mn a IO. ID.

10.0 T.ra Xll.llll.0211.02t.02 10.7610.70 10.76t.26 7.827.777.82 .05 Yldt X9.939.B9.8.UI 13. 2213.0813.22. 17 edSec NtReSA NJMA 34.6233.SI34.62 .56 34.1933.6834.19 .78 41.4941.3541.49t.78 Opport SchoferV SchleldProV Schrodlnpn Schroder Schwab Funds: CA TF GovSI 13.1012.9913. 10 12 10. 0910.

0810. 09 02 seueier NatRst TCU MSP ME I Diversified Inc Declared Stock Splits ATTN Aveca 1 for 3 reverse Astra AB 5 fori Chevenne Software 3 for 2 Comverse Technoi 1 tor 10 r.e-T verse HomeDepot4for3 Homecorp Inc 3for 2 ts HlthSct HIYldf MuAZt NYMnA eu Utility IDS Group: BluCpp Bond CATlfp DElp 7.307.307.10 .01 7.317.307.30 7 2A7. 267.26 .01 4.1B6.076.1I .12 5.245.215.23 .03 5 475. 365.42. 08 9.989.989.98 CUGSP POCA idelitv Spartan: 4.974.954.97 .06 18.7618.I718.74 .39 9.749.479.76-.03 1.648.588.64 .07 8.646.588.64 .07 2.462.412.46 .04 B.948.838.VJ 14.0413.8614.

04. 24 15.5015.2015.50 .33 10.8210.7610.82 .09 10.9O10.851O.9O 11.9811. 2011.98 19 U.6311.37I1.63 .32 15.7015.3115.70 .23 3.923.843.92 .09 13.4412. 1512.46 .11 11.2410.8411.24 .25 16.5315.7016.53 18 17.1817.0317.18 .20 14.4314.3314.43. 13 12.071I.8012.02 .07 9.989.969.98 .02 11.2011.0311.

19 15 19.3418.7719.34 .11 16.0815.7616.08 .29 29.7928.9229.79 .58 31. 6031. 1731. 60 40 6.918.748.91 .12 15.5115.3315.41 .04 10.049.7210.04 .24 11.1110.9911.12 .17 10.5310.4910.49. 02 10.41 10.2910.41 .15 12.

1511. 8612. 15 26 11.2011.0111.14 11.8011.5211.80 .16 11. 2311.0811. 23 18 19.9019.4019.90 29 31.

5930. 5831. 59-. 16 15. 5815.

5415. 56. 01 19.8619.7619.86 .14 12.6512.S412.65 .04 9.158.988.98-.08 16.4316.2416.43. 16 14.0513.9414.04 II 34.2133.8234.10 .11 13.1813.0213.0301 12.8212.7112.78 13.8913.7713.89 16 11.2511. 1411.24 .12 9.

169.069. 16 .13 11.6711.5511.67 16 13.4113.2813.41 16 13.7013.5613.70 16 15.4714.8615.47 .31 12.1112.0812. 10 .03 11.6611.6311.65 30th Century: PA MA If. 1814.8915. 14 4.976.886.97 .10 CAHYrn CTHY nr oiinv 7.287.277.28 .02 7.337.327.33 .02 intmat MuCAt MUFLt PhnxA sdvia ttn Nil 1000 SrntWInT StrDvA Growth nrei carp zror 1 ntl Game Tech 2 for 1 1 10.3 IU.2 IU.3 1 1 1I.4411.2011.44 .23 4.304.

284.30 .02 765 755.75-.01 11.1928.5011. 19 .44 13.2O13.O613.20 17 13.9713.5713.97 .24 9.719.569.71 .08 14.4213.7714.42 .24 28.6628.4328.68 .43 10.1710.1510.16 9.219.049.21 .15 9.169.019.10-.04 9.339.309.33 9.869.839.84 .05 8.357.798.31 7.016.977.01 .02 10.6 1 10.53 10.61 .10 10. 1210.07 10.07 .02 10.9110.7710.91 17 10.8310.7110. 83. 15 10.8410.7410.

84 13 10.88 10.7810.88 12 12.4812.3712.48 14 11. 4011.3411. 34 10 13.2513.2213.25 .11 8.167.917.96 .02 9.659.639.63-.05 12.5512.4212.55 .15 11.0210.9611.02. 12 10.4210.4010.40 14. 4414.

4714. 64 20 12. 2812. 1812. 28.

12 9.479.449.45 .02 14.2114.1814.21 .21 18. 5818.3218. 58 .32 9.169.139. 16. 06 14.0113.9214.01 10.7010.4410.70 13 9.0SB.83B.83-.

24 14.0213. 7614.02 .31 NMA ISCOV quItPIp xtrlnp edlnco 7.29.297.Z9 7.347.337.33 7 337 397 37 ultPAt STGIAP Govlnn 14. 2913. 6814. 29 12 23.6022.8923.58 .31 9.739.599.73 13 5.835.795.82 .03 99.9999.4299.64 .54 39.9539.0239.95 .96 Scudder Funds: 10.5210.4010.52 15 14.1814.

0014. 10-. 01 YTxFt oncoster colony 4 tor i awyers Title 3for 2 lonin rn i ecnA TX MA Balanced IntlEq LTBondn LtdGv 9.369.319.31 .01 CalTx GlobBdp GloGrp Growth WldlncA Select 9.549.509.52 .10 14. 1214. 1014.

12.01 6. 146. 096. 14 .06 12.0011. 9211.99 14 eons urnirure 4 ior 1 Ibertv Media AJ.B 2for I U.2811.1811.21 .14 11.7711.6811.76 11 11.1211.0211.

10 12 10.2210.20 10.22 .02 10.96 10.9110.93. 03 12.0211.9812.02 .04 10.2810.2610. 27. 01 12.5512.4212.50. 13 11.0811.0011.05.

OS 11.6511.5511.64 .13 11.3011.2111.28 .09 11. 0210. 9211. 00 10 9.949.959.95 .01 10.0810.06 10.08 .04 18.4818.3818.4804 ion Munln 9.349.319.31 .01 10.009.979.97-.03 10.009.949.96 106.59 106.03106.56 108.86107.66108 86 1,51 xElntn xELTn AO KB AZMBt RnlR May Dept Strs 2 for 1 Miners Natl Bnco 5 for 4 lira 1 nsrTE nil jhy HYrn caput Develop GNMA Globl GISmCo Gold Grwlnc 10.069.9910.06 .06 Itra SGv Owens 81 Minor 3 for 2 RnVIR 21.6421. 2721.

64 .32 12. 1812.0212. 18 .20 AUSIll CpUtlp GNMA HIYIdp 7 MagCop STMMII ShrtTrp Pioneer Fund: Eqtncp Plonr Bd CapGr PionMuBdp urope plonrFd 5.945.925.93 .05 5.145.105.10 01 17.5617.0017.55 .25 4. 784.754. 78 .04 5.605.545.60 .06 8.077.948.01 02 11.

2411.0011.24 15 5.485. 415. 48 .08 5.585.535.58 .06 5.435.375.43 .07 12.3912.2512.39 .20 5.395.355.39 .04 1.1 7312. 8713.23 19 AHY rn 1.891.891.89- vista CalMnBt r.AMR MgaRtmtp Mass Mlchp pantneon inas 1 ror jo reverse 1 piedmont Natural 2 tor 1 Promii Cos 2 for 1 16.6815.8816.68 .06 96.9096.7596.83 .10 10.78 10.3010.78 .25 18.7018.1316. 70 .12 12.2512.

1512. 25 12 10.9110.7610.91 .18 ShtBd ShtinMun unavou 7A 777A. 5074.70 1 .23 U5AA uroup: NtRst PacGrt PrcM Premier SearsTE np Managed STUSp Strat TaxEx USGvtt Utll nf Vol Ad WW Inc WldWdt TCCort TC at 8. 748. 718.

74. 01 8.748.718.74 .01 10.6010.4810.40 14 CapFdBt gsvGfn 8.058.028.05.0I 7.147.127.14 15. 6315.4515. 83 .32 9.729.669.72 .08 14.6114.4614.61 .13 10.6510.5610.65 .11 1S.1815.0415.12-.05 22.3121.9922.31 .43 19. 1418.

8919. 16 .37 70 nR19.7770.08.25 iducapn Unlvest Corp PA 2 for 1 NlbP utl 0 Balanced income Internatl IntlBdn LPMIB CpHOBf wesbanco inc zror 1 wan treei: uroEa TE CABdn Cornst stock saiifs mis week I.PI I i 20. 5920.5120.56 15 NewD PacBsn 26. 1715.7376.02 28.3828.0328. 10 .03 11.9911.7511.99 .06 11.

1611. 1011. 11 .03 Draas FuroBt 10.5510.5210.53 NMA Co 9.979.879.97 12 10.7810.44 10.78 16 9.489.299.37-.09 10.049.9910.03 .04 10.049.9910.03 .04 10.94 10.5510.94 .19 20.9820.4820.98 12 Air Sensors 1 for 6 reverse ir- CSF Holdings 3 for 2 Candies Inc 2 for 9 reverse -ii recMto A.49A.79A.29 06 FedSecBt InHorGvt LatAmer rn MA Tx MedTF MgdMunn NYTxn OH Tx Gold Grwth 7.997. 957.99 1. 04 I2.3712.2712.34t.09 12.0911.9912.05t.08 10.9610.87 10.87 .03 11.0710.9411.0305 10.019.989.99 .02 10.8510.7210.85 .16 15.9815.6015.98 .30 9.529.289.52 16 11, 9111.

8611. 91 06 10.009.969.97 .02 10.1010.07 10. 10 .08 10.5610.5010. 52. 03 inancial-lnvesco: FLMB FdFTBt ncStk Lenrrai f-iaeiirv tjanx jior 4 Ctattl's Inc 1 for 4 reverse 10.1510.

1310.14. 03 TCNortp 17 7017.0711. 19. 13 Dynomcnp 11.0110.4311.01 .07 Emgrthpn 9.148. 769.14 .03 USGovtnp 7.927.857.88 .04 ncome ntl pa tox Progres Select Stock StrAggt StrEqt Strlnct StrSTt StrWGt 9.169.159.14 9.179.159.17 .01 GIAIBt lear cnannei commun ior 4 lectronlc Arts 2 for 1 irst Savlnas Bank SC 3 for 2 OualGr 5.555.475.55 .09 5.435.315.34 6.

876.756.87 .10 9.589.519.54 .06 19.4319.0319.43 .34 14.7914.4214.79 .03 9. 209.089.20 .13 6.426.384.41 .05 1.031.031.03 4.274.214.24-.01 4. 144-104. 14 .04 4.836.796.83 11 10.8910.8110.89 11 in nolo 7BKI S3 .11 rena iz.reiz.jjK.tt.v 18.6316.1516. 63 34 13.

9613.7613. 94 .16 13. 1313.08 13.09. 08 12.1112.0212.09 .07 11.7511.6511.75. 12 13.1613.0613.16 14 14.4514.3314.45 16 10.71 10.6810.71 .03 11.3011.

2211. 30. 11 YBdn Kionrnp PloThreep Piper Jaffray: Balanc EmerGr Govt Grlnc InstGv MNTE NatlTE PacEurG Sector ilUOB Value 18.4818. 1318.48 .30 28.1827.4728.08 10 lILVB LllltP. xEITn xELTn IIS Intelllaent Info 3 for 1 1.901.901.90 nergy v.vw.viv.w nvlrnn 7.267.067.26 1.

07 qtyp 17.2316.8617.23 1. 38 urooen 10.4010.2510.32-.il 16.6816. 11 16. 68. 29 9.849.829.83 10.

119.9610.11. 19 1 1.7611.5711.76 .20 11. 1811. 1011. 18 10 11.4311.2611.43 .21 10.9210.

8U0.81-.05 15.4215.5015.62 .09 18.60 18. 1818.60 28 irIRR 12. 1812. 1112.18 20 15.3B14.9615.27t. 15 3.

243. 113, 24-. 01 1 1.0S 10.931 1.08 .06 12.4212. 2712. 4Z IB 13.4713.2111.40 20 10 699.

8410.09 TxEShn VA Bd WIdGr ST Bondn STGIbln TxF Zer2000 Security Funds: Action fl Bond Equity HealthBt IntHdB InSvcn 18. 9918. 2618. 99. 80 loin 17.6217.4617.62 IB 17.6017.1817.40 .32 X7.

107.047.04 .01 21.1221.0322.12 .47 21.9320.8521.93 .44 LatAmBt Un ted Funds: Modine Mtg 2 for 1 Ocean Optlque 6 for 5 Olsten Corp 3 for 2 Whitney Holdings 3 for 2 Annual Earnings Higher. Adams Rsrces and Energy 1.20 vs 1.45 Agnlco Mines Ltd .22 vs loss IntGovn 13. 1013.0213. 05 .05 9.999.89.V Ol 10.9910.8410.99. 18 10.7710.6910.

77 11 DelCapP Z4.5l4l.aj4.3lt.lV Dectrl 17.0416.8317.04 .26 Dectrllp I3.4613.2913.46 .24 Delawrenp 18.6818. 3718.66 30 Delchp 6.946.936.94 .02 USGOvtp 9.099.049.05 .02 Treasp 10.1410.1210.13.01 TxUSp 12.4412.3712.44. 11 Txinsp U.5411.4911.56 .08 TxFrPap 8.638.578.63 .07 Dreyfus: 1 Bna Utll Inc ISI Muni pn ISI Trstp IndOneGvT InvSer Optifd: CapGr I QualStk 10i3310.27 10.28. 04 10.40 10.2510.40 10 7.S77.497.S7 .01 6.586.526.56 .06 20.3120.1320.31 .22 Accumuttiv MAMB MNUB nflGrn l2.r0!4.OJI4.4 unds: x8. 138.058.05 .04 6.136.026.13.

11 7.327.147.32 .15 X10.4810.3810.45 .10 13.7012.3112.70 ond Utiln 10.8910.5410.89t.17 19 1911.9511.29. 11 12.7012.3112.70 .27 MnHYBt MnlnR invesi TxEx Confine VFrenD 6.6U 6.46 I6.6U IB 4.S44.834.83-.01 11.3211.2111.32 .14 10.6510.54 10.65. 13 6.296.206.22 AdiUS Balance CalTx CapApr GoldGvt 13.1913.0413. 18 .09 10. 3610.3310.

36 .03 MnLtdBt 5.345.255.34 .09 5.335.255.33 .09 Ultra Goldn 4.374.254. HlthScn 30.4728.5330.24-1.19 Allegheny ip i 1. 10 vs v.oi clrfrt Fiinrit: ytsec MnlB 10.6410.5910.59 01 7713 1113.22 11 nci AmShsnp 16.4416. 3S16.42 15 no 7.i.u.irt.w4 5.475.435.44 .02 4.124.094. 12 .03 9.

139.089. 13 .06 22.4222.0722.40 .35 Bona 13.4413.4j13.tjt.xj 7 3 OVT nvPflnp nvPfNY stel np IP Growth NtReso I AAA 11.5111.4311.51 .09 16.0515.85 16.05 .21 12.8812.6412.88 .27 9.529.379.43 uiea Kscn k.p j.vt vs j. 1 llled Waste Ind .08 vs loss mer Natl Insur 6.37 vs 4.76 105.77102.90105.77 2.57 12.4612.4412.45-.01 12.6712.6512.66 01 Hlghlnc Anr-nn 14.4514.0714.45 .26 Industrlnp x5.2O5.06S.20 1 .08 10.9910.8910.99 13 8.638.528.63 .13 10. 0510. 0210.

05 .03 10.2810.2010.28t.il 13.5713.4813.57 .17 11. 1711.0911. 17 12 12.2112. 1012.21 14 10.6210. 4910.62 .15 10.8510.7410.

85 .14 15.6415.5315.58t.07 11.3911.2611.39 .15 19 4ni7.lA17.40t .21 5pt3hSnp 4U.U4 IV.U4U.U .40 USGov 9.589.529.52 .02 14.9814.8214.96 19 16.6116. 2816. 59 .21 NYMnB ndlnconp ii.Biii.4Bii.Bit.xg ncome ntlGth 9.829.769.82 .06 6.666. 516.57 0 NTAAR seltgman Group: inrn H.ysiB. ly b.vb .3 9.819.739.77 .06 10.3010.1810.24 9.939.919.92 OHMB Front Amer Studios Inc .20 vs loss AmeriscribeCpl.84vs.64 1 Applebees Intl .82 vs .67 Arrow Electronics Inc 1.81 vs.28 PocBasn 11.

5611. 5011. 56 .09 CalTxn 15.5115.2915.51 .25 Callntn 13.5913.4113.59.21 CTIntn 13.5113.3513.41. 17 CvSecn 8.438. 338.43 .04 Dreytus 13.3013.0513.30 .24 qu I Eqldx Europe FEF GNM GlbGv Growth Gwthln HIYIdn JP Income Janus Fund: Balanced X9.028.958.95 x9.058.988.98 .01 Municpl MunHl pnrH rr Sellncmnp 6.726.696.

it. 02 Techn 21. 1520.4421. PA MB 10.1810.1310. 13 .02 18.5518.2118.55 17 16.1115.

8616.11 .23 11, 4811. 3011.48 16 19.2218. 5619.22 .38 9.579.529.57 .07 19 7nifl.R519 17 .23 weepr etlre 9.769.709.76 .06 U.0010.9410.98 .05 11. 00 10.94 10.97 .05 nierprise Ixlnc undn ircl Amer F-unas: 7.677.557.67 15 5.385.355.38 .05 9.459. 149.45 .04 7.567.517.56 .06 13.4912.9913.49.

14 6.206.036.20 .07 90.3419.9626.34 .42 PhnxB ST GIB aeieinun i.jh.wi;.jt.m Llntn 13.6013.4213.56. 18 CapltFd COIOTOX ComStk Comun FloTox GATxEx GrowthFd Alt All xl0.221O.O61O.22t. 16 51 13.87I3.4713.87 .08 13.0713.0413.04 .01 NMA np 15.4315.4013. 4I Balanced SciEngy Vanguard utd Services: AHAm 5 bqlnCBt ExchFd a FdMgAp FMgBp GlEqAp GIGvAp GIGvBP GlEqBP GvScBP GvScA GvTg97 GvTIA GvTIB MorbAp tforbB HIYIdlnvp i MunlBdp Paces PaceFndp TaxExp TXMSp IU.27 IU.4U IU.4 14.8314.6614.83 1. 24 8.728.708.72 1.

02 14. 4814. 1514. 48. 17 13.1913.1013.19.

13 4.964.924.95 .01 11.0110.8811.01 .15 9.028.999.01 .02 5.255.243.24 "1 033 073 07 TechB GnCAMun 13.9513.7213.95 .25 GnMuBdnp 15.7315.5515.73 .21 8.598.538 .59. 06 9.269.229.24 .03 9.959.879.87 .02 12.4512.3512.37. 03 9.119.009.06 9.028.878.87-.02 10 5010.3910.50 14 Grthlnc IntGvt ShTmBd Twen Ventr 9.969.S39.96 .09 16.4415. 8916.38 .20 7.607. 527.60 .09 13.0412.8413.04 18 11.9911.

3911.99 20 7.967 .887.96 .12 B. 188.098. 18 .11 5.805.615.79 .10 14. 2214. 1614.22 .10 9.638.548.63.

10 8.348. 278. 34 .09 1.368.308.36 1 .08 8.878. 808. 86 .08 8.047.988.04 4.08 8.

088.028.08 1. 07 R.39A.778.39 1 .14 quiry qldx xdlncp TX MB 10.2610.07!0.26t.Zl vll. 1811. 1511. ISt.Ol 4.144.004.1103 Income IntlBdn IntlDls Intstk Japan MdTxFrn MldCapn Astec inaust inc I.64VS i.iz Baldwin Piano and Organ 1.75 vs 1.30 Blessings Corp 1.94 vs 1.84 Boston Scientific CP .57 vs .44 CCP Insur Inc 2.52 vs 2.51 CD I Corp .17 vs loss CMI Corp .08 vs loss CNL Rlty Invstrs .95 vs .85 4-CSS Indust Inc 3.74 vs 3.37 Catdor Corp 2.35 vs .17 Covolfer Homes Inc .81 vs.05 i WlrilnrR nNYMunnP 20.622U.6U2U.84 .49 rlncn 15.lll4.8415.llt.28 uron ibRscn 5.445.405.60 .01 ntlnc MetLile Stalest income LoTx MossTx MdTx MIchTx GwthOpn 12.2111.7912.11-.0I Ltdlnc 23.7023.

1723.59-.33 50.6749.6050.67 .68 20.1419.7220.14. 32 9.168.959.0105 13.1412.8013.14 .21 19 0711 9117.07 18 GldSh Growth 1 X10.1910.1510.15-.02 Xl0.0310.0110.01-.02 10.7210.5010.72t.19 15.0714.8915.07 1. 19 CA CdDAO eaEa 9.419.399.41 .02 9.419.399.41 .02 13.1612.8813.16 .27 15.3015.1315.30 13 15.2315.0615.23 13 x6.386.336.33-.03 X10.3710.2910.36 .08 12.3412.0712. 34 24 12.4012.1112.40. 25 11.5811.5311.58 .06 10.0910.0110.09 .09 11.2811.

2111. 28 .08 inaex io.j io.vi io.jx -j InsMunnp 19.5319.1819.53t.39 12.1911.8812. 19 10 23.6422.7923.64 .40 13.6713.5513.47 .19 19.4119.2219.41 30 neon Stock 1.561.501.5006 5.835.705.81 .05 13.3213.2113.32. 30 11.0810.8611.08. 24 X12.

1112.0312. 11 11 9.659.379.58 .21 bnergv Falnc wriow JapanFd John Hancock Ait All CATE DIscvBt Growth 8.276. 168.27 .14 9.479.049.47 .10 10.359.88 10.35. 58 10.3310.2310.33 15 14.1213.6814.12. 30 7.637.587.60 .03 17.7A17.A712.71 .05 ealEstn 10.3310.2810.31 .05 nterm t4.4i4.joi4.4t.n nvGNn 15.5815.5315.53-.01 Eqlnvstp 13.8213.

5713.82 .21 Txpr 14.6514.0214.65 .21 WrldGldn bovsec 11.2611. 1611.26 12 MA Int 13.4413.2413.44 1. 21 UATnvn 17 051A.9217.05t .17 STBOSIb- stEagl nr tHawMu irst Investors: ictiioo 11. 2311. 1011.

23. 17 11.0510.9511.05. 13 MinnTx MO Tx NotlTx NJ TE NYTox NC TxE OhloTx OrTE bvmc np Hllnco USBOSF USBosG NewAmn Asia NewEron NwHrznn NJ TF NYTxF OTC Fdn SclTchn ST Bdn ST Gib SmCapval MunBdn 13.4113. 2613. 41 18 ia 1 1 TE fp 15.5815.14 15.57 .31 TxE HYP 9.819.559.81 .05 16.8716.2716.87 .17 12.1111.9912.

11 14 12.2712.1412.27 14 12.3011.8112.300! 7.537.507.52 .02 11.4211.3111.42 .14 9.049.009.01 .03 ModAsts 14.4314.1414.43 .04 16.7016. 0416. 70 .22 8.037.928. 03 1. 13 8.478.

388.47 1. 10 7.957.887.95t.09 8.538.458.53 .09 7.887 .837. 88 .04 8.338.258.33. 10 A. AAA A1A.A4 .04 Vol org Cohu Inc 1.51 vs 1.30 Colteclndlncl.llvs.09 Columbus Energy CP .83 vs .02 Commun Hlth Syl 1.43 vs 1.40 Consolidated Strs .78 vs .44 Corrections CP Amer .26 vs toss Costor Corp .85 vs .67 Cotton States Lf and Hlth .71 American Funds cibqp 6.

226. 206.22 .02 8.698. 548. 69 09 8.208.128.20t.l0 8.278.208.27 1. 10 10.97 10.8310.95t.15 Globip Govt nc fo HI I TaxEx AmBalp 12.

4812. 3412.48 .14 7.717.697.71 .04 16.5316.2216.53. 31 9.499.439.49 .08 9.999.989.99 .01 7.417.387.41 .03 13.6413.4713. 64 18 17.7517.0917.75 .45 Jintn I3.621J.4IJ.3V Munn 13.7213.5613.72t.19 wLdrsnr 32.7632.0032.76 1. 42 YITxnp 12.0511.9012.05t.17 VTnn 16.1416.0116.16 .20 5.105.095.0V 4 R14.R04.81 TaxEx fp ignra J.3Z J.ZJIJ.3Z Mun nco value Line pu AdjGv Aggrln ConvFdn U3UV3 rp 21.6221.3721.62 1.

44 Monitor Funds: ncome nvGrd Hancock Freoam 12.9712.8312.97 13 10.5810.41 10. 58 .10 10 9410.9010.94 .05 5.095.055.09 .04 11.8411.8U1.84-.01 5.085 055.08 .02 4.023.994.02 .03 10.2T10.2210.24 .05 13.4713.1713.47 .28 10.7610.7210.76 .04 12. 1011.8212. 10 .23 13.2013.0713.20. 16 14.50 4.4 14.50t.

11 10.349 9110.36 .42 vTech unan Fxinl Gwth I PaTxExp CoTxHy CalTxQ SCTE GovGtd HIYBdp MtgSec Sentinel Group: item. IfeHYn 7.106.997. 10 1. 13 8.318.248.31 1. 09 7.327.287.304.03 6.636.604.63 1.

03 6.746.716.7103 7.357.247.35 .1 Income 8.73B.OB.4-.UI 649 SA9 5At .01 22.1411.9921.05 1. 14 25.4724.8925.47 1 .57 21.9321.7421. 924.21 22.1421.9922. 05 14 75.4774.8925.47 .57 nvrnA llnBt lobA .49 DSG Intl Lyd 1.36 vs 1.26 j. Datasouth Computer .11 vs loss Decorator indust 1.68 vs loss Dime Svgs Bk NY loss 3pecur Specln TxFree TxFrHY TFInsm TxFrSl LevrgeGthn MdUSAp 32.0431 .9032.04 .26 15.4315.4015.43 .12 33.7433.3033.44-.15 18.0417.7218.04.

33 14.41 14.31 14.36 .08 uniri FxInT GrwthT NYTEInnp 18.3018.1418.29t. 19 Peoplndt 15.7615.4415.74 1. 33 PeoMldrn 15.8315.4315.83 1. 17 ShlnGvn 11.6611.6311.64 .02 ST men 12.4812.4612.47 .01 ShtlntTEpn 13.2713.2213.27 .05 ThdCntr 8.298.048.29 .14 11. 0910.

8311. 09 11.0210.7711.02 .11 NJ 1 rp 22.0621.4722.06 .32 10.84 10.7310.84 .14 14.5714.03 14.57 .03 11.2911.2011.29. 12 13.0913.0313.06 .05 9.849.759.84 .12 12.3312.2312.33 .12 10.5610.4310.55 5.365.345.36 .02 5.445.415.42 .01 10.8510.7610.79. 08 11.0610.9611.06. 12 YTXF inbqi MtoBk 21.9421.7021.

94 .36 10.099.9510.00 .06 71 0371.7471.92 .21 Z.34IZ.UZIZ.34 44 5.4914.8915.49 .31 14.3023.7824.30 1 .26 GlobBt GlobRx GITech GoldB MgTEBt NY TE SpclSltn TaxEx USGvtn Van Eck: GolOResp OhtFT H1S.0114.8114.S5-.03 X6.856. 796.80 .04 x28.7828.352B.49-. 11 10. 51 10.4310. 44 .01 15.1915.1015.

19 12 12.7512.6512.74 12 11.6711.6311.67 .04 15. 3814. 8815. 38 .12 10.6210.5610.62 .08 14.7914.7014.79 11 us int US Long VA TF Prime Volue: UST nt 13.2 J.6I J.0J PA TF SpecBd SpSIt ToxExptp Balances Bond ComStk GvSecs Growth HflT 5.6815.5415.57 .06 1.8811.7711.88 .14 in iin 4Ain .11 14.1614.0414.16 .17 15. 2015.0315.09 16 3.933.793.7903 unmrisin 21.

1221.0521.09. 05 10.239.479.47 31 18. 3018. 1318. 30 12 in -nm 7010 33 4.04 MonltrSI 14.4614.3814.44 .07 IB.

2217.94 18.22. 28 19. 3519.0419.35. 39 12.4512.1812.45 .09 gbKA lOTKKTP Ulivin IO.J4IO. to.

IB Dreyfus Premier: A UiinS 1i 3111. 1111.11 .12 110.13 10.1110.11 .01 X9.979.939.94 .03 vin. 7110 AA10.70 .05 bcoiao inc Z.U3 vs loss Electrocom Automation 1.02 vb .68 Electromedics Inc .17 vs .13 Escalade Inc .51 vs loss Fedl Rlty Inv Tr .41 vs. 25 Fst Franklin Cp 2.84 vs 1.94 Fst Regional Bncp .37 vs .32 Forest Oil Cp .36 vs loss Fuquo Ind Inc loss Guaranty Ntl Cpl.62vs 1.44 iwomfc 17.4817.0117. A7 .32 X13.70 13.6113.70 13 14.9714.6714.97 .22 S5.0854.555S.08 .14 i inc SentrvFdn 97.

5526.9827 .55 .46 gBkBf TWIriBt IV.JOIB.WIV.JU 9.349.339.34. 01 MontSmCo AdiGvt Gvtlnco IncBnd TF Inc ValuGr pirsi umana: Equity 12.4312.3312.43 .04 X10.1710.1310.16 .05 MG Fixed sequoia X10.3310.O910.33 X10.42I0.3510.39 .02 X1O.191O.1510.18-.02 1.IMUA l4.JBI4.4'li.JOt.l CapValA 11.1610.8710.87-.17 inriinv STWdCp Wrldlnc WrldTrn VanKampen Mer CA TF Growth 9.068.798. 79-. 16 8.918.878.88-.04 9.339.219.2111 12.8312.7712.83 .09 17.8I17.4917.81 20.1319.6620.13. 44 10.1310.0710.

13. 06 19.2419.0O19.24 .09 8.458.448 ,65.01 Shawmut Funds: Eri Inr IB. 17 10.3710.33 .07 15.0114. 4215.01 .25 10. 47 10.4210.

44 .05 10. 9510.8910. 95. 08 13.9213.7613.92 10 9. 879.739.82 .07 Ml? nnuni MrnKnil X17.

1216.621. 1Z 10.7310.60 10.73 .21 12.2212.0912.22 .15 t-xaincn Fxln FPDvAstp FP TE intp FlrPrEqT GrEqulty 9.439.339.43 .13 Mora Stan Instl FUMunA 15.1514.9915.15 18 GlblnvA 13. 7013. 6613. 70.

09 AmcapF AmMutip 1 BondFdp 1 CcrplnBlp Cavwidp upoc i Fundlnvp Govtp GwthFdp 1 HITrstp 1 IrtcoFdp IhtBdR 1-lnvCoA NwEconp NewPer SmCpWp ToxExptp TxExCAp TxExMDp TxExVAp WshMutp AmGwth AHer'tg Am Perform: Bond Equity IntBd AmUtlFd AmwyMutt Analytic AnchCapf Aquila Funds: AZ TF CO TF HI TF TF 13.0012. 8413.00 15 I2.8112.7012.79 .12 10.34 10.1710.34 .15 10.63 10.5810.60 1. 05 Kemper Funds AdjGov BlueChp Calif Dlvlnco EnvSvc FL Tx Glblnc Grth Hallmark biecrronics z.JU vs ACiciry AslanEqn prlmryT Princor Funds BIChp Bond CapAcc EmaGr loss 11.761I.59U.76 .19 11. 3811.3011. 38 10 20.6920.3720.69 .34 21.

1920.8221. 19. 10 unncbq iv. 13 iu.u iu. tj 1 IntGvIn 10.2410.2010.22.

03 LT inc 10.0910.0710.09 .02 SmCopEq 10.039.8610.03-.06 19.6219.3119.62 15.8915.48I5.89 .26 15. 5815.4415.58 17 16.0515.9016.05. 18 17.2317.0217.23 .39 9.008.799.00 .21 1.241.191.24 .05 oai FmGr 13.4713.11 13.47 .25 7.837.747.83 10 7.917.867.91 .04 13.2613.1213.26-.02 10.7010.5710.70 16 9.249. 199.24 .08 14.2213.8014.17 .20 9.669,609.66 .05 8.748.678.72 .07 8.318.248.31 .08 10 A710.5A10.A7 .14 GhmaA I3.4BI3.4JI3. MAMunA 12.2012.0812.20 .15 MOMunA 13.1313.0213.13 15 MIMunA 15.8215.6415.82.

21 MNMunA 15.4415.3315.44 14 MunlRilA 14.6314.4814.63 18 11.7411.6211.74 IS snearsan unas A EmMXT IjOVT Flrprni First union: BoiTn BalB FxtnB FxInT 15.8915.7115.89 .20 15.8915.7015.89 .21 17.6717.4317.67 .26 9.179.099.09-.08 9.179.O99.09-.08 nirieia hiyio InsTxF Munln MulncB PA TF STGIA ST GIB TxFrHIp USGvB USGvtp EqGr Fxdlnc 11.7111.641 1.69 .05 28.3227.7228.32 .38 12. 6112. 5212.61 11 12.3212.1912.32. 15 14.0113.9414.01 .15 10.6910.6010.69. 15 14.2613.6214.26 .06 10.9510.84 10.92 11 11.6111.4411.60.

12 10. 97 10.9110. 96 .07 10. 9010.8410.84. 05 10.4610.3010.37 11.6211.4511.62 .24 16.

8816. 7116. 88 23 20.37 20.1220.37 .24 AdiGvA 10.009.989.99. AoGrAp 20.5019.8720.45 ApprAp 10.8010.61 10.80 TtlhAn 10.059.8610.05. 11.7411.4211.74 15 10.7910.7510.79 .05 10.7910.7510.79 .05 10.8110.7210.81 .10 Hamburger Hamiet Kesr vs loss Harley Davidson Inc 1.51 vs 1.04 Harlevsville Grp Inc 2.14 vs 2.05 Health Images inc .53 vs .49 Healthometer Prods .16 vs loss Home Depot Inc 1.09 vs .80 a Hooper Holmes Inc .73 vs .76 Howtek Inc loss xlO.831O.7610.8O ncome ntlFund GIFxInn NYMUHA 14.4I4.3BI4.4 NCMuA 13.4913.3613.49 14 nt Ea 5.245.

195.Z4 nsTFB 0 MunlBd valueEa Talln 110.341111 09110.75 2.02 Growtn Manoged TE Bd World ProvidentMutUdl Grwlhp Invst PaTaxp 14.5314.4814.53 .05 16.0516.0016.01 .03 16.0616.0116.03 .04 OH MuA 13.1613.0613.16. 12 X12.1111.8512.09 .15 Xl0.9610.91 10.93 .04 23.7423.4623.74 .55 7.697.517.65. 10 12.2712.1312.27 .17 AlMuAp 10.4610.3610.46t.12 A 494 914.49 .71 MulrCATF MitttRnft 10.8110.7410.81 .09 17.4417.I217.44 .41 17.4417.1217.44 .41 MnBdTn VaiueB valueT PA MUhA 16.3I6.04I0.3 Vnnrff Fxehanae: TX MuA 21.4421.2321.44 1. 26 Mutual Series: VA MuA 16.98 16.80 16.96 1. 21 Flagship Group: 11.

3011. 2011. 30 12 12. 1111. 9412.

08 09 13.3913.2013.37 .15 10.2010.0510. 19. 11 9.149.089.13.08 7.947.837.94 .08 5.084. 865.08 .03 9.459.219.44 .03 98 4798.0678. 42 .31 NT Ir Retlrel Retire2 Retlrel Retire4 ST Glob SmCpEq Technol Beacon 22.4622.1422.42 .21 CopExchn 140.31155.

40160. 31 5. 28 DepBstn 84.8183.2684.81 1.33 Divers 169.58166.25169.58 1.96 Drevtus strategic: Discovery Idexx Lobs Inc .71 vs.63 r. Intercorgo Cp .88 vs .77 Interface Inc .71 vs .52 Ionics Inc 1.85 vs 1.45 Ivnx CnrD .65 vs .21 X7.917. 767.91 .09 13.4913.4013.49.

12 9.699.629.69 .09 X13. 0112.9413. 01 .05 12.0812.0512. 07 .04 x9.879.809.84 .01 6.919 539.56-.30 Crowlhn 31.3931.1131.39 .15 10.7610. 54 10.76.

09 25.6525.0825.65 .33 77.0775.3377.07 1.08 TaxFrB TotRet USGvt VolShrsp Wrldp ExrhBOSn 707.2 V8.B47U7.Z .0 UUQITU Shares LOrVlUA I0.UID.3JID.U FdValAp 7. 487. 407.48 1. 09 GIOpAp 25.3725.2425.37 1. 14 HllncAt xll.5511.46U.55t.

01 LtdMup 8.258.228.254.04 LtdTrp 8.178.138.14 .03 MgGvAp 13.2113.1413.15 .02 MgMuAP 16.7116.5016.71 .28 MoMuAp 13.1913.0713.19 15 NIMuAp 13.3913.2313.39 19 Income Inv A 10.8310.7510.83 .10 10.7410.6710.74 .10 I1.7211.44U.72 .10 It. 1210.9911. 11 14 10.9310. 7910.93 .17 10.7910.4910. 79 .14 10.9010.7410.90 .19 10.7410.6110.74 16 17.4617.2417.46.

27 11. 1811.0511. 18 16 14. I 14.3 it.OT ID 20.9720.4420.97 .10 29.9529.7929.84 .03 Mutual of omana: ExchFdn 241.55235.42241.55 4.37 FlduxExn 149.90145.84149.90 3.37 SecFldun 124.93122.82124.93 2.22 11 4711 1C11.39 .07 Wldlnvp 10.41 10.3010.4 1 I. 10.069.8510.06.

TF otRetrn 7.046.9 1 Kruaspc 7.49.4V.4V .06 John Sonflllipo Son .95 VI .83 Lifetime Cp .56 vs loss LlqulBox CP 1.73 vs 1.48 LltcnfieldFlncl.73vs.58 10.8210.77 10.82 .08 10.6110.7410.61 .09 V.JV.J3V.J6 Prudential Funds: aa 1 AZ TE CT TE Ft. TE GATEP GldRbp KY TE KSTEp LATE LtdTE Ml TE MOTE 5.285. 285.28 .01 Vanauard Grouo: OR TF 10.42 ll3 12.7412.6212.74 17 USGvt Kemper Premier: Divin AdmlTn 10.5510.4410.48 .04 ArborOoklnAn 10.1210.0710.09 10.4010.3110.40 NIChA NIChB 5.875. 635.87 .03 12.8011.2812.80 .31 12.5812.0612.58 .31 9.949.939.94 .01 Dupriv yrr DupKvsm fn Eaton Vance China EVStk GvOblg Growth 11.0410.9111.04 16 7 AA7.A47.64 Babson Group 1990A fi 9.359.069.32-.05 AdIA 1.671.441.47 .01 Bond PrMtAP 14.0013.7913.79-.04 10.6610. 34 IO.3Bt.lZ 10.

2610.2310. 25 .02 14. 21 14.0514. 21 .23 10.1510. 1010.

13 .04 10.8310.7610.83 .08 11.8711.7611.87 14 13.9211.42 13.92 .19 11. 0610.9510.97 .02 10.9710.8910.96 .11 GVT Growth HIYld STGI 9.949.899.91 10.4510.3610.45. 12 10.5510.4910.54. 05 AdmLT AdmSTn AssetA BdMktn Convt Growth Income TaxFree NCC Funds: Equity Fxdlnc OH TE NDTxFrfrn NYL Instil Fds: EAFE Bond GrEq. 15.2314.9815.23 .15 Lumex inc i.ui vs Maine Public Svc Co 2.93 vs 2.62 May Dept Strs 4.71 vs 4.02 Medophls Cp .57 vs .45 Medquist Inc .56 vs .50 Merisel Inc .67 vs.

43 Mobley Environ Svcs .32 vs .30 Mohawk Indust 1.29 vs .77 UtllA 15.5615.5215.55. 24 SmCoAp 14.27 14.1014.27 .38 WlncAp 6.896.856.89 .01 12.8012. 5312. 80 .21 17.7917.2817.74. 25 7.947.907.94 .04 7.987.877.98 .08 8.678.656.66.

02 9.509.099.50 .07 13.6113.2813.61 .16 10.9110.8110.91. 12 10.5810.5010.58 .10 9.709.619.70 .09 incaos Invest fo 10.54 10.43 10.54 21 13.2613.0013.26. 23 11.6711.6111.65 .06 8.007.778.00. 14 8.338.308.33. 04 7.457.397.45 .09 10.3310.2210.334.14 12.3012.1312.21 17 9.239.149.23 .06 54.5154.4954.51 .03 8.528.28S.52.06 -mCDEa 15.9415.8415.V4 12 7012.

4612. 70. 24 NLItS NY TE 10.9010.7710.90 Ea nc WWPAp 1.8I1.BUI.BI BIOCKUV CAtnAp EqutA EqlncA ICnA GIObA GlAstA GIUtA GvPlAP GrthA 11.6511.5511. 45 1 Explorer 12.7712.4712.71 .02 OH TE 9.789.649.70 .02 10.6410.5610.58 .06 13.7813.0313.78 .38 11.8311.6411.83. 14 13.6313.4613.63 .27 42.

7642.1542. 76 1. 10 12.5512.2312.55t.27 16.7316.3716.71 1. 20 9.429.379.424.07 AnRrRt 70 4719.8420.42-.23 TotRt Kent Funds ExpEqn 10.4910.4 1 10.49 .11 12.0311.9012.03 PAltP TnTE 0 MunBd Nautilus STGblt STTsyp SpcEqf ApprBt 10.7810.5910.78 .14 12.9112.4812.91 .27 11.2811. 1511.28 14 9.879.779.87 .06 1.901.891.90 13.1813.

1213.18 18 9.449.399.40 .02 11. 1211.0311. 10 12 17. 2716. 8217.27 .38 R.438.

398.43 .04 Morgan Prmcpn Prefd 11. 3211. 1911.32 16 10.8910.8010.89 .12 Myers LE Co Group 1.37 vs 1.14 NDC Automation Inc .41 vs .04 Natures Sunshine Prod .53 vs .41 Nordstrom Ine 1.67 vs 1.66 VA TE 11. 1311.0811. 12 .04 9.469.399.46 .10 11.4811.4311.46 0 -xainn dxEq 11.2611.1211.28 06 10.3210.2610.

30 .06 10.6010.4010.60. 22 10.2910.1810.23 10 (1410.0310 04 .01 16.8116.4616.81 Ouantn 11. 2511.2011. 22. 05 13.3513.1013.35 .28 11.4911.3811.49 .33 10.7010.6810.69.

02 12.3112.0812.31 17 10.2410. 1910.24 25 13.2913.1213.29. 15 ntibq 9.069.029.06 Omnicom Grp Inc2.45vs2.00 Cflian 17 1 fd MtM 25.3425.1525. 16-. 01 inaxBa fndxEq MultA ST Bd ValEq National Funds: Bond ColTxE FedScTrp lOIVlUO ID.U ID.33IO.UT ConvBt X14.

4314.3714. 43 .03 DlrVIBt 13.2313.0H3.22t.O7 DvslnBt 8.298. 248.29 1. 02 EurpBt 11,8811.7411. 64 .06 GIBdBt Xl6.3016.2116.22 GIOpBt 25.3125.1925.31 1.

13 RuRi 10.O91O.0U0.O2t.03 16. 2016. 0016. 20 .26 22.302I.9422.30 .25 10.3410.2810.34t.09 10.6010.4010.60 .25 NJTxFt 10.5410.4810.54 .08 rnTvFt 10. 5310.47 10.52 .08 14.2113.98 14.11 .14 21.

1319.9621. 13 .22 17.3916. 8717.39 24 28.6127.5328.61 .49 12.1311.7612. 13 .03 29.2728.6829.27 10.5410.5310.53 MedTE valEqpn Keystone: CuiBlt CusB2t Fortis Punas: Alt AMP CapApp Copltlp Fiducr GlbGrth GovTR Grwth HIYIdp TF MN 7.677.627.67. 06 14 7814 1916.74.

11 9.939.939.91 11, 6311. 4711, 63. 12 12.6512.3712.65. 20 11.2511.16I1.2S.11 9.309.279.30 .02 19.0518.9619.05 .30 11.9911.8611.99 15 xl.012.002.O1-. 01 13.7813.6613.78 14 x9.959.849.84-.

11 9.839. 769. 83 .07 9.829.759. 82 .07 GfupA HiyrdAp InVerAp MultlAp MuHIA STGlAp UtllAp ColMUt Adl qutB nt Eqlnc nt 9.139.089.0V star TCEF Inn TCES USn GNMA HYCorpn IG Corp STCorpn STFedn STTsry ITTsry LTTsryn FLTxFt 10.5410.4910.55 .09 MATxFt 10.4510.3910.45. 09 NatTxFrt 10.4210.5610.62 .09 NYTxFt 1O.5610.4910.56 PATxFt 10.6110.5510.60 .08 GrlnBt 9.679.569.67 .16 18.5418.

1418.54 .41 21. 8421. 5121. 84 22 e9.259.199.24.07 ell. 0311.

0011. 01-. 01 610.4610.4310.44 el0.4910.4710.47-. 01 GrOpBt 21.0520.5121.05 .31 15.19 5.1815.18 25.7924.4525.79 .44 8.298.238.29 .06 10.5810.5210.58 .08 11.0410.9311.04 13 11. 4611.3511.

48t. 15 13.5713.5213.57 .06 13.5513.4913.54 .06 9.V49.V4V.V4 17 7912.5212.79 .21 17.7817.41 17.78 .03 Eaton Marotfin: TF Nat 16.5216.3716. 52 .22 4.814.764.81 .03 9.879.779.87 .10 7.757.457.75 .08 23.8323.3223 .83 .41 9.288.989.28 .22 7.086.727 .08. 10 5.985.925.96 .02 14.6514.3214. 36.

05 11.5511.4511.55. 13 ALTxF CUSB4 CUSKH CusK2t CusSlt CusS3t CusS4t Intl KPMt TxETrt TF NY inur InGrB MulFlAP MulFIB Stock TxExmptp TotRet widopp Ntllnd Nations Fund: 10.04 10.0110.04 .01 611.0710.9811.00. 06 610.36 10.2710.28 08 41.8441.0441.86. 89 17.4617.0517.46 .26 12.8812.6612.88 .26 11.4211. 2511.

42. 16 11.2511. 1211.25 15 10.0810.0410.05t.02 10.8410.73 10.84 .11 11. 1911. 0811.

19. 15 10.40 10.2810.40. 15 10.7510.43 10.75. 15 11.47U.40U.47.08 AZTF CalMnt CT TxF 11.3511.2311.33 10.4710.3010.47. iax5uun IndxExtn IdxTotn 8.168.018.

16 10 7.657.597.65 .02 12.4612.2612.46. 10 K31. inc vs .40 Paragon Trade Brands 1.55 vs 1.52 Porker and Parsley Petrol 1.05 vs .77 Portland Genl Cp 1.93 vs loss Prlmark Corp .30 vs .02 Quaker Chem Cp 1.33 vs .57 Rainbow Technologies .95 vs .80 Red ions Inns LP. 72 vs. 71 Roper Indus Inc .17 vs .09 Software Etc Strs .83 vs .57 Sthn Union Co .27 vs.

19 Sport Supply Grp .80 vs .58 Stonhome I nc 2.32 vs 2.21 Telephone and Data Sys ,91 vs .59 Texas Utlls Co 3.26 vs loss Tlton Corp .26 vs .25 US Cellular Cp .13 vs toss Universal Hospital Svces .70 vs .27 Vista Resources Inc 1.63 vs 1.23 Vons Cos Inc 1.89 vs 1.45 WolbroCorp 1.63 vs .98 15.21 15. 1B15.2U 1.901.901.90 11.0010.7611.00. 21 k9.949.899.90-.03 10.3610.3110.36 InvGdBt 12.6212.4712.56 16 MgGvB 13.2113.1413.15t.02 MgMuBt 16.71 16. 5016. 71 .28 NvMuBt 17.6717.5317.67 .17 PrMtBt 13.9813.7613.76-.06 PrmTRBt Kl5.3215.1215.32 .09 SectrBt 14.68 14.4514.68 21 SpEaBt 14.7613.8314.76.

50 StrlnBt 17.1316.9417.13 .22 TxExBt 18.2318.0718.23 .20 UtIIBf 15.5615.5215.55 .24 WlncBt 6.896.856.89 .01 9.409.339.40. 09 S.3S8.ZV8.J6 .11 TaxFrr U5 GVT Fortress Invst AdjRlt Bond Gisi Munlnct OH Fortp Utll 11.7511.5911.75 BOIAS CapGr 10.5410.3810.54 .12 10.6710.3210.67 .21 9.719.319.71 .11 10.069. 7610.06 .27 10.9410.8010.94 17 9.509.369.4106 7.937.887.88 t.OS 42.3741.5442.17t. 90 Keystone AmBrlca Aulncfo idxvol IdxEurn IdxPacn MxsrrTm FlxCnnt GNMA nt GIAStB GloblBt GIUtB GlbGA nt GlbRsnt GvPIB nt GvtSc np GrthB GtOpBt X9.929.849.84t.03 x9.539.449.44-.07 11.0310.9511.03t. 10 1 1.32 1 1.2511.31 .08 X12.B512 8212.85.

16 2.492.432.49. 03 11.4411.2811.44. 19 10.5810.4510.58. 16 7.457.427.45 .04 10.5710.4410.57. 16 10.7410.4510.74 13 11.

0210. 9011. 02. 14 AuSTIfp 11.8111.5111.81 .32 10.2210.1010. 10 10.9210.8910.91 .01 merui ir Falnco 9.129.139.32 .24 8.728.438.72 10 9.869.849.84 .02 BOO 879 89 .02 Eqint FloTxF GA TxF HI Inc KY TxF MD TxF MATxF MITxF MN TxF MO TxF dx nstn Bond Enterp2n Entrpn Gwthn Intl Shadow TaxT-rSn TaxFrL UMB UMB Hrtn UMB St Value Baird Funds: Adilnc BlChlpp CapOev BokrGvn BoronAst Benham Group: AdiGovn CaTFIn CoTFinn CaTFSn ColTFH CoiTFL EqGron EurBdn GNMAn Goldln IncGron NITF In NITFL Tar1995n TarZOOOn Tar2005 Tar2010n Tor2015n Tar2020n TNoten Berger Group: 100 10) Bernstein Fds: GvShDun ShtDur IntDur Ca Mun DIvMun NYMunn Intivaln BerwvnFd Boston Co Inst: CaApBt ItasB 0 Lxr ir 9.749.649.74 .06 13.1713.11 13.17 .17 12.4S12.5012.58-.02 10.029.9910.

02 10 9.449.399.40 .02 10. 2610. 2210. 23 .02 15. 7415.41 15.74 .22 16.9216.4816.92 .37 8.428.

398. 42. 04 8.027.988.01 .04 GovSecsp IdxBal 10.5510.4010.55 1 14. 3314. 0614.

33 .06 6.496.346.49 8.488. 118. 14.2814.0014.28 44 wall Ea Sm Cap MuHIYdn 10. 92 10.8210.92 .1: 10.AB 10.5910.68 .1 12.6412.4412.64 16 11.2011.1011.20 13 13 7A13 1913.7A .27 11.0610.9511.06 13.3713.2413.37 4.956.794.95 .14 iniir a MaBd MOMunlp MBS Munlncp 11.6611.5011.66. 22 10.

5210. 4810. 50 .01 9.489.319.39-.05 10.6510.5910.61 .05 11. 1411.0411. 13 12 10.

1410.1210.13. 01 11.2411. 1111.24. 16 4. 294.

284.28 .01 9.999.969.98 1 .02 IR 5910.5110.59t .10 F-aunaers broup BlueChp np Dlscv 0 11.1311.0211.11 12.0311.8712.03 91.4091.0791.30 Shearson Funds Advsrsp 10. 8410. 7810. 83. 06 18.9418.

29I8.94 .21 25. 4024. 5425. 40t .03 10.9410.79 10.94 .18 11. 1411.0311.14.

14 11.4111.4811.61. 16 10.2610.1610. 26. 14 10.7210.6410.72 .11 8.037.998.03 1 .05 23. 9422.9823.94 .33 Munflntn MuLtdn MuLongn Mulnlg MunShtn 11.2611.1411.26 12.7512.6212.75 NJ TF NYTxF NtMunt NCTxF 10.5010.4610.50.

06 24.0122.5424.01 .40 22.6821.8122.40. 45 9.489.439.48 1 .07 15 83 15. 12 15.83 .36 CPI2B ElnAp FtxAp GIOAp GvSAp HrtEGrp HrtGrp ImdA Omeoa PtxAp StcAP TxFAp WrldBdp UVI Inc inNY PrnRetn Prlnll 10.5510. 4810.48 10.5910.1610.59 HlYldB nt IntGII IntGIIB InVerB nt MultlB PacGrB STGIbB MunArit Frntr np GovSec Grwth np Incom np 64.4045.5844.19.' 45.4044.4245.21 32.4431.8132.18 11.6111.4511.61 t.lZ 12.6312.3512.63 1. 20 11 0710 9711.

04t. 11 15.7215.7015.71 .02 8.628.578.62 .07 CAIns prniup OhTxF ORTxF't 10. 4110. 3510. 39.06 17 5A17 4017.

5At .17 8.538.488.53 .08 11.0310.931 1.03 .08 8.9B8.888.98 .10 7.847.767.84 .01 7.497.137.49 .31 11.I210.9911.11 .14 11.1211.0311.08 .10 SCMunp StratFx Value VA Mu 11.3411.1811.34 10.7510.6610.75 11.7011.5711.69 7. 687 .487.68 .02 11.6411.3411.04. 7. 207. 107.

20 .01 11.0010.8911.00 13 10.8110.7110.81 13 11. 1111.0111. 1I .14 10.8910. 7710.89. 14 13.4213.

2513.42 11 13.46 3.2313.46 07 16.3815.9916.04 10.7410.7110.73 ShrDean Sierra Trust: CalMu 9.299.279.29 1 .02 12.2512.1212.25t.16 10.6910.57 10.69 .15 11. 8911.7611. 89. 16 11 7511.1711.75t.il 10.5710.4810.57 .12 9.018.95B.97 1 10.9210.7910.92 PA TF VATxF FrlloEa 10. 139.9710.

13 16 vvorxingmens lap mags i.yv vs 1.98 Zoom Telephonies Inc .62 vs .41 Annual Earnings Lower. Bird Corp .38 vs .95 Burger King Inv Masters .53 vs .85 Calif State Bank .98 vs 1.01 CodaEnergylnc.02vs.il Cap Transamerlca 1.28 vs 1.41 Commun Satell 2.18 vs 2.35 Contl Svgs Am 1.02 vs 1.85 9.899.879.89 .02 IARF a sped pn widwGr FountSqBal Franklin Group: AGE Fund AdiUS ARS AL TF Equitable Funds: 1.781.771.78 .01 FL insn NJ Insn NYlnsn OHInsn PAInsn SPEnrgr SPGoiJr -SPHithr SPServ 13.3913.0113.39 13.3811.7511.38.: 9.789.629.78. 10.97 10.88 10.95 .10 11.47 14.22 14.47 .10 8.148.018. 14. 10 17.1014.8117.10.

24 10.48 10.4510.47 .02 11.4311. 11U.63 .36 11.0210.9311.01 .10 70.0219.6220.02 .30 14.81 14.7114 .10 Landmark punas: Balan 11.4211.3211.42 .14 11.5111.3711.51 11.2511.1311.25 15.0814.9015.08 9.879.869.87 11.9311.7311.92 .21 9.969.89V.91 ll.5811.4Sll.5Bt.1S 11.4111.3211.41 1. 11 12.0011.8612.00t.16 12.1612.0612.16 12 neuoer ger nei AMT Bal genesis uordn LtdMat Manhatn Must Partnrs SelSelctn MuFL A MuGat MunHYt Munln MuMdt MunMAt MuMnt MunMIt MunlModt MuNCt Equity 10.0510.0510.05 11.7111. 6211.71. 8.608.508.56 .02 11.

5611.4111. 56. 18 xll. 3711 7511. 31 .0 14.3614.1914.34.

14.2514.0814.25. Boiano 1 GovScBt Grins GrlnF GwthF a GwthB 22.1221.5222. 12. cpincp EmrGrp Grlncp IntlGr NotMup STGIP USGov Smith Barney: CopapA CapApB NYTF np USGvn LaurelStk 2.44Z.44Z.44-.01 AZTF Callns 21. 7321.

0921.73. 20 12.3512. ZZ1Z.J3 IB 11. 2411. 1511.

23 11 12.7411.7411.75 12.8312.8112.82 13.4913.4113.42 11.7213.6313.72 13.6513.5713.64 SPTecn 10.6710.6410.64 11.S711.S011.S7 .08 12.llH.1111.21t. 12 7.457.407.45 .06 11. 8511.7611. 85 11 18.2417.6618.24 11.8311.7611.83 19.1319.0319.13 SPUtll ColTFr 18.8618.3118.86. 8.518.

50B. 50 x9.979.919.92-. 02 17.2214.8517.22 1. 34 7.947.857 .94 1. 10 10.8510.81 10.85 .04 10.9010.85 10.87 .04 21.6621.

1721.68 .40 9.709.709.70 30.5630.27 30.56 .48 STWF STYVBt 12,8912. 5412, 89. 11 12.8412. 5212.86 1 uiiratia NewAltert NewCntCapnfp NewUSAt North Am Sec Tr 8.548.528.53. 01 10.6810.5810.68.

13 34.8733.4834.87 1.81 11. IVIU.VJII.1V 12.3811.6812. 38 11 X19.55 19.4019.55. I 13.6113.4513.60 16.5816.2316.58.: 11. 1611.0811.

16. 09 11.3411.2011.34. 07 9.649.449.63 .09 13.7013.6113.69 12.3812.29I2.36 16.0015.7516.00 14.2513.9514.25 .22 TxE xB EqtyStn 11.8411.7411.84 12 11.5311.4211.S3 .16 12.2712.1512.27 .14 12.2212.0912.22. 15 11.0310.9311.03 15 16-6216. 4616.

62 .20 11.9811.9511.96 .02 10.7A10.1610.20.07 MunNJt MUNY MunOht MuPat NtMunt Struct 12. 1012.0112.09 1 14.2116.0414. bquiryp GIGovt IncGroA IncRetA Evergreen Funds: Fvrarnn 11.9213.6013.91 AstAllp 12.9612.85I2.96.15 LeoenNT LeebPern Lego Mason: Gvtlnd np InvGr tip MD TxFrp PATF Splnv np TxFrlnfp TotRet np VplTrnp Liberty Family: 1A 3514. 1616. 35 .21 7.096.

94.0V 12.3312.2512.33 1. CO TF CT TF CvtSec ONTC Equity FedTaxFree FL TF GA TF GIOpI Gold Growth 17.1516.5817.15 .09 10.7010.S510.70 .09 10.8410. 7710.8303 13.0912.8213.09 II 11 0711 A9U.92 .21 14.1825 .4914.11 13.2213.1613.16 11.8211.7711.77 14.3 (4. If 14.3 11.0320.6421.03 9.739.729.73 .01 12.51 12.4012.51 .01 13. 1713.

1513. 15.01 NTL 9.689.549.59-14.7214.3214.72 111.1111.0211.03 27.7127.1527.71 13.0012.7213.00 11.6811. 6111.68 11.8511.7811.85 wenesiy Wellngtn Windsor Wlndii Wldlntn WIdUS Vista Fundi Bond CopGr Equity Govlnc Grlnc NY TF ST Bond Bloourrnp wth Grlncp USGvlp 13. J5 13.21 13. JJ 13.1017.8713.10 MgdlB 10.37 10.3010.34.

08 10.57 10.5210.57 .04 8.788.708.71 I 17.1416.7617.14 .24 18.9918.9018.99 .29 9.309.269.28 .02 10. 8910. 8810.89 MoGovtA MunlCal MuFL MunLtd 10.2310.2010.22. 03 28. 8427.8928.84 .86 9.529.439.52 .09 AIOCAP 15.03H.771S.03.: 10.3210.1110.11-13.7913.5113.79 Neinvmr NelnvTrn Kl 1.8811.771 1.77 .1 USGvfnt UtIIB Putnam Funds: Am Gov Adlusp AZ TE CalTax Convert CpAT 11.3711.

2511. 3 16 20.2620.0120. 26. 41 11.8111.5911.81 12.9712.81 12.97 .20 13.4113.2613.41 .20 6.766.736.76 .03 14.0013.8514. 00 .19 13.95I3.8113.95 .19 13.4413.3313.46 17 2B.

56 28. 1528.56 Amuur Cnvlncp 11.1011.0111. 10 vlO 5710. 4A10 Found LtdMktn MunCA MunlF Retire TotRtn VatTm ExcelMldas ExlnvHIp FAMValn FBL BICt FBI Gtht FMB Funds: X11.9511.8511.92 14.2614.01 14. 10.4910.3210.35-.1S 14.

5114. 1914. 51 30 2.612.542.56 7,627.597.62. 03 20.5920.3120.59 02 26.1825.6926.18 13.2213.1613.16 10.6010.5110.58 tvuvBBn FundB: X10.27 10.2310. 23-Xl2.

3212.2112.30 2.292.282.29 11.9011.7911.90 9.889.879.88 9.329. 249. 32. 10 8.738.628.73 .12 18. 7818.6118.

78. 15 42.8642.6042.86 .33 10.109.9310.10. 16 12. 4712. 4412.

46. 04 X14.9914.9016.95. 18 4. 204. 194.

ZU 01 ml 1 nsur urp vs .91 Enterro CP .92 vs 1.40 Evons ond Sutherland Cp .78 vs 1.07 Health Care REIT Inc 1.91 vi 1.92 lpscolnc.98vs2.53 wave Inc .40 vs 1.51 Mens Labs inc .11 vs .42 Medical Graphics Cp .27 vs .33 Midsth Insur Co 1.35 vs 1.08 Mine Safety Appiioncss 1.42 vb 2.92 NotlEducatlonCp.02vs.18 Natl Gas ond Oil Co .48 vs .50 Notl Presto Indust 2.53 vs 4.98 NthCdnOlls.12vs.25 Orion Cap Cp 4.S2 vs 4.69 Roval Appliance Mfg .81 vs 1.09 Sonltlll Inc .47 vs .91 Slurry Rainbow Oil Ltd .66 vs Sthn Calif Water 3.63 vs 4.68 Tuboscppe Vetco Intl 1.15 vs Turner Corp .15 vs 2.06 Vorco Intl .07 vs .45 Williams WW Co 1.53 vs 1.81 Acquisitions and Mergers First Fidelity Bancorp Vlllogo Financial Services Ltd New Listings. Advo inc NYSE Stocks-. Dean WIHer Discover A Cn CA ins 11. 071I.O11I. 11 7R11 A9U.7B .12 fi lei Tllft HllncBd TxFree USGvSec HtllFll 15.5215.3015.52 14.22 4.2114.21 uivur Dvrlncp vA Alfl 548.

54-. 04 ca vai FL val 17.18 16.901 IB 12.9912.9112.96. 10.8S10.43 10.85 .11 10.8510. 7010. 85.

16 10. 3410.1810. 34. 17 10. 8510.6310.

85 23 10.44 10.2610.44 19 10.3010. 2110. 25-J 11.571I.47II.57 AstMgrB CopapA ItgsAp InlA MgdIAP SpGrAP TfBdA BlvdBIChlp BlvdMglnc BrlnsonGlbn Brndvwn Bruce BriindoSt 13.6513.5913.59. 13 10.0610.0610.0A-.01 12. 2912.

2112. 29 .20 MunINt MuNJ MunNY SHTSY USGvtA UtllAp SmBrShO SoGenln SoundSh SAM SC SAM val SCMBF 12.6512.5612.65 9.569.319.56 InsMun 11.0611.011 1.05 10.91 10.8410.91 Liberty Financial: 16 29 18. 1310.19. IS MA Ins MA val MDVal 9.VIV.W.VI 10.2510. 1310.25 1 incm Volumet Vovoaeur Fds: AZIns COTF FL msd GroStkp MNlns Mlnnlnt MlnnTF USGv VIcnStkp XIO.OBIO.OZ IO.UJ-10.5210.4110.52 22.1721.4622.17 1 06.

77105. 08105. 0B- bnoyKBSP EurGr FBdlnp FL Tx George Global GIGrop Grolnc 10.7810.7310. 6 18.8418.4118.84 10.6610.5910.66 11.0411.0011.03 19.4519.3619.45 15 16.4516. 2016.45 .19 11.5611.4211.56.

18 15.3615.0815.30. 18 11.0010.8711.O0. 14 37. 5430.8332. 54.

55 10.6810.5710.68. 14 9.549.519.54. 03 11.3311.2711.33. 16 10.2110.1810.21 .03 97 (I17A R777 01 .35 11.2711.1911.27 11.7311.6611.73 12.1812.1012.18 12.3512.2812.35 1 11.7511.6611.75t 11.8511.7511.85t 11.1611.0911. 16 19.1012.0712.10 11.1811.1411.38 11.3811.1411.38 10.4810.4310.47 10.4810.4310.47 10.5710.5110.57 10.5710.5110.57 18.

SOU. 5018. loll. on 10. 97 11.

00 Muniua NJ val NY Ins NY Vnl iininc TF Bond USGov Utll LmtTrm LlndDv Lindnr LoomlsGr LoomlsSm 10.8liu.rnu.e 9.439. 329. 39 .05 10.7010.66 10.69 .02 9.599.469.59 15 13. 8413. 6713, 84 21 H14.8514.7714.79-.0S 7.577.527.56 .03 13.2013.0013.20 19 23.

9122.6423.90 .58 12.8212. 7612. 82 .06 10. 029. 9810.

02. 04 7.177.137.16 .04 B.37R.10B.324.1S 12.61 12.5412.61 SpPtStk 21:2821.0621. 28 .19 DIVECP IvE I IntOCP IntG I MITF MITF FPA Funds: Copit Newlnc Parmnt Peren Foirmtn Federated Funds 10.9110.8110.85 10.6010.3410.60 Stagecoach Funds: AletAlc 1l.7818.S918.78. 30 OH Val 9. 459.

409. 45. 06 10.2510.1510.25. 11 10.62 10.4410.62 19 10. 6110.

4810. 61. 14 10.5810.4310.58 .16 10.3610.2310.36. 14 10.3710.25 10.37 14 19. 8819.3919,86.

51 11.0810.7911.08 21 19.7219.0219. 72. 07 12.46I2.U3I4.40 -K 11.1612.7811. 16. 07 7.247.047.24 .08 CA TF X1U.V4IU.HIV.V4 vvaiidT Weill Peck Greer 33.0431.4232.04 13.2713.1413.27 Ir IncoSer IN TF InstAdi InsTF IntlEq LA TF MD TF MossTF MIchTxF MNIns MO TF NJTF NYlns NY Tox NC TF OhlolTF ORTF PATF PremRt PuerTF SI GOV SpEq TA Gov TxAdHY TX TF USGov Sc Utilities VA TF Fremont Funds: MltAit Equity CA Int vin 4I1A 3T1B 48.

15 24 11.5211.4SU.45-.05 11.8811.8011.88 12.3412.2312.34 1 1.7311 .641 1.73 10.5510.4810.55 5.585.515.58 I 11.8111,7211.81 2Z.U2.JJ22.U 19.1418.7919.14- PA vol VAVal OokmarkFd Qakmrklntl Qberwels QceonTE OldDomln .768.698.76. 09 13. 9413.6513.93. 21 Tudor 23.8631.9013.84 WPGGovtn 10.6010.5510. 57 WPGGthn 122.38118.04122.38 1.: WPGGthlnn 24.1123.4924.11 CrpStk GNMA Gthlnc USGovt VRG Stnrhrstfiv X16.3916.I716.21.

16 Heoirn HlghYidp HYAdp Income Invest Manlnp MoTxlT MITxIlp Munln MnTxIlp NJ Tx NewOpp NY TaxEx 9. 569.529. 56 .05 B9.489.319.48-.03 12.9012.6812. 90. 29 13.7413.5313.74.

28 10.9010.7810.90 14 11.1116.8811.11 X10.8210.7810.78-.01 Mncao 10.5710.54 10.57 .05 19.94 19.59 19.96 .34 15. 1014.9115. 10 21 16.6016.4116.60 .24 WeltzVal 19 Emerging Mexico Fd rights 9.979.969.97 IO.J6IO.J210.JJ 10.7310.6710.71 1 13.8013.6313.80 15.28I5.1415.28 11.4511.2011 45 22.0121.6022.01 81vEalnc ivBoiin Oppenheimer Fa 9. 139.079.07 .01 10.9910.9510.97 .1 Affiliated BondDeb OeveiGthp 1990 FdVolup GlEap Gllnc GovtSec TaxFr TF CTp TxFrCalp TF FL TFMOp TFNJP 6. 101.

111.40 9.799.179.29 9.99.V6V.V7 67.7466.8567.74 10.5610.45 10.49 10.7210.6910.70 State Bond Grp: Commn Slk Dlverslfd Progress 11 9711 8111.97. II assbia 3.03J.04J.U4 12.0711.9312.07 I 10 AA1O.5710.A6 .11 Manufactured Home Communll. ties Salomon Inc preferred Storage Technology pfd NYSE tends-. AON Cp 6 8s 99 AON Cp 7.40 02 15.7715.70 5.73 17 081A.7617.0B .37 8.588.556.58 11.6911.6111.69 7.377.257.26 Bull Bear Op: FNCi np Glbinc np Goldlnv np GovtSec np Munllncnp SpecEqtnp USOvs np Bumham C8.SRitvn CF Equity CFBIntFI COM Funds: CapDev Mufl Calmos CoiTrstn ColUGvn Calvert Group: Ariel ArielAP GlobEq Inco Social SocBd 12. 4311.

9712. 43. 34 11.0610 9811. 06. 09 NYTOPP ll.1117.811l.11 xB.

928.888.92 17.7517.6217.75 24.8823.7924.88 7.597.467.59 11.2221.1021.22 32.9332.3432.93 9.999.809.99 10.1610.1110.11 18.4817.5528.41 27.3426.9027.34 13.5313.3713.52 13.1113 8913.11 11.0210.9010.93 19.8319.1729.51 20.9620.4120.96 14.4414.3814.44 X17.8217.6917.78 30.2129.9130.18 X17.3217.1717.27 91 5321.2621.53 11.2711.1111.27 9. 169. 159. 16 I 11 A911. 4711.62.

24 laxbx us Gov 0 5.335.325.33- ArmSSpn Arm 1 ExchFdn FBF FlgtiSn FSTi Isn FGROn FHYTn FITiSn FIMTn FSIMTn FslgtlSn FSBF V.6JV.3V.6J 9.379.309.37 .09 9.269. 199. 26 .09 9.149.079.14 .09 9.379.799.37 .10 17.75I6.8317.75 .28 9.379.289.37 11 9.079.029.07 .06 9.188. 709. 18 16 9.349, 279.34 .10 9.409.319.40 .12 027 .936.02 13 9.459.359.45 1.

13 14.9714.8514.97 1. 15 15.4115.4115.61 1. 24 9.259.169. 2S 12 13.8813 B513. 68 03 10 009 9A10.00 .17 10.

8110. 6410. 81 20 12. 4212. 3412.42.

09 32.4830.8532.48 1. 47 i mg hTxl! 10.3710.3610.37 11.6911.6011.69 11.9211.1111.91 5. 165.085. 16. 09 5.385.315.38 .09 5.

435. 365. 43 .09 10.5810. 4710.58 15 Stein Roe Fds: CapOpp Gvtlnc 14 AON Cp 7'! 94 10.7010.6410.6B 11.3311.1911.29 14.7414.1814.74 13.4313.0913.43 16.8916.7816.89 15.8815.8615.87 V.6V.63V.6t.l4 14.1514.1114. 144.02 AUNIP6VJV6 TF 14.7511.4724.7S .11 10.5210.4610.48 .04 11.

9611. 8711.95. II 9.949.889.92 .05 9.289.239.25. 03 22.1371.3622. 1J 9.109.079.10 10.4710.4010.42 10.5310.5210.53 KI6.0515.9U5.91 34.4024.0524.39 11.8611.8411.85 15 Morrill Lynch 6 Ca Inc 11-21-98 10.6810.4510.68 HyMunn Income TF PA TF Hip TOxNYp 3.

133. IU3. 13 12.01 1 1 .88 12.01 18 4 195. 135. 19 .08 intmaan 11.0910.9811.06 15 .1415 0315 .14 westcore: Ballnv BasVI BdgPI Eq Inc IntBd LT Bd MIDCOGr Modval OR TE ST Bd wood Slruthers: WlnFI In WinGrtn WlnGltn WlnAGtn Woodward Fdi: Bond Eqldx GrVal IntBd Intrns Opport WrkCltBI 10.7010 6410.47 Biuemp ChpHYP DIscFdp Eqlncp GNMA GIBlop GIGrp SlobEnvp lobol Bold vtsec HlghYidp IncGrop InsTEP IntrTE InvGr NYTOXP OpenhF PA TE PA TE Strlnp TaxExpt tfhyF TF Int Texas USGov Utllp Vista Voyoqop AdlBl CATxBt GeoB FLTxBt 10.129.9410.12 11.S011.291T.50 .27 10.75 10.64 10.75 10.84 10.68I0.S4 .21 12.32 2.1412.32 7.116.947.11 .09 11.6011,5211.60 9.439.359.43 9 13.5713.2413.S7t 21.7921.4021.79 24.4123.5424.41 26.

1625,8626. 16 11.8611.8411.85 11.6611.4311.46 19.0218.2419.01 12.0211.9912.00 .05 9.869.699.86 .04 18.6728.5228.67 9.679.409.40 10 11.0010.9410. 4-, 02 13.7113.6413.71 .09 3. 145.045. 14 .08 17.4117.2417.41 17 15.0414.9415.04.

11 II. 1411.0711. 11 .07 13.07 12.9513.07 .13 10.029.B110.02 .15 12.4712.3612.47 .12 26.9526. 0826.94 .47 10.189.BU0.1B 10.8810.8610 8701 31 0517.7318 05 .24 38. 8537 .32.18.85 .59 10.7010.69 10.70- SocEq TxFLti 1.728.

628. 72 t.i: Bill A513 Rl .71 31.0330.7531.03 IntMun MgdMun PrlmeEqn Sped Stock TotlRetn StrotD StrottnGth Strong FundB! Advlg CmSfkn Dlscovn GovSc 20.3320. 1620.3Z 9.589.469.58 15 13.9213.7413.92 16,5418,4610,52 10.7510.5510.75 10.54 10.43 10.54 10.5110.4610.46 10.6710.5410.67 12.6512.3912.65 11.0910.9311.09 Boca Research nergy loSvstems Corp First Southern Bancorp Inc. Penn Central Boncorp Inc Philip nvlronmental Inc Roosevelt Fncl pts Sensormedles Cp Sumitomo Bank pfd Tecnomatlx Technologies Ltd Or. dlnory Washington Homes Winston Furniture Co Removed from Trodlno NYSE Stocks-.

Alabama Power 8.72 pfd ME I Diversified inc 1 Union Electric pfd NASDAQ NMS-. S4.B953.8054.B9 28 68 6378.73 10.6130.4830.59 16.81 16.8V 16.0 it X16.3516.2316.35 15.431S.7U13.4J 13.4913.2713.49 10.3410.2410.31 11.3411.2611.34 14.1415.1414.14- 11.3611.3111.35-8.668.578.65-X10.2010.1510.20 10.2010. 15 10.20 5 565 525.56 Xll.64U.50U.64t Xll.6511.5111.65 15.5814 8715.58- 7. 537.487.52. 03 GIGrBt Muni 22.0821.8922.08 7R 117R 0R7R 31 FunaTrust: Aggrestp Groin tp Gwth fp Inco fp ModTR fp GT Global: Amer EmMkt urooe GovlncA GovlncB GrlncA HllncB HllncA HlthCrp Intl Japan LotAmG Pacific StratA StratB 10.

1010.0910. 10. I 15.7015.4715.70.: 15.7915.0215.79 10.8010.7010.77 9.709.639.70 .1 Special 5 035.075. 03 1. 03 5 045 075.04 .03 26.476.5J76.64 cfr 44.9344.0644.93.

60 incAp IncBf 10.9710.9410.95 6. IB t. 24.1415.8014.14 13.8613.4413.86 26.4825.7526.48 9.899.849.87 22.0321.6322.03 12.3412.2712.33 II 2911.2311.29 14.3414.2814.34 4 11.0310.9411.00 10.179.939.98-10.0510.0410.04 19.9419.7819.96 10.46 10.4010.44 ll.l1ll.llll.lt 13.7413.6713.74 12. 0911. 9412.094 10.

5010. 4210.504 17 9012.8ll2.90t NJTxBt NYTxBt TxExBt GrlnS USGvB UtIIBf VovBt Quest For CA TS st GnmgIS GnmaSS pn MaxCap Fidelity Adviser: Eqpgi EqPlln EqPGR 8ovlnp rwOppp HIMup HIYIdpn IncGtp LtBIn Overseas pcsifp tepi Fidelity Invest: AorTFrn AMgrn AMqrGrn AMgrlnn Balanc BlueCh CAInsn CA TF 0 Conoda CaoApp TxP VT USOov Cambridge Fds CapGrA GvlnA Gwtn CopGrSt GvlnB GwthB MulncBt CaoMUdx It CooltolEO rl I 10.9613.8013.85 18.96 14.75 11.96 14.2714.2414.27 15.3114.9015.24 14.9414.7414.94 14.2814.2614.28 15.3014.8915.24 15.4515.2315.45 10 6410.4310.64 1(1 1199010.11 inco InsMun Intl Invst MunlBdlt 24.4823.6874.48 .54 10 7810.2010 28 10 15.8015.1015 80 .33 8.037, 798.03 16 10.8610.7110.77 I 108 178 27- 9.259. 199. Z3 9.379.299.37. 10 9.

369. 289. 36. 11 9.469,369.46. 13 13.I312.3I3.13 .19 13,8513,8213 5.

03 9.969,939,98 18 10.099. 73I0.09 20 1I.11H.9911.11 .14 11. 6811. 4611.66 IS 11.6411.5911.63 .03 10.6910.5316.69 .14 10.931P.B410.92 .16 11.1411.21 11.34 .15 11,6811 4611.68 1.988.878.87 novo inc 10.96 0.90 0.92 15. 4015.2215.

JB- Applied Blosvstems Inc 9.929. B' I4.4S14.2SI' Target ToxFreBP Tlmep TotRt USGvtp VOISfk Pimco Funds: Frgn Grwth Lowour Fund 1J.S012 2711 50 .21 11. 3111. 1811. J1 10.069.95 10.00-19.1518.9519.1S 10.3410.2610.34 10.1610.1310 16 10.3410.3110.34 20.6619.9620.66 15.9511 4115.95 1 15.22l5.0llS.22t I4.20l3.9114.20t Opptnty St Bond STMunn Total SunAmorlca Fdl 10.6610.4010.64 13.1912.8513.19 14.4214.2614.42 13,1513 0413.08 9.959.519.95 7.537.507.53 11.41 IU.B4I I.

14.3014.1914.: Grlnc 10.8010.7110.80 XII. 1911. 1211. 13 Xll. 1911.

1311. 13 12.4612.2512.46 14.8614.6114.86 InvQln ,711.87 3510 .5 14.0713.7914.07 .30 10. 3010. 78 10.30 .02 X10.3010.2710.27-.OI 11.2210 8411. 22 .27 19.0818 1619 08 4.10 18.1317.5518.13 Wright Fundi: Curln GvObn InBlCh JrBICh NearBd QuaiCoren SelBChn TotRet Yacktmn np YomGlob Zweig Fundi: SlratA ZSAppA ZSMAA ZSGvAp ZSPAp StratB ZSAopB ZSMAB ZS GvB ZSP CshfarV Fund SW NOTI 1 I Oooor- A.W6.V66.VB.UJ iff Agguin BalAst CopApt 1 Divine X10.

0210.0210.02 SmCop 184 1:4 1 1,1412.091 15.77 15.4915.77 9.239.169.19. 10 079.969.99. Elm Inonclal Services Inc Inlorum inc Natllonal Savings Bank of Albany Receptech Corporation Security Inonclal Holding Co The Sumitomo Bank of California Dep Shri CorperotB Nams Changes. Fst Bolton Invest Fds Corp Cash to Fst Billion Invest Fds Initlt MM Pi). MEDSTAT Systems! Inc to The MEDSTAT Group Inc 10.4110.1410.41 11.8411.8011.84 11.1011.0211.10 21J220 5521.12 22.7322.2122.73 1 1I.0010.

88 10.99 12.3712.2412.37 13.3515.0615.3! 14.2314.1714.21 9 038.989.03 4.V4.V54.V3t 18.18 17.5611.11 5. 185,145. IB OS 1S.M1I.10IS.M-.07 1.17l5.12lJ.!5.03 10.85I0.8410.8S Telecom Wldwp OobeMI Funds: Asset np ConvSc Eqlnc np Growth np SmCopG Volue Galaxy Fundi: EqGrtn EqtVal Eqlncm (1 HIQ Bd 11.1411.9011.144 11.5513.3413.55 11,4711.3711.47 10.3310.2710.37 12.9612.7412.96 13.1612.9013.16 13.3113.3011.51 11.4711.3711.47 10 1410 2810 33 12.9512.7312,95 ShortT it TotRet TRIM PNC Fundi: OrEa idxEap JntOvp 'vitlEqp Mgdi .16 7.447.427.43 .01 12.2011.7912.20. 19 15.8515. 1215,85 .38 8.

998. 768. 99 12 10.5810.53IQ.55t 10.4810.3910.48 141.91139.32142.91tl. XI0.96I0.8910.92.05 USGov x9.869.809. 81 ,03 iBBFund: BEAItlf IqGthp 10.6910.

4810.69. 23 GvtSecp 10.4610.4310.45 03 HIYdBdp 10. 16 10 07 10-10 .01 RSI Trust: AclBdp 1l.841I.S91l.84 Corep 10.1210.6610. 82 12 EmGrp EmGtht Fed Sect Growth Hllnct HIYIdp TE Insp TotRet Gvlnp CivTinc MedRS PBHG Trend Cardinal CardnlGvt CarlICO CornegOHTf CenturlnO Cntrvsfir ChCapBC ChubbGrlti 15.3014,9215.30 8 081,058 08 9.419.399.41 12.6312.5912.63 14.9614.4814.96 T.65V. iw.wt 14.2513.9214.25 12.6412.4612.64 6.896.888.88-12.3312.2512.33 9.919.799.91 8 996.898 12.3712.0912.37 15.5415.391i.54 13.1915,0815.19 10.8710.6310.82 11.9411.7311.94 12.4612.2912.46 10.9510.8610.90 tt 9744 1174 Capinco nr ConarStn Contra CnSec DviHnyll Dlitq 11.7912.6512.

79 18 ZB.23.6l'B.43t 15.7915.63l5.79t 15.7415.4215.74t 24.3323 8674.33 1 17,2916.9317.29 55:4631.9132.46. 67 28.8927 .6226.89. II 10.039.9910.01.! 11,8211. 7511. 7S.

05 9.199.129.89 .07.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Quad-City Times

- Archives through last month

- Continually updated

About Quad-City Times Archive

- Pages Available:

- 2,224,034

- Years Available:

- 1883-2024