Argus-Leader from Sioux Falls, South Dakota • Page 10

- Publication:

- Argus-Leaderi

- Location:

- Sioux Falls, South Dakota

- Issue Date:

- Page:

- 10

Extracted Article Text (OCR)

THE DAILY ARGUS-LEADER, SIOUX FALLS, S. D. SEVERE DECLINE HITS PORKER MART DURING PAST WEEK Prices Tumble 35 to 50 Cents on Tuesday Session -Packers Fear New Tax DEMANDS ARE LIMITED Big Packers Remain Off Market-Fresh Supplies Lightest of Season (By Argus-Leader Market Bureau) Sioux Falls Stockyards, Oct. Upheavals in the orderly manner of marketing swine, aggravated by new complexities tossed upon an already fearful packing industry by the government's plan to tax their product, encountering clogged consumption channels under present conditions. brought one of the severest declines to hog prices during the past week witnessed in many years and left the market considerably lower for the period.

Processors, fearing that price increases on the finished products will bring material damage to the present rate of consumption of meat, put a check on their killing activities this week and the market took the severest drop in one day to be witnessed for several years. Receipts were generally below normal over the country and could not be construed as a factor in the sudden de- cline. Demands Absent Tuesday Weekend Financial, Livestock, Grains The following is a list of prominent Leader Market Bureau showing prices at ago; the 1933 high and low; dividend STOCKS- Div. American Can 4.00 American Tel. and Tel.

9.00 American Tobacco 5.00 Anaconda Copper None Atchison Ry, None Borg-Warner Co. None Cerro de Pasco None Consolidated Gas of New 3.40 DuPont 2.00 Electric Bond and Stk General Electric 40 General Motors 1.00 Gold Dust Corp. 1.20 Hiram Walker None Homestake Mining 12.00 Montgomery- Ward None John Morrell Co. 2.00 Pennsylvania R. R.

2.00 Public Service of N. J. 2.80 Sears Roebuck None Std. Oil of Ind. 1.00 Std.

Oil of N. J. 1.00 Union Pacific 6.00 United Aircraft None United Biscuit 1.60 U. S. Steel None Burke Stock Letter Comparative Prices of Stocks close stocks compiled by the Arguson Saturday and a week returns: Close -1933 Sat's Week Ago High Low 85 92 14 5 46 31 681 19 10 17 10 12 300 315 373 145 40 40 56 25 23 29 37 32 47 30 34 17 42 98 109 132 22 Grain Markets Are Decidedly Uneven Wheat, Corn, Oats and Flax Show Net Advances- -Rye, Barley Record Losses Minneapolis, Oct.

S. D. Grain markets were decidedly irregular during the week ending Friday, with wheat, corn. oats and flax showing net advances while rye and barley showed net losses for the period. The wheat marker fluctuated within a wide range, showing considerable weakness during the few days of the week, but gradually gaining strength and finishing lis higher December than a week ago.

Minneapowheat advanced cents for the week, closing Friday at Flour Demand Broader Liquidating pressure carried over from the previous week ran the market into further sharp early the market quickly rebut declines versed itself when new buying found both cash and futures offerings light. Domestic flour demand broadened materially on break and mill demand against flour sales was very active. Cash demand for durum was active and there was very little milling durum offered from day to day. Rye continued to suffer from liquidating pressure with many holders selling out because of large amounts of rye headed this way for import. Minneapolis December rye declined cents for the week, closing Friday at Oats firmed with wheat and also was influenced by a marked improvement in cash demand.

December oats at Minneapolis advanced cents, closing Friday at Flax Firms With Wheat Barley was decidedly irregular. The market went into a sharp downward trend early during the week, along with other grains, and failed to react much when other grains strengthened. Minneapolis December barley was down cents for the week, closing Friday at Flax firmed along with wheat and also was influenced by somewhat bear demand for the meager offerings. ROSENBAUM GRAIN LETTER Chicago, Oct. prices prices have finally steadied and hardened, after depression to the averages of early spring.

Initial recoveries have been burdened with the similar excessive unsettlement. the extent and the continuity of stock market liquidation creating new, if only temporary, areas of frozen security assets. If the subsisting grains gave up all their 1933 gains, the other food commodity markets did not better, stocks did no better. It is the logic of such a condition that draws from it the sound expectation of a better stock market after a while and higher grain values. There is no surplus oats, rye or barley problem if under consumption of wheat and corn is a surplus problem, it is under attack in three ways.

If times are still hard we have hard times prices to move corn and wheat. The weather cut the 1 wheat yield 211.000,000 and corn yield 583.000,- 000 bushels the government will see to it that uneconomic redundances shall have no soil root this fall or next spring. The supply, and not how reached will govern May and July 1934 values. We know that on October 17 sterling closed at $4.59, francs at December wheat hit oats 25, corn barley 37, the oracles of the exchange market found auguries of the final abandonment of currency inflation. We could not see an essential reflation between gold price of dollars or our bond refunding of midOctober and our ultimate currency policy.

Whatever the dollar is, or will be, the prices quoted were far to low. On their bases cash and nearby grain was eagerly bought, and price rallies have been continuous, The tendency of the grains is advance a little rather than decline much. Common sense, even that even timid loyalty which concedes rather than proclaims, can not deny this is still a hard times market, traveling along on modest sales for daily consumption. and imposing discount on next spring prices which far sighted buyers will not long hesitate to profit by. Canada faces a real world surplus problem, with a contribution of 270.000.000 bushels of wheat to it.

France has almost 100.000,000 bushels more than she needs. Argentina's new crop export surplus 1s 150.000.000, Australia's will be over 100.000.000. Russia, Rumania. Hungary, Germany, Poland, have grain to sell sell it. They work on the indestructible thesis that "prices" does not come first but must be humanely postponed to even such a routine vulgar detail 88 Broomhail's estimate of this year's world needs AS only 552,000,000 bushels, which market volume so far shows may be too high -Rosenbaum Grain tion.

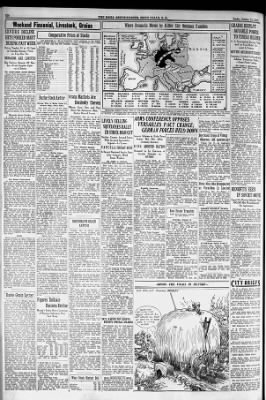

What Stock Market Did Sat. Fri. Advances 104 405 Declines 261 Unchanged 140 164 Total Lasues 673 830 Where Dramatic Moves by Hitler Stir Ominous Rumbles BELGIUM POPULATION I SWEDEN 6,092,000 ACTIVE ARMY ITALY 89,224 TRAINED RESERVES NORTH P.44,566,968 495.000 SEA 457,189 6,017,500 LITHUANIA BRITISH EMPIRE RUSSIA 449,583.000 POLAND 14,726,000 138,000 HO 403.192| EMPIRE de 711,453 POLAND 332,100 CZECHOSLOVAKIA ATLANTIC OCEAN R- 1,645,000 RUMANIA SLOVAKIA 244.850 R. 1,489,000 SWITZ 79 1,485,550 FRANCE P- 47,000,000 RUSSIA 607,000 R- 848,600 6,328,000 SPAIN 18,025,000 GERMANY YUGOSLAVIA 100,500 138.934 GREECE TURKEY R. 1,447,724 AUSTRIA BULGARIA DENMARK ESTONIA FINLAND GREECE HUNGARY LATVIA LITHUANIA 21,200 33.000 8,100 A 13,533 34,575 85,875 35,800 23,000 19,466 R.

30,500 345,000 190,000 52,000 HOLLAND NORWAY PORTUGAL SWITZ. SPAIN SWEDEN JAPAN UNITED STATES 28,500 15,100 39,800 494 A- 209,500 33.500 225,000 132,069 330,000 315,000 $80,000 2,115,000 838,400 307.120 Chancellor Hitler's drastic disarmament conference and of Nations has emphasized (Associated Press Financial Writer) New York, Oct. began the day in fairly good spirits, but lively selling that centered around issues which have had greatest speculative appeal promptly squelched the improvement before it had gone very far. Heavy liquidation alcohol stocks and of metals, though to a lesser degree in the latter, sent the list spinning downward around the turn of the first hour and prices ended an active Saturday market with many net losses of 1 to 7 points. The average decline was 2.4 which more than cancelled Friday's recovery.

Sales totaled, 1,260,160 shares: it was the busiest weekend session since July. Close Is Above Lows The break by "repeal" stocks appeared to have been prompted by a to report that the government planned place a limitation on profits which these companies would be allowed to make after prohibition repeal. Long accounts were thrown overboard hastily and severe reactions occurred in some of the more active favorites of this description. With liquor issues and metals weakening, other groups lacked stamina to do much resisting and the market declined actively late in the final hour. Closing prices were somewhat above the lows.

Forecasts of imminent Russian recognition encouraged moderate buying of farm implement and a few other industrial stocks. the theory being that Russia was a good prospective customer of certain American companies. However. the market did not look particularly robust during this demonstration and volume dwindled before the break developed, Farm Unrest Depressing Many observers felt that unrest in the agricultural middle west had had a rather depressing effect on sentiment. Wall Street's guess was that President Roosevelt would have something to say about the farm price situation in his radio address to the nation tomorrow night.

Perhaps in anticipation of such a development grains rallied, but by the close wheat had lost most of its advance. With the slump in stocks focusing on volatile favorites, it was apparent that large speculative holdings, presumably of the group variety, had been dumped, for one reason or another. National distillers products flopped closing about a point above the low. U. S.

Industrial Alcohol, American Commercial Alcohol, Commercial Solvents and Schenley closed to lower. Celanese and Johns-Manville lost more than 4 and U. S. Smelting slumped Allied Chemical struck an airpocket that gave it an extreme loss of 10 points, two of which were recovered. T.

T. Yields 3 Points Declines in U. S. Steel. General Motors.

Chrysler, American Can. Bethlehem. General Electric, Sears Roebuck, Southern Pacific, Baltimore Ohio, Santa Fe and dard Oil of New Jersey ranged from fractions to about American Telephone vielded nearlv 3 net. while Case. National Biscuit and Union Pacific had slightly larger losses.

LIVELY SELLING SQUELCHES RALLY IN STOCK MARKET Decline Centers Around Issues With Greatest Speculative Appeal-1-7 Losses CANCELS FRIDAY RISE Is Busiest Weekend Session Since July--Liquors, Metal Issues Weaken JOHN L. COOLEY DELL. RAPIDS BOY SCOUTS RECEIVE SPECIAL AWARDS Dell Rapids, Oct, 21-Dell Rapids Boy Scouts held meeting In Dougherty's hall this week which was characterized by several events of importance to the troop, Scout Executive H. C. Gilbert of Sioux Falls was present and took charge of the meeting.

Harold Schmidt Forest Filliott. Robert Eagan. and Orville Olson received Arst class awards, and Tames Cato the Eagle award. Forest Elliott then presented the Rev. Harold W.

scoutmaster here for nearle three vears. with five-year veteran's oin. and John Larson, in hehalf of the troop. presented him with a remembrance. Earl Billiter was abnointed as die.

trict dennte commissioner for this ares. Mavor Marrie Henderson snoke briefle and Sunt. U. 8. Paris of the city schools save a short talk.

nine as his theme, "Scouts in School." Mothers of the Scouts served lunch and a social hour was spent hefore the quests hade farewell to Scoutmaster and Mrs. Warar. who left Friday for their new home at Alexandria, MILK PRODUCERS TO MEET Members of the S'ous Falls Milk Producers association will meet in the chamber of commerce rooms at o'clock Tueedar night to discuss a ende for milk producers, and other matters pretainine to their business, 16 was announced late Saturday. Sunday, October 22, 1933. GRAINS DISPLAY NOTABLE POWER TO FINISH HIGHER U.

S. Government Buying Credited for Food Relief Account Is Feature BUYING OUTBURST EARLY Optimism Address Credited to President's -Some Tomorrow Night Profit Taking BY JOHN P. (Associated Press Market BOUGHAN Chicago, Oct. Editor) sharp breaks in securities. -Despite markets displayed notable grain much of the time today, and strength up at a moderate advance.

wound An outstanding feature sistent buying done in was perand May deliveries December credited to United of States wheat and ment for relief account. governprices of the day in the Highest market, showing cents rise wheat associated with an early outburst were buying based on optimism over of President nouncement of an address anRoosevelt tomorrow night from presumed conditions to deal with agricultural a more definite and perhaps giving also ministration's monetary outline of the programme. adWheat Crop Is Less above Wheat yesterday's closed unsettled, cent advanced, oats finish, corn provisions unchanged to a up, rise and 15 cents. of Helping to keep wheat pointed upward most of the time values day was the fact that although toconfirmed reports would not down not that the Washington was wheat dealing and with plans administration accorded corn cotton loans similar to those for making was taken, too of growers. Notice patches saying United Liverpool States farm disstrike overseas, news was attracting attention price advances and had contributed to further in Great Britain.

A estimate from the factor department was an of stimulating crop this that the world wheat agriculture tely 200.000,000 year would bushels be approximathe last than was less case year. Broadening Selling Partly Profit-Taking of selling pressure wheat became sufficient at out stage, early however, gains. to more than wipe The increased selling taking, but was partly due to profitwas also attributed in large degree to pronounced weakin ness fstocks. Rallies which ensued were the last simultaneous hour of grain trading with further government purchases of wheat and with demand from millers, but the recovery was not fully maintained. Cables reported cooler weather in Australia and rains in Argentina.

Corn and oats displayed relative strength as compared with wheat. Moist weather conditions were unfavorable for corn movement. Provisions averaged higher with grain and on possibilities of trade arrangements between the United States and Russia. A slump of 35 to 50 cents per hundredweight, bringing the price of the choicest butcher grades to the $4.00 level, hit the market Tuesday of this week in one of the dullest sessions on record. With the trade appearing to be in a complete collapse activities dwindled on this OCcasion until selling forces were somewhat bewildered.

No buying faction appeared willing to trade at any price level throughout the early rounds. Later in the day, however, local killing interests were aroused to life and the light run on hand sold at figures 35 to 50 cents lower than on Monday. Prices Tuesday were nearly a dolJar per hundredweight below the season's peak figures touched only the week before, repeating the performance of several previous weeks. Choice butchers had not sold for $4.00 per hundredweight at this market since September 6 of this year and $5.00 hogs were bought here as recently at October 3. But mild recovery was scored on the other days of the week and the period finished well below the starting with point.

At the low time Tuesday, the choicest butchers bringing only $4.00, top hogs were fully 50 cents lower than on Monday when $4.50 day's was level paid was for these kinds. Tuesfully 85 cents below prices here Friday of the week be- fore. Sow Losses Unrecovered All classes of porkers were hit by the slump as sows, which constitute the bulk of supplies on the market at this time, sold off fully 35 cents Tuesday. Prices on this division showed little power to recover on following days and remained at the low level. Good to choice sows met with fair demands on Monday and sold up to the $3.50 figure, reflecting only a dime drop from levels at the finish of the week before, but were slashed to the $3.15 mark on Tuesday.

These hogs other made little upward progress on days of the week and held near thi slevel till the finish. Receipts were the lightest of any week recently and well below normal for this time of the year. The record day was on Monday when only 985 hogs were brought here. Friday brought the fewest hogs with a count reaching only 227 head. Supplies arrived in small droves throughout the week and were of common quality, for the most part.

giving forced observers the impression only sales were being made at this time by producers. Well finished hogs were comparatively scarce and the bulk of supplies were rough and thin kinds. Cattle Better grades of light heifers reunder reliable support from shipper mained in favor all week, especially kinds buyers. On the other hand, grassy reflected some of the bearish sentiment current in all markets at this time. Any change in grass cow quotations appeared to favor buying interests.

Early movement of these kinds during the week proved somewhat in excess of immediate needs. Bull trade seemed a little uneven throughout the week but not much change was recorded in values. Vealers practicaly remained changed throughout the week AS supplies continued rather light. Recent sharp reductions in ed cattle values seemed to attract enough buying support from cornbelt feeders to maintain prices throughout the week in the stocker and feeder division of the market despite an unfavorable market slaughter cattle and fairly liberal receipts. In general closing quotations for practically all grades and classes of stockers and feeders remained in the same notches as noted last week.

Burke Grain Letter Chicago, Oct. 21-Wheat-Finished at a small net gain and at an average advance of about six half cents on the week compared with 54c higher at Winnipeg and 3c higher at Liverpool for like period. Early buying was a result of accumof ulation over night orders but the advance ran into profit taking with holders disturbed by the extreme weakness in stocks. Government agency credited with doing further buying. Much evening up over week end and pending the address by the president scheduled for day night.

9 p. Central Standard Time. General belief is that it will be of a constructive nature. Other domestic markets developed more strength than ours and Winnipeg also was stronger than ours with much buying based on talk of continued hot weather in Argentina. Export business in Manitobas 000 bushels.

Bureau of agriculture economics estimates world wheat production this year for the tries reporting so far off about 000.000 bushels from 1932. Demand from millers has been brisk. Market rallied well from all dips on commission house buying in which eastern houses were active, Today's action was encouraging. It is ural to expect profit taking on good advances which will serve to keep the market healthy but with aid coming from such an limportant source as the government and also with active locals inclined to look for higher prices the buying side on moderate reactions seems decidedly preferable, Corn--Held a large part of its advance and was independently strong at times. Decreasing primary receipts reflected in stronger tone to the spot market, Country bookings to arrive 90,000 bushels.

Shipping sales 68.000 bushels, Commission houses bought. Results of the processing tax on hogs and reduction in corn acreage are having some effect with the market acting as if (Private Wire of Burke Grain Security Sioux Falls). New York, Oct. the midst of all the present day theorizing about wages and employment and the purchasing power of labor, one -present fact remains, namely, that wages, together with all other costs of production, capital and management, must be paid out of the proceeds of gross sales. If these payments exceed the latter a drain upon capital takes place, which, if continued indefinitely, can only result in the ultimate extinction of the employer.

Criticism. now SO prevalent, regarding NRA requirements takes into account this new drain on capital. The further acceleration of the present trend of reemployment and wage increases under NRA calls for a corresponding increase in gross sales values to be achieved by increased selling prices and increased retail consumption. Investor is Buying Source Increased selling prices alone ment for the obvious reason that cannot sustain increased employincreased prices would largely offset increased money wages and not provide the buyers needed for an increased industrial output. As increased employment itself cannot provide this additional buying power, it must come from other directions and in the face of an unfavorable volume of foreign trade it must come from the increased consumption of those of our own citizens who have the money to buy, chiefly the investor, large and small.

Nothing will stimulate buying of the substantial character needed to sustain a broad industrial recovery more than a rehabilitation not only of capital values but confidence in their stability, This, for instance, has been already evident in the relief afforded real estate in the removal of pressure on mortgagors with buying power diverted from the reduction of mortgages, released in many other directions. Nothing will act more surely to destroy the buying power of the investor than the spectacle of declining security values and apprehension as to the future. Going hand in hand with the stimulating effect of the operations of the NRA it would be deplorable if another wave of pessimism were witnessed. It is hard to escape the conclusion, therefore that the stock market and the commodity markets of the country can serve as very valuable aids in the administration's program to revive purchasing power, Correction of market abuses is inevitable, but cooperation becooperation between financial centers of the nation and the administration is absolutely necessary. Street, Gov't, Cooperate In this connection it is heartening to note that some of our best informed editorial writers, who are most enthusiastic in their support of administration policies, are now stressing more and more the necessity of cooperation between Wall Street and Washington if the capital market is to be reopened and investors are to be encouraged to place their funds in channels which will stimulate the return of normal conditions to industry.

The Federal Reserve is doing its part in its campaign to maintain excess reserves of member banks at the record level of approximately $800,000.000. This supplies an excellent background for the return of an active and healthy bond market. An obvious prerequisite to revival of investment confidence would be seen in the increased activity in the so-called heavy industries. In this group, Steel has been an outstanding laggard. Stimulation to buying by public consumers is likely to receive its first stimulus in the form of government purchases, This is already underway and additional moves are to be expected as an important part of the national recovery program.

-Jackson Bros. Co. Figures Indicate Business Decline Moody's Index Shows Lowering of Business Indicators Over Past Week New York, Oct. 21-(P)-Statistics appearing during the past week indicated a further decline in ness activity, according to Moody's Index Figures for freight car londings, electric power production, and steel ingot output. These index figures are adjusted for seasonal variation--that is, if the change from the previous week should coincide with the normal seasonal change, the index figure would be unchanged, Carload- Elec- ings trie Steel bined Latest 58.3 101.7 50.2 70.1 Prev.

week 57.7 103.8 55.2 72.2 Month ago 58.0 105.3 55.8 73.0 Year ago 57.1 94.7 23.6 58.5 1933 high 63.7 109.2 78.1 83.7 1933 low 45.6 88.7 15.5 50.5 (1928 weekly average 100) Copyright, 1933, by Moody's. it would like to do better. Oats- Developed As much strength as any other grain. Profit taking on advances, While a trading market seems in prospect at the moment we believe the shortage in production this year will make itself felt before long and anticipate higher prices. Rye Moderate trade.

Provisions- With Chicago hog packing from March 1st to date showing an increase of about 1- 000.000 16 is not difficult to understand the recent decline in lard prices. Hogs top 4.60 Jackson Bros. Boesel and Co. move in withdrawing Germany from the millions of soldiers announcing its retirement from the League the distribution of in these active and the military situation in Europe, with its which form forces, with what has been called a CONFERENCE OPPOSES VERSAILLES PACT CHANGE; GERMAN FORCES HELD DOWN General Scheme to Scale Down Armies But Not Allow Germany Increase RING AROUND NATION Hemmed in by Environs of Greater Strength on All Sides -Back of administration moves to prevent the collapse of the disarmament cause is contemplation of the burden facing demands the world should German for equality be worked out in terms of French "security." Before Adolf Hitler's government recalled its representatives from Geneva and announced Germany's resignation from the League of Nations, the disarmament conference had disclosed that it would frown upon any material modification of the Versailles treaty which might bring about a restoration of power, Equality Postponed When the German withdrawal came it evoked revelations that the general scheme under discussion ments provided a scaling down of armabut in the world war victor states without any accompanying upward revision in the vanquished countries. It would be at least eight years, and possibly longer, before practical equality would be accomplished.

Today there is a ring of steel around Germany. In the "French influence" area of Europe are five nations capable of putting 13,716,674 trained soldiers in the field. Poland, on the east, has 332,100 active and 1,645,000 in reserve. South of Germany are the Little Entente nations Rumania with 244,850 active and 1,485,500 reserves: Czechoslovakia with 138.000 under arms and 1,489,000 trained men, and Yugoslavia, whose army numbers 138.900 and whose reserves total 1,586,600. French Army Largest Then on the west is France with 607.000 men on active service and 6,328.000 trained reserves.

The republic thus replaces imperial Germany as the world's premier builder of armies. Compared with these hosts Germany has but 100,500 regulars, no reserves. no fortifications such as bristle on the French side of the boundary, no tanks. gas or siege guns, limited ammunition and nothing but a commercial air fleet, whereas France has amassed nearly 5,000 battle planes into the most formidable air force in the world. The German army looks puny against the backdrop of 1914.

Some 800,000 regulars and 36.600 officers goose-stepped to the first battles of the World war and behind them came 6.200.000 reserves. The regulars composed 217 infantry regiments, 18 battalions of light artillery, machine gun detachments, 15 fortress machine gun detachments, 110 cavalry regiments, reserve classifications. The map shows shading indicating countries "ring of steel" around Germany. thilda Ausen: lots 16 and 17, block 12, University addition. Jacob Vollmar to T.

L. and Mae Shinneman as joint tenants: tract 12 of County Auditor's subdivision of Macy's First addition and Brookings addition. 100 field artillery regiments, 25 regiments of foot artillery, 35 engineer battalions. 3 railway regiments, 9 telegraph battalions, 6 balloon regiments, 5 airplane battalions and 1 mortar battalion. Just as the Versailles treaty decapitated Germany's standing army it ended her glory on the sea.

In 1914 the great Heligoland naval base was considered impregnable. The German fleet boasted 355 vessels. There were 47 battleships, 56 cruisers, 152 destroyers, 47 torpedo boats and 39 submarines. The treaty reduced German sea power to 6 battleships, 6 light cruisers, 12 destroyers and 12. torpedo boats, and dismantled Heligoland.

Army Term 12 Years Germany's lack of reserves results from the voluntary 12-year enlistment imposed by the Versailles pact on regular army servce. It was a French idea gained from the Franco-Prussian war. All Europe was under the impression there were no more than 60,000 regulars in the Prussian army of 1870. Secretly, its officers hit a plan of training men in upon few months and moving them out of sight while visible ranks filled with recruits. When the Prussians marched into Paris their army numbered 250,000.

The 12-year, non-conscript service was designed to discourage enlistment and keep German manpower visible. Real Estate Transfers Taken from the Abstract Co. Daily Report. Thursday, October 19 Britha Johnson to Christine. Johnson: rods of and west 10 rods of 6-102-49, and 31-103-49.

G. H. George to Minnehaha County: lot H-1 of 13-101-49. Isabel Morgan, et al, to E. H.

and Paulina Drescher as joint tenants: east one-third of lot 2, block 21, Brookings Edmunds' Sioux Falls. F. Lloyd Douthit, et al to Fannie B. Douthit: east 130 feet, block 16, Emerson's addition, and lot 1, block 4. University addition.

Melvin L. Sells, sheriff, to Fire Association of Philadelphia: lot 16 and south one-half west two-thirds and south one-third of east onethird of lot 17, block 22, Bennett's First addition; $4,644.94. Friday, October 20 George W. Guenther to Jettie A. Magnett: west 50 feet lots 10, 11, and 12, block 35, Folsom's Second addition.

Jacob Vollmar to T. L. and Mae Shinneman as joint tenants: lot 12, block 4, Brookings' addition. Thomas Corisis and wife to John and Kate Groth: lot 16, G. S.

Carpenter's subdivision of block Gale's Seventh addition. Serena Thorsheim to Mrs. Ma- Boy Scout Troop at Viborg Observes 18th Anniversary Vibarg, Oct. impressive ceremony took place here last night when troop 18, Boy Scouts. celebrated its 15th anniversary.

Dr. E. A. Johnson, scoutmaster since the troop was started, received a 15 years veteran's pin, as well as a special certificate, and a service star for five years' work after having received a ten years' star after his first decade of service. Merit badges and other distinctions were awarded to a number of scouts.

The Girl Scout organization participated with a drill and several dances. After the program and ceremony Dr. and Mrs. Johnson entertained a group of the visitors at their home with an informal visit and lunch. Troop committees were present from Centerville and Parker, as well as former Viborg scouts.

Hotel Man Who Disappeared at Vermillion Is Located Vermillion, Oct. I. Delitt, St. Paul hotel man who disappeared from the home he was visiting here last week, has been located. Under a commitment sued by County Judge R.

L. Collar he was taken to the state hospital by Sheriff Will Russell for observation. FORMER RESIDENT BURIED services were held at the Catholic church here for a former resident of Flandreau, Miss Bebe Mead, who died at the home of her nephew at Benson, Minn. She was 71 years of age and had been in poor health for some time. Some years ago service, she retired from the Indian having been an employe at the Flandreau Indian school here for 30 years.

She made her and home went in Flandreau Minnesota for several years to about a year ago. Some of her relatives live here. The funeral was conducted by the Rev. Father Kelly, of Flandreau, assisted by the Rev. Father Medicus.

of Britton, who is a nephew of the late Miss Mead. LUTHERANS HOLD PARLEY Central Dakota conference of the American Lutheran church met at St. Paul's German Lutheran church of Webster this week. The Rev. L.

Seehaase was reelected chairman for the conference and the Rev. H. Deiter, secretary-treasurer. Papers were read by the Rev. L.

W. Westenberger, the Rev. F. J. Kordewich, and the Rev.

L. Seehaase. London now has 155.000 lonely people of both sexes, mostly living in homes consisting of only one room. Exports. from the United States to Russia are about equal to those of the latter part of 1928.

AMONG THE FOLKS IN HISTORYOUR EARLIEST TRAFFIC PROBLEM NEVER MIND GETTIN OUT AND WALKIN' AROUND I'LI GET AROUND ALL RIGHT AS SOON AS TH' ROAD GETS A LITTLE WIDER CHAR WILL BENEFITS SEEN IN SOVIET MOVE Expert On Russian Industry Says 300,000 Men Would Benefit By Agreement Cleveland, Oct. 21. (P) Three hundred thousand men can be returned to American industrial payrolls if the United States and Russia complete an economic rapprochement, Kenneth H. Donaldson, expert on Soviet industry, has vised the state department at Washington. Professor of mining engineering and recently consulting engineer for an American mining company operating in Russia, Mr.

Donaldson today expanded on a report he made to the Roosevelt administration on what he characterized as the tremendous benefits which would follow recognition of the U. S. S. R. by this country.

Russia, said the college professor as an initial premise, needs a dollars worth of material. America, he said. as a corollary, can have $350,000,000 annually worth of this business. But this, he added, depends upon this country's accepting raw materials as part payment and sets up a financing arrangement. His figures on business with Russia by states included: New York, $80,000,000 Pennsylvania, 000: Ohio, Michigan.

Wisconsin, Indiana, $10,000,000, and Illinois, $10.000.000. He estimated that 250 tions in this country would receive orders of $1.000,000 or more each and that at least 100 others would get orders for a half million or more, CITY BRIEFS Dr. F. A. Tjaden, Pierre, arrived in Sioux Falls Saturday for a brief visit with his mother, Mrs.

Berahrdina Tjaden, 823 South Minnesota ave. He planned to leave early today for Mitchell to attend a tors' convention at Mitchell. Special Sunday at Virginia Cafe No. Roast young duck 40c; or baked or fried spring chicken 40c. rolls finished, Special 35c.

Studio, City and farm loans and insure Costello Co 121 N. Main ave. ance. 1. See cash prize contest on page Special Sunday at Virginia baked Cafe No.

2: Roast young duck or or fried spring chicken 35c. Bell Creamery for better butter S. H. Whitmer, vice president, and 0. Chapman, treasurer of the Policyholders National Life Insurance leave today for Chicago to attend a ing of the Life Agency Officers atsociation.

Have your car greased on the new Super -Service. The Modernistic bedroom suite 10 be given away at the Catholic ladies carnival is now on display at the G. G. Rug and Furniture Co. Bobby Smith.

"Nobby Signs." Miss Ruby Gloe, has formerly accepted of Windsor position at Beauty Fantie's Beauty Salon, Shop a starting Monday. Jewelry Co Diamono loans. Ryde shed and forcing Climbing a on window, top thieves a broke into ave. Pay's Art during store, the 122 night. South A checkup Phillips to find any dise missing, police were told.

today failed page 1. See cash prize contest on According to word Henry received Bruhn, here by South Prairie a daughter cal Mr. and Mrs. Thursday of to Estherville, and 1A. Mrs.

Waiter.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Argus-Leader

- Archives through last month

- Continually updated

About Argus-Leader Archive

- Pages Available:

- 1,255,537

- Years Available:

- 1886-2024