Star Tribune from Minneapolis, Minnesota • Page 46

- Publication:

- Star Tribunei

- Location:

- Minneapolis, Minnesota

- Issue Date:

- Page:

- 46

Extracted Article Text (OCR)

L'Sl, Star Tribune Bysnimass 3,607.19 L. 'I- Saturday December 171994 1D. -wT W6 Technology Column six On the road Intel and its Pentium chip get more bad reviews Technology group recommends clients delay purchasing PCs with flawed chip Associated Press to recovery Jaguar Cars near profitability after years of losing money and face New York, N.Y. An influential technology consulting a- m.tf. ir mm We re not on track until we're showing of an error," the firm said in a statement.

"The statistical spitting match that has ensued fails to allay user fears or address the issue that errors can in fact occur." Intel has placed the chance of hitting the flaw as one in 27,000 years. IBM said it could happen once every 24 days. The Gartner Group suggested that IBM had other motives for stepping in to the affair, noting it is has sold few Pentium-based PCs to date. No other PC makers have followed IBM in speaking out against the flaw. Compaq Computer which passed IBM to become the leader in PC sales this year, said Thursday that it would continue shipping Pentium products.

licity for the world's leading chip maker. Gartner said companies should delay large-volume purchases of PCs with the advanced chip but could continue small-volume or individual purchasing. The statement is significant because its roster of 4,000 clients include many of the nation's largest companies. Gartner also castigated Intel and IBM for confusing customers with different assessments of the flaw's severity. IBM, which is developing a chip to rival Pentium, said this week that it would stop shipping Pentium-based PCs because Intel understated the trouble.

"While Gartner Group believes that the probability of errors occurring is low, it is nevertheless impossible to fully gauge or anticipate the impact The Gartner Group's statement was the second independent assessment in two days to confirm that, in general, the Pentium chip flaw presents a risk to some businesses but not consumers. On Thursday, PC Week, an industry newspaper, said its tests found the flaw can produce the wrong result, depending on usage, from once every two months to once every 10 years. The flaw generally changes a digit four to 19 spaces to the right of a decimal in a result of a division problem. It only happens with about 1,700 combinations of numbers and does not affect other math functions, word processing, games or communications. The error was disclosed by a mathematician on the Internet computer network last month.

Intel then acknowledged that it had found the problem last summer and corrected it recently during a routine upgrade of the chip's factory process. But it will be early next year before the corrected chips are widely available. Some customers have criticized Intel for not disclosing the flaw when they found it and not offering to replace the chip with no questions asked. Gartner Group's analysts decided to make the recommendation at their weekly meeting. The firm estimates replacing a Pentium chip would cost from $30 to $200 per machine.

"We want to help our customers save money and not spend money unnecessarily," said Kate Berg, spokeswoman for the Gartner Group. black numbers at end of a full year. But clearly the path is looking Nicholas Scheele, Jaguar oM nrm recommenaea t-naay tnat companies postpone most purchases of personal computers with flawed versions of Intel Corporation's Pentium chip. Gartner Group of Stamford, said it was making the recommendation to save clients money if they decided to replace the chips, which are the brains of PCs. Gartner said corrected chips should be available in a month or so.

The recommendation further aggravated the problem confronting Intel over its flagship product, which can botch some obscure division calculations. Intel's belated admission of the defect and its refusal to replace problem chips has brought bad pub chairman By Richard W. Stevenson New York Times "MOT' Coventry, England viw They were madly painting ahd-polishine at the Jaguar Cars plant in Coventry one recent day, mak; ing the place sparkle for a Communications Summary trom a loyal customer, Queen; Llizabetn 11. But the changes at Jaguar of late have been more than cosmetic. After nearly five years in which it.

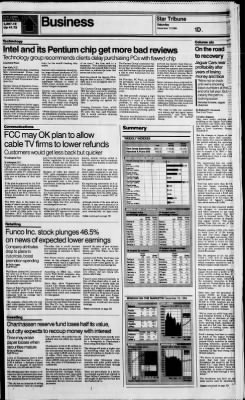

WEEKLY INDEXES FCC may OK plan to allow cable TV firms to lower refunds Customers would get less back but quicker has posted nothing but operating losses and made its parent company, Ford Motor look Weakly netehg Weekly 3.10 Dow Jones Industrials 3807.1 9 11 6.80 Standard Poors 500 toohsh tor having paid $2.5 billion to acquire it in 1989 Jaguar appears on track to reap 458.80 11.83 2.60 i something more than a visit from the queen: a profit. CT? The turnaround has not come Percent change from a week ago: -0 20 I MVCB I "20 easily. The inefficiency and slop- (year ago: 1.10) piness ot Jaguar manufacturing were far worse than Ford had ASEOTC (year ago: Equity funds (year ago: Taxable bonds (year ago: expected when it bought the comr pany, and the amount of monej and time needed to set things '1-45 1 10.08 Washington Post Washington, D.C. Faced with a backlog of more than 6,000 consumer complaints, federal officials are considering allowing the nation's cable TV companies to negotiate reductions in the refunds they owe to millions of their subscribers. If the plan is approved by the Federal Communications Commission, cable TV customers probably would get quicker, but less generous, refunds than if the FCC followed its formal procedures for processing complaints.

right far greater. y- Municipal bonds fcaH 1 Ford has sunk more than $4 bit-lion into Jaguar, including the aiyear ago: Bond funds Jyearago: CDs sure from the industry to ease up on further regulation. In the past few months, Hundt has led efforts to permit the industry to raise prices somewhat to expand service. Because of cable law passed in 1992, cable companies potentially owe millions of dollars to consumers in overcharges. So far, the FCC has processed only a few dozen complaints, ordering about 1 million in refunds.

Those settlements were only the top of a huge pileup of paperwork. The FCC has been laboring for more than a year to process the roughly 6,400 complaints filed by consumers who claim that they are being overcharged for service. Discussion of a settlement process within the FCC appears to be a tacit admission that the agency cannot speedily handle the flood of com plaints, despite having added at least 60 attorneys and accountants in the past four months to deal with the problem. The agency, which has twice ordered cable companies to cut their rates, designed the process by which subscribers could plead their cases and possibly receive a refund. By negotiating settlements with cable companies, the agency believes that it could avoid months of administrative delay and probable legal challenges from the cable industry, according to a senior FCC official.

Although details of the plan still are sketchy, it may prove attractive to the cable industry, which would not only pay reduced refunds but would save substantially on legal costs. Cable continued on page 3D purchase price, accumulated losses of more than $1.2 billion capital injections and a $320 mil (year ago: 4.16) Money funds lion investment in a newly introduced update of its XJ sedan, the backbone of Jaguar's product E2S0.75 1 ago: 2.37) Real estate (year ago: 9.64) Gold (year ago: line, which starts at $53,000. The FCC plan is the latest in a series of recent moves by the commission to meet cable operators' concerns. Since championing a second round of cable price cuts in February, FCC Chairman Reed Hundt has been under intense pres 10 largest price 10 largest price The survival plan required wholer sale changes in manufacturing and labor relations to cut costs and improve quality that had sunk to abysmal levels. (The fa-" vorite bumper sticker of disgrun- tied Jaguar owners: "The parts Retailing falling from this car are of f.he, finest British Despite slashing 6,000 jobs from its work force of 12,700 during the past four years, Jaguar wilT have a struggle convincing Ford-that Britain is the most efficient place in which to build the next Funco Inc.

stock plunges 46.5 on news of expected lower earnings generation Jaguar, a higher vol ume, less expensive sedan expect! ed to go into production by the lowered the price of new releases. Other retailers, such as Target Stores and Title Wave, have followed suit. Thursday that it would increase promotional spending and aggressive pricing in response to heavy competition. Weekly Weekly Weekly Weekly Laet netehg chg Lett net chg chg Brainerd 10 2'2 30.3 a Funco 5V -7'a NtCptr 16 3 26.2 Damark 8 -2'; Possis 7 1Mi 18.4 UltPac 5 -Ta Innovex 1578 2'a 15.5 fvldeoU un 534 -1 -14Tt HEI Mn 5 14.3 MGI Phr SVi -120 FSFFIn 9 1Mi 14.3 1' Zees 7H HMNFn 10 1ft 14.1 Lectec -7t -9 7 GrowBIz 11 1 13.9 jj LasrmTc 7 -9 7f MtnPkFn 14'z 1 13.7 Autolnd 1634 -116 -8 2- DalgCps 18'2 2 12.1 STwrAuto Tz 10 largest by percentage 10 largest by volume of shares traded Weekly si Weekly r. volume Weekly fj haree Weekly (00) Lett netehg.

traded Lett net chg TelCmA 111720 2Vt Vz 3 Funco 41.6 5 -7'; BestBuy 56236 29 -1 flnovGme 21.2 3 -V UHltCrs 45928 45 3 Innovex 16.6 15 2V i. Norwest 40215 23 ArdonPd 14.2 7 Vt 'j MMMs 39342 51V; BestBuy 12.9 29 -1 Normans 37597 5 'A Ftteam 11.1 15 VA I Unicom 31520 24V; 3 HEI Mn 9.6 5 GnMlll 24734 57 2 Zeos 9.4 7 fj Funco 24050 5 -TA LasrmTc 9.1 7 Honywel 18090 30 1 'Brainerd 8.5 1034 2'i Company attributes drop to plans to cut prices, boost promotion spending Analysts said Friday that Funco was forced to follow big chains' discounts of new video games by cutting prices on new and used games. Wall Street reacted negatively because, as the company said, the strategy would "result in significantly lower margins and lower net income vs. expectations." By Sally Apgar David Pomije, Funco's chief executive officer, did not return telephone calls Friday. Funco's stock behaved similarly to that of Musicland after it said in November that it would slash the prices of new releases in its Sam Stan Writer Wall Street slashed 46.5 percent of the value out of Funco Incorporated stock Friday in a trading avalanche after the company said its third-quarter earnings would fall below analysts' expectations.

Shares of Eden Prairie-based Funco nose-dived $5 to $5.75. A stunning 2.32 million shares traded hands, compared with an average day's trade of 69,200 shares. I The company, which sells new and used video games through its 180 Funcoland retail stores, attributed the drop to its announcement i- According to IBES which tracks Wall Street estimates, analysts said Funco would earn 45 cents in the quarter. Since May, when Virginia-based Circuit City Stores stomped into town, the Twin Cities area has been a battlefield for a price war that has spread from music and computers to video games. The war, which first started between Circuit City and Eden Prairie-based Best Buy Co.

has reached retailers such as Minnetonka-based Musicland Stores which has Goody and Musicland stores by as much as $5 so that it could meet the $10.99 and $12.99 prices of Circuit City, Best Buy and even Target. WINDOW ON THE MARKETS December 16, 1994 Analysts immediately said the move, combined with increased promotions, would hurt short-term ZZ3 ClosrV41.72 to 3807.19; 1.11 earnings. Funco continued on page 3D Lett Net Pet 4000 34 Vi '4 Possis Dlametrc Varltrn 11.5 9.1 88 7 6 9'4 Investing end ot the decade. But the progress so far has pro-" vided a clear shot at long-term survival for the luxury-car maker, which company executives say' is Britain's largest single exporter. Barring some unexpected foulup; Jaguar should post a profit in the-three months ending on Dec.

3ll its first positive quarterly result in more than four years, following the economic recoveries in Brit ain and the United States and XhS, introduction this fall of the re? styled XJ sedan. Sales next year are projected tot exceed 38,000, up from about 31,000 this year and 28,000 las year, but well below the peak of 49,500 in 1988. Analysts are ex- pecting a modest profit next yea ft though it remains unclear how Ford will recoup its investment. "We've come an awful long way.S said Nicholas Scheele, a Ford exv ecutive who is chairman of Jag4 uar. "We're not on track until' we're showing black numbers at the end of a full year.

But clearly1 the path is looking easier now than it was two years ago." Ford's strategy has been to retain-as much of the Jaguar heritage and mystique as possible, but, tj impose Ford's expertise in manufacturing efficiency, quality cpnj trol and information management on a company that had come to, represent all that went wrong wittt British industry. i I "We drove in systems and proce dures that had been prove throughout the world by the FproJ Motor said David Hudson Jaguar's plant director. "Since lh acquisition, in terms of manufac turing, we've been through a rcvo lution." 5 The revolution was built on thd same tactics used by automotive Jaguar continued on page 3D Funco 534 7 5 DlgitBlo UltPac ft V4 3850 VlL- ll'lA. 3800 I "JTI 37so Ysmr -r aeso 36oo 3650 1111 1 gfil, IU-LU-Nov. Deo.

FMTWTW Past week Chanhassen reserve fund loses half its value, but city expects to recoup money with interest Vol. (QUO) The investment losses recently were V4 TelCmA Funco MMMs 2767 21 2106 5'4 2064 51 Don Ashworth, who added that the setback does not affect any capital plans. cited by Moody's Investors Service for a downgrade in Chanhassen's Time may erase rjaper losses when securities mature bond rating trom Baal to Baa. 31 l2VJllJU-'i OoeeM .60 to 729.00; Treasury yield curve The change will mean a higher cost of borrowing when the city sells e.6r 1 i i nearly S3 million in bonds for vari ous projects next year. Several other Minnesota cities, 660 I i 'I rn rr 828 I 1 wo IZ 726 Jrr wo TT 976 1 I 990 I 828 EES: I 900 1 1 1 eo 7.6 .70 60 66 60 4 6 40 36 3.0 counties and other public institutions have suffered losses through Chanhassen invested $6 million in derivatives whose value is tied to the international benchmark interest rate called LIBOR and the price of coffee.

Their value went in the opposite direction of the indexes, so when LIBOR rates and coffee prices rose, the value of Chanhassen's securities fell. But because the securities are government-backed mortgage bonds, the city will receive face value when they mature in the year 2003. They were bought at a discount. In the meantime, the city receives interest payments. investments in derivatives.

Yeeterday 1 week ego By David Phelps StaffWriter i A 'city of Chanhassen reserve fund has lost more than half its value or $3.4 million because of paper losses in a handful of derivative securities, city officials said Friday. But officials said they expect to recoup the full investment plus interest when the government-guaranteed securities mature in nine years. "The city has no intention of selling our investment," said city manager Most are participants in a deriva tive-loaded mutual fund offered by Piper Jaffray Companies. Chanhas JiuiK 1 I 1 10 Oct Nov. 0.

sen bought its derivatives from Kid MTWTfiF Psst wssk Source: BiMge rntormatton Systems der PeabodyA Co. I.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Star Tribune

- Archives through last month

- Continually updated

About Star Tribune Archive

- Pages Available:

- 3,156,115

- Years Available:

- 1867-2024