The Oneonta Star from Oneonta, New York • Page 11

- Publication:

- The Oneonta Stari

- Location:

- Oneonta, New York

- Issue Date:

- Page:

- 11

Extracted Article Text (OCR)

Your Income Tax Oneonta Star Feb. 1,1956 11 Figuring Deductable Items I Third of Seriei BT FKANK O'BRIEN After you have claimed your exemptions, the next work is filing your income tax return is the business of putting down your total income and determining how much you can deduct from it, for business-connected and personal expenses. Aflfr that, you may be able to reduce your income subject to tax further by exclusion ol pay received while you were ill. or injured. At line 5, on page 1 Form 1040, you put down your income in 1355.

Notice that you are directed to put down all income. That means, put down your total income as though no deductions had been made by your employer lor federal Income tax, social security, union dues, charity contributions, etc. But in using Form 1040 you may have to go behind the scenes and do a little figuring before you put down your 1933 income. This is because business-connected expenses are deducted here. THERE AKK FOUR TYPES of deduct their business expenses on separate schedules, business connected expenses de- employes." (Ex- businessmen are not deductions penses ol the subject here--just business expenses ol employes).

The point needing explanation is how these deductions are handled- In the case of business-connected separately, or $1,000 for all expenses for which your employer partly or entirely reimburses. you. (except expenses of travel and transportation) you add the amount of expense money he paid you to your wanes. Then you subtract all the law allows you to deduct, up to the amount of expense money you received. This may be less than I the expense money you got, and that would mean entering at Line 5 the total of your wages plus ex- claim 10 per cent, or the dollar maximum, in the tax computation table at the bottom of page 2 of Form 1040.

The dollar limits are $1,000 on a joint return, $500 for a married person filing others. IF YOU think your deduct- able expenses may come to more than that (this Includes deductions nf both husband and wife on a joint return) you can claim the total by Itemizing. You list your Itemized expenses In the special box for them on page 2 Form 1040. Deductable items are listed. pense money you cannot deduct.

and their handling explained. But if Tur allowable business-con- in the instructions pamphlet, nected deductions are more than the- expense money you received, i ltl you can deduct the remainder among your personal expenses, on page 2 of the form, under miscellaneous expenses. In either case, attach a worksheet, showing your calculations, to your Return. DC THE case of the other types of business-connected travel costi, other transportation, and expenses of outside salei- men-you add tn your the amount of expenst money you received, then subtract the total of your allowable expenm leas or more than the expense money you got) Enter the result as your total wages for the year. This sounds complex, but It Is worthwhile, because proper handling of your business-connected expenses influences your adjusted (rots Income (total Income less business connected expenses).

And the adjusted fTOH income figure Is the basic figure from which your tax Is computed. BUSINESSMEN AND on page 11. There no change In deductions from list year. The change this year is that you can now Itemize your personal expenses while using the short form. In a nutshell, deductable expenses include contributions to churches, chanties and many non-profit organizations; Interest paid by you including Interest often disguised as "handling charges" In installment payment contracts, within certain limits: most non-federal tax payments; your net loss resulting from fire, storm," auto accident, shipwreck, storms or thefts; medical and dental costs over and above 3 per cent of your adjusted gross income, within dollar limits listed in the Instructions (the dollar limits, but not the 3 per rent rule, apply to persons 65 or over penses nf child care under specific limits; allowable business-connected expenses not deducted on page Expenses reimbursed by insurance benefits are not deductible, but the cost (to you) of accident and health insurance is deductible, a medical cmt.

Next comes another item that may be of considerable benefit tn you. like your business-connected expenses. It can reduce your adjusted gross income. This is the sick pay exclusion. This provision of the 1954 tax code lets you exclude (within limits) from your income amounts you received from your employer while you were away from work due to illness-or injury.

HERE ARE THE sick pay rules (more clearly and fully than set forth In the Instructions): In the case of absence from work due to injury, your sick pay exclusion begins with the first dollar paid while you were away. In the case of sickness, it begins only with your second week's sick pay, unless you were hospitalized at least one day the first week. In that case, the exclusion begins with your pay for the first day away. It is easy to figure out the amount of your income you can set aside, tax free (exclude) as sick pay. The top amount you can claim is J1UO a week.

Therefore, if you make anything up to and including J100 a week, you can exclude all the sick pay you receive (except that the firs week's pay in the case of illness-not injury'--may not count). Ju determine your daily rate of pa (your weekly pay divided by th number of days in your norma. work week), and multiply that the number of work days when yo were absent and paid. That your total exclusion. Since the top rate is 1100 a weel persons who earn more than JIO a week get their exclusion lik this: Divide J100 by the numbe of days in your normal work week That gives you your daily exclu sion.

Then multiply by the numbe of work days your were absen That gives you your total exclu sion. But remember that in th case of illness, the first week pay may not count. THE REVENUE SERVICE ha ruled that pregancy itself is no an illness. So if you were on pai absence due to pregnancy, tha alone does not make your leav pay excludable. But if you were actually ill during any of that time your pay for the work days yoi were ill is deductible.

You may have changed jobs dur Ing the year. If so, your employers may have'collected more than th JM.OO maximum ol Social Securit (F.I.C.A.) tax. If this happenec you can claim credit for the plus you paid at lane 5 of Form 1040, page 1. Write tax in the "where employed" column If you are filing a joint return and both have this type of credi compute and claim them separati ly. Also, you may have made est mated tax payments in 1935 I addition to withholdings from you ulary.

You get credit for this line 17b of Form 1040. page 1. Persons with wage and salary income only, now have the information they need to complete the new "wage earner's short (AP Newsfeatures). Drew Pearson Contlnntd tram who owni ofl-xu property If Ellender of LouliUna. while both Senitori Daniel Johnion ot Texti received heavy contribution! from Internti.

So much money waj volunteered for Senator Daniel by the oll Intereita in advance that Sen. Torn Connally, a conicientlom public sen-ant who frequently bucked the oil-gai boyi, bowed out of the race. Lyndon Johnion'i bligeit money backer durlnc hit political career hai been Grant Brown and members of the Brown and Root firm. It at the home of Gcorie Brown, himself the head of a bit (as pipeline company, that Lyndon wai stricken with hit heart attack. Lyndon has done favors for this company which would amaie the nation.

In the old days Sens. George Norris, Bob LaFollette, Hugo Black and Warren Austin, one or more of these senate stalwarts might have risen up to challenKc the voting privilege nf a colleague who had a pecuniary Interest in the bill. But today that isn't likely to The precedent of the private-expense fund happen. Nixon with its patent conflict of Interest, and the tendency to vote for the interests that put up the money to elect a entor. Is firmly rooted with a large group of senators.

Other senators would like to stand up for so, called senate ethics but don'l like to buck the leadership. It isn't popular. It also makes life difficult when committee assignments are being passed around. Sn the real loser in the voting on the natural gas bill, If sen- ate Rule 12 Is not invoked, will be the American Democratic system. For the American public will know what the score is a will think less of the men It sends to Washington-- which Is not a happy state of affairs In day when we are fighting to preserve the American form of i government.

Note 1-- One senator who hai no pecuniary Interest In i the natural fas bill ls havlnc a slruffle with himself la Sen. Dennis Chavtt, Democrat of New Mexico. Chares haa i spent most of his career cham- i plonlnc the hoiimilff. labor iroups and lht little fellow. Recently he's being pressured by the persuasive leadership of Texas' Lyndon Johnson and some of the big Inter- Mis.

Note 2--The gss-otl senators are so confident of victory that they have dropped word to certain senate colleagues up for reelection this year that they don't need their vote--among them Butler of Maryland, who comes from a gas-coniumlng state, and George of Georgia. The gas senators figure they can get by without jeopardizing the reelection friends. chances of certain Westford WESTFORD Dr. and Mrs. Mauritz Johnson and four children.

East Schodack, were guests of her parents, Mr. and Mrs. N. H. Busacker.

Mr. and Mrs. Bernard Phillips Davenport Center Danlrl Harrington--U1S DAVENPORT -Mr. and Mrs. Harmon More and their daughter Miss Lucille More of Syracuse attended the wedding of Miss Elsie Gralien and Leif Zakariisen in Norwich.

Miss More was maid of honor. George Baxter Is ill at the home of his daughter and son- in-law, Mr. and Mrs. Royce Odell, Oneonta. Mrs.

Sterling Carrington and daughter Sherry Mellott attended the 6th birthday party of Janet Seeley in Oneonta. Mr. and Mrs. Sheldon Bax ter were guests of Mr. and Mrs.

Royce Odell in Oneonta on the 49th wedding anniversary of Mr. Baxter's parents, Mr. and Mrs. George Baxter. Mr.

and Mrs. Daniel Harrington were guests of their son-in-law Mr. and two children, Cynthia and daughter and Douglas, Schencctady, visited A 0 1 tier sister and family, Mr. and Mrs. James R.

Huntlngton. A new oil heater has been purchased of Andrew Skinner of Worcester and has been installed in the Methodist Church. Mr. and Mrs. George Redden' and children of Andes were guests of her mother, Mrs.

Jay Mould. Mr. and vard and Mrs. J. Keith two children, Har- John IF YOU OWE '500 and would lite lo pay it off of about a week ran help you and Mary Kay, of Andes, visited Mr.

and Mrs. F. G. Tyler. Mrs.

Bruno Motyka and sons, Eugene and Edward, were guests of relatives In New York City. They attended a wedding i while there. Glenn Whiteman and Mrs. Harold Whiteman attended the funeral of John Pierce, Worcester. MarvlrtntJ Mrs.

Rilh K. Eldred Hehenerut--Mil MARYLAND Mr. and Mrs. Ernest Blencoe were given a surprise party at their home here by about .10 friends and neighbors. Mr.

and Mrs. Blenroe were married last week In West One- onla. Miss Dlanne Cady li at home now after being i patient In Baiselt Hospital. Mr. and Mrs.

Albert Houghton and children, George, Jeffrey nd Mlrharl, Allamont, called or. Mr. and Mrs. Arthur Hauihton. HERE IS A BUSINESS-UKE WAY TO PAY OVER-DUE BILLS It molti no whal tk.i.

bill, gitfctr Alt PAIt el l.i, 1 IOAN AT THIS OFFICE liuttad cl Mv.nl (kit yov OMIT I PATMINT TO A I And, b.il to Mk poymtni 01 l.til* at a i fen Ml lht total pa MW KIT mot nil It our CONSOLIDATION BILLS PUN practical irau to pay bllli tlllmONI.WIItl.MVIIIT UPSTATE LOAN COi. INC. T.iok.i. tn MII tin ATI THI TO r. M.

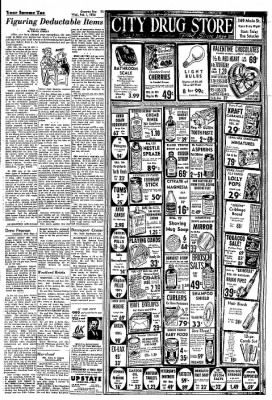

torn IH M.I. TIHIJ.S CITY DRUG STORE IS -149 Main St. Open Every Night Starts Today Thru Saturday BATHROOM SCALE Made bj Famous Manufacturer Precision built for accuracy Magnifying lens for easy reading. Lifetime guarantee. Choice of colon.

Ruhber safety mat. Usually 6.50 3.99 Chocolate Covered CHERRIES In Cordial Cream Lutciout trrt-npeaei tkerriw In liquid coriiiX cwtrrt wri dmle-dipTtd ehocDlrn. FULL LB. BOX Regular 69e VALENTINE CHOCOLATES MMOUJ IIUNDS-- UUGfST yp HEART I1IREDDMT I Choice of 25-40 50 or 60 Watt 8 99c 2.00 1 on i 1.29 ICANOV CUPBOARD SCrlRAFFT'S HEARTS 95M.85.3.70 MOnO HEARTS UKBI Ib. Box ARRID CREAM DEODORANT Urge Site ty 03 TiT OF Wintergreen I MR Jl REG.

Me Pro-pliy-lac'fic Tootii Bnisii 23' RICHARD HUDNUT SALON CREME RINSE Hair Conditioner Mttn hur ihiay imble. TVU. rm sl-tt 1.75 Ui Reg. 1.25 NESTLE SPRAZEI Fiaet toft few hair qaieUy iH caiilf. Now Only EVENING IN PARIS DEODORANT STICK AYDS CANDY For Xtrfvcfng 2.98 Little Liver PILLS Iodine Mereurochrome I n.

as r. UiuaNy SJc CMc. Alopnerr PILLS 100's FATHER JOHN'S IN, Strrt pmpirition 'trim trj. Dcfcihtfa Ui SAVE 75c TIM cm, 2.00 REYLON AQUAMARINE LOTION fctltdt WvlUSCIMTTU 1.25 CARDS Xffroctivt, Choice Usually SOc 33; YOU GET FIVE No. 60-B Havana Blend CIGARS FOR ONLY Urge Slit Usually us JTjje oy tvr'S' liTTlW For Home and Office Pack of 100 We 29' GUARANTEED TO KILL RATS AND MICE rua i -30 rouio I.3T Frs-SssHSK I -----M FREE ATOMIZER with Byron's BOUQUET SPRAY Air deodorant ind refrtiher.

ELmi- ejttt odor ta kit- clotrt. ikk nan, rtc StairJm. Choice of Slrlrrtncrt. USUALLY 7Se 39' ELIXIR TERPIN HYDRATE aid CODEINE COUGH SYRUP 1.00 Reg.47'GLEEM TOOTH PASTE 94c Value CITRATE of MAGNESIA U.S.P. 50c Ritpberry Fliiortd ASPIRINS For Children tit? i 100 TAILETS 2-51 FOR FAST RELIEF FROM TIRED, ACHING BURNING FEET REG.

Shaving Mug Soap 6 FOR 44' New, Miracle Wondtr Drug DONAHIST SYRUP film pkk rtfcl cngh fMt-MtlOf fiJONWiBT .29 SOLO PLASTIC CURLERS For Home Permanenls 79 UNION'S FOOT ICE S49 FOOT-ICE MAGNIFYING SHAVE and MAKE-UP MIRROR foSUt 59 BRIOSCHI SALT! CERBER'S STRAINED BABY FOOD CUu jir. vacuum ruckrd. Corcpltte selection. 4 for 35 SHAMPOO SHIELD Kttpt end a Iran trei and foci. Usually 50c 33 Sore Throat? loiffi work tut I Ctnn kill.

I FtnixiiDt prwnrUr I 1 1 1 1 ton tKrttt mouth TYRO-MYCIN KROXIDE niUSIMT CASTOR VAUHTIHE GREETING CARDS Dairy flCARAMELS Bag REG. 39c "-K CHOCOLATE MINIATURES MWKE FRUIT FLAVORED LOLLY POPS GIANT IAS "DRUEKE" Cribbage Board Complete with SALE! Humidor Frtsh Washington INI 14 I'" 1 TOBACCO I REG. 98e BUCKSKIN BRIAR PIPES lett! Hair Brush '-KSE SIZE Bristle Lucitc Handle ft t'sual. 12-pc. Comb If 1'ir romk 'W mERWM lMmCTW u.ir.

-04. lift EPSOM 1 SYRINGE fcyppflDT SALTS i1T JHrn JUlUM 33' Ltfi 23' 1.49 Lif..

Get access to Newspapers.com

- The largest online newspaper archive

- 300+ newspapers from the 1700's - 2000's

- Millions of additional pages added every month

About The Oneonta Star Archive

- Pages Available:

- 164,658

- Years Available:

- 1916-1973