The Cincinnati Enquirer from Cincinnati, Ohio • 20

- Publication:

- The Cincinnati Enquireri

- Location:

- Cincinnati, Ohio

- Issue Date:

- Page:

- 20

Extracted Article Text (OCR)

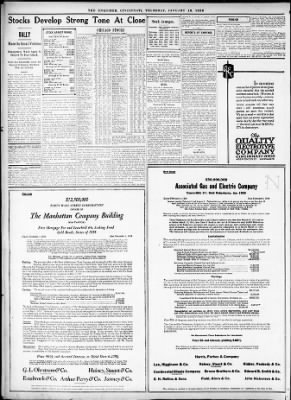

THE ENQUIRER, CINCINNATI, THURSDAY, JANUARY 16, 1930 M(WMMVWwwVwVWWMwVMMwJ achieved by a process of gradual evolu tion. FOREIGN Pomlntck A Bomlnlck Easy money. Stocks Develop Strong Tone At Close Investment trust buying and a slight In Stock Averages. crease In public participations are current STS! UL CABM TO TUB ENQUIllEH. ractora or importance and we iook tor further Improvement during the balance of the week.

London, January 15 The stock market had a quiet but cheerful tone today. Copyright, Standard Statistics Company. SOInd. 20K.lt. SOUtll.

BOT'I Wednesday 169.5 1.11.1 S1S.7 111.9 ssuea of transatlantic Interest wena firm, CHICAGO STOCKS Chemical, molasses, margarine and match STOCK MARKET RANGE. REPORTS OF EARNINGS urltics had a firm tone, while tobacco, (Quotations by Associated 414 psr rent early, and unchanged from Tuesday's clous. The rale of discount In Ihe upon market for 30-day bills was 4 5-1(1 per cent, compared with 4H Pr cent early and 4H per cent at Tuesday'! close, and for 90. day bills was 414 per cent, compared with 4 S-3J per cent early, and unchanged from Tuesday's close. (m ill.

CAnl TO THB SNQUIKSR. London, Jnnuary 15 The Financial News Is Informed that one of the largest American railways has placed a contract for 30,000 tons of copper. Deliveries are lo he made within three years, contract being based on 16a per pound. Fails, January IB (AP) Prices were firm on the Hourse today. Three per cent rentes 88 francs 80 centimes, Five per cent loan 108 francs 80 centimes.

Ex' change on London 12.1 francs (3 centimes. The dollar was quoted at 25 francs 46U centimes. artificial silk and textiles were quint. RALLY oil group was easier, while rubbers ISalea.lHlBh.iLowlClom. Total Sales Of Stocks.

35 wore steady. Talking machine securities were quiet. The mining group had a quiet Altofer Brothers report for six months Prav. 168.3 Week 18.0 Vesvr 20S.S years sujo 144.3 Wkly 107.5 High, 1B. X53.8 Low, 18S9.

111.3 1.11.0 ltft.5 1.14.1 180.1 10S.5 167.8 117.7 S15.6 8 10.3 O0.7 137.3 104.0 3S3.1 156.6 171.3 160.1 105.0 137.1 107.1 3A.1.5 110.3 tone, but Khodeslans were tn demand. ended September 30, net Income after all 350 550 500 30 200 4050 60 diaries and Ftdoral tuxe of Ford Motors, was quoted around 2 Hracilian Tractions ordinarily around S.S'JO.IOO 1.878.0OO 3.62,iflO S.t.ni.ano tales Mocks Previous dny Snme lny lat Year to date eiume period lutt year. equnl, after preferred dlvldoml require 39 and International Nickel around Made On Small Volume ments, to 93c a share on 135.061 shares or 36V4. 33 2H 24 3Vi 2314 20 4 234 26 Mi 934 54s 16 30 154 common stock outstanding. Total sales, 3,630,060.

The gut edgo division nad an easier Total Sales Of Bonds. K. Jvlnuey reports for year encieci liecember 31. net Income of after tone today. Foreign Issues generally 60 were steady.

Home and Argentine rails 1100! chargea and Federal taxes, against ($57,346 in were easier. Manhattan Dearb. Meadows Mfg Mid West Utll A Po war Midland I'nitcd Mo-Kan Pipe Line, McGra Elec Mid-West Utll ne Miss Val PI Modlne Monighan Mfg Monroe Chem pf Morgan Lithog'ph. Muskegon Mot Spe Nachmann Sp'gflll. Nat Family Nat Leather Nat Repub Inv.

Nat Secur Po ctf Nat stamlard Martin Farry Cornoratlon reports for 200 60 1730 10.20.-1,000 10,978,000 98,131.000 128.364,000 Sales of bonds Previous ilay Same day last Year to date Name period last year. SriCIAL CABl.g TO TBI KMQC1SIR. Montgomery Ward Again Is Subject To Bear Attack. Amsterdam. Netherlands, January IB (AP) The Bank of the Netherlands to day reduced Its discount rate from 4(4 per cent to 4 per cent.

50 quarter ended November 30, net loss of $85,251 after charges. This compares with net loss of 137.654 In 19-8 quarter. London, January 18 Money on call here Kill 60 28 today closed at 4 per cent, compared with 34 4 2. 24 23 204 234 36 9314 62 10 30 4 144 1H 37 1 61 14 85 35 14 314 40 684 184 624 6 114 17H 19 nun ini t'ompany reports for year ended Pocember 31. net profit of $8,342,495 after all charges and taxes.

Equal to a share on common, against $3,008,027 or 3-4 20, 33 4 36 4 3Vi 64 1(1 SOU 15 17 38 19 ll 14 86 36 14 40 684 184 isi 17H 33 group activity is most prominent, achieved a new high on the recovery. Stock Loans. SrgCIAX IMSrATCH TO TH1 KNQl'IRKR. New York, January IS There was a on common in 1938. 400 100 100 100: 750 830! 60 250 500 250 100 Creamery Package Manufacturing Com Steels And Amusement Issues Are Features Of Session Oils React, With Cut In Crude.

Avcrags Of 15 Railroads. Aterajce of 15 railroads 13.V31 I'miou tlay YVeelt aero 133.33 Same period last year 62 Average Of 15 Industrials. Averase of 15 Industrials 81 Previous day S02.01 YVeek air 1 Same period last year S22.66 Nation! Terminals IK 51 14 86 36 14 2 40 684 184 63 pany reports for the fiscal year ended November 30 a net Income of after nil charges. Including reserve for Nat Union North Am Amer Pow No A So Am Corp. expiration or patents and Federal taxes, good demand for Pennsylvania, Fox Film and Sears KoehucU in the stock loan market today.

Kates generally were: Bethlehom Steel 3 per Radio 4, United Statea Steel 4, American Smelting 4, Studebakor 4, General Motora 4, Uen-eral Electric 3. American Tunhnn. a equal arter preferred dividends to a share 155,000 shares of common stock, 750 Northwest Bancorp 150 as compared with a net of $434. SS4. oi $3.68 a share on the same number of Oshkosh Po pf Penn Gas Elec.

Perfect Circle 184 17Vi Average Of 30 Stocks. 50 100 100 common shares In th previous fiscal year. After payment of $326,500 In dlvlrlends. Telegraph 3. Standard Oil of New Jersey 4, Consolidated Gaa 4, United Aircraft 3, 33 3 $25.1.060 was added to the surplus, against Public Serv xd 2174'217i 10'317Vi asn 3, American Foreign Pow 1001 IB.

16 $30,284 In the previous year, after pay Arcing of 30 Previous day Week airo Same period last year. er 3, i-ackard 3, American Can 4, Sears 168.51 166.59 181.14 650 ment or 4404,000 in dividends. Holly Development Company renorts Music Co Rath Packing Raytheon Reliance Ross Gear 23 17 17 net profit ior 11 months ended November nucnucK a per ceni ana tox Film flat. Money. SrXCIal.

DISPATCH TO THI XNQClBlfR. 100 1001 350 1100 600 900 30, 1929, alter depreciation, depletion, In tangible drilling costs and income tax ac Railroad Average Of 30 Bonds. Average of 30 bonds 06.07 Previous day YVeek aito WUS same period last year Bb.im 16 23 17 17 31 li 8-h 334 6 60 23 26 4 37H 18 33 4 23 17 17 314 8H 30 6H 60 26 27 17 cruel, rf $80,096, equal to approximately 9c a share on 900.000 sharna outstanding. Sanamo Elec Seaboard Utilities Sheffield steel Adams Mfg I 60 30S0 301 Allied Mot 111! 650 16 16 ll4 Allied Products xd! 100 37 37 37 American f'alortpel 100 26 25 Am Com Pow 1301 24 Vi 24 American Equities 330 IS 17 IS Am Hallo 60 1 ls li Am Service 800 7H 7 7 Art Metal xd 200 19 18 18 "4 Assoc Tel 1350 24 24 S4V4 Atlas Stores 3350 221j 1 9 "Vi Auburn Auto 300 190 180 185 Paxter Laundries A 1 1 i 11 2050 36 34 35 Blnks Mr 100 36 3ti 26 Born-Warner 6S0O 35 3S'i Borln Vlvatone pf. 150 13 13 13 Inter.

100 27 2" 27 Banco 50 CI vj 21V Brown Fil WrA 250 19 1S- 19 Vo Jl 300 11H 104 1 1 VI Butler Bros 3150 15 15 IS Si Castle AM 50 47 47 47 Ceco Mfflf 150 17H 17 17 Cent Pub Serv A 150 35 35 35 Cent So 1250 22U 23 Chicago Corp 6300i 14 13H ChlcaKO Corp pt. 3500 39t4 383s 394 Chicago Flex Shaft 100 15 15 15 Chicago Investors. 1250 7ki 7 7 Do pf 350 SI is 34 Chicago Yel 550 27 27 3" Cities Service 6250 29t, 28H Cluh Aluminum 250 6 4 6 Comnwlth Edls xd 125239 237V 239 Conity Water Serv 200i 13 12 4 1H-J Construct Materials 50 144 144 1 Po pf SOOI 394 39 394 Consumers 200 64 6 4 6 4 Contl Chicago ctfs 12700 64H Continental 50 20 20 20 Cord Corp 2250 12 ll'i 12 Corp Securities 50 544 644 644 Cent 111 See 50 27 27 27 Cent States Pur 100 94 4 90 94 4 Coleman Lamp 100 36 35 35 Community 50i 31 21 21 IHvia Industrie 50 3 .1 IVxter Co 100, 13'j 134 134 Kddv Taper 50: IS IS 18 Electric Household 2300! 44 4J 44 Kl Research Lab xdi 3501 'i FitrSim Connell I 200! 49 4S4I 4SU Koote Gear A Mac 5501 7 IT7, General Parts 6001 36 Cleaner lOOl 21 21 21 Godchaux 100 18 17 "4 18 Gr Lakes Aircraft. 2501 4 4 44 44 Grimsby-Grunow 10S001 20 19 19 Hart-Carter 1001 22 22 22 Hormel A Co 100 38H 36'ii 3S, lloudallle Hersh A 450! 2: 22 22, Do 300 20 20 4 20 Illinois Brick 100. 28 26 26 Inland Vtillties 500 24S J4V, 244 lnsull I'lil Invest 830; 594 68l 58 Ho pf 2nd Ser 200! 87, S7 Iron Fireman 90o 24 I 24H Jefferson Elee 3550424 4041 42 Kalamazoo stove 3ooi til 604 Gl Kats Pruit 100 37; 37i 37 i Kelloss Switch 1501 64 54 '34 Pecker Colin 50 12, Ken-Rad 100 ST, 84 Kirsch pf 301 IS IS 18 Lane Prus C.

1001 5 5 5 Libby-McNeill 500 19 184 19 Lincoln Pig pf 501 434 434 434 Llndsav Xunn Tubl 1501 284 5iW 24 Lion Oil Refining. I 350 1941 18'i l9'a Lynch Glass Mach 1501 15 14 IS New York, January 15 Call money dropped to 4 after renewing at 4Vi per cent. Pemand was very poor and outside and $124.47.1 nr l.lUc n. mIimia thn miniA 50 23 Standard Predglngl 60 400 400i 100 24 110 pf Stone (HO) Co. S7s money was freely offered at 3hi per cent.

Timo money was unrhanged at 4 4jf414 Der cent for all matnrliua rn.n.,.,-..i. i 150 Studebaker Mall A 18 135 133 630 1354 344 34 4 paper was quoted at per cent for prime 60 50 Swift Co Swift lntl a Thompson (J R) i. 1 cr ceni ior gooa names and 97 38 97 31 Time-O-Stat Contr crm mr names not so well known Comments By Brokers. 25'4 124 24 4 period of 1928. Freeport Texas Company, reports a consolidated net Income of $4085,041 for the year ended November 30, equal to $5.69 a share on 729,844 ccpltal shares, against $3,275,575.

or $4.48 a share. In the previous year. The net Income for the quarter ended November 30, 1929, was or $1.84 a share, against $869,366, or $1.19 a share, in the preceding year and $1.3.1,182, or a share. In the 1928 quarter. The Cities Service Company reported net earnings for 1929 of $43,433,386: a new high record and more than 59 per cent above the 1928 total.

Per share earnings of $1.18 compared with $1.14 for the twelve months ended November 30 last. Net earnings for December constituted a record for one month, totaling tt suln of 55 Per cent over tha rCC'IAL DISPATCH 10 TH. SNQtTIIUCX. New York, January 15 The stock market developed a decidedly strong tone during the afternoon session today, following more or less Irregularity and heaviness during the morning. Immediately after the opening renewed pressure was exerted against Montgomery Ward and a few other Issues and while some of these nave ground readily, the main body of stocks held quite well.

Montgomery Ward dropped more than five points to make a new bottom under 39 and a number of the pivotal issues eased off from a point to three points. For the most part, however, prices did not give way to ny material extent and this probably was the basis for the renewed courage of traders, who began to buy stocks in the afternoon. The rally which got under way soon after mid-day took prices briskly forward on comparatively little volume and closing quotations were not only well above the earlier low-levels of the day, but showed fair sized net gains over Tuesday's final prices in the majority of cases. United States Steel closed at 172 Vi, with a gain of nearly l'i points. 'American Can showed a corresponding train to close above 125, Montgomery Ward was actually off three points Hill One of the Indications that there Is still vast buying power ia seen In the l.eavy oversubscription to the Ilfio.nni) nnn 34 4 97 38 25 124 2S1l 42 10 32 154 18-4 564 32 27 7 '4 23 43 10 31i 14 25i 12 4 24 41 10 32 154 184 25 4 22 27 ISO 60 50! 4000 250: lOOl 100I 350 9001 400 700 2501 100 100 American Telephone Telegraph 5 per uvurmuiuo tooi.ut'u.tiuu were old.

With such a Dower behind th there is nothing to worry over the fact 18 254 214 264 7 4 mm. speculation is at tne moment rela Unit Corp United Gas 8 Gypsum pf r.adio Utll Lt Po vot Utility Ind Po pf Vortex Mfg Po A Wahl Warchell pf Wnrd Montg'ry A. Wayne Pump pf, West A Tel xd Wextark Po -id Wlnton Woodruff Yates Zenith Radio tively quiet. 234 234 Gibson We advocate a trading policy In glancing over our list of patrons we arc pleas antly reminded that the satisfied customer comes back. Of course, it is our business to satisfy none ex pects to hold trade any other way.

Active accounts tell their own story and sometimes, such patrons are more than satisfied. We try to excel and it is in that spirit that our entire organization works day by day the year round the result just must be QUAL ITY in electrotypes. QUALITY ELECTROTYPE COMPANY CINCINNATI-OHIO 436 PIONEER ST. CANAL 6975 150 130 1284il3il 29 284 24 19-t, 31 47 14 14, 150i 350l 800 100! 100 100 60 550 27 214 31 47 14 1444 214 31 47 14 14i 6-4 BONDS. same month of 1928.

First annual report of the United Corporation, Morgan-Hnnbrlglit Utility Holding Company, formod January 7, 1929, disclosed that market value of Its holdings on December 31 was approximately above their cost to tho corporation, despite the crash of the securities markets In October and November. Total securities held as of December SI were carried at total cost of $301,916,947. compared to an estimated value of on that date. Cash on hand and working accounts totaled $18,390,229, making total assets on a hook value of Income for the period from January 7 to December 81 totaled of which $1,272,417 was realized from profit on sales, commlss'ons, while the remainder came from dividends and Interest. Chi Rv A 6s 4 45 45 Sou Pept Strs s.

1335,000 98 98 I 98 Swift 6s .44 1.000 1014 1014U014 Wis Bank Shares. I 400 US U' Stock sales, 145,000 shares. Bond sales, 113.000. at its closing price of 40i, but this represented a recovery of more than two points from the low. A wide variety of other stocks ended the day with net advances averaging one to two points.

"While the report persisted that the forthcoming statement of earnings of Montgomery Ward would be rather disappointing, officials took occasion to deny reports that the company is closing its retail stores. It was stated that out of of 550 stores only one of two were closed because of unsatisfactory location and that the company is not diminishing its mall order promotive efforts and will continue to open additional retail outlets. There were several encouraging news developments during the afternoon. The Philadelphia Federal Reserve Tank lowered its rediscount rate to conform to the 4'j per cent rate of the New York institution and there was a decidedly easy tone In the credit situation. Call money eased off to 4 per cent and was available at 33 per cent in the outside market.

Amusement and theater issues were outstanding strong spots during the afternoon, with Fox assuming a prominent position in the upswing. This stock gained nearly 2 points to get within a fraction of 23. while Loew's advanced nearly 3 points to sell above 51 and Famous Players ran up to 51 for a gain of nearly 2 points. Radio Keith-Orpheum sold above 25 for a gain of nearly 2 points and most of the other Issues in this me purcnast or sound, active industrials and utilities on reactions for profit-taking on bulges. Pyer.

Hudson Co. Steels were stimulated mildly by the Iron Age report, which showed a growing demand and gain In production, althouxh somewhat at the expense of prices. Motors and coppers continued to lag. The market still continues to he a two-sided affair with a gradually firming undertone. We would adhere to a trading position In the rails, utilities, and leading industrials.

Westhelmer Notwithstanding pressure against several members of the mercantile group, the market, as a whole, gave an excellent account of Itself yesterday. The upward trend has become more clearly defined and a strong opening Is looked for this morning. Hutton With a stock like Montgomery Ward making a new low and the genera, lint holding their own it begins to look like the market Is showing signs of strength. Would buy the standard stocks at the market. Otis Further progress was made In the uphill battle the market has been making.

This constitutes additional support and encouragement for the policy of holding leading stocks for higher prices to be STATE OF OHIO, TMVISION OF SKf'l'R-1TIFS. DEPARTMENT OK fOMMEKCE. Purnuant to the provisions of the Ohio Securities Act notlre ry publication is herebv Riven that on the ia ilr.y of January. 1930, BPn Knufman, of Southwest Corner Fourth and Main Street. Cincinnati, Ohio, filed with the Division of So-turitles.

at Columbus, Ohio, an application for license to act as a salesman in the Mat of Ohio, and that said application la now pending. Dated this 2d (lay of January, 1930. BEN" KAUFMAN. HAW SILK. New York, January 13 (ATI 1'1'iw silk futures closed; sules 540 bales: March $4.63, May $4.5.1.

July $4.45. Open market quotations (60-day basis), Shanghai steam extra $4.40. Canton double extra A 14.16s $3.05, Japanese crack double extra $4.75. lowed by a general price adjustment In all the Important producing areas. While most stocks were displaying a greatly improved tone, there were several specific stocks failing to participate In the better sentiment.

Radio closed at the lowest price of the day, Timken was off a fraction and U. S. Freight sold off on light volume. Utility stocks as a group were in much better demand. Consolidated Gas furnishing leadership by advancing to the best price of the present recovery on substantial volume.

Tills stock, of course, is considered the logical leader If the utilities are to enjoy a revival of investment and speculative possibilities. Electric Tower Light, in which division displayed sympathetic firmness. Earnings of most of these companies currently are running at entirely satisfactory levels and the outlook continues bright. Motor shares were again Inclined toward heaviness and most of them eased off moderately. There were rumors in some quarters to the effect that General Motors soon would announce new financing on a large scale, but those close to the company declared such reports to be without foundation.

The petroleum stocks were somewhat in supply, following the announcement of crude oil price reductions by two prominent companies, which probably will be fol New Issu THE CINCINNATI TAR CORPORATION. NOTICE. The annua! meeting of shareholders of Th Cincinnati Car Corporation will be held In Room No. (thirteenth floor, chamber of Commerce Building, Fourth and Race Cincinnati. Ohio, on Monday.

February 10. 130. at 10:30 A. M. The stock transfer hooks of The Cincinnati Car Corporation will be closed at the close of business Jamriry CO, and will remain closed until th opening of business on February 11, 1930.

E. C. Secretary. '1. ill' ''L New Issue $12,500,000 FORTY WALL STREET CORPORATION OWNER OF $30,000,000 Associated Gas and Electric Company Convertible 5 Gold Debentures, due 1950 Dated February 1, 1930 Due February 1, 1950 Interest payable February and August 1.

Redeemable at a whole or in part at any time on not less than 30 days' published notice at 103 on or before January 31, 1940; thereafter at 102 on or before January 31, 1945; therafter at 101 on or before January 31, 1949; thereafter at 100 to maturity; in each case with accrued interest. Coupon Debentures in denominations of $1,000. The Public National Bank and Trust Company of New York, Trustee. Reference is nude to a circular descriptive of these Debentures, which is summarized in part as follows, for a more complete stats ment respecting the Company and these Debentures: These Debentures will be convertible at the holder's option at any time after March 15, 1931 and on or before March 15, 1933, into Class A Stock at the rate of 18 shares for each 1,000 Debenture, subject to the Indenture provisions with respect to stock split-ups and combinations and certain stock dividends. In case the Debentures are called for redemption on or.

before March 15, 1933, the conversion privilege may be exercised only up to the tenth day before the redemption date. The Indenture will contain provisions for the adjustment of interest and dividends on conversion. Capitalization The consolidated capitalization of Associated Gas and Electric Company and its subsidiary companies as of November 30, 1929, assuming the sale of all of this issue of Debentures and after giving effect to recent financing and to the acquisition or retirement of securities and to calls for redemption since that date, is as follows: Associated Gas and Electric Company: Outstanding Class and Common Stocks (no par value) 7,768,320 shares Preferred Stocks (all of equal rank) Liquidation Value $24,983,700 Debenture Obligations Convertible now or later into Stocks at Company's option 86,832,000 Convertible 5 Gold Debentures, due 19S0 (this issue) 30,000,000 Other Funded Debt of Company 208,433,232 Subsidiary Companies' Funded Debt and Preferred Stocks: Associated Electric Company 43, due 1953 17,851,000 Other Subsidiary Companies' Funded Debt 143,705,200 Subsidiary Companies' Preferred Stocks Liquidation Value 53,431,750 Minority Common Stocks and Surplus applicable thereto 2,274,472 Includes 5ri Investment Ctrlificitej and Interest Bearing Allotment Earnings The consolidated earnings of the Company and subsidiary companies, irrespective of dates of acquisition, for the twelve months ended November 30, 1929, and annual charges on securities outstanding at that date, assuming the sale of all of this issue of Debentures and after giving effect to recent financing and to the acquisition or retirement of securities and to calls for redemption since that date, were as follows: Gross Operating Revenues and Other Income (89,177,899 Operating Expenses, Maintenance and Taxes (except Federal Income Taxes) and amounts applicable to minority common stocks 40,756,445 Consolidated Net Earnings before Interest, Depreciation, Dividends, etc $48,421,453 Annual Interest and Dividends on Funded Debt and Preferred Stocks of Subsidiary Companies (less $775,576 credit for interest during construction) and Annual Interest on entire funded and unfunded debt of Company to be 21,284,644 Depreciation $4,238,210 Consolidated net earnings as above ware, befora depreciation, over 2.27 times and after depreciation, over twice the abova annual interest and dividend charges. Includes interest on Investment Certificate and on $8 Interest Bearing Allotment Certificates, but excludes Interest ea obligations now convertible at Company's option into stocks. Over 92 of the gross operating revenues was derived from electric and gas operations.

The Convertible Debenture obligations of the Company which are now convertible into stocks at the Company's option, and the Preferred, Class A and and Common Stocks which are junior to this issue of Debentures, have an aggregate value estimated, on the basis of current quotations, to be in excess of $400,000,000, We Recommend These Debentures for Investment Price 90 and interest, yielding 5.85 These Debentures are offered when, as and if issued and received by us, and subject to approvsl of counsel. It is expected that Temporary Debentures will be available for delivery on or about February 3, 1930. The Manhattan Company Building New York City First Mortgage Fee and Leasehold 6 Sinking Fund Gold Bonds, Series of 1958 Dated November 1, 1929 Due November 1, 795 infest. Msv I ind November 1. payable the offices of C.

L. Ohrslrom ft Co and of Hley. Stuart ft Co in New York City nd Principal at the principal ofme of ihe Trute. Coupon Bond in interchangeable denominations of $1,000 and $500: registerable as principal. Redeenable, at the option of the Corporation or through operstion of the sinking lund.

in whole or in pin. on any interest payment date, upon ihirtv davs' pub'ished notice, to ind includinj November 1. 1Q3. at 105: thereafter, lo and including November 1, 1937. at 103; thereafter, to and including November 1, lW.

at 102: thereafter, to and including November I. 1957. at 101: and thereafter at 100; in each case with accrued interest tn the date hted for redemption. Interest payable without deduction for normal Federal income tax not in eicess of two per cent per annum. Refund of certain Minnesota.

Pennylvania, Connecticut. Kansas and California tales not to exceed four mills. Maryland tax not to eiceed four and en ha.f mills. Kentucky, Virginia, West irginia and District of Columbia tales not to eiceed five mills. Michigan eiemption tax not to exceed five mi.ls.

and Massachusetts lax measured by income not to eiceed sii per cent, to resident holders upon written application within siity days alter payment, all at provided in the Mortgage. Guaranty Trust Company of New York, Trustee. The Mortgage provides for qutrtrrty Sinking fund, beginning November 1930, sufficient to retire these Bonds or before mtturity. Building: The principal office of the Bank of Manhattan Trust Company will be located in The Manhattan Company Building, which is now being erected on the north side of Wall Street, New York City, adjacent to the Assay Office and Sub-Treasury of the United States, and extending through to Pine Street. This is one of the most desirable locations for a bank and office building in the Wall Street financial district.

The building rises to a height of 70 stories and will be one of the outstanding commercial structures in the world. Except for a small portion on the westerly side of the Pine Street frontage, the building is scheduled for completion by May 1, 1930. Forty Wall Street Corporation has entered into a contract with the United States Government for the purchase of the Assay Office site, adjoining the building. The statistics contained herein with respect to the estimated income of the building, the deductions therefrom and the estimated value of the completed property, are based on the acquisition and improvement of a small tract (aggregating 1,117 square feet) proposed to be presently acquired from the Government, but exclude the bal ance of the Assay Office property, possession of which cannot be presently obtained. Earnings: The annual income of the completed building has been independently estimated as follow Grow Income Operating Expenses, Ground Rent, Maintenance, Insurance, Allowance for Vacancies of $400000 which is over ten per cent of the estimated annual rent roll (exclusive of the space to be occupied by the Bank of Manhattan Trust Company), and Taxes, other than Income Taxes 2, HI, 000 Balance Maximum Annual Interest on these Bonds 710,000 The Bank of Manhattan Trust Company, a subsidiary of The Manhattan Company, has leased and contracted to lease space in the building at an annual rental of over $1,000,000, of which over $893,000 commences May 1, 1930 and the balance prior to May 1, 1931.

Leases and contracts for leases have already been signed for more than sixty per cent of the estimated net rentable area of the building. The annual rental from space already leased or contracted to be leased is considerably in excess of estimated annual operating expenses, maintenance, insurance and real estate taxes, average annual ground rent and maximum annual interest charges on these Bonds. Security: These Bonds are, in the opinion of counsel, secured by a direct first mortgage on the land owned in fee by Forty Wall Street Corporation and the leasehold estates of the Corporation, subject to the aforementioned lease of space to the Bank of Manhattan Trust Company. The Corporation has agreed that if, by December 1, 1930, it shall have acquired the aforesaid small tract on Pine Street, aggregating approximately 1,117 square feet, it will convey this property to the Trustee, subject to no prior lien, as additional security for these Bonds. If such property shall not have been acquired by December 1, 1930, the Corporation agrees to retire, through the Sinking Fund, not less than $1,500,000 in principal amount of these Bonds.

The value of the completed property, including fee, leaseholds and building, has been independently appraised at $22,000,000. On the basis of this valuation, these Bonds will represent less than a fifty-seven per cent loan. Completion of the building has been guaranteed by Starrett Brothers, Incorporated, and The Starrett Corporation. Management: The building is being erected by Starrett Brothers, Incorporated, lt is owned and will be operated by Forty Wall Street Corporation, which, like Starrett Brothers, Incorporated, and Starrett Investing Cor poration, is a subsidiary of The Starrett Corporation. Price 9614 and Accrued Interest, to Yield Over 6.25 The tboie itMtuu it summarized rem and is subml la feffer Cef.

IP. A Starrrlt. tkr. Prttidfnt (As CarparaJian, ta the Bankers. These Bands are aftrai taken, as and if issued and received by us, and svbiect la tke appravtl al caunsel; alsa subject ta chauta price and friar sale.

Dtlhery may be made tke frst instance in tempartry ar dtjinitivt Bands ae in intenm certificates a) a New Yark City bank trust campany. Harris, Forbes Company Kidder, Peabody Co. Lee. Higginson Co. Halsey.

Stuart Co. Incorporated Continental Illinois Company Brown Brothers Co. Edward B. Smith Co. Ineorporatod Field.

Glore Co. John Nickerson Co. Ohrstrom Co. Hahey, Stuart Co. Incorporated Incorporated Estabrook Co.

Arthur Perry Co. Janney Co. Incorporated Thl information and these stau.ulra, although nof guaranteed, hava been taken from sources belieod lo be reliable. The above offering; la made by such of the abova named dealers as ar duly licensed under the Ohio Securities Act. E.

H. Rollins Sons ThU tittering it routined to llrrn.ed dealer, of the Dlvl.lon of Sororities, Department of Commerce, of the State of Ohio..

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

Publisher Extra® Newspapers

- Exclusive licensed content from premium publishers like the The Cincinnati Enquirer

- Archives through last month

- Continually updated

About The Cincinnati Enquirer Archive

- Pages Available:

- 4,581,614

- Years Available:

- 1841-2024