The Palm Beach Post from West Palm Beach, Florida • Page 218

- Publication:

- The Palm Beach Posti

- Location:

- West Palm Beach, Florida

- Issue Date:

- Page:

- 218

Extracted Article Text (OCR)

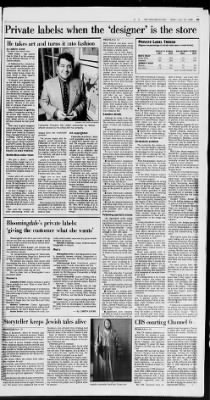

SI THE PALM BEACH POST FRIDAY, JULY 15, 1988 9D Private labels: when the 'designer' is the store He takes art and turns it into fashion Private Label Trends (Figures are percentage of private label sales In retail stores) ii mm SPECIALTY 1982 STORES 1987 MEN'S WEAR Dress shirts 14 24 17 Sweaters 18 26 11 16 WOMEN'S WEAR Blouses 9 16 5 5 Knit shirts 24 7 9 rin i 1 tw I. SHERMAN ZENTStaff Photographer Fashionlab President Mel Lisiten surrounded by framed artwork created by the artists with his company. By LISBETH LEVINE Palm Beach Post Fashion Editor NEW YORK Mel Lisiten likes to think of as his company as the Motown Records of the fashion industry. At Fashionlab Lisiten has brought together artists, producers, scouts, manufacturers and distributors. But instead of records, Lisiten brings clients the latest trends in mass apparel clothing and graphic art.

"It became very obvious that no one had ever organized this total business into an industry," Lisiten said in an interview at his West 36th Street office. Non-fashion industries, he pointed out, have benefited by treating design as a business. "In the advertising industry, there's an agency concept. In architecture, there are agencies. Motown is the same kind of company Fashionlab is today, making records." Fashionlab is part of a growing number of companies catering to the private label industry.

The company can offer clients a complete design service or simply sell them artwork for their products. Their team of ghost designers turns out products for clients that include Federated Department Stores (now owned by Campeau Marshall Field Co. and JCPenney. They've created apparel for Coca-Cola Clothes, Pepsi Apparel, Gloria Vanderbilt and Pierre Cardin. The company generates between $2 billion and $2.5 billion in retail sales and employs 160 people worldwide.

Multimillion-dollar team "We give a client a multimillion-dollar design team at a very reasonable price," said Lisiten, who charges a client an annual fee of between $135,000 and $150,000 for complete design services. Lisiten, who is 49, started Fashionlab five years ago, after selling his design business in California. He had planned to retire, but people kept calling him to do freelance design work. "At first I thought it was a novel, interesting idea," Lisiten said. "And I did it for a few companies.

After about nine months of doing this by myself, I was working almost 20 hours a day and realized that I needed a lot of help." How does the company go about determining trends and Art copyrighted Fashionlab owns the art, which is all copyrighted, and licenses it to clients for a specific time, he said. The company wouldn't reuse a pattern for a similar product, he said, but a duck print developed for a children's line might be just the thing for another client's shower curtains. One client may only want to buy artwork for sweatshirts, while another may want an entire package. Zodiac USA, for example, came to Fashionlab wanting to develop a line of clothing to complement its footwear. Fashionlab not only worked out the concepts for the stores and the 14 categories of clothing in the line, but helped put Zodiac in touch with licensees and production facilities.

"There are thousands and thousands of manufacturers who need direction," said Lisiten. "I realized that there was big opportunity in this country, not to design unusual clothing, but to design for the mass markets and to organize a company that can put out. What we're trying to do is give big companies plenty of design where they weren't getting enough." PRIVATEfrom ID $210. Wolford said most stores would price it around $190, saving the consumer $20 and still allowing the retailer a healthy profit. A recent tour of local department stores turned up some of the price discrepancies in private label designs.

At Burdines, a fully lined, double-breasted women's suit in viscose and linen by Kasper for A.S.L. cost $190. A similar suit by Lauren Alexandra (a private label by Burdines' parent company) was marked down from $179.99 to $129.99. But a striped cotton men's dress shirt in Lord Taylor's Kensington line was priced at $45, the same as the Perry Ellis Portfolio shirt sitting next to it. A few other examples: At Lord Taylor, an Ellen Tracy silk shell for women with a button back was selling for $92, while a similar private label top was "specially priced" at $44.99.

In the juniors department at Burdines, cotton miniskirts from the Generra Collection were marked down from $28 to $19.99. A skirt from the store's Club Coconut Grove line was selling for $18. Examine details Although the styling in the garments is similar, quality may vary. The consumer should examine the quality of fabric and finishing details. Private label apparel is nothing new to the industry.

It has long been a staple in men's suits and has traditionally filled a store's needs for basic items such as crewneck sweaters or sweatshirts. In the past few years, however, private label clothes have become outright fashionable, and retailers are promoting their own lines with fervor. Private label merchandise moved from a back-seat position in the industry to become a driving force. Consider: Spitalnick and Co. dropped its own line of women's career clothing in March to concentrate on its more profitable private label business, said vice president Bill Spitalnick.

The company makes clothing for stores including Burdines, Brooks Brothers, The Limited, Nei-man-Marcus, Saks Fifth Avenue, Casual Corner and Macy's. The Leslie Fay Cos. blamed poor quarterly earnings earlier this year on the growth of private labels. Many brand-name manufacturers are increasing their private-label output or creating a separate division. Last fall, Spiegel featured an Anne Klein outfit on the cover of its main catalog.

For fall '88, a private label ensemble takes over this prime position. Following specialty stores The department stores diving into private label goods are following the lead of specialty stores such as The Limited, The Gap, Ann Taylor and Banana Republic chains that owe their success to the strength of their own labels. The Limited, which has more than 700 stores in the United States, is completely stocked with exclusive merchandise, from earrings and pantyhose to clothing. Its own labels Forenza, Outback Red and Moods by Krizia are consistently among the top-selling lines of women's sportswear in the country. The number of store-controlled labels has more than doubled in the past five years, according to a study conducted by KSANPD, a research firm in New York, and commissioned by Kurt Salmon Associates.

The study shows that 11 percent of all men's, women's and children's clothing bought in the United States can be classified as private label. Besides higher profits, there are several factors fueling the growth of private label: Designers are opening their own stores, often a few doors down the mall from a department store carrying the same label. American designers who have entered retailing include Ralph Lauren, Calvin Klein, Adrienne Vittadini, Liz Claiborne, Esprit, Tommy Hilfiger and Willi Smith. Department store mergers are likely to result in consolidated buying offices, making private la- turning them into marketable products? The process begins with the shoppers, people employed by Fashionlab to report on what's happening in stores and on the streets all over the world. Fashionlab has shoppers in Tokyo, Los Angeles, London, Paris, New York and Italy, and plans to add more, Lisiten said.

Artists at Fashionlab studios then work from these ideas for example, an art deco theme to develop artwork that is used on products and clothes. Fashionlab has studios in New York, London, Florence and Como, Italy. "Right now we have 9,000 paintings open to use," Lisiten said. "Fresh paintings that have been developed along trend lines of what we see going forward, whether it would be in menswear, women's wear or children's wear, home furnishings or accessories. All of this art will find its way eventually into one of these areas." The company now has 40 working themes in its repertoire, filling drawers in the studio with everything from African art to nautical looks.

and a half ago rently centers on DEPARTMENT STORES 1982 1987 Source: KSANPD Purchase Panel kinds of things," said Carey Watson, senior vice president of mar-; keting for Burdines. "There was a need for us to develop private label goods that we could deliver when the market was right for us." Burdines' recent additions to its private label lineup include Club Coconut Grove in juniors and FLA in ladies' active sportswear as well as in sheets, towels and cosmetics: Most department stores will not disclose what percentage of theiri business is devoted to private label, Ed Johnson, a retail analyst and, director of the Johnson Redbook Service, which tracks consumer buying trends, figures that private label goods now account for 20 td 25 percent of the merchandise in department stores. While industry experts all fore-! see continued growth for private1 label, they differ as to how much; Robert Campeau, chairman of Campeau whose retail take! overs have put stores including Bloomingdale's, Burdines, Jordai Marsh and Maas Brothers under his control, has said he would like to see private labels grow to becom 35 to 40 percent of his stores' busij ness. i Mel Lisiten, whose company, FaJ shionlab produces private Ia4 bel lines for about 50 clients, pref diets store-controlled names will eventually account for two-thirds of sales for major retailers. I Paving the way for the growth of private label is the decline of th designer name.

i "I think we're leaving the design er era in that people aren't really affected by designer cars and de)-signer pens," said Carolyn Egan-fashion editor of The Tobe Repeii, a trend forecasting newslettg "There was a point that anything designer put his name on was more desirable. I really think the American population is maturing in selection of what they buy more sophisticated." Designer Norma Kamali -K-lieves the fashion industry is about to undergo profound changes. "I'm told that designer thingsjnp longer are important in th age," Kamali said. "I think Tot this promotion of title is about Wte dated, and I sense that's one of better things that will happen to the industry." Kamali, who designs groups of bathing suits and sportswear exclusively for Bloomingdale's, creates the samples, then leaves the fabric buying and manufacturing to he store. Most experts agree that priae label clothing will not put out of business.

The squeeze is most likely to be felt in the iflid-dle, they say, among the EvanjPj-cones, Russ Togs and Leslie FayVof clothing. Wolford sees private labels hurting designers' secondary lines, which are aimed at carejpr women, as stores continue to promote their own lines in this lucrative area. Too much private label merchandise, on the other hand, will hurt retailers in the long run, analysts say. 3 "They're going to lose their customer base if they neglect name-brand merchandise," said Dan Wewer, vice president and retail analyst at The Robinson-Humphrey Co. in Atlanta.

"They should use private label to complement, rather than replace, name-brand merchandise." Customers who are used to relying on designer names don't seftin to be shying away from these store-created labels. "I think a lot of customers argpf the opinion that they're paying too much money for a label," said consultant Kirk Palmer. "They're more interested in fit, quality and construction than the actual label." Channel 6 mored to then have gone to Channel 6, where they were warmly received by its owners, TVX Broadcast Group. "I know absolutely nothing about such a meeting ever taking place here at this station, and I certainly would be among the first to said Charlie Folds, Channel 7 director of community affairs and public relations. "To the best of 5ny knowledge, nothing has changed with our situation.

We plan tQte with NBC until our contract expires January 1, 1989, at which time we'll be affiliated with either NBC or CBS depending on hOw things go." However, Skipp Moss, Channel 6 vice president and general manager, confirmed CBS had been in contact last week with his station and described the network executives as being "extremely receptive' to the idea of buying his station for a reported $60 hillion. Bloomingdale's private labels: giving the customer what she wants' bels more economical to manufacture. Chains such as Federated Department Stores (now owned by Campeau Corp.) have developed private label lines for the entire chain. Retailers can give consumers what they're asking for instead of what designers are offering for the season. If Calvin Klein is making only thigh-high skirts, the retailer can manufacture its own mid-calf length skirts to give consumers a choice.

Brand names such as Cherokee, Chic and even Levi's have lost some of their appeal to upscale retailers as they've become available at stores such as Sears Roebuck Co. and JCPenney. Department stores are also tired of competing against discount and outlet stores carrying the same merchandise at a lower price. Stores have fallen into the trap of "me-too merchandising," Wolford said, and need exclusive merchandise to set them apart. Exclusivity problem The exclusivity that makes private label merchandise appealing to the retailer holds one obvious disadvantage for the consumer: If no one else is carrying the line, there's less incentive to mark it down.

When Bloomingdale's started its swimwear sale in June, all of the '88 bathing suits were marked down except the Norma Kamali collection, which is exclusive to the store. On the whole, however, experts say consumers benefit from buying private label apparel. "I think (consumers) are saving money with private label merchandise and getting a good value for their money by and large," said Kirk Palmer, president of Kirk Palmer Associates, a consulting firm for the retail industry. The way that private label takes shape varies greatly, depending on the degree of the store's involvement. For instance, Neiman-Mar-cus may call a manufacturer and place an order for 5,000 cotton sweaters bearing the store's label.

Other retailers design the garments themselves or work with a manufacturer on the design and fabric. Among department stores, R.H. Macy with an in-house design staff of 80, is generally acknowledged as the leader in private label. Macy's executives say private label merchandise now makes up 30 percent of its apparel, up from 6 percent in 1981. Bloomingdale's has created seven women's labels, 12 men's lines and five children's brands, said Shawny Burns, fashion director of branch stores.

Stores must usually work on their private label lines about a year in advance, particularly if the garments are made in the Far East and Southeast Asia. It sounds easy enough, until you figure in the unpredictability of fashion. If, high waists suddenly replace dropped waists, stores may find themselves with thousands of unwanted dresses on hand. By manufacturing in the United States, retailers can reduce the process to three months. Combine the unpredictability of fashion with the dropping dollar overseas, and it's obvious why more and more companies are turning to U.S.

manufacturers. Private label has long been crucial to keeping Florida stores stocked with cotton T-shirts in January, when Northern stores are filled with coats. "One of the things that's different when you're a Florida store is when the market is offering you wool sweaters and wool pants, you're still selling summer-weight CBS courting MICHALSfrom ID Most TV industry observers expected the two stations to swap immediately after the sale of Channel 4 to General Electric, NBC's parent company, was approved. But Channel 7's owner Ed Ansin refused to let NBC out of its contract. Because NBC has both the Seoul Summer Olympics and the World Series this fall, Ansin has been reluctant to give up his lucrative NBC affiliation before the contract's expiration or at least until after the broadcast of those two premiere events.

One rumor has it CBS presented Ansin with a $240 million ultimatum last week to buy him out. He allegedly countered with a firm $380 million asking price. The negotiations apparently were not fruitful. The CBS executives were ru Bloomingdale's decided a year that private label was important its own division, said Shawny Burns, fashion direc- -tor of branch stores. Headed by Joann Langer, the division has seven women's labels, 12 men's lines and five children's brands.

"It's not just knocking things off," Burns said. A lot of it is developing things for a lifestyle and the customer what she wants." The division also supplies store buyers with merchandise they feel is missing in their designer clothes. If the sweater buyer asks about cashmere turtlenecks, a researcher will find out how and where to get them made and the cost. Here's a closer look at Bloomingdale's more knit separates, but plans include sweaters and blouses. Bloomle's Express: Casual, weekend basics.

Comparable to Lizsport. Men's Metropolitan View: A European point of view in top-quality business clothing. Comparable to Giorgio Armani menswear. The store plans to add more sportswear. Peterborough Row: Traditional, quality clothing mainly in suits, dress shirts and ties.

East Islands: A new line focusing on casual weekend clothing with enough gentility to make it suitable for The Hamptons. Comparable to Ralph Lauren and Perry Ellis. Eastern Standards: Luxury clothing with a distinctly English flavor. Here you'll find four-ply cashmere sweaters and updated classics. Think of who else? Ralph Lauren.

City Sport: Dressy weekend wear for men who feel comfortable in Claiborne and Cacharel. Who's Next: A sportswear collection for younger men who enjoy wearing Kikit, Tommy Hilfiger, WilliWear and Marithe Francois Gir-baud. NOHO: Young, kicky casual clothing for beach types accustomed to wearing Gotcha and Jams. BAC: Short for Bloomingdale's Athletic Club, BAC is ail-American activewear, from sweatshirts to shorts. By LISBETH LEVINE enough to merit Anne Klein II of weekend ba adventurous and Cathy hiph-nuahtv such as hand- Lauren flavor.

for work. Cur- "prominent labels: vwv Women's Catherine O'Neill: Stylish clothing in quality MlrtTA'. fabrics suitable for work. Think of and Ellen Tracy. Studio Coordinated groups sics such as T-shirts and sweaters in simple styles 'And 9 wirio ran OP nf mlnrs PnmnaraWo rn I.iyonnrt tMind Lizwear.

Via 3: Clothing for the slightly dresser. It hangs near the Leon Max M-Vv-- JXHardwick lines. Mad son Collection: Classic, fT'sportswear focused on special items, knit sweaters. All with a Ralph Sutton Studio: Lots of basics Storyteller keeps Jewish tales alive www--" M. Breslovers, who refrained from drinking hard liquor because it was thought this would detract from the power of the stories, Tobesman said.

Some of Breslov's contemporaries disapproved of his stories because they were often incredible or did not seem religious on the surface, Tobesman said. Tobesman gave an example: "Once a king is pursuing a deer, but he could not catch it. The royal ministers caught up with him and said, 'Your majesty, let's go 'I must capture the replied the king, 'but whoever wishes to go back can go "That's one of his (Breslov's) cryptic ones," Tobesman said, referring to the story's underlying meaning. In Judaism, he said, the deer symbolizes gentleness, much as the lamb in Christianity, and the story is a moral about pursuing one's religious ideals. Tobesman is happy that storytelling is enjoying a revival these days, but he complains that some are telling the stories merely for academic reasons.

"(The stories) were told to elicit emotion from people, and if a story oesn't elicit any emotion from people, then it serve its purpose." CONTEURfrom ID living in Baltimore, where he teaches high school history at a rabbinical seminary. He has i JSpSJut 70 storytelling engagements a year and twice that many on an informal basis. CHis stock of stories includes Jewish tales fjpm outside the Hasidic tradition and folk tales more widely told. Depending on his audience, he Hiiwin sprinkle in Yiddish and Hebrew words. He member of the Jewish Storytellers Network j3nd storyteller-in-residence at the Walters Art Gallery in Baltimore.

SJrJis stories reflect the culture from where gffley originate, he said. Generally, your Eastern European (Jewish) Stories have to deal with a physical type of IHSppression but a spiritual freedom. As you get jafitd Western Europe, they deal with a physical ftcedom but a spiritual oppression," Tobesman said. SItabbi Breslov, like other Hasidic storytellers, deliver his stories at the dinner table and would talk for hours or even all night, Tobesman saiu. The stories wt're considered holy to the I i ft A Hasidic storyteller Rachmiel Tobesman.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the The Palm Beach Post

- Archives through last month

- Continually updated

About The Palm Beach Post Archive

- Pages Available:

- 3,841,130

- Years Available:

- 1916-2018