Star Tribune from Minneapolis, Minnesota • Page 42

- Publication:

- Star Tribunei

- Location:

- Minneapolis, Minnesota

- Issue Date:

- Page:

- 42

Extracted Article Text (OCR)

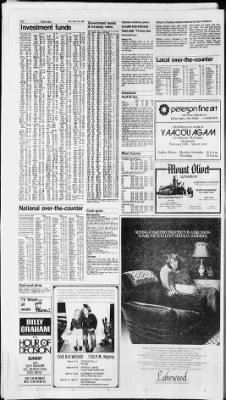

10C Feb. 28, 1981 Saturday Dayton Hudson sells interest in four centers Government bonds treasury notes Investment funds NEW YORK (AP) Closing Over-the-Countar s. treasury Bonds for Friday. Rata Mat. data Bid Asked Bid Chg Yld Sell Buy Shearson Funds: 6.M Mar 10 99 14 .2 13 87 Sail Buy NELIft Fund: Eouit 19.34 21.02 Sail Buy Delaware Group: Oacat 14.78 15.61 Dayton Hudson Corp.

said Friday that it has sold its interest in four regional shopping center projects to the Equitable Life Assurance Society of the United States, New York, N.Y. William Andres, chairman of the Minneapolis-based retailer, said the sale will result in an after-tax gain of about $12.5 million in fiscal 1981. The centers are Valley View Mall, La Crosse, and Quail Springs Mall, Oklahoma City, both of which opened last year; The Orchards, Benton Township, which opened In 1979, and Spring Meadows, Toledo Ohio, which Is in the early stages of 'development. Valley View was wholly owned by Dayton Hudson. The corporation held joint-venture Interests in the others.

Mar 1981 1981 1981 Sail Buy Inv Iridic 1 41 tnvQual 90S 148 Inv Bos 13.32 14.36 Investors Group: Appre 1261 13(6 1340 1582 43 75 7.38 15.20 14.41 Grwlh Incom Deiaw 41 7.43 1544 17.24 45 1040 IIM 20.59 1981 1981 1622 1773 1513 16 54 16.92 II 10 14 18 NL acorn Rel Eq NwOIr Trleng Sierra Gt Dalch Frt DHa a43 133 TaxEx 6.01 4,29 6.73 10 NL IDS Bd 420 4.36 IDS Grt 1270 13.80 IDS HIY 3 70 3.15 NEW YORK (AP) Tht following quotations, tup-pi ltd by tha Notional Association ot Socuritioi Dollars, ara the pricas at which thasa sacuritiat could hava baan sold (nat assat valval or bought (va-lua plus saias charge). Sail Buy Able 21.4 NL 1981 1981 1981 1981 Sherm 0 Neuberger Berm: 973 NL Dren Bur 14 Dreyfus Grp: A Bnd 1 47 Sigma Funds: Enrgy IDS NO NL NL NL Capit 1591 17 39 1981 9.25 10 04 9.54 10.39 4.69 510 14.38 15.72 681 7.44 1981 1981 22.05 24.10 Dravt Levoe Nina Sol Inc 1981 12.39 NL 99 21 .1 99 .1 98.14 98. 14 98.25 .1 97.17 .1 98 9 .2 7.27 .1 94.21 94.28 .1 977 .1 7. It 5 18 .2 97.20 .2 98 24 .1 95.8 .2 95.20 98.13 .1 4 21 .2 7.24 .3 7.24 .2 93.14 .1 93.24 99 24 2214 3214 3.73 4.33 16.41 15.24 20.04 7.55 1803 10.21 1981 9 17 99 5 98 12 98 12 9821 7.13 98 5 7 23 4 5 4.24 7 3 715 5.14 7.14 8 20 5.4 5 14 999 4.17 7.22 7.20 3.4 3.10 99.22 4 7.40 NL NL NL NL NL NL NL NL 1981 1981 Eastern Airlines plans to build fuel-efficient fleet with 175 new jets Associated Press Miami, Fla. Eastern Airlines plans to sell off most of its current aircraft and buy 175 new, fuel-efficient jetliners over the next 15 years, company officials said Friday.

By the mid-1990s, Eastern hopes its fleet will consist of European-built A-300 Airbuses, Boeing 757s and a 150-passenger, short-range jet that is still on the drawing board, according to spokesman Jim Ashlock. Eastern, also may operate its Lockheed HOI Is into the next decade. The planes could cost between $40 million and $50 million each, for a total purchase price as high as $9 billion. Ashlock said Eastern has not signed purchase orders for the 175 jets. Inco Invest Trust Vent SB Eoty SB l(Gr SoGen In Sw Invs Swlnlnc Sover In Mutt Frog Tax Stock Select Var Py Inv Resit IsW Ivv Fd JP Grth JP Inco Janus 12 86 14 05 9.11 996 13.92 15.21 1544 14.75 8.83 9 29 1577 1451 10.26 11.09 4.27 4.62 14.61 15.38 Acorn 24.17 AOV 14 57 Afutura 14.06 NL NL NL Ta 10.52 ThrdC 141 Ear1 Glh 1.19 Eatoni, Howard: 3 24 3 37 21.13 22.97 6.71 7.29 9.62 10.45 5.41 5.91 33.20 NL 9.75 NL 12.50 13.59 741 105 9 07 NL 1981 1981 Guard Libty Manht Partn Schus Newt Gt Newt he Nlchola Noreast NoStar Stk Bnd Reg NY Venl Nuveen Omega AIM Funds: 1981 9.09 Balan 143 CvYld 1416 15.14 Local over-the-counter 1981 1981 10.20 NL 15.8 I6.W Edson Fours Grwrh State Bond Grp: f.73 1982 1982 12.07 L.

8 29 L. 12 80 N.L. 8 86 9 68 7.07 7.40 Com SI 516 6 40 John Hancock: HiYld Alpha A BirrhT I9 60 21.13 4.25 4.50 13.03 14.05 11.44 12.33 15.89 NL 1240 13.77 Divers 5.68 6.21 Sped Slock American Funds: 740 8.09 9.77 NL 94.8 Progrs StFrm Gl StFrm Bl Eberstadt Group: A Bal 1.63 9 43 Bond 12 92 14.04 Grwth 11.28 12.26 Balan 8.60 9.35 Tax Ex 9.23 10.03 Kauhnn 2.24 NL Kemper Funds: 15.57 NL 1770 NL .3 12.60 NL Chem Fd 100.22 100 2 7.4 97.8 One Wm 14.71 1483 14.53 14 45 14.39 14.78 14.79 14 90 1484 1484 1503 14.55 1467 14.32 14.48 14.44 1429 1425 1420 1347 13 48 14.08 1379 14.14 14.02 13.51 13.68 1378 1387 1375 13.80 13.99 13.17 13.58 1367 1345 13.71 13.73 1354 13.54 13.98 13.44 14.29 14.11 13.44 14.04 13 48 1350 13.34 StStreet Inv: 10.04 10.97 Oppenhelmer Fd: 92.31 .3 9.67 10.57 Oppen Exch 66.35 Fedl 42.18 NL NL 15.71 17 17 16.46 17.99 Incom 7.55 8.03 13.31 14.55 12.19 13.32 9.51 10.39 11.57 12 64 1.45 9 23 12.10 13.22 7.91 1.64 Grow EngRs Survey Eltun Tr Elfun Tx Evrgm Fairfld Amcp A Mutl An Glh Bond Fd Inv Grwlh Incom ICA Pars Wsh Ml Apr May May May Jun Jun Jul Aug Aug Aug Aug Sap Sap Oct Nov Nov Nov Dec Dec Jan Fab Fab Fab Mar Mar Apr May May May May Jun Jun Jul Aug Aug Aug Sab Sep Od Nov Nov Nov Dec Dec Jan Fab Fab Mar May May Jun Jun Aug Aug Sao Nov Nov Dec Fab Mar Invest 65.21 65.57 Steadman Funds: Am Ind 3.50 NL 1984 129 33.67 NL 9.30 10.14 11.58 12.66 8.63 9.25 7.55 7.93 14.27 1560 18 33 20.03 1296 14.16 12.45 13.41 HI YkJ Mun Ootn Summ Tech Frm BG una vail NL NL NL 900 780 7.86 984 8.52 859 Bid Ask PHCInc 1.0 1.4 PtofSales 1.4 24 ProdDesIgn 1.0 2.0 OualllvHomes 0.6 16 QuaiProdClrc 2.6 3.4 ReoPlasllcs 2.0 26 RobelBeef 14.4 160 Roberlson 1.4 2.2 ScoilLand 2.4 34 SolldCont 2.4 3.2 Spearneadlnd 5.6 6.6 Sleenberg 2.0 26 Sielnlnd 10 1.6 Swenko 1.6 2 2 Technalvsis 70 80 ToolFngr 10 20 TOPIas 24 34 UnivMark 16 2.2 Vaughns 1.0 1 6 WlnSlepnens 47 5.3 2.23 3.20 4.28 428 3.8 3.20 3.14 93 8 3 28 4.17 2.15 7.11 7 18 90 4 1.11 9.23 Bid Ask 05 1.1 10 bid 1.6 26 1.0 2.0 2.2 bid 2.0 2.6 1.3 17 2.6 3.2 3.4 44 2.0 2.6 100 11.0 1.5 2.1 132 14.2 2.0 2.6 1.0 20 30 4.4 22 3.0 02 06 2.2 2.6 2.6 3.6 OTC quotation! from tfNA5D Bid Ask indkat ifitvr-dtattr pine, from Colwalllndut 4.0 6.0 lOnicControls a mark mdttr nxh security ComblnColnc 3 0 3.6 javelin ot of approximately 3 pm. DacolahBk 9.4 Krelitz Ptki do not (txluot markup, DateComm 3.4 5 0 MS. OOI I morttdown or comrmiiion.

Fig- DalaMap 0 4 1.0 MallHse um alter oecimal poum ore DataSvt 1.1 1-5 MarshallFoods eiorirhi IQwM not omlable Devac 20 3.0 Medicon hom mortal moker Bid Ask Diagnostic 1.2 20 MelaCom AgChem 1.4 10.4 DlnlngCnptCom 0 6 12 MICom Agresource 10 1.4 DlnConceptUntj 10 MlcroComCorp Alladlnlnfl 2.4 30 DinConceptWrU 0.2 06 MidAmSankCp AIINalluns 4.4 7.0 Eldorado 0 3 0.6 ModernFoods AWCompulerSi3.4 4.2 EMC 4.2 52 NahFlnch Barbers 10 2.0 ElecSensor 4.1 4.5 NnrlBeautv Besco 07 1.3 Fllmtec 9.4 114 NoSlarAcc BioWedlcus 04 1.2 FlapJackFoods 0.3 0.6 NoSiarComp Brolhen 1.0 1.6 FotomerK 50 6 0 Nolnstlnc Cherne 2.0 3.0 GeneticLab 1.4 2.0 NormSlateEnt ChristianBros 1.0 16 IndComp 2.4 3 4 Numerex CtiromaGio 1.3 17 hinovex 10 2.0 Oahelnv Hi Yld Inc Bos Optn Sped Tx Fre AIM Time OTC Sec Param PaxWkt Perm Sq Penn Mu 1796 19.26 7 80 0.52 23.37 25.54 17.7J 19.38 6.81 NL 2071 22.63 9.58 1047 24.63 76.77 947 10.35 942 NL 8.46 NL 5.07 NL 10.47 11.44 93.28 95.4 .4 5 .2 3.14 .2 93 24 .3 93.20 .4 3.14 .2 4.4 .2 94.21 .2 92.23 .2 97.15 .1 97.22 .2 90.14 .2 91.19 .1 99 27 .2 93 I .5 Assoc .93 Invest 1.56 Ocean 7.15 Stein Roe Fds: Balan 7105 Cap Op 2139 Tot Rl Amer General: Keystone Funds: Cap Bd 6.19 6.77 Cus Bl 13.67 14.49 14.09 15 40 NL NL NL NL Stock 1925 Federated Funds: Am Ldr unavail Exch unavail HI km unavail Optn uneven PenTF 13.35 13.98 Tx Fre unavail US Gvt unavail Fidelity Group: 14.52 1805 1245 6.92 NL Phlla StnSpl StnTx Stretlnv Strat Glh SunGrth 3 Phoenix Chase: Cut 67 Cut B4 Cut Kl Cus K2 Cus SI Cus S3 Cus 54 Intern! 7 96 870 2310 NL 10.92 11.93 Livestock 7.21 7.88 7.24 7.91 6.67 7.29 18.91 20.67 976 10.67 973 10.63 4.40 481 1282 14.01 Asset 1479 Entro Hi YW Mun Ventr Cmstk Exch Fd Am Grow Harbr Pace Provid A GthFd A Merita 9 18 984 16.13 16.93 20.73 22.66 13 46 14.71 39.22 NL 11.14 12.17 34 55 NL 1149 12.78 26.76 29 25 3 87 4.17 7.30 7 87 101.4 101.10 .4 99 2 99.6 .2 0.10 90.18 99.21 99.29 .1 Bond NL NL NL NL Tax Mod 13.33 14.57 Tmpl Gl 7 43 1 12 750 75 4 75 13 939 7.00 743 130 43 475 10 13 1243 7.00 7.75 12 13 7.25 11 38 11 SO 4 13 4.3B 13 OS 7 Sa-lS 00 11.31 7.00 1.00 9.25 3 I. 2S (.43 1(8 8 13 9 00 II. 13 38 11.88 12.13 7.13 7.88 13.88 38 15.13 1343 8.00 13.88 25 7.88 11 43 3.25 8.88 25 11.88 75 700 88 10.50 7.25 14.25 25 13.25 8.88 4.38 7.25 1325 12.13 14.00 8.00 3.25 4.25 10.38 14.38 8.25 43 11.75 1350 7.88 8.00 4 13 00 1200 743 12 38 825 8 75 25 10.75 3.50 8.25 1075 13.00 Mass 2.10 92.18 .2 89.14 89.19 .4 Tmpl Balan 665 9.45 Grwth 914 9.99 Front unavail Sped unavail Pilgrim Grp: Pi Fd 14.24 15.35 Mag 4.47 4 82 Mag In 7 16 772 Pioneer Fund: Bond 7.95 8.69 6.41 47.13 1203 1030 22.82 34 00 27.21 Lexington Grp: Conors Conifd Dsfny Eq Inc Exch Magel 4.18 94.24 17 52 19 15 968 1052 8 00 870 17.34 16 95 Cp Ldr 14.15 15.57 84.4 .14 11.28 1.8 .2 13 34 GNMA 7.51 NL NL NL NL NL 280 4.95 A 10.47 NL Trns Cap Trns Inv Trav Eq Tudr Fd TwnC Gt TwnC Sel USAA Gt Mun Bd 6.53 83.4 1 1.4 4.17 92.4 85.24 1.14 10.43 NL 15.96 NL 102 NL 1071 1178 13.79 1143 91.12 .2 4.25 .5 2.12 .2 84 .8 Fidel 18.91 Grow Resh TxFOI Life Ins Llndnr 11.93 14.11 12.05 Fund 20 03 21.89 Gvt Sec 902 4.01 A Invest A tnvlnc A NIGIh A Nllnc Amwav II Inc 1241 13.56 NL NL NL NL NL Nl 13.49 13.44 1334 13.32 13.42 13.42 13 41 13.49 13.53 1.24 .2 11.70 NL 1534 16.77 1671 NL USAA Inc flpeterspn fine art 943 5.20 Loomis Sayles: 7.39 7 90 Plan Inv Pllgrth Piltrnd 3.1 93.9 84.22 84.30 1014 101.12 1 2 2 1647 18.00 13.54 14(0 Hllnco HI Yld LI Mun Puritn Salem Unt Accu Unit Mul 7.74 10.66 776 11.32 780 9 12 10.63 Capit 1742 Mut 14.18 NL NL Axe Houghlon: Fnd 8 72 9.48 Price Funds: United Funds: 88.28 89.4 NL NL NL NL NL NL NL NL NL NL NL Lord Abbelt: Aran 8.54 Bond 4.92 933 5.38 98 20 87.24 Afflltd 874 942 Thrift Trend 3916 West 50th Street Edina MN 55424 61 2920-6070 29 89 14 1380 2 1354 4 13 11 13.51 8.14 87.14 80.24 82.29 988 81.24 4.06 4.41 9.29 10.15 14 84 18 40 13.79 15.07 1.36 NL 13.11 NL Incom Stock BLCGt BLC Inc Babs Inc Babs Inv Financial Prog: Con Gr 1271 13 89 Con IK 10.13 11.07 Fktuc 27 40 29 95 83.5 98.10 .2 5.24 .4 Grwlh 14.25 Incom 6.06 Era 21.24 Horlz 14 55 Prime 1000 Tx Fre 8.00 Pro Services: MedT 15.46 Fund 850 Incom 7.67 South St. Paul Friday Cattle Calves Hogs Sheep Today 2X100 100 5,000 300 Week ago. 1,701 96 4,3 2S3 2 weeks ago U43 139 4371 190 Year ago 1,458 87 6415 97 SOUTH ST.

PAUL, Minn. (AP) (USDA) Friday Cattle and calves hardly enough slaughter steers or heiters on offer lo fully test prices; small end of the week supply considered near steady; cattle wet and muddy from overnight rains with weighing conditions in favor of seiier; few lots high good and choice 2-4 1050-1250 lb slaughter steers 58.00-60.60; mixed wood and choice 1050-1500 lb Holsleln Steers 54.00-57.00; few choice 2-3 12S0-16O0 lbs 57.00-58.00, few lots choice 2-4 925 1100 lb slaughter heifers 57.50-59.00, mixed good and choice 850-1100 lbs 53.50-58 00, slaughter cows moderniely active, steady; utility and commercial 2-4 40 00-4400; few 45.00; few commercial No. 4 37 canner and low cutter 38.00-43.50; slaughter bulls scarce, steady; yield grade 1-2 100-2100 lbs 1000-1400 lbs 48 00-52 00; veelers 100, not enough lo make fair test of trade. Hogs barrows and gilts slow; mostly 50 lower; 1-2 200-240 lbs 40.50; few lots 41.00; 240-260 lbs 40 00-40 SO; 260-20 lbs 39 280-300 IDS 38 00-39 00 sows slow; weights under 500 lbs 50-1 00 lower; 1-3 300-500 lbs 36.50-37.00, 500-650 lbs 37.50, 50 cents lower; boars over 300 lbs 31.00, tew eany sales 32 50-33 00. Sheep 300, all classes steady; choice and prime 95-120 lb wooted slaughter lambs 52.00-55 00; choice and prime 95-150 lb shorn slaughter lambs with No.

1 2 pelts 54 00-57 00; utility and good slaughter ewes 16 00-24 00, choice and fancy 60-B5 lb feeder lambs 56.00-62.00; 85-100 lbs 53 Dvna 770 Indusl 443 Incom 8.44 95 18 Beche ChancHr: Fst Investors: Bnd Ap 13.92 15.01 HI Inc Incom Muni UtScI Vang Utd Svcs 1278 13.97 975 1066 6.31 6.57 9.52 1040 11.33 1218 6.02 NL 100.10 100.14 83.5 83.21 .1 82.2( 83.28 .11 83.3 84.3 1 0.20 90.28 .2 102.4 102.12 .2 NL NL NL Bnd db 9.30 10.16 Dev Gl 16 41 17.93 Incom 2.70 2.91 Lutheran Bro: Fund unavail Incom unavail Muni unavail US Gov unavail Mairs Grt 1580 N.L. Inc 29 8 5 N.L. Mast Flnand: MIT 12.44 1341 MIG 12 66 13.65 Disco 8.65 9.67 HiYld 968 10.38 HiMun 13.25 13.87 NwDecad 13 99 15.00 TaxEx 100 NL 12.04 13.16 4 69 7.31 Pru SIP 13.25 1448 Putnam Funds: 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1982 1983 1983 1983 1983 1983 1983 1978-83 1983 1983 1983 1983 1983 1983 1983 1984 1984 1984 1984 1984 1984 1984 1984 1984 1984 1985 1985 1975-85 1985 1985 1985 1985 1985 1984 1984 1984 1984 1987 1987 1987 1988 1986 1988 1989 1989 1990 1990 1990 1990 1987- 92 1992 1988- 93 1993 1993 1988- 93 1993 1993 1994 1989- 1994 1994 1995 1995 1995 1995 1995 1993- 98 199( 1994- 99 1995- 00 1995-00 2001 1994-01 2000-05 2002-07 2002- 07 2003- 08 2003- 08 2004- 09 2004- 09 2005- 10 2005-10 Grwlh Incom Oom Stock 83.5 83.13 .7 488 13.88 13.44 13.65 1347 782 (84 13.27 1362 13.30 1338 13.44 13.41 13.48 1342 12.09 1335 1342 13.35 Conv 13.38 1462 742 8.03 87.22 .3 NL NL 7.35 Tax Ex 8.07 Beac Glh 12 24 Beac Hill 12.66 Berger Group: 100 Fd 13.14 101 Fd 10.18 Value Line Fd: Fund 1474 1717 kxom 676 6 93 Lev Gt 17.04 17 48 Spl Sit 11.29 11.58 Vance Sanders: 870 963 NL NL 8.81 2198 ml Eq Georg Grwth Hi Yld Incom Invest 44WIEO 44 Wall Fnd Gth MID 14.95 1612 4.4 9.14 79.14 79.14 7530 82.14 94.4 NL 16.42 17 95 1274 13.92 1161 1298 1473 15.80 566 6.07 9 31 10.17 1374 15.02 5.17 5.65 MCD 9 95 10 87 Founders Group: MFD 7 53 Boston Co: IPI Inc 11.84 12 80 Jhn Cap 26.41 NL Sost Fnd unavail Bun Bear Op: Exhibiting the work of YA4COU AG AM Sculptures, Multiples, Serigraphs February 28th March 14th Gallery Hours: Monday-Saturday 10-6 p.m. Thursday 10-9 p.m. Opln Grwth 845 Incom 1490 NL NL 1176 20 23 11.83 12 75 1134 12 23 7 80 8 19 6 22 671 2273 NL 75 5 623 NL 9.66 Invest CapEI Comm DeBstf 4943 684 MFB MMB MFH Mathers Tax Ex 1789 1878 Vista 1409 17.58 94.30 77.14 10 13.53 12 13.19 Capm 11.11 NL 3261 NL Mulel 9.59 10.48 Sped 21.41 NL Franklin Group: AGE 346 373 Brown 5 54 5 97 78.18 .4 80.

18 .4 13.28 13.20 Merrm Lynch: Vovag Ralnbw Revere 14.59 15.95 3 72 NL (.26 NL Caolt 13 19 Golcn 13.54 NL NL Overs I 87.8 .10 13.24 Calvin Bullock: 84 .2 5.82 DNTC Bulk 1592 1740 NL NL NL NL 13.35 14.39 7.64 6.24 48 52 6093 7951 38 32 48.22 8.63 9.43 74.30 .4 87.1 7 97.25 7 83.12 .10 Safeco Sacur: Eoui! 1163 Grwlh 16.41 Inco 10.92 ExBsl ExFdf FidEI ScFidf Sped Meat futures 12.54 13.19 1342 4.31 12.75 NL NL NL NL May May Jun Aug Aug Aug Sap Dec Fab May May May May Aug Aug Nov Fab May Aug Nov Fab May Nov Jan May Nov May Nov Fab May Aug Nov Aug Aug Fab Fab Fab Aug Aug Nov Feb May Aug Nov Fab Feb May May Nov May Nov May Fab Aug Feb Aug May Feb Nov Aug Nov May Nov Fab May 1216 13.01 1841 1974 972 9.60 777 8.09 9.84 10.25 978 9.98 978 9 88 (56 692 6 80 7 08 10 80 11.55 12 00 6 25 Basic Capit Eou Bd Hi Inc Hi CHI IntTrm LlMal MunHY Muniln PacFd Spl Val Mid AM 47.11 .3 14.43 1577 Grwth Ulils Incom US Gov Capit Equll Funds Inc: 4.08 1.89 644 9 27 5.82 440 2.04 694 999 6.27 'CHICAGO (AP) Futures trading on the Chicago Mercantile Exchange Friday: 16 5.94 Vanguard Group: Candn CMvid Hilnc Month Nl WS TxFre Cnl Shs Chart Fd Cho Dlr Exptr 26.27 SiPaul invest: Capit 16.02 17.04 Grwlh 1334 14.19 Sped 22 45 NL Scudder Funds: 83.18 45.31 48.31 68 2.92 3 19 11.02 11.88 9.69 10.59 9 36 10 23 9.15 9.61 1072 11 56 18 84 20.59 20.50 NL 35,78 NL LIVE BEEF CATTLE (40,000 lbs) Open High Low .19 12.23 .3 13.07 12.48 2 1323 4 13.58 Net Close Ch. 65.05 .55 65.30 9.49 NL 1269 13.02 72.10 727 Com SI 14 22 68.20 87.14 93.30 99 4 798 798 7430 82 8 3.30 74.29 94.22 778 76 10 80.10 87 (3 75.30 84 25 7.21 (2.12 44.11 82 18 44.31 48.23 47 72.2 71.31 74 1 82 18 72.9 80.14 832 82.24 81 24 9518 88 18 437 834 49.4 44.14 67.10 90 452 44 14 42.25 44.10 471 49 30 72.18 81 12 1.4 78.28 98.10 6.39 NL Chestnut Devol 2003 MMkOpI 68.90 Cmrce Ind Tr PHot GT Pec Gete Op GE S4.S 74.17 .15 13.14 83.18 .18 5.94 64 60 67.20 67.80 66.35 67.55 6875 65 42 68.20 68.90 67.42 6867 68.75 15.97 Colonial Funds: Apr Jun Aug Oct Dec Fab Apr 13 11 4(52 10.34 1(34 7.31 47 50 NL NL NL NL NL NL NL 67.42 68.67 4875 NL NL NL NL NL NL NL NL NL NL NL NL NL NL 15.64 29 53 72.25 .3 80.24 .4 Incom Intl Fd MMB Sped TxFre NL NL NL NL NL NL 9.07 GESS Lg Ind Tr GNMA Ivesl Morg MuHY MuSht Mulnt MuLg ODIv I QOIv II TrsrCo Wetlsl Welltn rGBnd HIYBd Wndsr 17.41 645 1285 11.20 (.97 1062 9.23 1192 703 2113 1106 10.17 7.25 8.33 10.66 84.2 83.2 Fund 11.15 12.19 Grwth 7.99 6.73 HI Yield 6.64 7.48 Incom 6.26 6.84 Ootn 1068 11.67 Tax Mg 15.21 16.62 .99 1215 17.09 Security Funds: 1320 4.54 13 19 1321 1329 1325 12.04 484 Est. tales sales 11,524. Prev day's open Int 45,494, up 43. FEEDER CATTLE il.J I I ITLJCn Akl 1 771 7.90 822 95 26 .1 88 24 43.23 7 84 4 .2 Bond 7.57 Eouty 723 425 725 4.00 4 75 788 7.50 8.43 843 9 00 4.13 8.75 10.13 300 10.50 10.38 1243 11.50 7.00 3.50 (.50 7.88 8.38 11.75 00 8 25 7 43 788 838 875 13 10.38 11.75 1000 12.75 Gen Sec Gnti Ind Hamilton: HDA Grwth Incom Hart Glh Colu Glh 20.33 NL 119 906 567 992 MONY 12.52 1368 MSB Fd 1857 NL Mut Ben 1071 11.70 MIF Funds: Fund 152 9.21 Grwth 557 602 NetBd (48 9.17 Mutual of Omaha: Amer 9.94 NL Grwth 503 547 Incom 8.18 Tx Fre 1007 1095 Mut Shr 43.74 NL NaessT 40.44 NL Nat Avia 951 NL Nal Ind 1S.37 NL Invest 9.67 10.57 Cwtth AB Cwlth CD 121 1.31 169 183 NL IS 12.64 12 1285 49.22 44.20 NL NL NL 6K 1160 26.54 NL 901 969 9 40 10.11 Comp Bd Comp Fd Mar 7085 70.85 69.47 Apr 72.30 72.30 70 87 May 72.65 72.70 71.15 Aug 7307 7307 71.57 Sap 72 80 72 80 71 50 Oct 72.65 72.65 7) 20 Nov 73.00 73 00 72.00 Jan 72.70 72.70 72.70 6980 -117 ta grj, iii i nCrxAM 7112 1.25 Eil? i 'llllr MORNING WORSHIP I -M I Jmilf 1 Hart Lev NL Concord 20 01 NL 162 57 Herok) NL 47.24 .4 12.94 90 6 .10 13.14 65.18 .4 12.78 44.30 .19 12 64 Connecticut Genl: Hor Man Ultra 9.10 995 Selected Funds: Am Shs 7.75 NL Sol Shs 17.08 NL Sefroman Group: Broad 12.87 13 82 Nat Inv 55 9 22 Cap 9 59 10.34 Un Inc 1109 11.96 Sentinel Group: 22.48 24 30 6.93 9.58 INA HiY ISI Group: 12.38 43 9 44 24 67.16 70.6 Nal Securities: 10.27 11.07 Vlkinglnc 1.00 N.L.

W.HSI 7 91 8 65 Weln Eq 28.32 NL Wise Inc 3.42 NL Wood Struthert: deveg 50 56 NL Neuw 14.00 NL Pine 13.15 NL NL No load (sales charge) Previous day's quote. 12.43 1243 12.65 1248 12.80 12.89 Grwth 600 6.56 Incom 3.52 315 Trsl Sh 979 10.68 TrPa Sh unavail Industry 6.85 NL Balan Bond Dlvid Grwth 72.24 .4 81.20 .8 Fund 13 18 14.25 Incom 6 10 6 59 Mun Bd 7 03 7.60 Cons Inv 12.87 13.37 Conslel 19.25 NL Constitu unavail Con! Mut 7.16 NL Clry Cap 16.10 17 41 Dlr Cap 2.14 NL DodCx Bl 23.55 NL OodCx St 20.46 NL Apex 3 93 4 30 Balan 7 08 7.74 331 3.64 5.43 5.85 (.44 602 6.49 6 02 4.49 10 69 11.53 1.01 (.52 91.12 79 4 8.14 Est. tales sales 2333. Prev day's open int 10,430, up 285. HOGS Apr 44.75 44.75 43 40 43 52 Jun 50.30 50.30 48 8 48 87 Jul 52.05 52.05 50 87 50.87 Aug 51.40 51.40 49 95 49.95 Oct 50.45 50.62 49.12 49 12 Dec 53.90 53 90 52.4 5 52.45 Feb 56.75 5675 55.00 55.00 Ett.

tales 8.838;Prav. sales 10 773. Prav day's open int 21,654, off 328. PORK BELLIES 19 1273 .2 12 94 Nov 2005-10 1349 1474 12.27 13.41 24 03 NL 21.76 23.67 Com Grwlh Sequoia Sentry 1273 1347 11.96 12.66 9 09 9.47 10.60 11.54 Itcap HY ItCap Ind ItCapTx Int Invst i mii "REVISIT THE MOUNTAIN" 1 I 50th St. between lames Knox Iv.

S. chukmschcxx 1 PASTORS 10.00 and 11 00 A.M. I Paul M. YoungdoM I I Carl O. Nelson, Laurel V.

Lindberg 2 00 9 Mark P. Wiberrj, Craifj E. Johnson Director of Music Organist 2 00 l- Jeffrey Rule Dr. Robert Oerglund Morvin Busse IS Treasury notea. Incom Slock Tax Ex Bid and asked prices quoted In dollars and thirty seconds Sublect to Federal taxes but not to Stale Income taxes.

5035 52 53 National over-the-counter Mar 52 00 52.40 50 35 May 54.20 54.30 52.55 Jul 56 10 56 10 54 07 Aug 54.60 54.85 53.20 Feb 64 50 64 50 64.10 54 07 53 20 64.10 Cash grain Est. sales sales 12,362. Prev day's open Int 13,365. Minneapolis Associated Pratt, from USOA Sales (lOOl)BldAtk 11 10.7 11.1 Sales (lOOt)BldAsk 1 12 4 130 62 177 18 1 Osmonics rmm.m InfrntGas Sales (lOOt)BidAsk Conwed 2 146 150 Coors 413 14 1 144 DanlbergEie 55 3 7 4 0 DaigCorp 4 5.4 6.0 Datacard 116 147 15.1 ImOairyQn IntRevGP htvCpAmr Jerncho Kahier 251 53 54 NASDAQ quotaliofli indicate higher) bxh and lowest oHeri from market maeen eocti te-curity at of 3 (Mmneapoiit timei PfKttoo not include relwl markup, markdown or commti-uon. Voktmt represent triorei which changed ownert during the day.

and inclvdtt odd Ion iguret mekide only iom trani-gcttom etteded by NASDAQ market maker, out may include tome dupkcotion where NASDAQ market maker, traded with each other. Sales 79 6 6 9 1 7 UO 144 29 6 0 8.4 1244 31 5 31.6 28.0 31.0 10 13.4 14.2 404 1.4 17 0.4 06 17 19.0 20 4 12 7.2 7 4 S3 44.0 45 4 I 87 92 DataAAetrlc DafeScooe OecisnDaia Dekalb KOA KavLeb Kayol KeldonOII Kinnard Kroy LSupPwr LelsureDyn 26 19 4 20 2 32 3 6 3 7 213 41.0 412 10 6.4 7.0 13 4.0 4.2 22 19 0 20 0 2 74 (2 43 19 0 194 30 2 2 2 6 140 2.7 3.0 20 1.5 16 Wheal receipts Friday 244, year ago 123; spring wheat cash trading basis unchanged to down prices down 2'i to down No. 1 dark northern 11-17 protein 4.34V-5.19W. Test weight premiums: lero lo one cent each pound 58 to 40 lbs; one cent discount each Vt lb under 58 lbs. Protein Prices; 11 per cant, 4 36'i, down Th; 12, 4.39, down 13, 4.51 'i, down 14, 4 town 4'1, 15, 4.16'4, down 2'); 16, S.11'4, down II'; 17, 5.19',down ll'i.

No. 1 hard Montana winter 4 47', down 4'i. No. I hard winter 4.39'a, down 12vs. No.

1 hard amber durum, 6.10-7.75, unchanged to down diversion 6.10-7.75, unchanged to down discounts, amber 75; durum 1.50. Corn No. 2 yellow 3.2244, up (7. Oats No. 2 extra heavy white 2.24, up 2 to down 1.

Barley, cart 126, year ago 83; Malting 65 PI, Larker 3 70-3 90 nominal, unchanged to down Morex 3 down 5 to down Beacon 3.65-3.85, unchanged; Glenn 3 80-4 00 nominal, unchanged; teed 2.88, unchanged; Duluth 3 05, unchanged. Rye No 1 plump 90, unchanged to up Rye No. 2 unchanged. Flax No. 1 15, unchanged.

Soybeans No. 1 yeHow 7.06, down Vi. Sunflowers 11.35, unchanged; Duluth 11.45, Ottartail PacGamble Pabst ParsSvsl Pavless PearChn Pentair PentalrPfd PtiotoConl PionHBr PotonsOil PolarlsRas Possls Research Reuter Rockor Rodac SiMComp SUuda SlPaulCos SAFE Schaak ScientltCom SdMedLf Sheloahl 38 21.2 21.4 149 15 4 15.5 50 20 0 20.4 134 14 5 16.6 122 13.4 20 20 I 20.3 I 23.4 23 6 4 30 32 158 38 5 3( 7 102 1.1 1.2 71 10 1.1 1 5.6 60 12.2 13.2 29 10.4 106 177 115 11.7 113 2.3 2.4 2 1.0 1.6 (4 24.2 25.2 25 38.2 38.3 4.6 5.2 15 66 90 69 106 11 2 10 10.2 110 6 1.6 2.0 10 2.6 3.1 LSAA (lOOs)BldAsk AdvCirc MagnelCon 2411 21.2 22.0 McQuiv (9 14.6 15.0 590 18.1 1(2 2 1.3 1.5 MedlcalDev MedSerco Mentor AdvClrUts AdvCirWIs AdvUnltd AirWis AlexAlex 32 61 26 3 1 59 5 0 5 2 179 9 6 9 7 246 12 5 13 0 44 2.3 3 6.6 8 6 7 6 9.0 2.0 2.6 4.6 5.2 169 20.2 20.3 1032 33 4 33 6 28 9 0 9 2 20 8 6 9.4 5 16.3 16.5 158 7 5 7 6 1 1.3 1.5 MinnFab Mtkalnc 4 MlracteRec 2.6 3.2 1.4 1.2 2.7 2 6 27 Deltak Dexon Dicomed Donovan Drexler Dynamic Dynasonlct EarthScI EconLab Econotherm Empllnc EnplreCm EnergyShed Erickson FabrlTek FarmHousa Feylnd lslBankSvt FstMidwest Flame FlexSteet FlightTrant FloraFax Florocarbon FossilOil HBFuller GiKServ GaoRes GotdMeoel 13 5 9 7J 1 WrSteak MitralMedC 38 5.4 5.5 5.6 56 57 8 6 9.2 ModCtrlCom 10 1.6 20 2.3 2.5 SlatesmanGp 64 51 3.0 344 41.4 41.6 2.4 07 tie i r-v, 4 ModCtrlUts ModClrlWts ModMercti 1.0 Amedco Analysllntl Apogee Argonaut Astrocom Banksofla BkCorpMont BriggsTr Brittech BuckAAears ButterMig ButlerNafl CPTCorp Chicago 3.6 25 67 64 3.3 25 80 10 53 6 26 0 20 0 1 210 21.4 1.0 1.4 2 33 40 26 9 0 9 2 17 28 0 21 2 3 17 22 298 34 6 37.2 2.5 MoxaEnery 106 12.2 12.6 MTSSvs 5 26.0 26.6 MurphvMtr 3.6 44 SleernsWtg SlernLlg SiormKing Sunslar Suntec Tampax Tennanl TSIInc TwnCtyBg 2.2 658 30.2 30.3 74 (4 I 6.2 6 6 12.2 126 13 70 72 6 3.7 4 1 12 14.4 15.0 277 3.1 3 2 82 14.7 15 1 3 13.4 14 0 55 6 7 7 2 12.0 14 0 2 11.4 12.0 CentMlg Wheat was nominally lower Friday; basis unchanged; corn was nominally higher; basis unchanged, rail car receipts were 21,000 bushels; oatt were nominally higher; basis unchanged; soybeans ware nominally lower; basis unchanged. Truck receipts: wheat 13J27 bushels; corn 163.829 bushels. Wheat No 2 hard red winter 3 82' in; No.

2 soft red winter 3(2n. Corn No. 2 yellow 349 (hopper) 3 394n (box) Oats No. 2 heavy 2 32 'in. Soybeans No.

1 yellow 7.25n. No 2 yellow corn Thursday was quoted at 3.47'n (hopper) and 3.37'jn (box). 14 32.4 34 0 1 94 100 102 152 1 54 18 29 0 30 4 67 16 0 16 2 1 120 130 CnNatlBkSh 321 4.7 50 CenturaEn 274 15.4 15 6 ChiChltnc 122 227 23.1 CWNWTran 113 57.0 57 4 NatlCitvBk 126 9 1 9.3 NariComp 1 19 2 20 0 NelworkSys 235 34 0 34 4 Nicolat 107 2) 0 21 2 NWNL 201 28 4 28 6 NWPubSvc 5 134 136 NWTeieProd 10 2.1 2.3 Norstan 19 14 0 14 .4 Norwesco 92 10.4 NuggetOII 191 46 5 0 NutrllionvVId 20 26 3 2 CHdfceoubtc 555 157 160 OlvBrew 5 12.5 13.1 Greco 10 16.4 17 4 ChiktsWId 47 56 57 Vaimont Vandusen VersaTech VTNCorp vVashSci Walerlnsl WebbCo WeighTronix WslnSlates Comsarv 44 2 3 2 5 43 7.2 7 5 30 3 1 3.3 14.4 15.4 5 18 4 19.4 3 13.2 14.0 619 44 4 5 MawkeveBk 4 147 15.0 Hawkins 9 3.4 42 Honlnd 31 17.6 1(0 ImmunoNuclr 15 13 0 150 Infolnn II 11.2 11.6 32 142 14.4 42 6 4 4 7 4 10 2 10.5 75 3.5 40 3.7 4.0 ConsulCom ConsulUts ConsulWIs Contec Gold and silver 1 't Wli i Gold: Yesterday's afternoon fixing in London S489.00. Yesterday's Engelhard late-morning telling price, New York $489 00. Silver: Handy Herman, New York 12.400 per Iroy ounce.

Hi' We're Double and Dallas Ruud. Our dad Brian is special to us1 He is coming to Minnesota for five weeks of power packed preaching and we'd like to invite you to hear him. We think he is a pretty good preacher, but then we heard too many others. TV Week-r-I all HQS? ml- Hf At HOUR0F DECISION SUNDAY with CLIFF BARROWS GEO. BEVERLY SHEA TEDD SMITH FIVE BIG WEEKS! 7:30 P.M.

Nightly AihI that too bad. liccause it will nlrcady be a difficult time, timided by grid'. With arrangements to make and details to take care of. It's just not easy to make the selection or cemetery clearly, fcspccially if' the ordeal is complicated by cold weather a rushed schedule and heavy snow, ikit that's hat it usually conies down to, if you don't take it upon yourself to make the decision. If you did, vou could do it at a time when the mo(x) isn si somber, and when you have more time to carefully examine the relative benefits of cemetery property and make an intelligent purchase.

Don't let someone you love inherit the decision. Make it yourself! Wisely, unhurriedly, calmly For a five brochure call 822-2171. March 3-5 March 6-14 FERGUS FALLS Armory DETROIT LAKES Junior High Auditorium CATHEDRAL OF PRAISE 84th Penn Ave. So. MANKATOJRINITY CHURCH North Mankato Sherman Webster Avenue March 15-29 newooi March 30 April 5 KTIS 2:35 PM 900 KC WCC0 11:05 PM 830 KC Ixikt wood Cemetery 3rX) lennepin Ave 4 -4.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Star Tribune

- Archives through last month

- Continually updated

About Star Tribune Archive

- Pages Available:

- 3,157,563

- Years Available:

- 1867-2024