Florida Today from Cocoa, Florida • Page 40

- Publication:

- Florida Todayi

- Location:

- Cocoa, Florida

- Issue Date:

- Page:

- 40

Extracted Article Text (OCR)

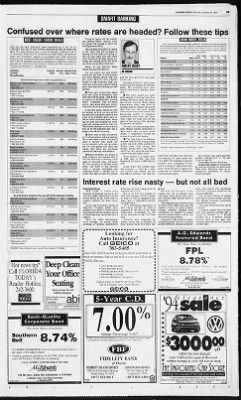

"1 FLORIDA TODAY, Monday, October 31, 1994 5E I Confused over where rates are headed? Follow these tips if Here are the annual percentage yields the largest-asset Melbourne-area banks and thrifts were offering on Oct. 28. Yields are based upon the institution's compounding method and the interest rate stated for the minimum deposit required to open an account, which might vary. Higher yields might be offered, such as for larger deposits. CDs are based on fixed rates.

INT 6-MO. 1-YR. 2.5-YR. 5-YR. BANKS MMA CHECK CD CD CD CD AmSouth Bank of Ft 2.27 2.02 382 Tzi S.25 6.14 American Bank of the South 2.52 1.92 4.30 4.76 5.11 5.40 Bank of Central Florida 2.28 1.76 4.30 4.55 6.15 5.35 BarnettBank 2.50 1.75 4.10 4.55 5.30 6.00 Beach Bank of Vero Beach 2.50 ,1 85 5.00 5.10 5.35 5 85 First Union National Bank 2.50 1.65 4.10 4.50 5.50 6.10 NationsBank 2.50 1.6S 4.10 4.55 6.95 6.95 Reliance Bank of Florida 3.00 2.00 4.50 5.25 5.85 6.25 Security National Bank 2.78 2.02 4.06 4.58 535 614 SunBank 2.50 1.75 4.10 4.50 5.50 6.10 United American Bank 2.50 1.82 4.50 4.75 5.35 6.11 THRIFTS pora) Gables Federal 2.02 1.26 4.08 4.47 5.26 6.05 First Federal of Osceola N.A.

1.30 4.75 5.20 5.70 6.45 Firstate Financial 2.50 2.02 4.70 5.15 4.15 4.95 Glendale Federal Bank 2.28 1.16 4.03 4.55 N.A. 5.87 Great Western Bank 2.50 1.00 4.05 4.60 5.35 6.20 Harbor Federal Savings Bank 2.50 1.60 4.50 4.90 N.A. 6.25 Indian River Federal Savings 3.00 2.02 5 11 5.30 N.A. 6.18 InterBank 3.00 2.05 5.00 5.35 5.75 6.00 Savings of America 2.25 1.26 4.50 5.00 6.18 6.50 MELBOURNE AREA AVERAGE 2.52 1.69 4.38 4.79 5.41 6.04 BRM NATIONAL INDEX 2.57 1.49 3.96 4.77 5.40 6.10 Trying to figure out the market and predict where interest rates are going? It's enough to drive the average person batty. One moment an expert is saying on the radio that the economy is heating up and rates are going to rise; an hour later you can catch some wizard on the tube saying, no, things are cooling down and rates are going to stay where they are.

Whom do you believe? What should you put your faith in? Let me throw my two cents' worth into the stew. It will prevent you from getting ulcers, and you just might wind up with a better handle on the economy than you could get from some experts being paid royal sums for handing out bad guesses. Don't get overexcited about each new sliver of economic data that that comes along. That includes reports on employment, housing starts, consumer and producer prices, and what-have-you; otherwise you'll wind up a schizophrenic. In the first place, there's no way for anyone to keep up with all the big and little economic subjects and most of us probably don't care to.

We're more concerned about keeping our jobs and making our mortgage and car payments on time. Let Wall Street continue to overreact as you sit on the sidelines and take a longer view of the economy. Don't rely on your stockbroker to tell you where rates are going. He or she doesn't know. I've yet to meet a broker who knew the correct answer to the rate question, but I've met plenty who resist the notion that there are historical patterns to the way rates behave.

Rates probably are going to keep rising for two reasons. One is that the economy is showing more signs of recovery than weakness, but the recovery is slowing down some. The other is that interest rates savings, mortgages and consumer loans always run in cycles that last at least two years, N.A. Not Available, Account not offered. 'Average Annual Percentage Yields offered on Oct.

26 by the 100 largest institutions in the 10 largest U.S. markets. SOURCE: Bank Rate Monitor, N. Palm Beach, 33408. Here are the best credit-card deals nationally as of Oct.

25 for customers who pay off their monthly balances as well as those who don't. The rates compare with a national average credit-card rate of 7.74 percent. Rates are for conventional credit cards, not premium cards, and information applies to purchases only. Cash advances frequently are charged interest from the date of transaction. Additional fees might be charged such as for exceeding a credit line, making a payment late, obtaining a cash advance, making an ATM transaction, or i if a check is returned.

variable rate. Institution Interest Annual Interest Free 1 Location Rate Fee Days From Phone Number Best deals for persons who carry balances Metropolitan National Bank 8.4V $25 25trans, Little Rock 1-800-883-2511 Federal Savings Bank 8.9 $33 25billing Rogers, Ark. i 1-800-374-5600 Simmons First Natl Bank 9V $35 25billing" Pine Bluff, Ark 1-800-534-4949 Arkansas Federal 9.5V $35 25posting Little Rock 1-800-477-3348 Central Carolina Bank-Ga. 10.25V $29 25billing Columbus 1-800-577-1680 AFBA Industrial Bank 10.25V $35 25billing Colorado Springs 1-800-776-2265 First Union 10.65V $39' 25billing; Charlotte 1-800-377-3404 a y- Wachovia Bank 10.65V $39 25billing Castle, Del. -800-842-3262 People's Bank 11.5 $25' 25billing Bridgeport, Conn.

(Union Planters National Bank 11.5V $29 25posting Tenn. 1-800-628-8946 '-''bid Kent Bank $38 25trans. Grand Rapids, Mich. 4 JlJSAA Federal Savings Bank 12.5V $0 25billing -San Antonio 't)ak Brook Bank 12.65 '25billing "Illinois 1-800-536-3000 mi 14.65V $0 25billing Boca Raton Best deals for persons who pay off entire balance monthly USAA Federal Savings Bank 12.5V $0 25billing San Antonio AFBA Industrial Bank 13.75V $0 25billing Colorado Springs 1-800-776-2265 Amalgamated Bank 13.75V $0 25billing' Chicago 1-800-723-0303 "First Western Bank 14.65V $0 25billing "-Newcastle, Pa. 1-800-837-6669 Bank 14.65V $0 25billing' Boca Raton -407-347-0007 First of America Bank 16.15V $0 25billing Kalamazoo, Mich.

1-800-423-3883 SOURCE: Bank Rate Monitor, North Palm Beach, FL 33408 Interest rate rise nasty but not all bad years from now, but with CD yields not reaching the same peaks they hit in 1989. For example, a one-year account, now averaging 4.77 percent according to Bank Rate Monitor, conceivably might pay 6.5 percent to 7 percent before the next downturn starts. spring. But with all the havoc it has caused, the rise of interest rates also gives many savers and investors choices they haven't seen in some time. The long decline of interest rates in much of the 1980s and early '90s pushed returns on many popular savings vehicles, ranging from certificates of deposit to money market mutual funds, to their lowest levels in a generation.

Consumers who borrow money benefited greatly. But for investors to profit from the decline in interest Associated Press NEW YORK Unless some stunning turnaround occurs in the next few weeks, 1994 will go into the record books as the worst year in modern memory for bond investors. In the past 12 months, yields on long-term Treasury bonds have jumped from about 5.75 percent to more than 8 percent, sending prices of these blue-chip securities into a tailspin. Since the 1970s, Morningstar Inc's average of mutual funds investing in general government ROBERT HEADY ON BANKING and the new upcycle is only eight months old. The only scenario in which rates would stop increasing and fall back down: The economy turns sour, which could lead to another recession.

The more people are confident enough to increase their borrowing, the faster rates will rise in the current upcycle. When banks make more loans, they drive up savings rates to replace the money they lend out. But even though more consumers and businesses are borrowing, studies of consumer confidence show some soft spots. That might not bode well for big gains in borrowing or for sky-high CD yields in the future. For now, the odds strongly favor slow, steady upward movement in what you'll earn on your investments regardless of what the economic oracles are saying.

The long, long view indicates interest rates are not rising as high as they did in the 1980s, and they're falling lower than during that decade. Here's what I see when I track the rate upcycles and down-cycles of the past dozen years: Rates peaked at a higher point in 1984 than in 1989. And they bottomed out lower in 1994 than in 1987. If you think that interest rates run in cycles I sure do then the current one should top out somewhere between one and two bonds has not had a single year of negative total return. But in the first nine months of 1994, that average which includes yield as well as changes in net asset value registered a decline of 3.61 percent.

It's a distressing experience to lose money outright on what is supposed to be one of the most trustworthy investments in the world, securities of the U.S. Treasury. Investors have responded by pulling money out, on balance, of bond mutual funds ever since last I LONGYYOOD OFFICE 901 East Highway 434 Lonswood FL 32750 By contrast, that same account yielded 11.65 percent in '84 and 9.5 percent in '89. Nothing but theory? We'll see. Latest rate trend: CD yields rose by seven-hundredths of a percent as Bank Rate Monitor's ratio of increases to decreases, at 13-to-l barely changed.

rates, they had to own significant amounts of long-term assets such as stocks and bonds. The several trillions of dollars they had in money market and old-line savings accounts meanwhile yielded less and less. Now that trend has been partly reversed. A money market fund investor who was getting perhaps $20 a month in interest on a $10,000 account (at a 2.4 percent annual interest rate) a year ago now receives about $35 (at a 4.2 percent interest rate). the supply rt Ask for Chris Catledge Investment Broker BC-202 5858A nee We Now Have Available FPL 8-78 Looking for i Auto Insurance? Call GEICO at 783-5485 I Since 1936, GEICO has been saving good drivers good money on I I their car insurance.

Find out how much you may save. Call us today. GEICO offers I Low down-payment I Easy payment plans I 24-hour countrywide claim service I Immediate coverage Free no-obligation rate quote I Call today for more information. Hurry of this bond is limited. Yicld to maturity quoted as of 102894.

Yield and market value will fluctuate if sold prior to maturity. Ask for a si Carol Gross Investment Broker LKXIUMWUS CWESTMjmS SIHCE ISST 262 E. Merritt Island Cswy Merritt Island, FL 452-0100 Call us today or stop by our local office: 325 N. Orlando Cocoa Beach Hot news tip? Call FLORIDA TODAY'S Reader Hotline, 242-3600. taacea i I a rWk Deep Clean Your Office Seating Watch years of dirt and build-up disappear.

abi Gill the Facility Services Division today. 723' 5003 American Business Interiors commercial interior 2015 Waverly Place design and furnishings Melbourne. FL 32901 Authorized Steelcase Dealer 74 rag Annual Percentage Yield We Now Have Available Southern Bell 10,000 minimum Deposit. Interest is compounded monthly. Rates are subject to change without notice.

Substantial penalty for early withdrawal. Call JERRY GOODCHILD today for more information. Hurry the supply of this bond is limited. Yield to maturity quoted as of 102794. Yield and market value will fluctuate if sold prior to maturity.

CALL JERRY GOODCHILD 729-0400 NEW 94 VW FASSAT only 2 left at this special discount similar savings on over 150 cars in stock FIDELITY BANK of Florida The Imported CapStope AGEdwards INVESTMENTS SJJVCE 1887 MERRITT ISLAND OFFICE 1380 North Courtenay Parkway Merritt Island, FL 32953 (407) 452-0011 134 5th Suite 102, Indialantic 729-0400 Member New York Slock Exchange (407) 830-4404 (J 1 mile north of the Melbourne Cswy. on U.S. 1 Member Member sihu AN BC-161-SMC Mon-Th 9am-8pm, Fri 9am-7pm, Sat 9am-6pm, Sun 12pm-5pm FDIC Call 7Z7-37H8 or 1-K00-ZZ6-7878 oi.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Florida Today

- Archives through last month

- Continually updated

About Florida Today Archive

- Pages Available:

- 1,856,866

- Years Available:

- 1968-2024