The Sydney Morning Herald from Sydney, New South Wales, Australia • Page 31

- Publication:

- The Sydney Morning Heraldi

- Location:

- Sydney, New South Wales, Australia

- Issue Date:

- Page:

- 31

Extracted Article Text (OCR)

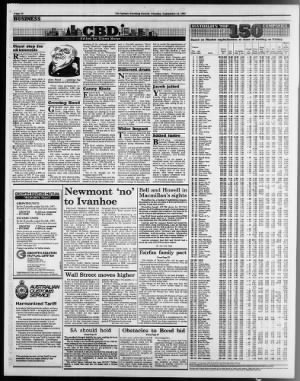

The Sydney Morning Herald, Monday, September 14 1987 bujshejess Page 30 If Bd) mm mssm Based on Market capitalisation at close of trading on Friday Giant step for oil interests i i I I I I I I I Return on Position Price har- Market Change Share Earn- Div Dtw erest holders This Last Capital Last 12 months on Price ings yield cover cover fundi Week Week Stock Sale High Low week Assets (Times) (Times) (Times) E-RATIONALISED Bruce TTyN said a Glynhill operator. We're We reckon DJ's, indeed the whole Adsteam group, is a long way undervalued." CBD reckons we might hear a bit more from EPI over the next few months. The Honkers arm will place about 20 per cent of its stock within a fortnight, to put a further $30 million or so into its already well-stocked war chest. Different drum Judge's sometime subsidiary, Giant Resources, has 10.60 25.10 2.47 12.11 7.22 1.76 364 1.61 2.65 1.44 1.37 4.51 1.23 4.74 2.08 3.70 5.57 1.42 3.32 'OW that he has a bit of time 3.32 030 086 1.40 281 2.55 255 406 4.62 1.44 404 1.00 1.09 281 2.35 442 2 64 347 1 53 1.72 19.70 1 99 392 3 12 437 334 2 40 246 3.10 290 7.25 231 1 85 307 1.47 1 93 475 3.32 FN on his hands after retiring from rapidly diminishing 4.23 2.17 2.18 1.87 1 48 2.34 3.31 1.13 1.15 2.SS 1.13 1.39 1.47 7.51 223 2 65 387 64 1.11 330 2.49 533 954 1S.3S 50.13 3 15 435 21.31 1292 11.30 14 13 11.69 29.13 13.18 20 68 308 1951 22.79 880 1660 17 03 21.93 6.36 11 63 3 83 1 41 33.73 bid to avoid the appointment of receivers or managers, after problems stemming from its failure to bring into the market a new product to replace its existing and out-of-date computer. Microbee hired Coopers and Lybrand to assess its businesses and the beancounter came to the conclusion that Microbee should seek additional equity capital, or try to refinance its debt with its banker Westpac, or another banker.

Interestingly, Westpac-con-trolled venture capital crowd Business Loans and Equity has been a major backer of Impact chief Mr John Price. Jacob jailed YET another investment package promoter has gone to jail with former Lincoln Hunt Australia Pty Ltd managing director Jacob Fedor Dubrinski-Hunt's opting for a prison term after failing to pay a $50,000 fine. Jacob copped his fine back in February after being convicted of aiding and abetting Lincoln to commit seven offences under the NSW Companies Code and the Securities Industry Code. The company had attracted close to $4 million from investors, many of whom were from the well-heeled medical profession, when it ceased trading in February 1986. Added lustre 10.30 23.00 9.90 10.70 5.66 5.40 9.02 6.90 5.58 6.38 5.80 10.05 3.68 6.40 6.60 4.30 4.60 5.60 12.10 4.80 8.94 5.00 4.65 3.90 3.80 17.20 5.80 4.94 11.35 7.20 14.60 3.85 8.10 4.40 1.78 3.45 5.60 1.46 3.54 048 337 1 58 3 90 1.94 1.47 meeting of the curiously named Young Presidents Organisation, and the smiling beer emir "charmed" the gathering.

Meanwhile, at the Wisconsin battle front, Heileman is giving out strong signals that Bond's bid will be contested fiercely, although a decision on a recommendation to shareholders is not due until September 18. Bond troubleshooter Peter Mitchell last Friday continued the lobbying at another level meeting Wisconsin Governor Tommy Thompson, who is likely to prove a difficult opponent. Tommy this week is convening a special session of the legislature to toughen the State's takeover laws. Canny Kiwis EASTERN European blue-eyed hunk Janis Spal-vins isn't the only corporate titan to benefit from David Jones's fascinating play on Bleak City's National Australia Bank. Former Kings Cross resident Ron Brierley is pretty pleased with DJ's efforts now that he and a few Kiwi mates are sharing in 10 per cent of the spoils of Spalvins reborn upmarket retailer-cum-bank raider.

CBD readers will recall that back in June when Adsteam whiz kid and Spalvins' loyal right-hand man, Michael Kent, was rejigging DJ's and DJ's Properties 9.6 per cent of DJ's came up for grabs. The Kiwi trio of Brierley, Bank of New Zealand and yachties Fay Richwhite swooped and picked up the $100 million parcel at $10.50 a share. The Kiwi vehicle, European Pacific Investments, shunted the stake into its Honkers arm, Glynhill. With DJ's now worth $12.50 a share and rising on the prospect of its moving to 1 5 per cent of Nobby Clark's mob, and equity accounting the stake, EPIGlynhill is looking at a tidy $20 million tax-free capital gain should it be inclined to take the money and run. Not to be, though, say the forgotten lads at EPI.

"The profit's not there until the money's in the bank and we don't intend to let go for a while yet," .15 .45 .12 .44 .22 .10 .08 .38 .08 .14 .20 .05 .30 .08 .05 .10 1.25 .40 1.00 .25 .02 .05 17.64 17.99 46.58 5311 12.18 11.83 21.71 1045 10.36 17.51 955 1387 57.94 18.13 20.68 1944 19 62 21.96 22.91 45.14 58 84 25.25 3250 58.24 7863 22.33 17.61 32.38 18.64 20.03 31.36 11.75 18.30 15 68 17.28 947 28.89 10.30 9.48 11.31 17.87 1595 1507 15 25 18 89 S.78 18.13 16.47 18 44 2571 1380 1384 48.99 11.42 6.43 13.25 2.56 6.44 2.87 3.25 4.78 4.35 3.37 4.20 3.89 5.18 1.33 3.45 2.50 2.65 2.07 2.69 2.63 2.15 1.80 2.33 1.81 2.12 2.15 8.10 3.45 2.78 5.52 3.60 4.93 1.12 2.95 3 60 1.14 2.44 2.08 7.80 5 60 9.37 2.40 0.92 2.20 3.09 2.51 0.42 5.27 088 2.52 1.63 1.43 2.92 1.50 5.50 2.28 1.57 2.03 2.48 4.50 10.98 11.60 5.96 5.62 9.60 6.98 5.86 6.52 5.94 10.40 3.80 6.90 6.60 4.48 4.80 6.00 12.70 5.50 9.30 5.20 4.70 4.95 4.20 18.40 6.30 5.80 12.20 7.80 14.90 4.05 8.20 4.65 2.19 3.52 5.70 11.74 8.80 14.06 3.87 2.80 4.15 5.90 3.55 4.68 9.50 4.40 4.90 2.95 2.55 6.70 3.00 12.00 5.00 2.22 4.00 9.14 9.70 enjoyed better support over the past two months, with a few analysts mesmerised by the appar-; ent potential of the dirt-digger. The Giant camp has been extolling the company's virtues -around the traps and producing dazzling mumbo jumbo about potential earnings. The need for a sales pitch is hardly surprising, considering the -share price had dwindled to just over $2 in June something boss Bob "Kidston" Needham found hard to swallow. i However, Brace's unquestion-? ingly devoted broking house, Paul Morgan and Co, has just put out a glowing report that reckons the stock has an immediate objective of $4.40, although CBD is puzzled about Morgan's rule-of-thumb -valuation of the group's Papua New Guinea oil interest Giant's subsidiary, Base has 97.5 per cent of permit PPL 56, located. to the and along the same strike length from the promising Iagifu oilfield in PPL 17, which is tipped to contain at least 500 million barrels of oil.

I Morgan has got out his calcula- tor and put a "conservative" value i of $300 million on Base's PPL 56 interest, despite the fact that dirt inside the permit has yet to be disturbed by drilling. Base also has a 50 per cent interest in PPL 76, to the north-east of Iagifu. i What puzzles CBD, however, is the dramatic jump in the value of 1 Base's oil interests. I Earlier this year, when Giant "made a huge $200 million-plus issue, the underwriters Mcln-tosh, Paul Morgan and Rivkin Capel churned out a corporate analysis of the group. Surprisingly, this put a conser-, vative value of between only $40 million and $70 million on PPL 56, with a total value of $80 million for the oil leases.

i With no wells drilled in PPL 56 'and action in PPL 17 very quiet over the past four months, CBD 'remains intrigued by this stagger- ing four-fold jump in value. Alan Bond making big impression on US workers. While value perceptions are naturally subjective, CBD suggests a few institutions attracted by Morgan's summation of the stock might like to do their own sums before jumping on the Giant bandwagon. Growing Bond GOLDEN beer emir Alan Bond's slick public relations juggernaut has started to roll in the sleepy US State of Wisconsin scene of his latest takeover battle. And with Bondy's $1.5 billion bid for Heileman copping a torrent of abuse from the brewery and its assorted political allies, it is shaping up as a bitter fight.

But the Bond team is well prepared and is waxing lyrical about what a nice bloke the beer baron and Metals Exploration Joss has been in the past. CBD's US spy even received an unsolicited call from a gentleman at Pittsburgh Brewery, Alan's first US acquisition and the springboard for his hard-sell campaign to the Yankees. The caller extolled the Bond team's virtues since Alan took over as boss at Pittsburgh. Employees there apparently are, deliriously happy at how wonderful the Aussies are to work with and consequently surprised that those ungrateful people down in Wisconsin could do anything but welcome Alan with outstretched arms. Our spy, by now close to tears, was told Alan once even flew his private jet to Pittsburgh to attend a retailer Woolies, Eric McClintock is turning his hand to charity.

Eric is to be chairman of the Salvation Army's next Red Shield Appeal, succeeding banking legend Vic Martin, the ageless head honcho at Australian Bank. CBD's spy confided that Westpac's Bob White had urged Eric to take the job. Hopefully, Eric who reluctantly decided to call it a day at the retailer's bunker on May 18, despite the protest of fellow directors will ensure the next appeal is a roaring success. Given the amount of red ink on Woolies' financial statements, Eric may well be required to use the experience gained with the Salvos to begin a fund-raising drive for Woolies. Wider Impact THE corporate grapevine has been running hot with rumours that laser printing outfit Impact Systems Ltd has bought a major chunk of troubled computer group Microbee Australia Ltd.

Impact, you may recall, recently teamed up with Basil Sellers Gestetner Holdings Pic the UK chum of AFP Investment Corporation Ltd in a joint venture deal for the distribution of Impact's laser printers throughout Europe and the United States. CBD understands that Impact has big plans for Microbee, which may involve a change of name and a move away from its traditional educational computer operations into a new sphere of activities. Last month, the Herald reported that Microbee was negotiating to merge its business in a 4.24 11.80 3.00 6.97 4.17 309 18.47 0.00 452 2.55 2.32 3.81 3.82 841 9.31 7.26 1.79 0.00 1.46 2.00 2.50 1.77 2.18 3.25 1.99 1.83 1.98 1.71 10.68 2.31 4.71 2.12 ne 2.56 2.92 2.23 382 3.60 1.42 3.71 15.33 4.79 LUE-chip computer account Fujitsu has given the nod to creative adshop 16110.200 7513.810 6432.970 5957.860 5268.520 4579.710 4303.670 3975.730 3902.060 3758.670 3709.470 3603.470 3593.840 3549.090 3417.340 3124.990 3115.590 2928.230 2754.850 2690.940 2682.000 2588.680 2472.210 2425.800 2280.000 2216.890 2086.690 1981.250 1920.490 1900.840 1851.370 1841.660 1787.360 1758.090 1726.600 1671.310 1611.680 1587.160 1546.390 1445.010 1385.310 1366.670 1366.320 1313.050 1254.060 1238.630 1188.020 1154.900 1154.730 1129.400 1128.870 1097.930 1086.500 1027.650 973.695 963.568 960.575 935.468 925.593 906.332 900.000 863.022 832.929 826.420 816.569 793.768 790.369 752.698 752.368 751.036 748.952 723.969 714.373 684.303 670.906 669.646 659.152 668.389 657.278 656.386 648.762 648.591 643.098 630.000 603.988 586.081 581.784 575.593 562.523 2 62 1.74 8.70 3 62 1.63 4 28 3.13 0 92 29 38 2.19 2.45 631 2.20 5.30 2.87 1.03 2 87 8 04 78.19 0 56 11.44 5 00 386 331 358 6.38 0 99 1014 281 222 623 269 402 390 253 2.75 233 2.24 4.37 2.93 2.98 3.45 2.48 1.20 1.92 482 11.47 1.79 327 302 2.85 2.42 1.17 001 2 97 2 68 3 68 0.75 7.96 11 50 4.45 1 53 4 10 3.43 3.04 1.50 3 62 1.92 3 75 286 2.18 432 3 77 1.44 4.73 0 52 4 64 1.45 313 248 355 7.23 1.00 1.86 2.48 1.76 1308 2.11 3.11 10.34 5. GO 2 92 1 62 8 25 1.34 2.15 658 67 12.79 0.75 4.15 1.76 0 78 10.65 8.70 12.70 2.85 2.05 3.90 5.60 3.55 4.00 9.00 4.00 4.70 2.67 2.50 6.40 2.65 10.80 4.80 2.15 3.88 8.40 9.50 1 1 BHP 2 2 News 3 3 WMC 4 4 CRA 5 5 Elders IXL 6 6 Bell Resourc 7 7 Coles Myer 8 10 Westpac 9 9 ANZ Bank 10 8 Ind Equity 11 12 Natnl Aus Bk 12 11 Bell Group 13 14 MIM 14 13 Boral 15 15 TNT 16 17 CSR 17 16 Pioneer Cone 18 18 Pac Dunlop 19 19 BTR Nylex 20 20 Comalco 21 21 Fairfax 22 22 Good Fielder 23 25 North BH 24 23 Placer Pacif 25 24 Newmont Aust 26 26 Lend Lease 27 27 Amcor 28 29 Bougainville 29 28 Brambles 30 31 Santos 31 32 RGC Ltd 32 30 AFP Inv Corp 33 34 FAI Insur 34 33 ACI 35 35 Bhp Gold Min 38 36 Gen.Prop.Tru 37 37 ICI 38 42 Adel S'ship 39 39 Peko 40 44 David Jones 41 40 Ariadne 42 38 Woodside Pet 43 41 Ampol Limitd 44 43 Burns Philp 45 47 AGC 46 45 Giant Resour 47 46 Amatil 48 49 Elders Res 49 48 James Hardie 50 50 Bond Corp 51 51 ANI 52 52 Mayne Nick 53 53 ERA 54 54 Westfield 55 55 Hooker 56 59 West Trust 57 57 SA Brewing 58 58 Aus Cons Min 59 60 Rothmans 60 61 Advertiser 61 56 Kidston 62 62 North Kal 63 64 Niugini Min 64 65 Old Coal 65 63 Woolworths 66 66 Cons Explor 67 69 Bond Media 68 71 Cadbury Schw 69 68 Poseidon 70 67 AGL 71 70 Northen Star 72 74 Arnotts 73 76 Ashton Min 74 78 Schroder PF 75 79 Westfld Cap 76 77 Ampol Explrn 77 72 Wormald 78 83 Email 79 80 Tooth 8t Co 80 82 Monier 81 73 Humes 82 81 Stock Trust 83 75 Pancon Min 84 84 Sarich Tech 85 93 Noranda 88 95 Bridge Oil 87 87 CIG 88 88 Aberfoyle 89 89 Howard Smith 90 91 Nth Flinders 91 85 N'man Gold 92 90 Gold Min Kal 93 86 Oakminster 94 92 Bdc Invest 95 94 Quatro 96 98 Linter Group 97 96 Caltex 98 100 Emperor Min 99 102 Kern Corp John Bevins to handle its account, worth about $1.6 million, a win that followed a tough pitching session against Saatchi and Saatchi Compton, and Forbes Macfie Hansen. Fujitsu is by no means a household name, but reckons the adshop can ensure everyone knows who it is in the near future.

The outfit is determined to carve out a bigger slice of the local market, after being ranked as Japan's largest computer and communications company. In Australia, Fujitsu reckons it is No 2 in the mainframe market. 8.70 8.80 2.70 .10 4.12 17.81 1.44 1.93 1.44 1.93 1571 11 27 7.71 15.18 19.56 10 62 217 29 60 1062 748 860 2348 1423 20.23 1831 243 1280 1000 1283 401 15 10 23 09 9 61 1568 1396 1035 1 94 2081 904 7.19 372 27 33 10.94 89 82 23 78 2 23 2302 1 81 1.22 1561 oe2 3.82 1030 20 07 1074 657 48 83 13 52 14 83 945 16.22 13 13 10 65 16 21 0 92 1.25 448 11.97 9 25 11 83 0.72 33 11 12 73 671 388 78 73 6701 337 8 35 4 93 .05 .10 .04 .05 5.70 0.85 2.85 1.27 309 1.61 0.95 1.69 13.36 608 17.33 2.00 1.39 56.35 0.00 3.94 14.29 37 59 10.48 43 06 8802 18.22 7.20 1.98 14.80 1.60 3.40 5.40 1.08 2.85 10.10 2.28 16.50 1.97 4.15 6.20 1.20 3.00 9 Newmoiit 6no 2 54 3.79 GROWTH EQUITIES MUTUAL 6.90 7.76 1.23 8.29 0.97 248 2.40 1.29 359 to Ivan ho 4.12 2.95 5.20 3.62 5 ri 1. 1.33 3.38 4.66 2.69 1.49 1.68 GROWTH UNITS In the 12 months ended 31st July, 1987, Growth Uni! in the Trust have returned 1.43 30 54 21.65 1.96 323 1087 263 1 83 15 30 305 456 3.93 4.83 358 2804 295 4.60 4.32 5.36 4.92 3.50 2.04 6.30 4.17 3.85 8.50 4.50 .20 .12 .10 .04 .19 .10 .05 17.72 38.01 21.70 22.60 18.23 16.17 47.37 11.15 16 00 1484 19.33 15 06 1841 25.20 GROWTH INCOME 2.33 1.38 4.26 549 1 83 550 355 4.12 2.62 4.33 609 0 63 0 24 1832 p.a. compound 1.82 p.a.

simple 1.00 322 1.54 200 1.56 1.83 1 48 1 93 649 088 Bell and Howell in Macmillan's sights Macmillan Inc, a leading US publishing company, has gained a 6.6 per cent stake in Bell and Howell Co, and says it may seek control. Macmillan bought 622,700 shares for SUS34.5 million million) and said it believed shares of the group, a company that originally won fame for its movie cameras and equipment, were undervalued. One Wall Street analyst said an acquisition of Bell and Howell made sense as a "logical extension of some businesses that Macmillan is already Analysts said the company finally had turned the corner after a long restructuring. Gone are the 8mm movie cameras and the slide projectors for which the company was once noted. It now has various well-positioned units: textbook and data-based publishing, mail-processing systems, information storage and retrieval, and video-cassette dubbing of motion pictures for the home video rental market.

Analysts estimated that Bell and Howell had a break-up value of $US70 or more a share. The New York Times Fairfax family pact From Page 29 .50 .18 .10 1i i INCOME UNITS In the 12 months ended 31st July, 1987, Income Units in the Trust have returned GROWTH 5.71 p.a. compound INCOME 14.08 p.a. simple These returns are assessed on the net Jmce of a unit (being $1.31 currently a Growth Unit and $1.05 currently $1.1 1-for an Income Unit) as at 1st August, 1986. The returns quoted are net of all service and management fees.

Future yields may bear no resemblance to past yields. 8th August 1987. Contact your adviser for further details. 9.18 1.37 266 1.62 3.07 1.92 2.01 3.69 17.43 9.35 205 2.13 10.07 1.98 28.51 7.46 11.88 5.32 1.84 17.56 1463 1.18 10.33 3.04 Newmont Mining's shares rose $US1 to SUS93.875. Both stocks were heavily traded.

Mr William G. Siedenburg, an analyst with Smith Barney, Harris Upham and Co in New York, said Newmont Mining probably was disappointed by the response from traders. He said the company evidently was counting on the spending plan to push its stock price above the Ivanhoe bid. The Newmont Gold plan, which Mr Siedenburg described as includes an enthusiastic assessment of the potential yield of the company's reserves, covering 1,000 square kilometres of northeastern Nevada. Newmont Gold said it had increased estimates of its total gold reserves by 6 million ounces, to 20 million ounces.

It said it would increase its production to 1.6 million ounces of gold a year by 1990. Newmont Gold expects to mine 913,000 ounces in 1988, compared with 585,000 ounces this year. The New York Times DALLAS: Newmont Mining Co has advised shareholders to reject the $US95-a-share (SA132) offer from Ivanhoe Partners, a group headed by Mr T. Boone Pickens. Newmont took this position after investment bankers at Goldman, Sachs and Co, and Kidder, Peabody and Co declared the offer "inadequate and not in the best interests of Mr Gordon R.

Parker, chairman and chief executive of Newmont Mining, announced at an analysts meeting in New York that the company's 90 per cent-owned Newmont Gold Co planned to triple production by 1990, a step that easily would establish Newmont Gold as the largest gold producer outside South Africa. Analysts welcomed the accelerated production program for Newmont Gold, but said they were unsure whether it would derail the unwelcome bid. Newmont Gold's shares jumped SUS6 to SUS44 in Friday's trading at the New York Stock Exchange. 15.80 30.97 17.29 20.92 16.17 20.37 11.95 47.30 13.42 20.72 34 95 34 05 57.16 3.50 1.59 5.70 3.30 3.85 8.50 4.20 3.00 2.80 4.00 3.60 4.75 1.78 4.55 8.40 5.00 15.70 2.70 9.64 0.88 3.70 1.90 7.00 2.75 11.00 3.50 2.50 4.10 2.20 4.70 8.20 3.00 15.00 2.80 3.45 6.50 3.02 5.10 5.80 1.55 1.70 .30 .30 .40 .12 1 GROWTH EQUITIES MUTUAL LIMITED 20 Loftus Street 1.23 319 1.79 260 0 17 1285 6261 4 09 1.41 3 46 2.55 1.29 20.20 2 50 1 40 384 51 1 66 3 57 2.14 2.91 224 203 1998 3.16 1 92 5 24 5.71 275 308 1 82 1 57 1 58 1.16 3 78 325 89 1.57 1 60 2.73 2.20 3 68 2 33 23 80 3 64 1 91 3 73 3.51 3.10 4 63 1.10 421 238 367 202 950 067 304 3 33 1.62 4 51 069 6.24 1552 5.63 1.81 5.38 0 98 2.75 184 04 043 2.10 .10 1.52 25.64 Full details of Tryart's offer will be spelt out wnen its takeover documents are released. They are Sydney N.S.W.

2001 Telephone (02) 27 7312 77 St George Terrace Perth WA. 6000 Telephone (09) 325 6177 Toll Free No. (008) 999 328 (Perth) Applications for Units in the Trust may only be made on the form attached to the current prospectus. Wall Street moves higher .20 1.10 .35 .17 .10 2.44 2.38 3.79 1.82 2.24 1.15 2.12 2.72 2.17 5.50 1.93 2.40 1.71 2.35 265 1.54 0.65 2.72 2.60 3.73 4.45 1.59 2.62 0.65 2.09 0.64 3.37 1.50 2.85 1.65 1.39 2.98 1.08 2.25 4.01 1.65 4.30 1.48 0.87 409 1.90 0.98 082 0.38 0.88 6.80 0.95 0.90 0.52 1.66 5.00 1.95 1.40 3.00 2.26 1.79 0.50 0.66 0.54 1.10 0.92 3.75 0.42 068 0.17 0.32 0.47 3.30 1.80 1.20 0.44 2.20 2.60 0.60 0.60 1.22 1.65 2.50 1.50 0.65 3.33 ii 1967 1387 43 80 2069 24.74 11.01 50 28 5293 54 82 17.34 25.04 52.66 15.92 27.14 12.33 14.08 20 28 17.26 1857 4.25 2.90 4.70 5.30 4.90 1.96 4.65 8.40 5.50 15.70 4.00 12.50 1.93 5.01 2.60 7.38 2.80 11.00 3.60 2.85 4.20 2.35 4.70 8.20 3.20 18.50 2.80 4.45 6.70 3.20 5.94 5.90 1.60 1.90 17.90 1.85 1.82 3.00 3.05 6.70 5.50 1.80 7.10 3.50 3.10 2.20 4.40 2.15 2.20 1.40 4.10 3.73 3.35 1.25 3.69 2.20 4.85 4.95 2.60 1.95 3.60 4.50 2.30 1.40 2.55 4.00 5.10 3.50 3.80 4.80 AUSTRALIAN CUSTOMS SERVICE expected at tne end ot this week. It is then that activity in Fairfax shares on the stockmarket may pick up, because shareholders will be able to assess fully the privatisation bid and choose whether to accept it.

Sales have been scarce in the past fortnight despite offers of up to $9-a-share by Mr Holmes a Court because most shareholders are awaiting full details of Mr Fairfax's bid. The release of the Part A also may lead Mr Holmes a Court to unveil further steps of his strategy. He will be forced to reveal details of the options deal he told the Herald last week that he had transacted. Any association between Mr Holmes a Court and another Fairfax shareholder will tip his total shareholding over the 5 per cent limit that an individual can hold in a takeover stock without identifying himself. If the options deal is with Mr Kerry Packer which is likely because the major institutional investors in Fairfax have denied any such link with Mr Holmes a Court then his holding could boosted to about 9 per cent.

Such a holding could be a springboard for Mr Holmes a Court to launch his own bid for Fairfax. Macquarie Bank has been appointed to advise John Fairfax Ltd on the privatisation bid. 562.374 561.600 540.564 532.770 530.022 511.372 501.842 495.000 493.742 484.869 474.750 471.104 469.329 463.422 457.818 455.043 450.000 443.530 442.765 441.392 439.914 437.361 438.214 429.034 423.482 419.451 414.709 408.380 398.750 390.803 390.630 386.185 383.040 389.016 388.478 357.069 348.279 345.898 344.337 338.919 333.752 332.469 332.271 332.175 329.114 322.886 319.075 318.780 312.233 311.377 310.129 308.271 304.359 301.437 300.618 300.000 298.745 298.242 297.695 293.747 291.437 2.90 1.95 2.97 1 00 307 .61 2.18 3.14 2.57 0.52 1.83 841.78 364 2.08 4 23 1.59 8.07 20.12 343 2.45 2.84 2.15 2 83 27 43 333 1.74 14 56 292 233 350 2.38 290 256 gained more than five-eighths of a point for the day. Friday's firming of the dollar is likely to reassure foreign investors that gains from stock and bond purchases will not be lessened by currency translations. The dollar's recent decline, and rising interest rates that stemmed from falling bond prices, had been behind the recent stockmarket pullback.

The Dow Jones Industrial average jumped 32.69 points to 2608.74, continuing a rally that began late in Tuesday's session. The key indicator, made up of blue-chip stocks, has now gained 63.62 points in its past three sessions, after a rapid slide that had trimmed it by 6.5 per cent from its August 25 high of 2722.42. The Dow gained 47.36 points for the week. The New York Times The resurgent stockmarket on Wall Street moved sharply higher on Friday as institutional investors took heart from the currency and credit markets, where dollar and bond prices shrugged off early nervousness and rebounded strongly. Investors and traders in all three markets apparently decided that, as a whole, the Government's reports on Friday about the nation's trade deficit and inflation were positive.

After the trade deficit was reported, the dollar plunged below 179 marks and below 141 yen. Buyers came into the market in force, and the dollar ended the day higher against both currencies. Bond prices fluctuated in a similar fashion. After dropping about a point early in the day, long-term treasury bonds recovered and eventually 9 02 1663 17.77 13 60 923 1492 13.09 033 047 2357 638 74.94 803 403 395 873 6.57 9 95 1237 18.71 15 03 14 92 24.15 1.64 121 43 7.S9 1 61 1 81 4 97 24 43 747 1354 6 12 763 17.44 9.19 893 100 103 AOG 101 101 AWA 102 97 Tubemakers 103 118 National Con 104 105 Sthn Farmers 105 99 Metal Man. 106 111 Metana Min 107 121 Rheem 108 106 Arimco NL 109 104 Clayton Rob 110 112 Petrsvil Sle 111 107 Forsyth NL 112 109 Pan Aust 113 108 Paragon Res 114 110 Peko Oil 115 113 Sons Gwalia 116 115 Aus Fond Inv 117 114 Equiticorp 118 119 Hill Fy Gold 119 116 Jennings 120 120 Taylor JN 121 122 Wesfarm 122 0 Asarco 123 117 QBE Insur 124 123 OPSM 125 125 Adel Bright 126 132 Deak Morgan 127 134 Normandy Res 128 124 Oil Search 129 128 Alcan 130 133 Nat Mut Ft 131 135 MPintosh 132 143 Battery Gp 133 140 Anglo Americ 134 137 Sthn Pacific 135 127 Centaur Min 136 130 City Resourc 137 142 Geo Weston 138 126 Tmoc Resour 139 136 Pioneer Sug 140 131 A Asset Mgmt 141 138 Sunshine 142 152 Brick Pipe 143 155 Comptr Pwr 144 145 Norgold 145 146 Danomic Inv 146 129 John Holland 147 139 Barrack Mine 148 144 Crusader Ltd 149 151 Dominion Min 150 147 Old Cement 2.99 2.30 17.69 2.43 17.69 6.19 2.11 1461 17.94 9.75 2.37 17.22 1.63 1.36 13.60 1.53 1.73 2.33 000 2.38 381 3.15 2.11 1301 13 49 0.97 1.25 000 1651 5.01 8.43 41.16 4.52 1.86 1.94 2.38 0.00 1.37 2 01 305 000 2.01 3.00 15.24 3.49 17.79 .20 .05 .01 .05 .04 1.80 .02 .15 .40 .07 .25 .25 .20 .07 .23 .45 .16 1.84 223 1.00 24.73 12.15 205 6.23 13.80 1.85 1.16 2.90 2.75 6.30 5.40 1.80 6.50 3.10 262 2.10 4.40 1.80 1.95 1.32 4.10 2.85 2.50 1.12 2.55 1.85 4.83 4.00 2.60 1.77 2.90 4.35 1.30 1.25 2.50 3.60 4.65 3.15 3.50 3.85 8 19 Harmonized Tariff Australia's first bicentennial activity will be a new Customs Tariff an eight digit system used by the worlds major trading nations.

The new Tariff will become law on 1 January, 1988. This document will form the basis of tariff assistance to Australian industry. It is an international classification system that will clearly identify all imports. Its statistical accuracy will provide more reliable information to government and business. Industry and commerce have been aware of the impending change since Customs published draft chapters of the new Tariff in August 1984.

The Industries Assistance Commission reported to the Minister for Industry, Technology and Commerce on the subject in February 1 986. Understanding this new system could be vital to your business. Obstacles to Bond bid From Page 29 i if 3'r 13.75 2 38 2 87 9 57 25 94 0 88 4 40 1.70 26.78 3 02 1.28 3 48 39.57 9.34 4.14 4.58 243 21.86 357 2.18 24 40 should hold From Page 29 The greenback dropped initially by a yen, sending the local dollar to its international high of US73.15c. The US dollar's rise forced the gold price lower, with the metal falling an ounce to Friday's US trade data showed that a substantial decline in the value of the dollar had not yet produced a big reduction in the nation's trade shortfall. Traders said much of the July shortfall was related to oil imports, and many observers expected oil prices to decline in the next few months as tension eased in the Persian Gulf.

Also, July was traditionally a month for weak US exports, some traders said. The deficit figure followed, the June billion deficit, a result that sent the US dollar into a 10-yen tailspin. for five years, unless there was full board approval. As well, the target company's assets could not be used to finance the acquisition. Mr Mitchell had not heard of either suggestion.

He believed the Governor's legislative intentions were to protect the integrity of Heileman's workforce. But since it was legal in the US ultimately to encumber the assets of a recently acquired company, any New York State-style law could force Bond to rework its financing plans. The bridging finance had been organised through a syndicate of four banks led by First National Bank of Boston, with Salomon Bros the junior lender. The same group was committed to participating in the permanent financing of the Heileman takeover, said Mr Mitchell. The price of Heileman stock had steadied at about $US41, albeit on healthy turnover of 900,000 shares on Friday.

.15 79.18 2.89 863 1587 347 3.35 6 95 17.17 25.82 2.51 550 3791 53.59 0.79 2.35 3 61 16.19 17.07 15.58 3.07 1.86 3.45 9.17 working version of the Tariff Is now available from any state office of the Australian Customs Service. Compiled in co-operation with the Sydney Slock Exchange State Service. Market Capitalisation include: escuiities convertible into ordinary share, rights, certain option and share participating in dividends and issues on equal terms with ordinary shares. Non-perticipetmg preference or deterred shares which do not convert into ordinary shares are eacluded Earning and dividend yield are based on the latest annual or interim profit reports. Vields and share prices are adjusted tor issues and capital reconstructions.

Discretionary charges (le BHPs Fined Asset Valuation Adjustment) ere added back to earnings..

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the The Sydney Morning Herald

- Archives through last month

- Continually updated

About The Sydney Morning Herald Archive

- Pages Available:

- 2,319,638

- Years Available:

- 1831-2002