Arizona Republic from Phoenix, Arizona • Page 52

- Publication:

- Arizona Republici

- Location:

- Phoenix, Arizona

- Issue Date:

- Page:

- 52

Extracted Article Text (OCR)

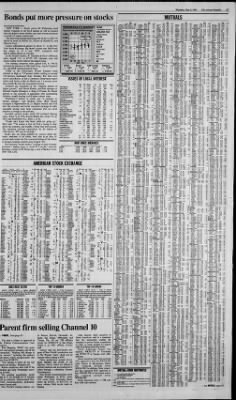

Thursday, May 5, 1994 The Arizona Republic E3 Bonds put more pressure on stocks MUTUALS Mr Otter OtKr CM NAV Pnce CM NAV Pnca CM NAV Pnxe 8.72 8.72 MAV Pnca UMBB 10 82 NL UMBHrt 9.38 NL UWBSt 16.17 NL Value 25 53 NL mEqpr 19.07 19.66 IndMfr 21.64 22.31 Insurr 18 98 19 57 MAY Pnce Munlnc 13.48 14.12 SelEq 1530 16.19 SmCao 20.09 21.26 Geven Funds: DvlpBd 8 14 156 NEW YORK (AP) The following Quotations, or suoolied bv the Narlonel Association of Securities Deel- WEDNESDAY'S MARKET Dow Jones industrial average Th NAV Pnce CM ARGA 11.92 12.19 ARMInBU.99 11 99 -AstAlB 13 09 13 09 EmMkA 10.83 11.49 04 EmMkB 1081 10.81 15 99 NL GlbEqC 16.15 NL GICEA 16.12 17.10 GltjFxB 1200 12.00 GlbFxA 1200 12 28 -M GvtAt 13.99 14.31 IntFIA 11.68 11 95 KPE 22.92 24.32 MunBA 10.93 11.18 SCapA 11.50 12.20 .1 3)3 -4)1 -3)1 i 13,697.751 erslnc. AAL Mutuant Bondo a5 10.13 CaGro 14-44 15.16 MuBd 10.53 11.06 SmCOSt 1049 11.01 Utll 9.84 10.33 AAftPktvst: BalS4.B 1436 NL CaGr 31.0S NL GlnlM 14.95 NL Gthlnc 32.47 NL HQ Bd 15.48 NL TxFBd 17.22 NL AST Funds: .14 .13 .25 .06 EmMkf 1527 16.07 .12 GIGvIn 9.18 9.66 Inntq 12.46 13 11 PfcStg 909 956 SmCos 1607 16.91 JO GvtEqty 22 58 NL Gredison McDenaJd: .04 .03 .03 EstValp 22.50 NL Gvlncp 12 53 12.79 OppValpl855 NL GHNatTE 10.06 10J3 Gmspg 14.24 NL Guardian Funds: .01 AstAII 10.66 11.16 .03 GBGInf 13.23 13.85 Park A 28 07 29.39 .01 .02 .03 .01 Tax Ex 9.23 9.66 US Gov 9 83 10.29 HTInEP 12 71 13.31 HTMgFlp 9 92 10.39 Manoverlnv Fds: BIChGrl 10.13 10 44 STGvl 9.63 9.78 LMH 18.09 NL -3)9 Landmark Funds: 4 iJ .02 -3)4 Lelsrr 38.82 40 02 .16 MedOtr 20.42 21.05 NtGasr 9.78 10 08 Paperr 17.44 17 98 ReoBkr IB. Retail 25.14 25.92 Sottwrr 25 47 26.26 Techr 38.08 39.26 .04 Telcmr 35 80 36.91 Transr 21.18 21.84 Utllr 35.33 36.42 .03 4)1 PMewty spenan: AorMun 9.70 NL GNMA 9.59 NL Govln 9.95 NL .10 .02 Hlonlr 11.90 NL .03 .06 .05 3)5 .12 .02 .01 intMunt 9.71 nl InvGrBd 9.79 NL LtdGv 9.64 NL LTG 1069 NL Munlnr 10.01 NL Shtlnc 9.45 NL SlntGv 9.46 NL ShtMu 9.78 NL FiduCao 18.70 NL 59 Wad Street: EuroEQ 29.99 29.99 PacBsn 37.87 37.87 SmCo 12.07 12.07 TxFSI 10.11 10.11 NYSE Composite volume 322,059,740 Issues traded 2,794 Advanced 917 Declined 1,212 Unchanged 665 New highs 31 New lews 53 Balan 13.77 14.46 332 Equity 14.60 15.33 Inline 9 28 9 6 7 U5GVT1 Utll 13.20 13.20 ValAdt 19.48 19. WWIn 8.64 8.64 WldWt 18 23 18 23 TCBalp 9 36 9 36 TCCort 11.98 11.98 TCInc 10 21 10.21 TCLett 1205 12.05 TCNorfp 9 34 9 34 TCSCpt 9.22 9.22 DelGrDlnsfl: uecn le.uz le.ux CXHwrl 18.03 18.03 .01 .03 Dlcpl 25.87 25.87 Dlchl 6.73 6.73 TsvRsI 9 40 9.40 .18 .01 Delewere GrouD: Trendp 13.03 13.82 Value 20.30 21.54 Delcpp 25.76 27.33 Oectrl 16.02 17.00 DectllP 12.51 13.27 Delawp 18.01 1911 IntlEqp 12.25 13 00 Oekhp 6.73 7.07 USGvtp 8 15 8.56 Treasp 9.40 9.69 TxUSp 12.05 12.65 Txlnsp 10.98 11.53 .04 .01 .01 .01 Haian 45.54 NL Inco 11.22 NL Stock 53.16 NL K01 DomSod 12.09 12.09 Dreman Funds: Contrn 13.71 NL HIRtn 15.91 NL SmCpVal 10.89 NL .01 Dreyfus: I I 1 I 3)1 -3)1 .02 .21 .01 IntlEq 11.96 12.39 USGov 953 9.68 Laurel Investor: .04 Aloe 14.57 NL CapApp 27.99 NL Itgsp 12.32 NL Into 13.46 NL MOdlp 10.51 NL SpGrp 16.37 NL TfBdp 11.68 NL .01 .01 .01 -3)7 SmCoGI 9.61 9.61 .02 USGvl 9.58 9.88 -3)1 Laurel Trust: Balncd 9.83 NL Intmln 10.39 10.39 .61 28 2 3 4 28 April .01 9.91 NL Slock 17.82 NL .47 May .83 Amex 1.40 to LeebPer 10.57 NL Lego Mason: AmLOO 9.BJ V.B3 GblGvo 9.75 9.75 Gvlntp 10.01 10.01 .10 HIYIdp 14.42 1442 InvGrp 9.71 9.71 Comp. Jl -v1 451.72 443.79 -3)3 FMHorGt 10.39 10.39 FnHrMr 10.27 10.27 .06 FlrstAmerFdsc .04 AstAIII 10.24 NL Balancel 10.54 NL .02 Eqldxl 10.42 NL Fxdlncl 10.60 NL GovBdl 9.08 NL Intlncl 9.65 NL Ltdlncl 9.87 NL MtgSecl 9.84 NL MunBdl 10.36 NL ReoEql 11.94 NL SpecEql 15.72 NL Stockl 16.29 NL First Amer Funds: A st AND 10.25 10.73 .04 Solnvp 21.35 21.35 TFIntp 14.94 15.24 TotRtp 13.75 13.75 .29 .44 .02 Harbor Funds: BOnO 10.66 NL CapAp Grwth Intl IntlGr ShtDur Value 15.87 NL 12.79 NL 23.58 NL 10.17 10.17 8.96 NL .01 .01 12 93 NL Heartland Fds: .03 U5GVP 9.63 9.63 .01 Valuep 2407 24.07 Hercules Fund: Euro VI 1031 10.31 LAmVI 931 9.31 NAmGI 9.59 9.59 PcfBVat 10.16 10.16 WldBd 9.54 9.54 Hertteoe Funds: .02 .03 CapApp 14.58 15.19 uivincp y.vo iu.31 IncGro 11.18 11.65 .02 .01 .03 .01 LmGovp 9.22 9.22 SCapp 16.13 16.93 HighMark Funds: Balance 9.66 NL Bond 10.13 NL GovtBd 947 NL Growth 9.83 NL IncGr 9.73 NL IncEq 11.64 NL SoGrEo 13.74 NL ValTrp 18.76 18.76 OF LOCAL INTEREST Emroo 14 SO 15.22 Gthlnp 10.34 10.86 UtillnD 11.62 12.20 AIM Funds: AdIGvD 9.66 9.76 Aorsvp 25.30 26.77 -333 BalAP 15.43 16 20 Charto 8 78 9.29 .01 Const 17.46 18.48 GoScO 9.40 9.87 GrttiBt 11.14 11.14 .01 Grthp 11.19 11.84 .01 HYOAP 9.61 10.09 .01 HYIdBt 9.60 9 60 Incop 7.59 7.97 IntlEp 12.75 13.49 LlmMO 9.93 10.03 MuBp 8.10 1.10 Sumlt 9.48 -331 TFInt 10.62 10.73 Utllp 12.95 13.70 UtIIBt 12.94 12.94 ValuBt 21.11 21.11 Valup 21.15 22 38 welnoo 16.98 17.97 AMF Funds: AdiAAtg 9.88 NL IntMto 9.45 NL IntlLlq 10.56 NL MtoSc 10.47 NL ARK Funds: CaoGr 10.17 NL Grlnc 10.14 NL Income 9.59 NL ASM Fd 9.77 NL Accessor Funds: IntFxIn 11.56 NL Morto NL ShtlntFX 11.88 NL Acemln 15.83 15.83 AcornF 13.29 13.29 AdsnCap 20.77 21.41 AdvCBatp 10.14 NL AdvCRetp 9.71 NL Advest Advent: Govtp 9.10 9.10 .01 GwttlR 16 44 16.44 HYBdp 8.95 8.95 Incop 12.37 12.37 MuBdN 9.24 9.24 Spclp 20.25 20.25 .02 Aetna Funds: Aetna 10.54 NL AslanGr 8.38 NL Bond 9.77 NL Growth 10.36 10.36 .01 Grwlnco 10.82 NL IntlGr 11.18 NL SmCoGr 10.48 10.48 BeuerdBteMAKarsen Diverse 12.28 NL InttEq 612 NL IntlFI 8.65 NL .01 JB2 Uteird Funds: JM Adllnc 988 10.21 BlChlpp 18.21 19.32 CapDvP 22.99 24.39 .06 bankers Trust: InstAstM 9.60 9.60 .01 InstEglx 10 38 NL nvlntTF 10.02 10.02 .01 .01 Invlnteq 13.86 13.86 invutll IU.U3 NL InvEqlx 10.32 10.32 BaronA 21.16 NL iBernett Funds: BasVI 15.32 NL Flxedl 9.88 NL Vllntl 12 82 NL Beseem 22.31 23.00 BevFundslnstt: 5T Yield 9.67 NL Bond 9.71 NL Equity 10.67 NL navFunds Invest: STYietd 9.67 NL Bond 9.71 NL Eoultv 10.67 NL BeacHII 29.60 NL IBSEmO 902 9.45 Benchmark Funds: Balncd 9.96 NL Bond A 19.29 NL DIvGrA 10.35 NL EqldxA 10.58 NL FocGrA 10.21 NL IntlBdA 20.25 NL IntlGrA 10 09 NL ShtOur 10.00 NL SIBdA 19.78 NL SmColA 11.25 NL USGvA 19.42 NL USTIdxA 19.48 NL Benham Group: AdiGOV 9.63 NL CflTFI 10.77 NL Cattln 9.58 NL CaTFS 10.10 NL EqGro 11.70 NL EurBd 10.58 NL GNMA 10.21 NL Goldln 11.60 NL IncGro 144 NL LTreas 9.13 NL NITFI 10.55 NL NITFL 11.15 NL STreas 9.77 NL TOIV95 93.53 NL TQ2000 66.92 NL TO2005 46.20 NL TO2010 33.07 NL TO2015 24.58 NL TO2020 16.88 NL TNote 10.03 NL Utllln 9.37 NL BernerOrouo: 1O0P 15.87 NL 101P 11.11 NL SmCoG 2.57 2.57 Bernstein Fds: GvSh 12.43 NL ShtDur Intour 12.43 NL 12.81 NL CaMu 13.15 NL 13.09 NL 13.08 NL 16.90 NL .02 .04 DIvMu NYMU innvai BerwynFd 18.45 NL IBerwynlnc 1 1.42 NL BMrudMC 11.07 11.75 Biltmore Funds: Balncd 10.03 10.50 Equity 10.22 10.70 Eolndx 10.20 10.68 Flxedln 9.32 9.76 OuantEq 9.80 10.26 STFIXIn 9.69 10.15 Blancbard Funds: AmerEq 9.51 NL MXIhtS 4.5 NL Flexlnc 4.83 NL .01 Lexington Gro: Cnvsec 13.72 NL .01 .01 .01 CLdr 12.45 NL GNMA 7.87 NL Globl 13.69 NL .03 .13 Goldtd 5.82 NL Gthlnc 15.71 NL Intl 10.40 NL -M SI Govt 9.70 NL StSII 3.85 4.08 3)3 Stlnv 2.22 2.36 TE Bnd 10.09 NL WldEm 12.33 NL -3)5 .01 Liberty Family: AmLdr 14.82 15.52 .01 CaoGAP 12.52 13.11 .05 EqlnAR 11.09 11.61 .01 Bloomberg Business News NEW YORK Stocks prices fell Wednesday amid further weakness in the bond market, as well as concern that the dollar's recent decline may lead overseas investors to avoid U.S.

assets, traders said. The Dow Jones industrial average fell 16.66, to 3,697.75, driven by losses in DuPont Procter Gamble Co. and Chevron Corp. Losers outnumbered gainers by about 4-3 on the New York Stock Exchange. Big Board volume was 268.00 million shares as of 4 p.m.

EDT, compared with 288.03 million shares on Tuesday. In the broader market, the Standard Poor's 500-stock index dipped 1.31, to 451.72. Oil, chemical, auto and electric-utility stocks suffered the largest losses. The Nasdaq composite index gained 0.93, to 740.30, bolstered by advances in Microsoft Apple Computer Inc. and MCI Communications Corp.

Yields on the bench-mark 30-year Treasury bond climbed as high as 7.39 percent before settling at arourfd 7.35 percent, unchanged from Tuesday. But that news drove stocks lower, as did a Commerce Department report which said factory orders in March rose 1.1 percent, more than double the rate that economists forecast. Investors are consumed by the "negative aspects of higher growth," said Steven Zenker, portfolio manager at McCabe Capital Managers in King of Prussia, Pa. Rapid growth in the economy is associated with accelerating inflation, usually leading to still higher interest rates. Wednesday's decline in stocks was "a prologue to further damage," said Michael Metz, chief market strategist at Oppenheimer Co.

Higher interest rates will slow the economy and curtail corporate earnings, he said, especially among some large companies that are most sensitive to swings in the economy. So-called cyclical stocks which fell included Maytag down at 18; Knight-Ridder down at 58; and Ford Motor down 1, at 60. "People can't forget 'why bond yields are going up," Metz said. "The reason is that the Fed is trying to slow down the economy, and frankly, I think they will succeed. The optimistic earnings expectations for the balance of 1994 and for 1995 may be too high." Stocks also are being clubbed by concern about the recent weakness of the dollar, even after more than 10 central banks made the first concerted defense of the dollar in foreign-exchange markets since August 1992.

The currency's recent decline "is going to scare overseas investors," leading many to "avoid U.S. stocks," said Jim Benning, a trader at BT Brokerage, a unit of Bankers Trust New York Corp. 3.800 3,750 3,700 4 3.650 i-o 3,600 3,550 3.500 21 NYSE 1 -0-61 V250.75 ISSUES AlliedSignal Aztar Corp. Banc One Corp. Burr-Brown Corp.

Central Newspapers Continental Homes Cycare Systems Inc. Dial Corp Express America GFC Financial Corp. Giant Industries Honeywell Inter-Tel Inc. Magma Copper Co. McDonnell Douglas MicroAge Inc.

Microchip Technology Motor Coach Indlntl Motorola PETsMART Phelps Dodge Corp. Pinnacle West Corp. RuralMetro Syntellect Inc. Talley Industries Three-Five Systems Tucson Elec. Power UDC Homes Inc.

Walgreen Co. Webb, Del Corp. NEW YORK(AP) Final STOCKS 30lnd 20Trn ISUtl 65Stk I i-Ezr 1. 4CIOM I 28 27 3715.00 1644.90 1315.33 1 A A DOW .04 .04 HIIHardG 15.37 16.14 .02 HomstdBd 5.05 NL HomstdVI 14.62 NL HorMan 19.83 NL .06 .02 Balanp 10.54 11.04 Equltvp 15.72 16.46 Eqldxp 10.42 10.91 Fxdlno 10.60 11.01 GovBdp 9.08 9.36 Intlncp 9.65 10.03 Ltdlnc 987 10.07 MIOScp 9.84 10.22 MuBdp 10.36 10.68 ReoED 11.94 12.50 Stock 16.30 1 7.07 9.22 9.46 15.36 15.36 10.68 NL FtBoslO pstfceor FrslFdE FstFdTof 9.49 NL First Investors: BIChPP 15.16 16.17 Global 5.97 6.37 Govtp 10.90 11.63 Grolnco 6.50 6.93 HlohYp 5.11 5.45 Incop 3.97 4.23 InvGrp 9.57 10.21 LfeBCp 13.70 1 4.73 LlteHY 10.47 11.26 USAP 11.27 12.02 NYTFP 14.29 15.24 SpSltp 17.30 18.45 TxExP 9.80 10.45 TotRtp 11.49 12.26 Utllln 5.28 5.63 FlrstMut 8.95 NL HudCap 12.70 13.30 Humnn 14.80 NL .03 .03 .02 HummrG 21.10 NL HypSD 8.93 9.21 HypSDl 9.22 9.22 Dlv PE Sales HI Lo Last Chg .67 15 5534 35V4 34V4 35tt 19 1187 6K 6Vi 6 tt 1.24b 10 4291 321 31 32 23 522 9 9V 9 .48 21 18 28 28 28 .20 9 254 16 15 15 -V4 35 18 lOVi 10 10 1.12 14 775 46 46 46 3025 9 8 9 1V4 .72 17 327 32Vi 32 32V, 10 276 9 8 8ft .96 14 2843 31 31 31 -V, 22 209 10ft IOV4 10 30 1235 15 15 15 -V, 1.40 15 1604 117 115 116 -Vi 20 1080 26 25V 26V, 30 1384 29 27 27 -1 .20 8 48 12 11 12 .28 2322403 44 44 44 V4 123 956 26V, 25 25 1.65 23 3991 57 56 56 11 1443 20 20 20 25 405 15ft 15 15 989 2 2 2 181 6 6 6 34 464 54 52ft 53 9110 3ft 3 3 205 6 6 6 .68 20 986 42ft 42 42 .20 16 286 15ft 15 15 EqInCt 11 08 NL .02 FTIef 18.70 19.58 FTIItt 10.59 11.09 HllnBd 10.83 11.34 .01 HllnBdCt 10.82 NL .01 MnSc 11.15 11.68 USGvCp 7.79 NL 3)1 USGvtA 7.79 8.16 UtIIFd 11.78 12.34 UtIIFCt 11.77 NL Liberty Financial: Gthlnc 10.70 11.20 InsMun 10.31 10.80 TF Bd 10.23 10.71 US Gov 8.83 9.25 Utll 10.92 11.43 LTMIVp 9.73 9.83 LtTrmp 9.82 9.92 Lindner Funds: Dlv 25.71 NL Fund 23.05 NL Utll 10.43 NL .02 Loomls Sayles: Bond 10.71 NL GlbBd 10.34 NL Growth 12.59 NL Griln 12.55 NL IntlEq 12.92 NL SmCap 13.44 NL 3)3 Lord Abt Counsel: BdDebTr 4.80 4.80 NatTF 4.54 4.54 US Govt 4.61 4.61 Lord Abbeft: Afllltdo 10.42 11.06 BdDebp 9.42 989 DevGtp 9.74 10.33 E0 1990P13 80 FdVlR 12.59 13.36 GlEqp 12.60 13.37 .15 Gllncp 8.33 8.75 GvScp 2.73 2.87 GIGro 10.01 NL PrcMP 8.64 NL STGI 1.79 NL ST Bd 2.93 NL Boulevard Funds: BIChIP 9.00 9.38 Manoln 9.61 9.9 StrtBal 9.74 10.15 iBmdyw 25.72 NL Bruce 98.61 NL BrundoSI 10.28 NL JONES AVERAGES Dow Jones avos. tor Wednesday, May.

4. TaxFrp 10.82 11.36 TFWAP 4.79 5.03 ValAPO 11.42 12.12 Lutheran Bro: 195.89 .03 A Bond 13.98 NL Aprecp 14 40 NL Asset AH 12.50 NL Balncd 13.15 NL Callnt 13.08 NL CTInt 12.95 NL Drey! 12.79 NL EdEIInd 12.14 NL FLInt 13.03 NL GNMP 14.36 NL GMBdP 14.56 NL Grlnc 16.41 NL GthOP 10.22 NL InsMup 17.37 NL Interm 13.76 NL InterEqp 15.12 NL InvGN 14.64 NL MAInt 12.91 NL MunBd 12.31 NL NJInt 13.08 NL NwLdr 33.76 NL NYlnp 11.14 NL NYTEP 17.60 NL Peoplnt 15.53 NL PeoMldrl6.72 NL ShIGv 10.95 NL STIncp 11.95 NL ShlnTp 13.02 NL ThrdC 7.96 NL USTInt 12.78 NL USTLno 14.31 NL USTSh 15.16 NL .06 .14 .01 .13 .01 .03 .03 02 .05 .08 Dreyfus Comstock: .01 .01 .02 .01 .01 CapVIA 11.55 12.09 CapVBt 11.40 11.40 PStoAP 9.42 9.86 PStoOt 9.43 9.87 Dreyfus Premier: CaDGth 15.58 16.06 GIDInA 15.39 NL GlblnBt 15.26 15.26 GnmaA 14.06 14.72 GnmaBt 14.07 14.07 .02 MuBBt 13.78 13.78 .03 .03 MuBdA 13.78 14.43 Dreyfus Strategic. GIGrp 34.05 35.10 Grwthp 38.90 40.10 Incop 13.41 13.82 Inv A 20.67 21.64 InvBt 20.48 20.48 Dupree Mutual: IntGOV 9.92 NL KYSM 5.17 NL .03 EBI Funds: .04 Equltvp 58.61 NL Flexp 52.53 NL lncomep46.61 NL Multlflx 39.40 39.40 Eaton Classic: China 7.84 7.84 FLLtdP 9.50 9.50 Govtp 9.42 9.42 NatlLtdp 9.55 9.55 NatlMup 9.18 9.18 .01 Eaton Marathon: OHLtdt 9.74 9.74 STGblt 8.61 8.61 CALtdt 10.03 10.03 Chlnat 11.39 11.39 FLLIdt 10.09 10.09 MALtdt 9.96 9.96 MILtdt 9.66 9.66 NatlLtt 10.14 10.14 NJLtdt 10.03 1 0.03 NYLtdt 10.04 10.04 AZTxFt 10.30 10.30 PALtdt 10.10 10.10 Eqlnct 10.56 10.56 GovtOblt 9.42 9.42 Hllnct 7.30 7.30 NattMut 963 9.63 TotRtnt 9 09 9.09 Eaton Traditional: China 13.58 14.26 EVStk 12.20 12.81 Grwthp 7.70 808 In BOS 8.22 8.63 MunBd 9.68 10.16 STTSVR 56.0 7 56.07 SpEqtp 7.81 8.20 TradGv 10 87 11.41 Tradlnp 6.87 7.21 TrdTotp 8.33 8.75 EclioEo 13.31 NL EcliDBal 1B.43 18.43 Emerald Funds: EmEqt 11.24 11.77 EmUS 10.10 10.58 .02 Enterprise Group: CapAp 29 94 31.43 GVSecp 11.46 12.03 Gwthp 8.11 851 Grlncp 17.51 18.38 HYBdp 11.16 11 72 IntlGr 17 09 17.94 SmCo 5.34 5.61 TElncP 13.36 14.03 .02 .01 25 Oil Evrgreen Funds: Evorn 14.17 NL Found 12.55 NL GloRe 13.75 NL LtdMk 21.31 NL MunCA 10.08 NL MunlF 10 22 NL .01 .03 Munllns 9.86 NL Retire 11.11 NL TotRtn 18.11 NL ValTm IS.Ol NL ExcMMId 3 95 4.1 ExcHYP 7.53 7.9 AM Vai 19 89 NL FBL Series: BIChlpt 18 32 1 8.32 Grtht 12.95 12.95 HIGrBt 1013 10.13 HIYBdt 10.08 10.08 .06 .04 Mangdt 11.61 11.61 FFB Lexicon: CapApp 11 10 NL Fxlnc 997 NL IntGv 9.95 NL SelValupll.35 NL SmCoGr 11.50 NL 01 .08 FFB Eq 10.38 10.87 FMB Funds: DIvECP 11.22 11 69 mtGCp 9.97 10 28 MITFP 10.28 10.60 .01 .01 .01 .21 .06 .01 .05 .01 .01 .01 .01 .01 .05 .07 3)7 19 .10 .02 .01 19 20 12 BroHl 9.26 9.75 Fund 17.03 17.93 Incom 8.35 8 79 Muni 8.16 8.59 OooGr 10.04 10.57 MFS: MITAP 11.34 12.03 -JB MIGAP 10.31 10.94 BondAp 12.42 13.25 EmGAD 18.64 19.78 .06 AMERICAN STOCK EXCHANGE Nasdaq A 0.93 lf 740.30 Close Chg 3697.75 1642.03 194.90 1310.40 16.66 4.41 1.58 5.74 PE Sam Last 2.12 99 2S .94 17 77 35 10 63 360 270 86 15 5 .04 13 9 7 .79 .44 15 .52 15 1.84 14 9 l.l9e 22 15 27 17 9 10 5 20 32 1 592 32 1 49 10 30 22 -V 24 19 -'A 123 4 'to 4019 45 71 7 175 13 222 5 1538 14 286 I'M 230 914 1418 VW 56 12 .52 14 39 .10 47 J6 53 121 13 34 12 39 14 606 37 280 5 481 II 637 15 -'4 'A 61 1056 31 40 .15 517 34 59 21 152 31 280 I 197 15 231 15 464 S3 4 2170 101 1 10.00 31 160 5 672 308 147 144 17 -'4 2 -'It 4 4 166 Vto- -V .07 70 tl 72 724 18' 650 19 '4 71 I 258 -V 39 I9'i 1.90a 1.71e 234 9 399 7 X35 26 96 4 52 10 .13 J3i 21 2 .491 .79 .11 211 11 45 3'4 2108 27 1 4799 25 1 129 10 22 II 60 46 120 90 14 12 14 13 .92 24 202 20 24 13 23 .91 131 1.12 II 56 16 1347 II 17 117 -1'4 60 7 11 12 14 4 i'to NEW YORK (API Wednesday's national prices for selected American Stock Ex change ssues. PE Sales Last Sam Last 148 4 291 10 140 3 260 6 355 3Vu Chg Munlln Munvst NTNCom NVR NVRwt Nabors NHItC NtPaW NtlRlty NatAlf NY Tim NIcNsA 177 3 -'i .80 St 482 t'k -Vi 396 I Viij BV 1747 34 20 31 78 5 Ooen High Lo 3730.17 156 38 196.55 1321.82 3670.09 1626.36 193.71 1299.95 PE Sales Last 41 9 877 9 SalSNPLn Sbarro Sceptre Schult ShelMMd ShltCms 401 164 7 111 3 389 6' 69 25 433 3'4 15 27 70 9 Simula SloanSuo SmllhAs Smiths SmtBIn SCEdptP SOUCOS Soartch 1029 25' 208 Vu 346 4'V SPDR SlarrtH SttrlEI Strutner StvleVW 277 306 63 70 4 9' 2 'Al 6 118 II 54 10 139 II 74 11 119 11 Sulcus Sundwn SEHKpwf 14 TSXCP Tastv 50 9 274 32 271 13 TejasPw Tetota TexBlun TeiMer Thermds 175 4 13 16 37 60 JIU .69 ,68 .68 .68 PE Sam Last Chg ClrcaPri 25 41 lO'i Citadel 356 5 -'A CtlFst 15 557 8 Clttllnc 22 51 7 ClearCs 53 122 36' Cotiu! .24 10 47 17 Col Ao pi A 2.50 284 CoKAHpl 3J2t 27 23 ColLb 1367 5 KmdAttn 147 7 A CwnptHl 54 15'A V. CrtsTom J0e 39 33 13 fContMK 10 123 10 CoKna V)l 1 It! 14 CnvstE 18 62 7 Cross 260 326 15 CmCP 22 49 22 CmCPB 19 64 19 A CwnCr .12 23 262 20 CrulsAm 10 3 Clrtu 64 15 iCvcwna 1431 I Datamt 138 297 2 Davstr 897 4 Dort .051 9 108 10 DetEIC 18 121 7 OewE Me 23 263 31' Dimartl 35 201 16 Diodes 22 403 Vi DunNc 120 71 8 OrvlMu 49( 163 9' DtKSffl I 102 4 Ductal 60 128 9 AIM Sir ALC AMIntln AMC mini ARC JARMFpt AiR ATTFd AdvMao.

AirWal AHaitrin AHoun AroirtGr Alcoa pf AmdhT AFstRn AExpl A AIM 85 AIM 1411 AIM 18 AlVtd AMzeA AMzeB AmPagn Amoal Ampalwt Andreas Aorognn Arhvni Atari uor AurorEI tAiua Chg -14 V11 -Vi -V, Vs EaglFn EchBFpt Echo Bay EcolEn Edited Elan Elanwt .76 9 1.75 .07 37? 3t II 26 115 8 100 10 67 21 252 3 41 23 240 l'Vt 17 66 40 14 1W 7 74 16' 64 I'M 141 6 ZllOO 60 1394 7' 25 18'. J71e 1.44 14 3.7J 1.44i5 10 .26 11 1.05e 17 26 26 98? 146 I'lB 94 12 75 12 15 21 18' 25 It 236 289 9 04 Its 153 16 65 12 113 1605 5 1083 I'M 80 236 I'M 1117 3 -Vm NichlsC NoiseCm NAVacc NttrTdi Numac NCAPln 690 9 II 5 IS 323 7 169 13' NCAPI2n NMDPI2n N0HPI2n NVAPI2n 50 12 250 48 .21 J4 5 17' 10 OSuRvn Olsten Orgngn '4 289 3' 'h-Vm 361 31 -Vt 3 -'it 17'4 5'4 17 '4 PLCSys PcEnpfC PcEnptD PGEotO PGEdP PGEptQ PGEDtU PGEdIX PacGKn PacltDl 450 4.75 2.00 2.05 1.86 1.76 5.00 3' 1 1 '4 3 -'A lit 80 16 19757 19 130 9 610 5 60 9' Pa9eAm PWHKwt PyVHKowt PWMKMwt PWUSJWt PamHM PeoGId PenEM PemTr PenRE P1IL0 PtwNet Phm Rs PGem lOe I.OOi 188 lit .051 .12 I I 64 103 911 40 8 '4 88 13 350 21 12 7 PE 29 GmTHn GrevLne GltCdag Gundle HsIIRtv Halsey Ham Mr Hart en Harold Hasbro 37 .21 15 .40 JO 12 JOaZZ Hasting HlthMors Helionet Hemlo HrtoMd HIShrTcn H'otuncn Hondo HoooHl JO 25 14 HovnEn Howtek 1.75 ICH ICHpf IGI WenNx ilmpOHO mcsfar Incvten IntHcm Inter Oio Intrmon 1J0 60 Jit 89 "34 13 InFnYwt Intlotry IntMur IntstGC IntPtyo ivuce .06 16 Jalsttn tJanBel Jonemt KVPtiBa KVPtlAa tn fanes KelyOG Ketema Kirov KogrEq LSBhd Lancer Landaur Laniz Laser LazKap LenAMGNn 2.94. LehGTeIn LehORCLn 131. lenYenot LeWYwt LltVem JO HMdl Lumex Lutia LynchC MacNSc MarnHrv Maxarn MedcR Medeva 14 9 Me 3 Media MeOq MercAIr Mermtc MKtlAnt MldRtyn MimMun J4e MinPlUB 7J4 4M5HKVI9I 29 19 108 36' 4556 11 'A 59 12' 568 Vt. 1015 33 104 19' 25 3769 1J0 28 28 1073 -I 775 17 -I 8e 73 13' 147 i'to 1.17 II 10 49'd 1 3tt 14 55 10 -to J2 14 171 II 8089 I -V I 2110 55 2 Z100 58 II 25 27 25 76 21' 35 22 26 22 86 17 jlOO 45 -1 94 4 564 -'M 157 4' 1135 5 251 V.

245 711 16'4 4 16 49' -Vi 76 40 Vi 44 22 2202 71 3 185 3 'n 131 23 799 21 64 33 103 4 19 10 207 14 1100 60 1Vi 37 It 26 16 50 12 46 II 31 13 48 12 54 9 21 25 2J2 14 Aloer Funds: GrWtnt 20.43 20.43 IncGrr 11.77 11.77 MldCGt 12.08 12.08 SmCaot 21.83 21.83 AWance Cap: Allanp 6.55 6.84 Balanp 13.41 14.01 BalBt 14.30 14.30 Bond A 12.74 13.32 Cnstvln 10.43 10.43 CpBBp 12.74 12.74 CpBCp 12.75 12.75 Countp 16.62 17.36 GlbSAP 11.38 11.89 GovtA 7.95 8.30 GovtB 7.95 7.95 GovtCp 7.94 7.94 Grlnc 2.32 2.42 GwthC 20.32 20.32 GthFP 23.94 25.00 GwthBt 20.31 20.31 GrlncBo 2.31 2.31 GrlnvB 11.64 11.64 InMAp 9.53 9 95 InsMB 9.54 9.54 InsMCo 9.53 9.53 IntlAP 17.94 18.74 MrlgAD 8.53 8.91 MrtoBp 8.53 8.53 MrtoCp 8.52 8.52 MtoTAP 9.73 10 16 MtoTBp 9.73 9.73 MtoTCp 9.73 9.73 MltlGC 9.85 9.85 Mltlnt 1.84 1.84 MMSAP 8.35 8.72 MMSBt 8.35 8.35 MIICAAP 12.45 13.00 MIICAB 12.45 12.45 MINBp 985 9.85 NMuAp 9.85 10.29 NMuCp 9.85 9.85 NEurp 12.51 13.07 NAGvA 8 99 9.39 NAGBp 8 99 8.99 NAGvC 8.98 8 98 PGttlAP 11.50 12.01 PGthBp 11.42 11.42 OusrAP 22.57 23.57 ST Mia 8.89 9.28 STMIbt 8.89 8.89 Techp 27.33 28.54 Wldlnp 1.87 1.87 AmSouth Funds: Balanc 11.61 12.16 Bond 10.58 10.91 Eoultv 14.46 15.14 Gvtln 9 48 9.77 LtdMat 10.24 10.56 ReaEq 17.06 17.86 Amanelnc 12.57 NL Ambassador Fid: Balncd 9.86 NL Bond 9.41 NL .01 .03 CoreGr 16.26 NL Grwth 13.11 NL IdxStk 11.64 NL IntBond 9.4S NL IntlStk 12.73 NL SCoGr 13.78 NL .01 Ambassador Inv. Bond 9.41 NL CoreGr 16.25 NL Grwth 13.10 NL IntBond 9.45 NL IntlStk 12.72 NL SCoGr 13.77 NL TFIntBd 10 17 NL .03 .05 Ambassador Ret Bondt 9.41 978 CoreG Grwth IntBd IntlStk SCoGr 16.25 16.88 .03 13.10 1361 .01 9.45 982 12 72 13.22 .05 13.77 14.31 TFIntBt 1017 10.57 Amcoro Vintage: Equity 10.24 10.69 Fxlnco 975 10.13 IntTF 9 91 10.30 Amor AAdv ant: Balan 12.01 NL Equity 13.56 NL IntlEq 12.04 NL LtdTr 9.80 NL Amer Capital: CmstAO 15.76 16.72 CmslBo 15.76 15.76 CpBdBD 6.67 6 67 CpBdAP 6.66 6.99 EmGrC 25 12 25.12 .01 EGA 25 29 26 83 .01 EGBo 24 82 24 82 .01 EntAO 12 06 12 80 EntBP 11.98 11 98 EqlncAP 5.32 5.64 EqlncBI 5.31 5 31 EqlncCR 531 5 31 Exch 106 83 FMoAP 12.12 1240 FMOBO 12.13 12.13 GlEqAR 11.68 12.39 GlEoBP 11.49 NL GIGvAP 8.35 8.77 GIGvBp 839 NL GIGvCP 8 33 NL GvScARlOOl 10.51 GvScBP 1003 1003 GvScCp 10 01 10.01 GVT97P 13.04 13.44 GvTlAP 8 36 8 78 GvTIBP 836 8 36 GvTICD 8 36 8 36 Grlncp 1244 13.20 GrlncBp 12.44 12 44 HarbAP 14 12 14 98 HarbBP 14 06 14 06 YklA 6.31 6.62 .0 HIYtdBO 6 33 6 33 .01 MuBAP 9 90 10 39 MunBBP 9.90 9 90 PaceAP 1140 12 10 .0 PaceBP 11.33 11.33 TEHAP 10 74 11 28 TEHBP 10 73 10 73 TxElAP 11.04 11.59 TxFIBO 11.04 11.04 UtllAP 8 75 9.19 Americ en Funds: ABelp 12 12 12 86 02 Amcop 1250 13 26 03 AMutIP 21 73 22 53 Bondp 13 35 14 02 01 CaolBR 32 06 34 02 Capwp 1548 16 25 CapWG 17 56 1863 Euuacp 12 10 23 45 .26 Fdlnvp 1787 18 91 03 Govtp GwftlD HI Trp Incop InlBdp ICAp 13.30 13 96 2626 27 86 .07 14 27 14 98 06 13 56 14.39 13 44 14.11 18 30 1 9 42 LITEB 14.02 14 72 NFCOP 29 36 31 15 NPerp 15 07 15 SmCpD 27 83 24 21 T.FxP 1156 17 14 Wsho 17 16 18 71 AOIbF 9 33 9 90 AHerttg 1 73 NL Amer NeM Funds: Grttl 4 15 4 40 Into 21.13 22 43 Trlflex 1511 160) API Or In 12.53 NL Am Perform: Bond 933 9 71 Equity II 41 11 89 02 IntHrt 10 25 10.57 AmunFsl Amwavf 1101 NL 7.47 7 70 AneJvMl Anelvt 1181 NL AncnrCaf 19 85 19 85 AauMa Funds- Al TF 10 70 IQ.aJ AetHnes PwMf. BakKe 55 NL .02 EiUnc 9 NL 15 f.InC 953 NL -4)1 ArcnPundt: Sal 9 74 10 70 04 EmGr 11 50 1704 05 Govt 9 99 10 4 Grolnc 12 71 13 11 -07 USi.ov 10 40 10 8 Amilnfl 8 48 NL AHantag 10 94 11.37 .01 AttetPunsIt: LAlns 1070 Gvtsc 9 18 10 19 01 Grolnc 13 79 14.21 01 NaMunl 10 7 11.12 BBAT Funds: gain vii nl GrotncT II 08 NL IntGovT 9 55 NL SIOnvT 78 NL 01 Pumrr. USI 14 01 jaoiAg II 32 117 .11 (jgif 11 31 II 78 BNV fntnc Miluuvf NY TF 10 77 NL 9 47 NL 9 93 NL ensenfl flnndL I NL B.mo-S 7 NL 01 11 75 03 nl.rot 17 17 NL Fnterp 51 NL Gwth 17 79 NL 11 NL 12 21 NL 104 NL 815 NL kin StWMtW tFrL .01 .01 .01 .03 .01 .01 .01 .07 .05 .05 .05 .02 .01 .01 .01 .01 .02 .02 .01 .23 .03 .03 .02 .04 .04 .01 U30 FPA Funds: Ceplt 19 89 31.27 Nwlnc 10 57 11 07 Parmt 1335 14 28 Peren 21 88 2 3.40 Felrmt 24 55 NL Fescien 17.44 NL Federeted Funds: ArmSSp 9 75 NL Arm I 9 75 NL Exch 70 44 NL FlOtlS 1032 NL FSrils 8 84 NL FGRO 2205 NL FHYT 8 83 NL FITIS 10 00 NL .02 First Omaha: Eoultv 10.41 NL Fxdlnc 9.72 NL SI Fxln 9.69 NL FPDAsto 12.60 13.19 FPMUP 11.83 12.20 First Priority: EaultvTr 10.40 NL FxdlncT 9.79 NL LtdMGv 9.72 9.92 First Union: Ball 11.71 NL BalCf 11.71 NL BalBP 11.71 12.20 FxInBP 9.89 10.30 FxInT 9.89 NL HIGdBp 10.29 10.72 HIGOC! 10.29 10.2V MnBdT 9.72 NL USGBP 9.43 9.82 USGCr 9.43 NL ValuBp 17.37 18.09 ValueCt 17.36 NL ValueT 17.37 NL Flao Investors: EmGtp 11.90 12.46 .04 ntneo 10.00 10.15 IntlTrp 12.85 13.46 MMunp 10.21 10.69 QuIGD 12.49 13.08 Tellnp 12.89 13.50 .02 TRTSP 9.52 9.97 Valuep 11.24 11.77 Flagship Group: AATEao 10.51 10.97 AATECP 10.50 10.50 AZTEAO 10.32 10.77 GkJRDO 17.04 NL IntTF. 10.10 10.41 LITER 10.57 10.84 UtllAP 10.08 10.52 Flex Funds: Bondo 19.36 NL Glblnp 9.31 NL Grthp 13.25 NL MuirfP 5.37 NL Fontaine 10.23 NL Fortis Funds: ASIA 14.07 14.73 CaApp 22.91 23 99 CaDIt 17.22 18.08 Fldcrp 28.27 29.68 GlbGrD 14.20 14 91 GvTRP 8.14 8.52 Grwthp 26.42 27.74 .02 HIYWP 849 8.89 TFNal 10 49 10 98 USGvt 9 08 9.51 Fortress Invst: AdIRtt 9 68 NL Bondr 9.34 9.43 SIr 8.65 NL Munlnt 10.50 10.61 Utllr 12.42 12.55 44WIE0 6.42 6.42 Forum Funds: InvBnd 10.17 10.57 InvStk TaxSvr 10.28 10.68 Founders Group: Bale 8.91 NL BlueCP 6.54 NL Dlscvp 19.82 NL .17 Frntrp 2651 NL 9.20 NL 12 17 NL 993 NL GovSc Gwthp Passprt Soecl 731 NL WldGrp 16.89 NL Fountain Sou ant Fds: Balncd 9.56 10.01 GvtSe 9.65 10.10 MldCap 1006 1053 QualBd 9.55 10.00 OuelGr 9 49 9.94 Franklin Group: AGE 2.69 2 80 AdIUSO 9.37 959 AZ TF 11.10 11.56 Ba Invo 21.84 72.17 Callnsp 11.76 12.25 3)1 CAIntp 10.21 10.45 CvtScP 1207 12 57 DNTC 9.42 9B1 FnultvD 6.74 7.02 Eqlncp 13 64 14 21 FISTarp 9.80 10 03 Fedlnt 10.41 10 65 FedTF II 72 1 2 21 GIGvInc 8.54 8 90 GIUIIIP 12 46 13 0 5 Goklp 13.96 14 54 Grwth 14.27 14.86 3)3 HY TF 10 78 11.23 Incom 2 24 2 33 InsTF 11.93 12.43 NY TFP 10.05 10.28 IntlEqp 13.30 13.93 NYlns 10.72 11.17 PacGrn 14.57 15.76 PrmRtp 6 14 6 45 01 SIGov 10.15 10)8 SCapGR 12 84 13 45 A Gov 10 13 10 55 TxAHY 8 28 8 63 .01 US Gov 6 A3 91 Utlls 9 06 9.44 Franklin Mod Tr CoOu 33 95 74 31 InvGdp 8 83 9 20 RISDvp 14 30 14.90 3) PrankHn Temor.

GioOlp 13 1431 .05 HerdO 12 94 13 34 Hllncp 11 11.61 Fremont Funds: Global 12 82 NL Growth 10 75 NL IntlGr 9 13 NL 06 CAInl 10 49 NL PundTrust: Aoorfn 15 34 15 57 Groltp 1561 I5B5 .0 Grthfo LIB) 14 04 Incorp V8I 9 96 MglRfOll 19 II 26 Fwndamenfal Funds: US Gov I 73 NL 8AM Fund: GB3I 43 5 151 17 I 1 Intl 190 41 700 4 7 9 PiRas 188 22198.13 3.00 ERunSAS: Dlvertld 13 7 NL -I Global 1 65 NL Income 1106 NL SASIO 1098 NL SA.5PM 35 83 NL 0 TaxFX 1141 NL Trusts 12.94 NL OB Funds: GtoOelC 1183 NL RKomeC II 47 NL IntlFqO 14 97 NL SlraoC 15 3 NL USFqO 15 75 NL USFqC 15 73 NL USFqA 15 73 NL OIT Invst EqSiK 14 NL TFNalt 5 NL at otam 17 07 71 05 05 05 05 Antero 1) 5 153 04 EmMkt 1515 151 EmMkB 150 15 08 Curoo 10 73 II 79 EuroB 10 A 10 A 19 GvlnA 9 07 9 4 7 0 GovlnB 9 02 07 GrlncAO 6 0 4 3 OrlixB 0-OA HtlCt IB 19 IB 39 Hllnc Hnnc A Htlt tm II 93 11 92 119) 12 52 148 140 01 104 II0O kiho mB 10 41 10 42 11 3ueno 1)0 1) II 09 JaitUB I1O0 1300 09 LatAG 70 75 71 7 LalAGI 70 1 7 30 1 7 'to 179 1)61 UK 17B7 17 87 I' StretAg 10 77 11 51. 10 7) 10 7 tl 143 1641 12 Telecm Wktwp WktwB 151 17)3 17 I7 .15 ItM I 10 10 10 II Asselp 37 a NL 01 tnvVl 1 1 45 Nl 01 fnx 11 19 II I GMnK OK omr GHelp Gwtttp St oO Vehieo 3 NL 10 31 NL 9 I NL 37 21 NL I 1 It 55 II 41 13 10 a ASIA (ql.lfl 10 41 NL I) 52 NL 13 70 NL tdtval Fqlrxm 17 .14 NL HIUBd 10 0 NL Intnd 90 NL Intrqf 17 4 NL Bd 97 NL JmtnPcl7 04 NL TF Bond to 14 NL 01 01 01 .02 ENSC0 ENSCot EmoBI EpitoM Equusll Escaon EsoRd EtiLav Ecel EjdLA Fcelttr FakCW Flbrtxl FtAust FAusPr Ftfmp Ftlbtr 10 "12 .99 2.00 10 125 JO 26 J2 32 21 45 .40 14 20 272 59 100 544 1309 28 214 165 106 114 7 70 116 27 FlscnP FlaRck Fluke FotstLD FrtAdvn FrkSeln Frtscm .01 .01 .01 .01 lAATrG IAI Funds: Balanp 15.57 16.05 10.31 NL 9.20 NL .02 Bondp .01 .01 .01 .01 .03 3)1 EmoGrpl5.07 NL Govtp 9.88 NL Grlncp 14.01 NL IntFd 13 68 NL InStBd 9.22 NL Mldcap 13.98 NL Reonp 21.12 NL ResveO 9.97 NL Value 11.60 NL .03 IBM Mutual Funds: LargeCO 14.58 NL MuniBd 9.86 NL SmalICO 17.74 NL USTreas 10.21 NL Utility 10.19 NL IDEX Group: Idex 18.08 19.76 2GlbAR 15.82 16.74 2GrAp 17.26 18.26 2TEAP 11.19 11.75 .01 2IPIAP 10.07 10.57 Idex 3 14.85 16.23 2FIXIAR 9.05 9.50 IDS Group: BluCpp 6.26 6.59 Bondp 4.97 5.23 DEIP 7.59 7.99 Dlscvp 11.27 11.87 .01 Equltp 10.80 11.37 ExtIR 4.27 4.49 .01 Fdlnp 4.85 5.10 GIBdp 5.76 6.06 GloGrp 6.5 7 6 92 Gwthp 17.26 18.17 HIYdp 4.45 4.68 Insro 5.37 5.65 Intlp 10.15 10.69 ModRP 11.2B 11.87 Mutlp 11.94 12.57 NwDP PreMtp Progp Select Stock StrAot StrEqt Strlnct StrSTt StrWGt TE Bdp Utllln 13.89 14.62 7.79 8.20 6.71 7.07 8.95 9.42 19.08 20.08 14.10 14.10 9.32 9.32 6.08 9B 5.44 3.82 6.42 .98 5.44 402 6.76 08 .04 ISI Funds: Munip NoAmp Trstp 1021 1069 9.35 9.64 9.52 9.96 IndOneGT 9.80 NL Independence cap. OPOrtp 10.8 11.38 SlntGvp 9.70 9.85 TR Bdp 9.55 10.00 TRGrp 11.96 12.52 Inv Resn 4.55 4.83 .01 InvSerORtlfd: CepGrl 12.53 13.29 .06 OualSt 13.83 14.67 USGvt 9.53 10.11 .01 Invesce: Dvnmo 10.23 NL .03 Emothp 11.62 NL .02 Enrov 10.41 NL Envlrn 6.87 NL Europ 13 IS NL FinSvc 15.33 NL Gold 5.94 NL Grwthp 5.23 NL HlthSc 34.00 NL HIYIdp 6.82 NL Indlncp 1149 NL IntlGr 16.45 NL Lelsur 21.91 NL PcBas 15.75 NL Sellncp 6.22 NL TxFreP 15.38 NL Tech 23.18 NL USGvtP 7.19 NL Utll 9.75 NL .01 .02 InvPflnp InvPfNY InvTGBt Iststn 3PGrfh 9 23 9 23 01 14.69 14.69 1644 1721 3 Inco 9.16 9.59 3PM Insftt: Bond 9 47 NL Divers 9.95 NL EmoMk 10.65 NL IntlEqtv 10.51 NL ST Bond 9 71 NL SmalICO 10 26 NL SelEqty 10 81 NL 3ackson National: Growth 10 75 11.29 Income 9 71 10 19 TaxEx 10.13 1064 TotRtn 10.47 10.99 Janus Fund: Balncd 12 13 NL Enterpr 20 70 NL FedTE 6 72 NL Flxlnc 9 21 NL Fund 1909 NL Grlnc 14 41 NL IntGvf 4 90 NL Mercury 12 89 NL ShTmBd 291 NL Twen 23 56 NL Ventur 4 7 60 NL WrktW 25.75 NL JapanFd 1185 NL John Hancock: DISCBI 9.07 9 07 Grwthp 16.01 16.85 LTGvAP 8 58 8 85 MgTEB 11 19 11 19 sr strata 8 55 i ss oi SOCEAP 15 31 16 12 SUCEBP 15.71 1571 SoOosA 8 07 8 49 SocOpsB 8 04 8 04 SlrlnAtp 7 21 7 55 StrlncB 7 71 7 71 TxExfp 10 38 1017 Hancock Freed nv Avtectl 10 43 109 EnvrAR 8 39 8 83 GlinB I 8 80 I SO GlobAR 1308 13 77 GkibBI 1291 1791 14 GllnA 8 80 9 21 GIRx 16 36 1 7 72 Gllecfl 171 II 54 09 GoklA 14 9 15 77 .01 GoMBt 14 93 14 95 PcBas 1461 15 3 17 RoBXA 71 13 27 24 04 RoBkBt 21 06 71 0 .04 Hartcectt Severgn: Ach A 1197 1760 AchBI II 90 II 90 BalAO 10 17 103 BalBP 10 13 10 12 BrvlAfp 14 4 13 14 BorvttB 14 4 14 44 InvAp 14 41 15 17 14 40 14 40 .04 9 69 10 15 InvBp USGAP USt.Bt 98 98 OI 3 49 NL 01 Kaufm Kamoer Funds: Adtoov 8 47 I 73 BluCh Divine EnvSv Gktlnc Grth Hlvkf Incom IntlFd Mun Rrtlrl Rettr2 RrHr3 RrnrA Rrtlrrf ST Glob 12 34 130 07 801 8 19 01 17 19 17 91 07 8 7 9 08 07 1)73 14 04 01 9 72 10 18 .01 8 7) 11 10 57 11 I 9M 10)5 1107 115 174 11 11 01 10 1 109 01 9 0 7 9 55 07 131 112 7 11 137 SmCuEg 5 90 It 01 Tech 10 I) 10 75 07 TolRI 9)) 9 90 02 115 Gv 89 I0 01 Kemper Invst Dlvlnt 3 9 jv Gvtl 701 701 01 Gwtttt Its 1M 02 HIVdt 7 9 7 9 01 ST Git 70 701 Shtlntt 111 12 St I'F 11 47 II 47 01 TotHtl 1)5 1359 Kemper Premier Dtvm 3M ft 01 Gvt Gwlti 7 07 7 07 ul It 77 17 17 07 yld rn 7 9901 St C.I 7 10 7 10 115 8 13 lis 115 13 1)4 Jhtlnf Smt pJ TnlMI 01 Keyslenet CusBI I CusPJt CusB4t usX II Cost 71 CusSIt CuxMl CuV4l 14 147 1)A) 151 5 04 5 04 )2 )1 8 1 8 1 373 131 I 01 I I 7 re I a a 37 1 4 33 19 47 kPMI TxF rrl 10 1 IB ta 7 47 TaaFt 741 evstene Amerfctfk 9 17 9 57 9 74 10 "4 4 9 77 12 09 17 1 07 9 9) 10 54 0.1 II 94 10 1 -09 9 SO 9 01 CAP! CPIIBI FMsA FOAA GK1A HrFOA 71 0 37 97 MiK.t A 30 72 0) 30 9 1 pi OmegA 1 57 17 5 03 StsA 7M BIS49l lit 9 55 10 a) 01 yvMPA I 9 0) POABt 9 01 QIVBI II 1 1 h) .09 Ovsni 9 so 9 SO 01 Irrvtnt I I 1 t. I 7 TFIII 9 54 9 54 OX XH I II II 4 t.r 9 54 9 14 07 pciACf 91 OvSl I 9 51 BM 7 7 51 Imrtv. 01 07 HIARP I A ti I ThmCrds Thrlnsts ThrmP tTherRen Thrmtx ThreeFS TolEolO TopSrce TofiPet TownCry TWAyto Trl-LHen Trmitech TumBA TurnBB TumrC US Ale USFGP Untmar US Biosd USCel UnvPat 23 13 II VKCal VKMAd2n VKMAVH acorn Viact Viratek 4P 421 VoyAZ VoyCOn VoyFIa VovMN VoyMN2 5 60 I 221 35 59 12 44 12 435 1 290 14 3150 3' WRIT WjtttA Witrtrd Wesco WstBrC WIRET 15 Wl J2 40 "to 1574 4 VS.

Xylraa 29 254 2' 477 5 15 1681 17 53 14 II 44 2 8 70 32 lOVn 7 13 25 28'-l 45 3' 14 BATs 177 13 BHC 12 37 75 -I BanFd l.rte It 21 70 "i -Vi BTcvMn 1.88 16 2J BTcWVin 1.90 41 23' V4 Barrio 25 57 17H BarvRG 17 169 18 BjvMM JO 34 76 IS SNKPWt 411 14 Belmac 1671 IVJ BencnE 20 35 25 Ben Eye 200 7 BergCa UOe 13 It -Vi Beiawli 333 I BiokMI J3r 49 31 21 -V. BioRA 10 94 17 Vi BlalrCp 105 12 67 44 1 BkxmtA .50 33 .129 36Vt Bownt JO 10 242 23 -H BradRE 22 131 V4 tBrandn .22 20 12 IS Brscng 14 54 12 -V. Bultton 5 234 Vi' ttWrtt Jl 24 613 31 1 CMC .846 13 132 II CIM i4t 90 CSTEr 370 I' -'to CeMvsri 679 45 Karofot 500 1200 65 Cerlnotri 82 51 10 CasWA 165 20 Client 14 222 10' CavalHs .01 14 120 IS' Vi CmlTc 174 5' -1 CntrPrn JPt 205 K'i CFCdao, .01 132 Cent of J.50 1100-41 CttrCm 41 113 I -Vi mDevA 29 125 CHE 17 263 33 1 Chnwed 1544 25 MPwr .11 12 3M 11 Cnertlti 3461 244 lJOa II 45 4lW 24 126 4" Polrlns Pdvoh PortSvs PrvEng PSColpf POSt 1 1 PbStl4 i is 7H 7 9 44 1 08 4.25 1.36 136 .80 PiGiMn PIGMT3H PutNY 25 IJ 32 375 1166 6 311 22 1422 I 54 9 243 9 40 24 QvatPd RBW 9RHIEnt RedEmp Rsrtln Rstlnt RnHo .146 1.50 90 340 It Roadmst Ropers Rolonlc RoyaiOg 34 13 I 'i 23 VT 61 10 HI S' 83 SOtmd 5PIB SPlPn SaoiCom 14 SalAMGNn 311 2100 99' 243 II S4iuECn 2 53-199. SaJMSFTil Bun Bear Gp: Glblncp 8.66 NL GoldP 15.39 NL GovtScp 14.81 NL Mulncp 15.96 NL QualGtp 13.27 NL SpEqp 19.46 NL USOVSP 7.84 NL BumhmP 19.87 20.48 33.69 NL ICGM Funds: AmerTF 9.19 NL CepDv 26.80 NL Fxdlnc 10.39 NL Mutl 27.32 NL Kalmosp 13.06 13.68 KATFIn 10 07 10.07 (California Trust: CalUS 10.37 NL S8.P500 10.79 NL 11.86 NL fCalverf Group: Ariel 28.87 3U.31 .03 ArlelA 22.02 23.12 GlobEq 17.88 1 8.77 Inco 16.24 16.87 MBCAI 10.15 10.44 Munlnt 10.04 10.32 Soclalp 29 03 30.48 .02 SocBd 15.94 16.56 SocEq 20.97 22 02 TxFLt 10.68 10.90 TxFLO 16.15 16.78 US Gov 14.04 14.59 Cambridge Fds: L6PGA 14.6V 15.54 GvlnA 12.98 13.63 GwthA 15.34 16.23 MulncA 14.57 15.30 .01 CapGBt 14 63 14.63 GvlnBt 13.00 13.00 GwthBt 15.23 15.23 IncGBt 14.85 14.85 .01 MulnBt 14.59 14.59 .01 CapMkldx 10.80 NL KappleHo Rushmore: EmoGr 11.67 NL Grwth 1152 NL Utll 9.31 NL Capstone Group: t-OSW I6.UB I6.S0 Gvtlnc 4.77 4.77 MedRS 18.16 1907 NZIand 11.01 11.54 NJapan 763 801 USTrnd 1307 13.72 Cardinal Family: AgoGth 9.60 10.16 Balncd 9 95 10.53 Fund 12.64 13.45 GvtObkl 8 16 8.54 .01 ICarllCa 12 92 13.60 CnKBIA 15.33 NL CnKBIB 15.30 16.02 CentrnGR 8 74 9.18 CntShs 22 72 NL .12 ChCapBC 12.91 NL ChesGrtn 13 59 14.01 Chestnt 139.65 NL CMCMHW 142.83 NL ChubbGI 16.15 17.00 rChubbTR 1436 15.12 Clipper 48 61 NL CoKHWai Funds: IntEqp 1726 18 31 FedSA 10 34 10 86 3)1 FundA 80S 8.54 GrthAR 13 70 14.54 HIYkJA 6.66 6 99 01 Inco Ap 6.21 6 53 IntGrA 10.14 10 76 NatRsA 12 2 3 1 2 98 SmStkp 17 77 18 85 SlrtlnA 6 91 7.25 TxEAp 13.08 13.73 TxInsAP 7.93 8 33 USGrA 11.66 12 37 USGvA 6.44 6.76 UtllAP 12.51 13.13 FedSBt 1034 1034 FundBt 8.04 8.04 GlEqB 12.16 17 16 GwthBt 13 63 13 63 HYMBt 9.74 9.74 HYSecBt6 66 6.66 01 IncoB 6 21 6.21 IntGrB 10 10 10 10 NalRBt 1220 1270 04 StrtlnBt 6 91 6 91 TxExBt 13 08 1 3 08 TElnsBt 7.93 793 -3)1 USGrBt 11.57 11 57 USGvBt 6 44 6 44 UtIIBt 17 51 12.51 Columbia Funds: Balence 17 42 NL ComStk 15 12 NL Fixed 12 61 NL Govt 8 16 NL Grttl 25 79 NL IntlStk 13 1 NL Soecl 19 67 NL Common sense: Govt 10 36 11.11 Grlnc 15 47 16 91 Grwtti 15 12 16 57 02 MunS 13 77 13.88 Compass Copnar. Eqlnc 12.

Jl 17 79 JJI Fxdm 10 70 10.60 10 80 11 22 03 13 57 14 05 1060 11 01 06 Grwth IntlEq IntlFI MunBd 10 10 70 10 2) 10.63 01 Shlnt Composite Oreuee BdSlkApll.50 1704 GwthApl2 13 17. TO InFdAP 8 64 9 00 02 NW50AP1434 15 02 02 TxEmAO 7 4 2 7 73 USGvA 10 0) 10.45 Canatloee Fund: Equity 14.54 aa VI Incm 10 10 33 01 LtdMat 1041 10 62 01 CennMufwar Govt to la lo eu Grwtti 14 7 15 54 .01 Income 9 46 9 65 TntRef 14 0 180 Ceowv 20.1 NL -3)7 CeraFUMHi: Eqlrtx 70 99 NL GIHcIA 9.31 NL VSIEuBO 13 14 NL 03 Cewen 1099 II 55 CownOO 17 39 13.02 AtAHp 17 75 NL 01 Eoultvo 15 84 NL OR Mun 12 72 NL 01 Stwcial 123 NL Cutler Trust. APvFQ 991 NL -03 Folncg Govt 's ni 9 I NL PA In 1001 NL Invesfer: Equity 10 47 108 04 Gvtlnc ITGvf Munlnc 9 50 969 968 98 10 03 101) VII 3201 2201 -04 CeuC.rf 1188 11 Convtt 10 18 10 5 rvUrl 17 77 17 77 DIvGIt 19 58 J9 58 Dlvlnt 9 73 9 73 furnl 17 SI 17 Kt OlMf 83 0 0) Gantvt 10 92 107 FedSecf 9 09 9 0 HitMc I 10 77 10 77 02 MiVklf 7 59 807-01 MuAt 100) 10 43 01 Inlmdl 51 5) 01 1 MMufl 9 58 58 NNt 11 51 1151 0 P.Grf 1947 1947 29 prrMt 104 104 .01 Premr 81 VIMu Mrtgrlt 1 Bd TU0 Strati TexCa 8 7 9 09 II I II I 101 10 at -01 90 90-01 89 89 14 17 14 II 1 1.50 1 1 90 or caitkxgeiy) uehMred seaul pay tor dntrgjution cotts .01 .05 .29 .01 .02 .03 Gaimco GaiiCU GatnaB MO 14 340 27 IS 03t J04 112 Gar an GaylCit GaylCKt GelmScj GenvOr 4GntFd GibwCR 27 5 434 4 61 16 47 12' 786 21 IS3 7 II 14 .72 14 .16 14 .70 31 GUttt CSmllt Guam GtVaXe Gftiar GorRunp Grtnrn 377 15' 237 12 249 10 333 3 .72 16 42 tit 26 196 5' GrOOAP 11.01 11.68 GvLtAP 8.63 8.85 GVM0AP 6.45 6 77 GvScAR 9.30 9.76 HllnAP 5.07 5.32 3)1 inOPA 7.64 8.02 LtdMAO 7.12 7.30 RschAP 13.14 13.94 Sect AO 12.44 13.20 .07 TotRAR 12 81 13.45 UtllAP 7.17 7.53 02 ValuAP 9.94 10.55 WGvAR 11.29 11.85 WoGrA 16.28 17.27 WTotAO 10.59 11.12 MuBdA 10.62 11.15 MuHIA 8.87 9.31 MuLIA 7.46 7.65 UIIIB 7.15 7.15 CdOGBt 13.78 13 78 BondB 12.60 12.60 EmGBt 18.57 18 57 GoldBt 6.09 6.09 GvMoBt 6.45 6.45 GvScBt 9 29 9.29 HllnBt 507 5 07 .10 -3)1 IntmBI 8.29 8.29 MAITB 11.30 11.30 OTCB 7.94 7.94 MIGB 10.24 10.24 RsChB 13.10 13.10 SectBt 12.42 12 42 MuBB 10.61 10.61 TotRBt 12.81 12.81 WEqBt 16.20 16 20 WoGvB 11.25 1125 WoGrB 16.22 16.22 WoTotB 10.57 10.57 MulnBt 8.54 8.54 ..01 MIM Funds: Bdlnc 9.07 NL Stklnc 10.02 NL StkGr 1084 NL StkAO 15 03 NL MIMLIC Funds: AstAII 13 28 13.98 Fxdlnc 9.72 1021 Invl 1697 1786 MtoSc 985 10.37 MMPrGt 981 NL MMPUn 9.42 NL MSB Fd 16 73 NL MackemleGrp: AdIGAP 9.71 9.B1 AmFdp 12 19 1293 Canadp 10.21 10 83 Flxlno 9.59 10 07 3)1 Global 12.33 1308 LldAAUP 10.06 10 37 NtMup 9.61 10 09 NAmerp 6 63 7.03 Mckniilvv: ChinaAl 9)5 9.97 IntIB 27.10 37.10 EmGrAo 1771 18.33 04 GrthAP 14 74 1564 GrlnAP 9.39 9 96 -331 IntlAP 27 10 38 75 -M Mainstay Funds: CBAOI 19.54 19.54 Conv! 12 65 12 65 CrpBdl 7 83 783 Eqldx 1365 1444 Globlt 1148 1148 Govt! 8 12 117 01 NRGklt 1002 1007 TxFBt 9.66 96 TolRIt 15 21 15 21 Vail 15 56 15.5 -JU Managers Funds: CapAp 24 79 NL StiEq 37 74 NL IncFq 27 01 NL ShorlGv 17 73 NL IntMtg 16 32 NL SI Bond 20 13 NL Bond 70 41 NL Intl! a 36 02 NL 03 01 07 Manner Funds: Fxdlnc 965 10 13 ST Fxln 9 68 9 88 TR Fo 124 1312 -03 Mark TwamFds: Equity IAI 1003 Fxdtncm 9 65 10 00 Muni 9 95 10.31 01 01 MarketWatch Fds: Fqultv 99 10 3 Flxtnc 9 73 9 9 IntFxIn 9 57 .7 Marguts Funds: GvSeiA 9 57 9 B7 01 GthlnA 9 64 9 99 VftlFAO 9 54 9.8 .01 Marsh Funds: Bel 9 73 NL Eqlnc 9 57 NL 01 tine 9 30 NL 943 NL 95 NL 94 NL 9 1 NL 999 NL mind inltxP MW1CM 1 Inc Stock Valtq -01 01 -03 -01 10 07 NL 14 34 NL Mansers Maiyl Funds: Fqlvtp 118 NL kscotp 10 31 NL Prsmfg 9 71 NL MmtOt 11 73 NL MentStr 12.14 NL MrgrFdg 13 77 NL 75 18 NL 01 MerreJLyncn: AmtnA 9 03 to ArkRAO 91 91 A 7 MA 10 74 107 BalA 116 17 50 7) 54 74 -31 19 9 7 27 39 12 .01 174 174 7 92 I 25 01 BVIA CAMA l9 A Cnsitp CpmiA ClnvGA II 04 II 50 07 Colt A II 10 11 31 07 Dvlo 1503 10 D'HA 15 47 1 55 71 uoA 1)57 14 AO 3 (15 AB I 77 1 A 14 71 15 73 01 1) 10 14 77 -3)5 75 GindA Gil A GIMrtA GIPsA C.IUIA GrIHA 10 AS 1 1 09 1)04 04 15 04 109 1) 17 TO 1) 5 HO 1 14 HeltlsA )M 4 1) 7 Instlnp InlFqA II 75 17 0) lAtAAr 14 7 13 7 IJ MnmA 7 91 9 74 MIMA 95 MultA I7 1007 MNHA 10 I 10 57 PA 77 11 73 5 -Jl PhnxA 13)1 14 74 SnvIA 17 II )7 B1 fivA 17 17 13 i ne OA 14 0 TetA I 71 5 57 1 yVktl.se A I A 04 a Antenl 91 91 9 07 9 03 41 7 AA 10 14 10 14 BAIPI II 7 II 1 04 BVIBt 7)1X1 3)00 Jl AAA) 19 9 Ft fkiinl J7 47 37 4) 14 Cpinpi tej 13 llnvl II 04 11 04 tl cpitni ii i to or ttregn 15 10 15 40 purPI 144 144 Frtv PI 9 1 a) 01 ft tt 14 14 5 41 pttn.BI 94 9 49 OI' GiP'ti -t II 14 I) 14 4 17 9 7 0 I II 1 II 0 147 I4f Gttual I1M I2M 0 17 17 pv I 54 54 euF at II it 11 IB It Gn.in ii ii IPI 14 71 14 tl AAne.nl fm 7M Ml MP I 9 9 99 Mxlftat 997 9 1 MMIS I 10 1 I I TOP 10 LOSERS NEW YORK (AP) Top 10 losers among American Stock Exchange Issues and warrants based on percent of change for Wednesday. No securities trading be TOP 10 GAINERS NEW YORK (AP) Top 10 gainers among American Stock Exchange Issues and warrants based on percent of change for Wednesday. No securities trading be- AMEX MOST ACTIVE NEW YORK (AP) Sales, closing arice and net change of the 10 most active American Stock Exchange Issues tracing nationally at more than $1.

low $1 or 1,000 shares are included. Vol Last Chg Pet Nam Vol Last Chg Pet 9,400 l'V 20.83 I.LItfldS 942,200 8 54 18,300 6V4 '4 16.28 2.BSHKwt 11,900 2H -'i 17.39 33,300 16.13 3.MSHKwt96 20,300 3'4j -H 39,600 1H 15.79 4.EnzoBI 207,300 9'i -I1 2,700 2H '4 11.76 5. Ampalwt 80,400 l1 -V, 34,600 4'4 9.68 6.Audre 108,300 1' -Vj 45,500 2'4 9.09 7.LsrTCWt 2,500 1'4 -V 16,900 4 8.47 8.Trlfon 27,900 -Vi 15,700 8.33 fGlblOcn 4,100 -V -862 2,500 4'4 8.33 lO.RXMdS 9,900 2'A. -V Voluma Last Chg 1,975.700 19H 942.200 8 -55A 808,900 1H -V 479,900 25'i 1H 455,600 ltVa 401,900 45'4 -M 376,900 3" A. 346,800 24'j -Vi 326,100 41n 315,000 3'g Nam 1.

Davstwt 2. Arhyth IGoVideo 4. Harken 5. LawrG 6. Tri-tlten 7.

InFnYwt S.Xvtron 9. PWHKpwt 10. Stage Mama l.lvaxCp 2. Lift Id 3. ExpLA 4.

VI8CB 5. EchoBav 6. SPDR 7. ENSCO 8. ChevSftl 9.

Chiles 0. Roadmst -0l! f.58 .08 .01 FITSSP 1000 NL FslotIS 1030 NL SiOtS 10.30 NL FST 2511 NL FSTISR 84 NL GnmalS 10 90 NL GnmaSpl0 90 NL FlgtSSP 10.32 NL IMTIS 10 47 NL MldCap 1085 NL MaxCp 1149 NL Mlnlcap 111 NL Shtfrm 1017 NL US Govt 9.74 NL SnTrMup 10.17 NL SRFA 16 13 NL Oil .01 .01 .01 FWeetv Adviser. FnPGr 78 B7 30 31 EoPInc 1533 160 GblRSC 162 17 45 Govlno 9 1 9 62 .04 GrOppR7S60 36 88 08 HIMUP 11 4 17 24 HIYIdp 11 41 119 03 kxGIP 14 68 1 541 ltdtr-D 9 92 1041 LIT BR 10 57 II 04 Ovseeo 13 92 141 .02 II ST Flo 90 9 75 SlrOop 19 57 70 55 Fidelity Nlvesr. AglFr II 3 NL A Mar 14 50 NL 01 AMorGr 13 58 NL AMorln 10 73 NL Balanc 122 NL BluCh 35 II 25 91 CAM 97 NL Cnd 1775 NL -Oil .01 03 CapAO 13) 16 Coiner 91 NL CnoS 145 7 NL 0 Contra )0 SI 31 45 0 CnvSc 15 50 NL Destt 17 74 NL Destll 27 NL OUFq 1 NL OS Dlvlntl 1190 NL DivGth 113 NL 01 FmGrr 1 74 1 7 3 07 EmrMkl I 13 NL 22 Fqlnc 32 19 NL FOII 1) 4 NL ErCapAo 11 90 NL Euroo Exrh Fidel Fifty GNMA GloBd GloBai GovISC Grot Grolnc Hivid InsMu 14 79 30 40 99 00 NL 19 IS NL 03 10 4 3 10 77 01 10 79 NL 01 10 73 NL 12 17 NL 9 59 NL 38 4 39 34 31 94 37 2 -01 01 01 01 .02 II 95 NL 11 I NL 10 19 NL Intnd InterOvf 9 41 NL kitor 17 30 NL mvGB 7 79 NL 3nan 13 55 NL LetlnAml) 79 NL LMMun 9)7 NL LowPr 17 59 1 IJ 04 Maoean 70 4 77 4 09 Mktlnr 33 5 NL 10 MIoSC 10)7 NL MunBd 79 NL Nv Ins 11 27 NL NewMkt 9 74 NL HwMl 11 74 17 10 OTC 779 71 A Ot Ovrse PtBas purlin ReelF RrKir SntBd yid 79 Al 7 re 18 79 KM 15 A NL 1395 NL OJ 0 -1 171 NL tat nl 9 47 Nl 101 10 9 Smr ap SF Asia 17 52 NL 21 31 5k- 19 I Nl. 0 StrlWOl 1 7 20 73 01 Trend 55 9 NL UtHinc 14 50 NL Vk 41 74 NL Wrklw 1)41 NL 0 0 17 keenly leMKhv Air 14 15 II AiioMr 7 71 ti Autnr I) I 7) 81 01 BMh hf 74 7) 5 4 07 B'drstr TO 7) 30 10 BrnArr 15 47 15 0 (hemr 37 31 7S 2 5 ft 41 ConPdr 14 40 14 B5 07 CclMor 1 71 19 79 07 IttAerf 18 I I 73 01 ml 17 7 1 14 07 le.frr I'T 177 10 tnrgvr I 17 41 10 no5vr 10M II 1 1 Imlrr II 14 114 01 Fmsvr 57 7 1 1 I) pnnrtr 7 19 A) oe Meatthr O) MM HemPr 34 51 131 18 IG Parent firm selling Channel 10 John Zanotti, chief executive of Great American, said in a statement that the transaction enables the company to pursue future acquisitions in radio, as made possible by federal rules increasing ownership limits.

Great American retains two stations, WKRC-TV in Cincinnati and WTSP-TV in Tampa, both ABC affiliates. Great American said it has received FCC approval to buy the KRXQ-FM radio station in Sacramento, where the company already owns KSEG-FM. In addition. Great American has requested FCC approval to buy WWNK-FM in Cincinnati, where the company already owns WKRQFM. Great American owns II FM and four AM radio stations.

in Boston, Detroit, Cleveland, Atlanta, San Diego, Milwaukee and' Tampa, 11a. All are CBS affiliates except for KNSD-TV in San Diego, which is an NBC affiliate, Conroy said. Conroy said the best-known program of New World's production arm is The Wonder Years, which ran six seasons before ending in 1993. Other productions include Zorro, Sunt Barbara and Stories of the Highway Patrol, which are offered to member stations and are syndicated to others through subsidiary, Ocnesis Entertainment. New World Communications stock closed Wednesday at $9.23, down I2H cents.

Oreat American shares closed up $2,624, at $19,374, on heavy volume. Both stocks trade on Nasdaq. PARENT, from page El The deal is subject to approval by lie Federal Communications Com-lission. Ron Bergamo, KSAZ vice prcsi-ent and general manager, said of the ansaction, "Nothing will change to le viewers," including the station's ill letters, which changed earlier this car from KTSP-TV. "I'm staying.

I think all our key cople are staying," Bergamo said. Station employees were told of the ending sale early Wednesday morn-ig. he said. The pending acquisitions would lisc to II the number of TV stations by suburban Atlanta-based New forld Communications, spokesman imcs Conroy said. New World's existing stations are Oatew Puneke Uovtnd ffL NL MetrlaG l)l NL 01 ej OJ Denser 17 4 NL MUTUAL-FUND FOOTNOTES Fe-rrlglmtlHtrMntOn.

Previous day quotation. I Stock rvktndot Spat, a Hgvidnd 3111 NL 14 71 NL uul lt ktn Mtml II NL 10 04 NL I) 44 NL 107 NL Ami 14 to Nl )iiwa Sachs Pmhr 15 ft 18 4f 14 A ISM 14) 11 0) r-eunc G'lc trrttF 02 17 14 ISM I) nor NL No hoof -end toed Fund auan or used KMKt Rieakn- unrkK ITtt-liuan. Rotfermmon fee) or coiwlixaeiil arigt 1 eq tears keq may aunty I Set MUT1IALS. page ES 1 i.

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the Arizona Republic

- Archives through last month

- Continually updated

About Arizona Republic Archive

- Pages Available:

- 5,582,684

- Years Available:

- 1890-2024